Last week, I started looking back on my Chicago finances posts, looking solely at 2014 STUMP posts.

Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

Given my current rough situation, I wanted to cheer myself up, but it’s going to be tough coming up with new stuff for this week, at least.

Let’s continue into 2015!

Let me give you the big wrap-up from a September 2015 post: Labor Day Fun: Chicago Tax Wrangling -- Throwing Money into the Pension Money Pit

Since May 2011, Rahm has had 4 budgeting cycles to get started on the problems. But nothing substantive has been done. He kept the short-term financing in place.

He touted a pension reform he had to have known the Illinois courts would strike down. Every politician should have taken heed that given the state wouldn’t be allowed to adjust health coverage for any retirees, they wouldn’t be able to adjust pensions with $$ amounts attached.

There was a big ramp up in contributions that had been baked into the law for years, but until now, when they’re forced to try to pay down their pension debt, Chicago did nothing to chip away at the problem.

So:

1. Rahm asking for more money via taxes was always to be expected.

2. Rahm will be asking the state for more…but the state is squeezed as well.

3. Rahm had to know this disaster was coming 5 years ago when he ran for mayor. He definitely knew it this year, when he ran for re-election.Daley got out. Were you so stupid to think it was for “family reasons”, Rahm?

…..

I wouldn’t assume that people won’t leave.

I wouldn’t assume people will hold still so you can pay for somebody who retired 20 years ago and whose prime service to the city was 40 years ago.

If you had paid for the pensions when they were accrued, you’d not have to count on a growing tax base to prevent pension fund money from running out.

Good luck, Chicagoans.

So now you know how it ends up… let’s see what happened during the year.

Lawsuits against reform

Some of this had gone down in 2014, with respect to Illinois state retiree healthcare benefit reform. It was struck down.

January 2015: Public Pensions Watch: Illinois Pension Reform Lawsuits

Last July [2014], there was a ruling from the Illinois Supreme Court that retiree health benefits could not be cut. Here was my reaction:

“The upshot of the ruling was that retiree health benefits could not be cut back, and what they meant by that was that a specific percentage of health insurance premiums would be covered by the particular pension system.

….

“Let’s think through the results here, and what is likely to happen.

“Most obviously: the various pension reforms tried on various levels in Illinois are dead.

….

“So if the state cannot cut a benefit that can fluctuate wildly from year-to-year, if the state cannot change a percentage of coverage, even if they’re paying more every year in absolute or inflation-adjusted dollars, then there’s no way the pensions, which are less variable, will be allowed to be cut.”

I want to note that for years, one of the reasons given for not pre-funding public employee retirement health benefits was that, of course, they could be cut whenever the state wanted to. That was a nice theory while it lasted, at least in Illinois.

….

Chicago is predicting cats and dogs living together if the court strikes down reform:

But the city’s filing nevertheless paints the bleakest and most accurate picture yet of the financial crisis that awaits the winner of the Feb. 24 mayoral election.

“The Chicago bill should survive, regardless of the outcome of this appeal. If it doesn’t, the city’s liabilities will increase by $2.5 million a day,” Corporation Counsel Stephen Patton wrote in the Jan. 12 filing.

“The city will suffer further [bond rating] downgrades that could materially increase the cost of borrowing money essential to funding basic operations. And it could make the city immediately liable to pay hundreds of millions of dollars as a result of default and early termination of debt-related obligations.”

Couldn’t happen to a nicer guy. There are separate lawsuits covering Chicago-specific pension reform, but I’ll leave that for now.

….

These amicus briefs were a nice idea, but the law isn’t going to fix this problem. My prediction on this case is that the Illinois Supreme Court will say “Nice try, but no pension reform for current employees (much less retirees). EVER.”

And then the Illinois politicians will have to decide whether they have the guts to take this on directly with constitutional changes, or if they’ll let the system fail catastrophically.

It is a choice.

Guess what happened.

(It’s a little further down this post).

Rahm Runs for Mayor Again

March 2015: Chicago Watch: I Warned Rahm, You Know

Four years ago, Rahm Emanuel came close to being yanked from the Chicago mayoral election due to residency concerns.

At the time, I had blogged (elsewhere) that Rahm should hope he got booted. Last April, I asked if Rahm regretted not getting booted.

‘And the “regretting it”, I mean is he regretting being un-booted from the ballot back in 2011, and winning the mayoral election?

‘I’ve written many times before that Rahm should’ve taken the clue of Daley leaving. Daley leaving should have been a red flag to anybody coming after.’

….

Well, we have a couple things going on now.

“CHICAGO (Reuters) – Chicago drew closer to a fiscal free fall on Friday with a rating downgrade from Moody’s Investors Service that could trigger the immediate termination of four interest-rate swap agreements, costing the city about $58 million and raising the prospect of more broken swaps contracts.”

Let’s do a little figuring here.

$300 million is 8.5% of the $3.53 billion budget. That’s substantial. And that’s before the step up in “required” pension contributions.

That is a more substantial hole, percentage-wise, than the $900 million (out of $34 billion) that New Jersey got sued for shortchanging its pensions last year.

The NJ $900 million was only 3% of the total budget.

…..

There is also the problem of getting the people to stay still to be taxed.

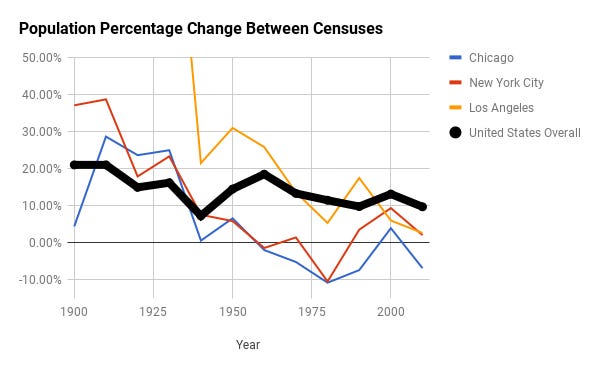

Here’s a comparison: number of people in Chicago, vs. number in NYC and LA

Chicago really used to be the Second City. Long ago. It got surpassed by Los Angeles in the 1980 census.

But let’s really dig in here – what were the percentage changes?

Note that thick black line — that’s the population growth rate for the whole United States between decadal censuses. It has always been positive (thus far).

….

Anyway, Rahm, you asked for this. Maybe you’ll get lucky this time, and lose your election. Chicago is likely going to go bankrupt in fact, even if Chicago can’t declare bankruptcy without Illinois state approval.

But the Illinois state government may just be in a mood to let Chicago sink.

And I doubt Obama will be able to get a federal bailout for his ole adopted hometown.

To be sure, Detroit was showing these kinds of cracks years before it officially went bankrupt. It takes a lot of time for the credit to run out….if nobody is watching.

But people are watching.

This will be very ugly, no matter who wins the mayoral race.

But for all that angst, Rahm won the mayoral election:

April 2015: Chicago Watch: Congrats on your "win", Rahm... I guess

Rahm Emanuel got re-elected mayor of Chicago in a run-off election, but it’s kind of hard to call it a win.

“Anyway, Rahm, you asked for this. Maybe you’ll get lucky this time, and lose your election. Chicago is likely going to go bankrupt in fact, even if Chicago can’t declare bankruptcy without Illinois state approval.”

Part of that remark had to do with the pension lawsuit(s) working their way through the Illinois Supreme Court, and part of the remark has to do with swaps held by the city and related entities.

Let’s see how those swaps are doing, shall we?

One of the counterparties is not interesting in altering their deal:

….

Sometimes I wonder why these entities are allowed to play in the swap space. I think governments need to be excluded from all sorts of financial structures, swaps being one of them.

….

In my prior figuring, Chicago can’t really cough up that amount of cash.

But look at those 1 – 4. Basically, they are using long-term debt to fund operational expenses.

(Just like pension obligation bonds, come to think of it)

That never ends well. Once the credit dries up, not only are they not going to be able to pay for their long-term obligations, they will probably not be able to cover their operations.

So, enjoy your “win” until someone else takes over the city because you can’t dig out of the hole.

I don’t really see anybody interested in filling Daley’s hole. Detroit was allowed to be whacked, so you’d better believe Chicago can easily be on the block as well.

I made a comment about Rahm not necessarily finding a hidey-hole in a Clinton White House… that Hillary may not win.

He did get to be an ambassador in the Biden administration, though. He is currently the U.S. ambassador to Japan.

On the swaps and CPS bonds

More on those swaps mentioned above:

March 2015: Chicago Watch: Doomed Finances Compounded by Swaps

I understand the desire to hedge variable interest rate costs with a guaranteed rate. The problem is what happens when one’s credit goes sour and one is trying to unwind these deals. When one is forced out of a swap contract, it’s not merely that counterparties stop making payments.

Nope, it’s that the swap is valued at the point-in-time and the value is made up to the counterparty.

That’s the theory, at any rate.

I don’t see Chicago ponying up $400 million for anything.

21 April 2015: Watch It Unwind: Chicago, Greece, and Asset-Grabbing

let’s go to Mark Glennon at Wirepoints on today’s funtime

“There’s no point in sugarcoating this. The financial crisis at the Chicago Public School District may come to a head this week, and the impact will extend beyond the school system. A CPS bond sale is scheduled for Tuesday, which is widely seen by financial markets as a test of whether it has a pulse. Here is a summary of key points from various sources:

“• CPS is just about out of cash, and its cash could be entirely wiped out on 48-hour notice, according to the Sun-Times. Specifically, the banks owed on $228 million of swap agreements have the right to demand it with that two-day notice, which would just about deplete CPS’s cash reserves, unless a negotiated settlement is reached.”

22 April 2015: Chicago Followup: How did those bonds do?

….and who bought them?

As per yesterday’s post, there was a bond offering from the Chicago Public Schools.

“(Reuters) – Yields topped out at [b]5.63 pct for bonds due in 2039 in a $295.7 million Chicago Board of Education general obligation debt sale[/b] on Tuesday, according to an initial pricing scale obtained by Reuters.

“The yield was [b]285 basis points over Municipal Market Data’s benchmark triple-A scale[/b]. The financially struggling public school district is selling the debt through lead underwriter PNC Capital Markets after its ratings with Moody’s Investors Service and Fitch Ratings were lowered last month to one notch above the junk level. (Reporting By Karen Pierog)”

Chicago Pensions and Illinois Pension Reform Ruling

May 2015: Chicago Pensions Watch: What does Chicago Say About Its Own Pensions?

While we wait to see if Chicago Public Schools can make its pension contributions, and what Rauner will do with the bill on Chicago pension contributions, let’s take a little look around at Chicago’s pensions.

In my Public Pensions Primer post exploring the updated Public Plans database, I used Illinois and Chicago pensions as my main examples for exhibits.

But what does Chicago itself say about the situation?

“What Are Acceptable Funding Levels?

“When a Fund’s assets are at a level that when invested they are sufficient to pay all the projected future benefits, the Fund is said to be “100%” or “Fully Funded.” A fully funded pension plan means each generation pays the full cost of the services its public employees provide.

“Below 80% funding, a pension plan is vulnerable to swings in investment earnings and can rapidly burn through its assets in order to fund benefit payments.

“What is the City’s Current Unfunded Pension Liability?

“An unfunded pension liability is the difference between the value of the promises made to retirees and employees for services already rendered and the funds available to pay for those promises.

“Currently, the City’s six pension funds only have 50% of the funding needed to support the current pension system.”

….

The 80% here is somewhat bullshit, but it’s not as much bullshit as one normally sees. One of the reasons a low funding ratio is bad is that one starts to have to liquidate assets to pay current benefits. It does not necessarily start at 80%.

Thing is, you can be in that situation at 100% fundedness, but yes, if a plan is woefully underfunded, it can go into an asset death spiral, where more and more has to be liquidated, until the funds are exhausted and one is trying to cover benefits as a pay-as-you-go concern.

Which generally collapses with an aging population.

Which is what we see in the Chicago pensions.

That was 49.5% fundedness in 2013. There was a nice, long bull run post-great financial crisis of 2008-2009.

Would you like to guess where the funded ratio landed for the Chicago Teachers’ fund landed in fiscal year 2023?

47.3%.

Here is the history of what they actually paid, plus what they should have paid:

Almost 50% of payroll. Hmmm.

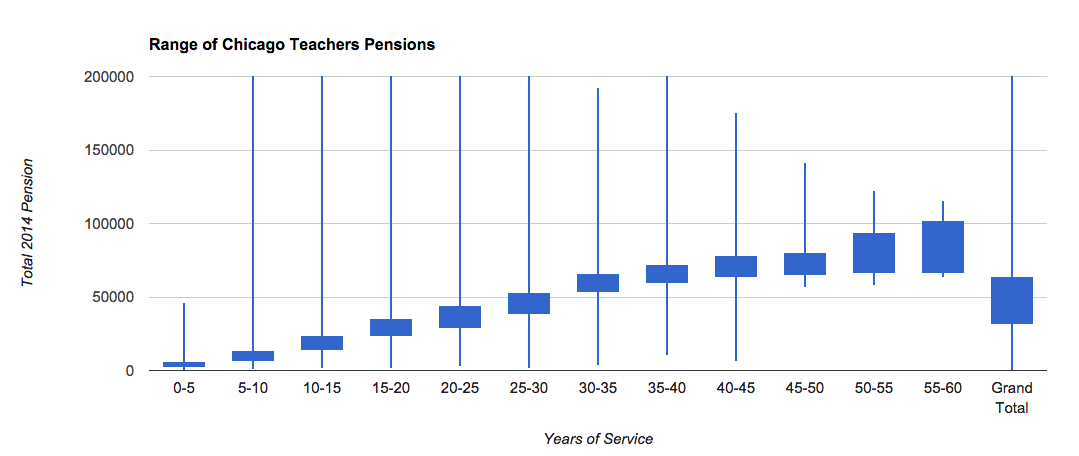

June 2015: Chicago Pension Watch: Teachers Pensions -- What are the Benefits like?

Distribution of benefits in 2014: (box & whisker plot)

In May 2015, Illinois Pensions: A Court Ruling and on How Promises Fail covered the Illinois Supreme Court ruling that one couldn’t adjust the pensions of current participants at all.

I have no doubt that they will increase taxes, but that puny boost is not going to do much in the way of filling the huge pension hole.

Anyway, seems to me that the next step is amending the Illinois State constitution to remove that 1970 clause. Then all the pensions will have as protection will be the assets actually in the funds.

Which was all the protection they had before, though only a few have started to realize it.

But maybe they’ll actually have more sure pensions once that clause is gone, because they will no longer be caught in the fragility of can’t fail thinking.

Chicago Bonds and Credit Get Downgraded in Response, May 2015

But here was the most immediate effect: Chicago Bonds -- Welcome to Junkville, Population: You

Surprising nobody, a bunch of credit announcements have been made in light of last Friday’s court ruling.

Here we go: Moody’s downgrades Chicago to junk status:

‘Moody’s downgraded Chicago’s credit rating down to junk level “Ba1” from “Baa2.”

‘The announcement, which the ratings agency released Tuesday afternoon, cited a recent Illinois court ruling voiding state pension reforms. Moody’s said it saw a negative outlook for the city’s credit.’

….

So here’s something interesting. Chicago cannot declare bankruptcy without action by the Illinois state legislature. And that legislature has the pension ruling for the state to deal with, at the same time. But the state is not in any swaps that have downgrade triggers (that I know of).

These interest rate swaps are of that family of “one neat trick!” which works only if you are legitimately hedging as opposed to making a bet on the direction of interest rates and hoping the bet works out. It does not make the insolvent magically solvent.

The problem is, the counterparties on these swaps want to make sure they get paid, and they generally put in covenants that are stronger than regular bonds (because you never know which direction the cashflows will go in a swap). If counterparty A looks like it’s not going to be able to keep up payments (usually triggered by credit downgrade), the counterparty B wants the deal unwound.

But Chicago can’t really afford to unwind those deals.

Maybe, just maybe, they shouldn’t have been allowed to enter those deals in the first place?

More bonds posts:

May 2015: Chicago Bonds Watch: Credit Ratings vs. Market

May 2015: Buyers of Distressed Munis: BEWARE! GET OUT!

May 2015: Chicago Bonds: Junk or Not Junk? That is the Question

May 2015: Chicago Bonds Watch: There's One Born Every Minute

May 2015: Chicago Bonds: Check Out These Investors Desperate for Yield

Stealing from the pensions

Sorry, BORROWING from the pensions.

July 2015: Government and your money: GIMME GIMME GIMME

As far as I can tell, Chicago isn’t yet grabbing at assets, though Rahm did recently ask, pretty please, could they borrow some money from the pension funds?

“One day after using borrowed money and savings generated by 1,400 layoffs to make a $634 million payment to the teachers pension fund, Mayor Rahm Emanuel’s administration is asking the pension fund for a five-month, $500 million loan.

“At a pension fund meeting Wednesday, Chicago’s newly appointed Chief Financial Officer, Carole Brown, said she’s well aware it’s a “big ask,” particularly after the history of pension holidays and partial payments that created the $9.5 billion pension crisis at the Chicago Public Schools.

“But Brown said the loan is needed to avoid even more devastating classroom cuts. The loan would be made in fiscal year 2016, when CPS would shift from a lump-sum pension payment to monthly payments. When the loan is repaid in fiscal year 2017, the Chicago Teachers Pension Fund would get the money back — with interest.

I’ll gladly pay your pensions Tuesday for some cash upfront today.

That’s convincing, right?

I mean, I know I’d want to lend some money to an entity that is going bankrupt.

That means they’re even more likely to pay back the loan, right?

The answer was NO: Deal or No Deal: Wrangling in Chicago

BORROWING FROM THE PENSIONS: NO GO

Thank goodness.

Thank goodness, that deal is off. (Or it was, as of last Friday… I wouldn’t be surprised if it comes up again.)

….

Thing is, this budget assumes so much on other things. For example, it assumes that there’s this $500 million they’re getting from the state… somehow.

….

But where is that $500 million supposed to come from?

Borrowing from the pension fund.

….

I think we all understand from the hokey-pokey they just tried with essentially the same $500 million that it doesn’t really matter if they borrow by putting in the money first and then taking it back, or if they just don’t put it in in the first place.

Good for the pension fund to tell Rahm to take a hike on this. They’ve got to stop with these budget tricks, because it’s not fixing anything.

More 2015 Posts

Yes, I had a lot of Chicago posts. I enjoy beating up on Chicago.

June 2015: Public Finance Disaster Watch: Chicago Public Schools

July 2015: Chicago (and Illinois) Watch: Shenanigans! Shenanigans for Everybody!

July 2015: Weekend Roundup: Chicago, Greece, Portugal, and much more

July 2015: Chicago (and Illinois) Watch: Don't Think You Can Escape to the Suburbs

July 2015: Chicago's DAY OF DOOM! (about the pension reform lawsuit)

July 2015: Public Pensions Quicktakes: All about Illinois and Chicago - includes the idea: “WHAT IF WE JUST DON’T FUND THE PENSIONS?”

August 2015: Chicago and Illinois Pensions Watch: History and Who is Serious

Enjoy!