Chicago is My Kind of Town to Beat Up On: New Mayor, Same Problems in 2023

Coming into the home stretch

While 2022 at STUMP was really quiet re: Chicago posts, 2023 picked up again as there was a mayoral race.

But nothing really new under the sun for Chicago problems. While a bunch of money was thrown at Chicago with federal stimulus bill(s) in 2021, and money was doled out over 2021 and 2022, in 2023, doom was looming. The new mayor was not going to be having any fun.

I proposed a novel solution. Really outside the box. WAY outside the box.

STARE INTO THE BEAN

Prior posts:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

2019: Chicago is My Kind of Town to Beat Up On: 2019 Edition

2020: Chicago is My Kind of Town to Beat Up On: The COVID Era

2021: Chicago is My Kind of Town to Beat Up On: The Payoff! Year

2022: Chicago is My Kind of Town to Beat Up On: No Chicago-Centric Posts in 2022

Chicago Mayoral Race in 2023

6 Feb 2023: Chicago Mayoral Race: Good Luck Dealing With the Pensions

This was a podcast episode with the following description:

In this episode, I commiserate with the poor sucker who wins the Chicago mayoral race, and has to deal with the pension disaster coming their way. Also, RIP for Laurence Msall, who had been President of the Civic Federation of Chicago for 21 years and died too young.

A key item in the episode notes:

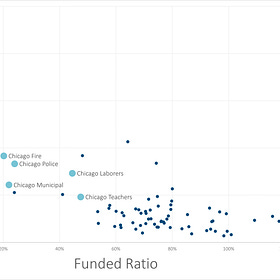

I will do a quick update on that item — that is from the Illinois page for the Public Plans Database, as of fiscal year 2021. Here are the same items for FY 2022:

I highlighted the same plans.

The key items to note are that none of them are paying close to 100% ARC (Actuarial Required Contribution — and yes, there are other terms now, but let us not get lost in the weeds) and the funded ratios are all horrible.

I have more detailed information about what is going on with these pensions, but you do need to know that this isn’t typical in most public pensions. Chicago is an outlier.

3 Mar 2023: Congrats to Lori Lightfoot! No Pension Failures on Her Watch!

This past Tuesday, there was an election for the Chicago mayor. Nobody reached the 51% mark, so there will be a runoff between the top two vote-getters. I will come back to that at the end of the post.

Here are the top 5, and you can see that incumbent Lori Lightfoot came in number 3.

While many others are casting Lori Lightfoot’s electoral loss as payback for all sorts of bad behavior on her part [I need not link these], I want to congratulate Lightfoot on her win: no pension failures on her watch.

The Next Person May Not Be So Lucky

To keep this simple, I will look solely at the two most significant Chicago pension funds: the Teachers fund and the Municipal workers fund, using data from the Public Pensions Database.

Now, the Chicago Teachers fund is not in an asset death spiral, but it is financially strained.

….

This isn’t a death spiral, as I said, but this isn’t great. This is a large fiscal pressure for Chicago and Illinois.

The Real Disaster: The Municipal Workers Fund

Here we go, a true disaster to come. When the assets run out, Lightfoot is going to be super-happy to know she lost last Tuesday’s race.

She knew, after all. I mentioned this in a podcast a month ago. Maybe she thought the state would run to her rescue.

The contributions have been extremely inadequate.

They should be contributing about 60% of payroll. They’re not even contributing half of that.

The funded ratio shows a plan in an asset death spiral.

Re-projecting cash flows for the Chicago Municipal Plan

In a post in 2017, I projected the assets running out in 2024, but that’s before they really ramped up contributions.

With my last projection tool update from Labor Day 2022, here are some stats:

Those contribution growth rates, even the 10-year, are unlikely to be sustainable for Chicago. The 5-year growth rates are definitely unsustainable.

But this is what happens as a “frozen” scenario - no increase in contributions, no increase in benefits, no investment returns (or losses):

….

What if investments again do nothing, contributions are frozen, but benefits increase by 4% per year?

Yeah, Lightfoot would be thanking her lucky stars then.

That’s what I was looking at before the runoff.

6 April 2023: My Condolences to Brandon Johnson, Next Mayor of Chicago

Congratulations to Paul Vallas on losing the election for mayor of Chicago:

Mayor-elect Brandon Johnson was out Wednesday thanking voters and talking about his agenda and priorities for the city.

With 99% of precincts reporting, Johnson has 51% of the vote with 286,647 votes, with Vallas having 49% of the vote with 270,775 votes.

Phew, that was close. Just a few thousand votes difference.

I’m willing to bet Vallas will be very happy in about a year when he sees the hideous financial mess he will not have to deal with. To be sure, he’s been through some of this before, but I am not sure he really understands how nasty it is.

I took that opportunity to look back at some of my greatest hits of beating up on Chicago (as I have been doing these past few weeks), a huge portion being the public pension debt.

Then I looked at what Brandon Johnson, the mayor to be, had promised for Chicago:

If Brandon Johnson thinks dealing with a few thousand dollars of unpaid personal bills is difficult, I think he will see some real difficulties in going from his campaign language to reality.

Johnson said while campaigning:

Vallas and his opponent, Brandon Johnson, do not intend to raise property taxes, but Johnson said his plan does include several other tax hikes to increase revenue.

“I don’t know if there is any other mayoral candidate in history of Chicago that has been willing to put up a balanced budget plan before they are elected,” Johnson said.

In his $800 billion tax plan, Johnson proposes bringing back the city head tax, where large corporations who do most of their work in the city will pay a 1-4 dollar tax for each employee. Johnson also pitches increasing the hotel tax, jet fuel tax, a tax on securities trading and increasing the transfer tax on property sold for more than a million dollars.

“All of that gives us the opportunity to eliminate the structure deficit, make critical investments without raising property taxes,” Johnson said.

Johnson insists a city income tax is not part of his plan, while Vallas said the budget can be balanced from within and Johnson said it can only be done with new revenue.

So, in a time when people are skeptical of doing business in person, Johnson is thinking of making it more expensive to go to Chicago.

….

Johnson has his work cut out for him. While he’s obviously buddy-buddy with the teachers union, that will get him only so far.

They may not be so friendly when he has tried out his tax ideas (and the inefficiency audit) and the extra money for goodies is not forthcoming.

But hey, maybe it will work. We will see.

So that was the mayoral election.

Johnson and his CTU buddies caught the prize, they thought. Let’s see what they’ve actually gotten.

Two Important Questions, One Serious Answer

Did New Chicago Mayor Brandon Johnson Inherit The Worst City Pensions in the Country?

Answer: Yes

Did New Chicago Mayor Brandon Johnson Inherit The Worst City Pensions in the Country?

UPDATE AND SPOILER: THE ANSWER IS YES. YES, HE DID.

Who will bail out Chicago?

Answer: Aliens.

The aliens answer is far more likely than the other options.

More 2023 Chicago-related posts

26 Jul 2023: Taxing Tuesday: Income Tax for Chicago?

19 May 2023: Spending Dreams of Chicago Mayor Brandon Johnson and Waking to Reality

25 Oct 2023: Taxing Tuesday: Gaming, Chicago Mansions go Downscale, and Dumbass Tax Research

6 Jul 2023: Chicago Pensions: Drowning, Not Waving

Interesting I used that title for a 2023 piece on a pension panel by the new Chicago mayor… for “innovative ideas” or something.

One can note the list: heavy on the public employee union representation, as well as other politicians.

Not seeing much in the way of representation of the people they’re probably expecting to pay for the pensions.

Though this is paywalled, I think the headline is enough — Greg Hinz at Crain’s: Biz groups excluded from Johnson's pension panel

All that said, there are probably at least a couple on that list (oh, budget director, maybe even that Director of Research & Employee Benefits for AFSCME) who may remember why Chicago was forced to ramp up contributions to its pension funds recently.

The very short explanation: if they continued with their old contribution rates, the funds would have run out of assets, and be on a pay-as-they-go basis.

Because I used a similar title on this June 2014 piece: Public Pension Watch: Chicago, Not Waving But Drowning

In the 2014 piece, I grabbed the 2012 FY funded ratios of some of the Chicago pensions:

Look above. What were they for 2022?

Better or worse?

Much worse?

Maybe?

Check out the contribution rate history that got you there.