Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

Let's Start at the Very Beginning.... of STUMP -- from 2014

Given my current rough situation, I wanted to cheer myself up, but it’s going to be tough coming up with new stuff for this week, at least.

Luckily, I started STUMP way back in March 2014. So I have a deep catalog to work with.

Before last week’s to-do, I started writing some new stuff on Chicago for the run-up for the Democratic National Convention in Chicago over August 19-22. All sorts of people will be running comparisons to 1968, though the last time it was in Chicago was 1996 (and that went well, if I remember correctly…. but that was Clinton/Gore for a second term, and they were young & full of vim & vigor… and I will stop there.)

In any case, I want to look back on the many ways I’ve beaten up on Chicago over the years, as this is one of my favorite pastimes.

Chicago’s finances suck and have done for a very long time.

Let’s check out what I had to say back in the year 2014.

A Decade Ago: Rahm Emanuel Tries to Make a Pension Deal in Chicago

2 April 2014: Public Pensions Watch: Chicago - Is Rahm Regretting It?

And the “regretting it”, I mean is he regretting being un-booted from the ballot back in 2011, and winning the mayoral election?

I’ve written many times before that Rahm should’ve taken the clue of Daley leaving. Daley leaving should have been a red flag to anybody coming after.

Let’s do a quick overview of what’s happening currently – to wit, Rahm is trying to deal with this-

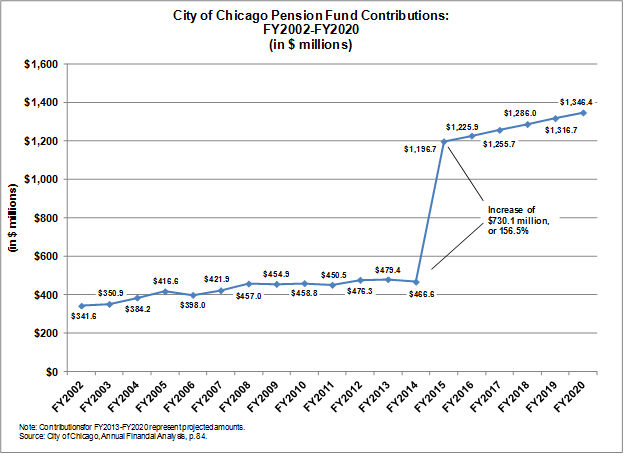

That is the projection of contributions the city of Chicago has made, and is supposed to make, to its pensions. That projection is from 2012, but I can tell you right now that the current state of play is not better.

You may wonder what actually ended up happening with contributions (because they sure as hell couldn’t afford such a huge step-up in contributions).

From the 2023 budget document, page 54:

So there was a bump up, but not by the full amount originally proposed… which is why the pensions were still ailing.

Let’s see what deal he proposed back then:

3 April 2014: Public Pensions Watch: Chicago Deal - the Basics

As a result, recently the mayor of Chicago (Rahm Emanuel) has put forth a proposal to deal with pensions. I will just cover the specifics of the proposed deal — reactions to come later.

….

1. Increase property taxes. Looks like scaling up to 10 basis points extra, on top of recent property tax increases.

2. Require more employee contributions – increase of 2.5 percentage points. In relative terms, though, it’s a 29% increase in employee contributions.

3. Cut in COLAs. I’m not sure what they mean compounded v. not compounded (how does one do uncompounded COLAs?) I will look more into the COLA issue later. It looks like it’s a relatively minor cut, though.

4. Increased contributions to pension from city (which were going to be required anyway) – with revenue from those extra taxes, a couple specified revenue sources, and then unidentified cuts/tax increases.

Step 4 is the obvious bullshit. When you’ve got a hole for contributions and you say “Well, it will come from somewhere”, that means that’s the bit that will never go fulfilled. It’s amazing how often governments manage to get out of paying “required” contributions to pensions.

Oh, and I remember how this all ended up. This is the benefit of a long-running blog.

4 April 2014: Public Pensions Watch: Chicago Reform Blitzkrieg? Ha Ha, FAIL

Yesterday I laid out the basics of a proposed pension “reform” from Rahm Emanuel, mayor of Chicago.

I did say that today I would write about reaction to the proposal, but in the interim I missed there was a lightning attempt to ram the crap through the Illinois legislature before anybody could react.

Ha ha, nice try, Rahm. You’re dealing with a bunch of Illinois politicians (and Illinois public employee unions). Did you think you’d actually be allowed to do this?

….

Republicans, even Illinois Republicans, are not entirely stupid.

Something in the bill that was a sure thing: tax hikes.

Remember that ‘temporary’ income tax hike that Gov. Quinn now wants to make permanent?

If the tax hike went through, that would be looked on as a permanent level. That wasn’t going to be coming down.

Anyway, somebody tried to be clever… actually, this whole thing was maneuvering in trying to be clever.

5 April 2014: Public Pensions Watch: Chicago Deal Reaction Roundup

So I’m going to do a whirlwind tour of reaction to Rahm’s pension “reform” proposal…we already know that the blitzkrieg approach failed, but that doesn’t mean the proposal is entirely dead in the water.

=cough=

I sampled from a variety of views, including far-left (which I always love going to):

Now, I love going to the leftie side of the debate, just because it’s so entertaining in its delusion. My favorite go-to leftie source on Illinois pensions is Fred Klonsky, a retired Illinois teacher. He has not disappointed this past week, and so I will link to a few of his posts.

From April 2, he posts a video on the pension cuts, saying it would cut benefits by a third (does he realize that would sound pretty good to taxpayers?)

….

Look, it would be fatuous to pretend Rahm isn’t a leftie himself. As well as Quinn. Watching [what] is essentially an internecine battle is amusing to a conservative (who is tired of being crapped upon by Republican leadership, but that’s for another day).

….

A lot of us who are kicking and screaming about public pensions are ones who realize that public pensions are going to get cut, because they are in a hideous position. This is lefties and righties (and lukewarm middle people), and many of us are pissed off not because we’re worried that taxpayers are going to get soaked — many of us know that you cannot soak the taxpayers enough. That’s why the pensions will get cut.

They haven’t yet, I know, but there are many ways to cut a pension, as the Ohio STRS folks will tell you.

RAHM, YOU IDIOT, THERE IS A REASON DALEY LEFT.

Seriously.

Rahm is not nimble enough to negotiate this particular disaster.

Rahm made the mistake of thinking he was smarter than Daley.

And what is hilarious is that an arch-conservative (me) totally agrees with a weenie leftie (Sirota) on this matter, and that I have made several leftie allies on the public pensions issue.

Yep, and that still is true. I agree with many of the people on the left re: public pensions that the participants in the pensions are getting/going to get screwed (yup), that many of the worst plans are ones where the sponsors deliberately underfunded them for decades, such as Chicago and Illinois, and then they try these “clever tricks” such as leverage and alternative assets to try to save themselves… and “contribute more later”.

Oh, and pension obligation bonds.

But that’s for a later post.

More Chicago Posts from 2014 (without quotes)

9 April 2014: Public Pension Watch: Rahm's Do-Over?

3 July 2014: Chicago Watch: Daley, Rahm, and a Restaurant

27 July 2014: Public Finance Watch: Chicago Faces Doom

17 Aug 2014: Chicago's Rahm Blames Poor Numbers on Shitty Economy (and not Dem Legend Daley)

4 Oct 2014: Public Pensions Watch: Don't Get Your Hopes Up, Chicago

29 Oct 2014: Illinois Connections Watch: Usual Biz in Chicago

On the Asset Death Spiral

16 Nov 2014: Public Pension Watch: How Screwed is Chicago?

Ah, the asset death spiral.

This is from the Comprehensive Annual Financial Report of the Municipal Employees’ Annuity and Benefit Fund of Chicago for the fiscal year ending December 31, 2013 (and 2012, but that’s an item I don’t want to touch right now.)

Let me explain the asset death spiral, which is when balance sheet weakness manifests itself in something really serious: a lack of cash flow to cover promised benefits.

Having to liquidate assets to cover cash flows is not necessarily a bad sign — if one has a decreasing liability (which means decreasing cash flow needs in the future).

This is not the case for Chicago. Nor Illinois.

One has to sell off assets when investment returns and pension contributions are too low to cover current cash flow needs. This reduces the asset amount for the pension funds…and if cash flow needs are increasing, you find that one has to liquidate more and more assets… until the fund is exhausted.

Remember that the equity markets did extremely well in 2012 and 2013…. and this pension fund had to liquidate almost 10% of its assets to cover cash flows. This is not good.

So far, Chicago has barely escaped the asset death spiral.

Other places (like Kentucky), are getting sucked into its embraces….

… or maybe not. I push Kentucky to the side for now. Chicago is still more prominent.

I’m 50, so 2012 and 2013 don’t seem that long ago.

2024 was the year that MEABF was supposed to fail until they started throwing money into its maw.

They were able to stave off the reckoning for a little while, but…

DOOOOOM

4 Aug 2014: Public Pensions Watch: Chicago Still Faces Doom

Last week, I indicated that Chicago Faces Doom, and it involved several bits, one of the largest being its pension liabilities.

So recently, it has been admitted that no, Chicago is not going to be making its ‘required’ pension contribution

When the liability is underfunded, and one does not make an extra contribution to make up for the underfunding, the unfunded portion of the liability grows the next year even if no new service gets accrued the next year. And of course, new service gets accrued, which also needs to be paid for.

Pretend you had a credit card charging 8% interest, and you had a balance. And not only did you not pay down the balance, you also charged more to the card.

Anybody who has had a profligate friend or family member with out-of-control credit card spending knows how that particular spiral ends. Luckily, usually the credit cards have somewhat of a sane limit, and recently minimum payments have been upped by many providers to make sure at the very least the interest charged is covered, so the debt doesn’t grow due to that.

But public pensions don’t work that way — the “credit limit” is implicit, and the illusion that the taxpayer can always be soaked for the pensions when they actually have to be paid have allowed these plans to get into precarious situations.

While stories talk about the looming pension payment spike of 2016, I assume there will be a ‘grand deal’ of some sort among all the Illinois politicians that allow them to ignore that the pensions will fail. Because they’re not spending what they fully owe (under nice discount assumptions) on the pensions now is equivalent to saying they do not intend to fully pay for the pensions in the future.

Notice that what they actually paid in 2020 was higher than projected in 2014. They paid $1.7 billion instead of $1.3 billion.

It’s still a lot less than they should be paying.

How is MEABF doing, anyway?

Let’s look at their largest plan: MEABF (Chicago Teachers is treated separately)

Even with the big ramp up, they’re only covering 76% of what they should be contributing. (And yes, that’s about 60% of payroll)

This is where their funded ratio is:

Yes, about 23% funded. They’re barely hanging in there. A bad year could push them into the asset death spiral.

Even with that huge contribution ramp-up, look at what the funded ratio did. A temporary bump up, but because it was still well below where it should be, the ratio kept slipping.

A decade ago, MEABF was able to be just over 40% funded.

Now, it’s barely above half that level in fundedness, for all the increase in contributions… because they wouldn’t bother to fund their promises.

What a lovely symbol for the DNC party to come.

My Chicago relatives will not be paying for the debt. They either died off or moved out of the City or left the State of Ill. I left too.

My kind of town Chicago is!! Democratic Mayor since 1931!! Illinois legislature is Democrat SuperMajority, JB Pritzker billionaire born in 3rd base but still thinking he hit a triple in life.

Illinois Supreme Court is a majority Democrat body or yes, oh yea, JB steered millions to the two new Democratic Justices in last election. For an old guy like me it’s just comic relief🤪!

I love the observation that Rahm felt he was smarter than Richard M Daley!! Actually he is right, but so are 50% of the people in the Chicago area (low intelligence bar for Ritchie). But Rahm was not sharp enough or slick enough to make any improvement with Chicago’s pension .