I switched over to Substack in March 2020, around the time COVID was really hitting…. but that’s not how 2020 started.

Prior posts:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

2019: Chicago is My Kind of Town to Beat Up On: 2019 Edition

Start of 2020: Some Predictions

2 Jan 2020: Happy New Year! Prediction Reactions and Upcoming Features

I’m not really expecting anything new for STUMP….

I was wrong about that.

I stopped making my own predictions, but I mainly reacted to other people’s predictions.

Elizabeth Bauer had a prediction about public pensions:

Prediction three: public pensions

Third, with respect to state and local public pension plans in the most-indebted states, that is, Illinois, New Jersey, and Connecticut, and the most-indebted cities, such as Chicago, I’m going to go out on a limb and predict that . . . precisely nothing will happen.

Yup.

I’ll go even farther.

Kentucky is going to get even worse than it is now. And all these places will claim that it’s not a crisis until the pension funds run out… and even then, hey! We can do pay-as-we-go! [This one will be coming back]

To wit: absolutely nothing is going to be done re: Illinois, New Jersey, Kentucky, etc. pensions that will in any way help

Those states will not do a damn thing until the pension money runs out and the bond markets are closed to them. They've shown this in their own behavior— Mary Pat Campbell (@meepbobeep) December 31, 2019

I'm expecting that in Kentucky. The new gov will likely do some arranging of deck chairs on the Titanic.

For Illinois, they'll pretend the consolidation of the small plans was consequential.

New Jersey… ¯\_(ツ)_/¯— Mary Pat Campbell (@meepbobeep) December 31, 2019

….

Mark Glennon at Wirepoints has his own viewpoint for the year… or decade, rather:

Instead, this is the time to address the most frequent theme we see in comments on this site and emails we get, which is the coming resolution of Illinois’ state and local fiscal crisis. That crisis will resolve one way or another over the course of this decade. We know that because simple math says it must.

By “resolve” I’m not implying anything benign. I mean what you readers have called it here – a meltdown, big bang, crash, finale. Call it what you want. We’ve used those terms, too, though sometimes in different ways.

Just “let it blow up” is a common sentiment. Why bother suggesting reforms, many have asked, when the political establishment has no interest in reforms? It’s too late anyway now, with or without reforms, others say.

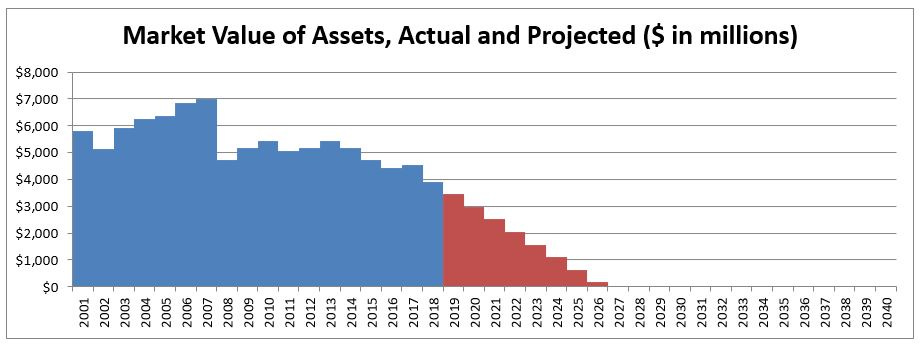

Before I get to his point of view, I completely agree with him that Illinois (and Kentucky and New Jersey and perhaps a few more states) will have their finances unravel due to pensions in the next decade. I’ve got the projections to show it.

I have much more to say about this later — but I’ve gotten into a really dark mood re: these public finance challenges.

I have discovered that nothing but complete disaster will teach many people. So that’s what they’re going to get.

….

Four years ago, I said there would be no bailouts. Maybe I need to adjust that, given what I’ve seen proposed for MEPs.

Maybe there will be partial bailouts attached to large reforms, state constitutional amendments, etc. I still stand by my saying that people will not be made whole — there will not be full bailouts of MEPs or public pensions or ….

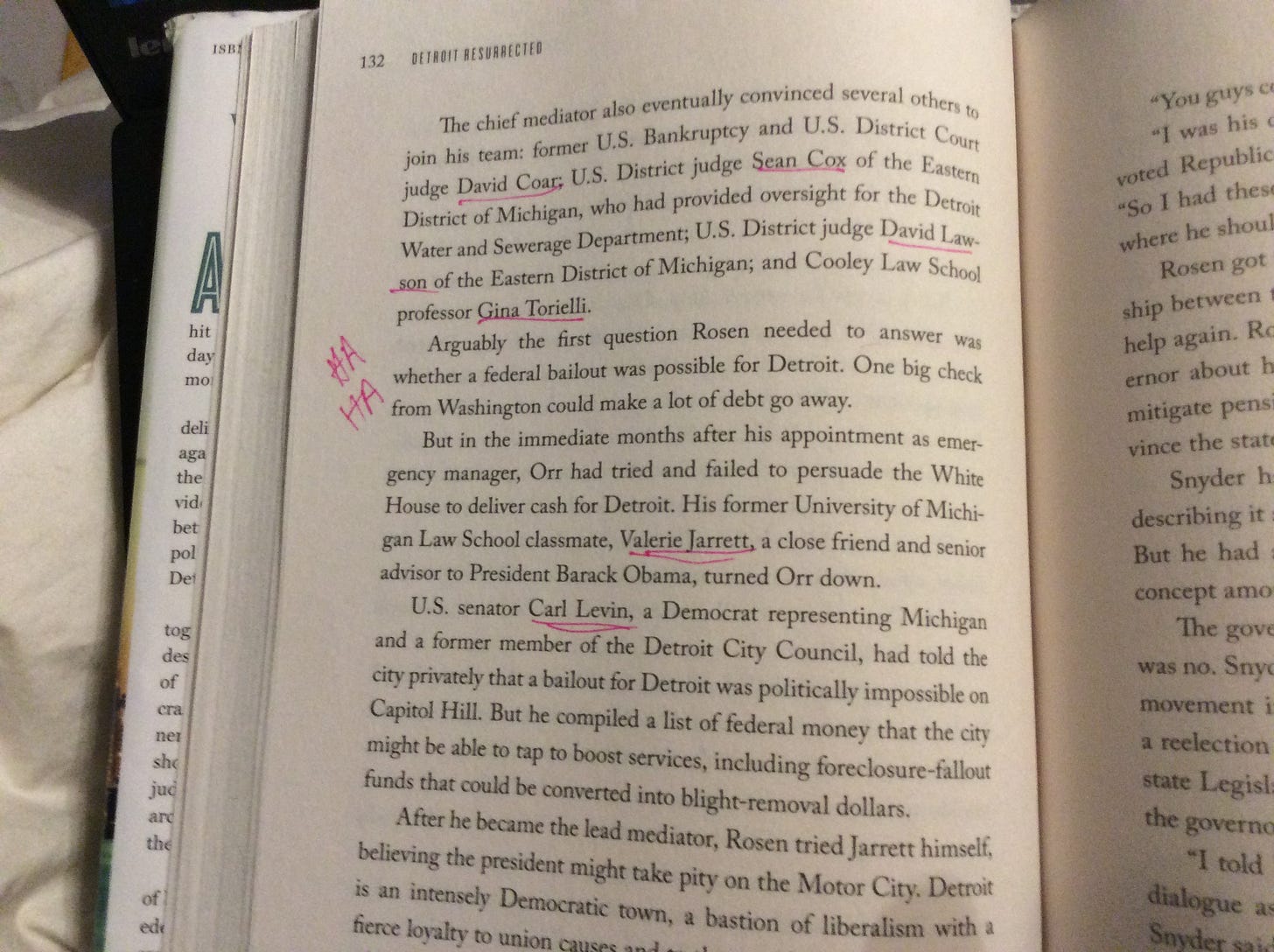

Detroit was given essentially nothing from the Feds. Rhode Islanders were given nothing. Puerto Rico is getting nothing. Chicago will get nothing.

Chicago will be the first to go in Illinois. Yes, some smaller Illinois municipalities have already gone (Harvey, Illinois comes to mind.) down that path, but they’re small, doncha know.

The funding ramps for the Chicago pensions are such that I do not see that happening at all. But I’ll leave that analysis for later.

I wish the Wirepoints guys well. I wish well many of the people I know in Kentucky and New Jersey, too. But it is going to get nasty, and “later” is happening in this decade.

You will see in this post (or the next, about 2021), that I was wrong about this… but for entirely unanticipated reasons.

When I get to now — 2024 — we will see that the 2020/2021 respite didn’t do much for Chicago other than put off the day of reckoning by a few years.

For what it’s worth, I didn’t beat up on Chicago (or Illinois) much in 2020, and no, it wasn’t due to COVID.

28 Jan 2020: Taxing Tuesday Special: State of the Cities from Truth in Accounting

I said that for this year I was going to lay off Illinois and Chicago a bit (after all, plenty of people around to do that) and concentrate more on New York and Connecticut.

And I did. I beat up on Connecticut and NY a lot during 2020. I was stuck at home and feeling sour about both states. And they gave me plenty to work with.

Chicago and Pensions

24 Feb 2020: The Moral Case for Pension Reform

Elizabeth Bauer wrote: The Bottom Line: Illinois’ Public Pension Debt Is A Moral Issue

I will pull out a small bit:

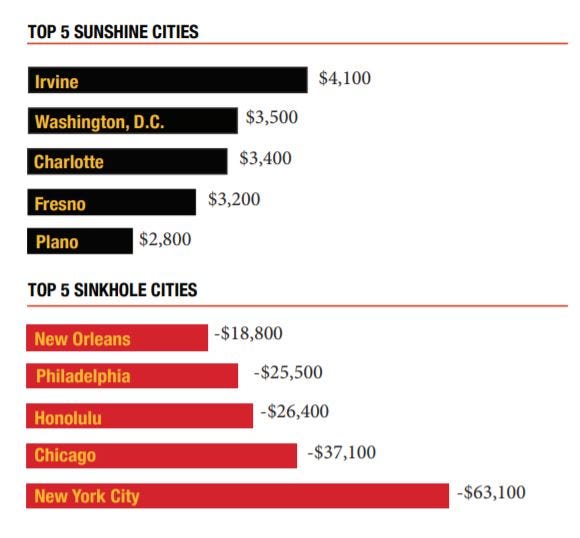

And it is no mere coincidence that a state with such a legacy of corruption is so severely in debt. Remember, Illinois is ranked second-worst according to Truth in Accounting, with a pension debt of $139 billion (by its reckoning) and a further $56 billion in unfunded retiree healthcare promises. Only New Jersey is worse, because of the state’s smaller size. And Chicago is second-worst of the 75 largest cities; New York City is worse only because its finances include the liabilities for its school system, which is a separate entity financially in Chicago.

…..

Corrupt state and local government officials who rationalize skimming a little for themselves, and voters who overlook this if they think their interest group (neighborhood, union, ethnic group, etc.) benefits from the state or city’s spending — it’s an attitude that led columnist Mike Royko to pen his proposed new motto for the city, back in 1967: rather than Urbs in Horto (city in a garden), it should be Ubi Est Mea, “Where’s mine?”And this is the very same mindset that accepts unfunded/underfunded pensions, in which the costs are not placed on other taxpayers in the here-and-now, but rather the people on whom the burden is being placed is the next generation.

I have a somewhat different take, and yes, it’s a moral issue.

NOT ONLY TAXPAYERS WILL GET HIT

One can concentrate on the effect on the taxpayer paying for services done decades before, which is what Elizabeth Bauer writes about. Current services get cut in order to pay for prior generations’ operational costs.

….

Because you need to realize: all cash flows will get squeezed as assets in the pension funds run out — the notorious asset death spiral:

….

WHEN THE MONEY RUNS OUT, PROMISES ARE BROKEN

As the money runs out, and other sources of cash are tapped out, this can end a couple of ways.

One way is official municipal bankruptcy.

One way is official municipal bankruptcy.

In bankruptcy, pension benefits can get cut. They have gotten cut for current retirees in Detroit.

A retired widow, Debra Westbrook spends most of her time caring for her bedridden adult son.

But it’s become more challenging, she said, after the city’s 2013 bankruptcy dealt a blow to her pension and health care that “threw everything into chaos.”

These days, the 64-year-old former Detroit water department worker said she’s struggling to cover more than $1,400 in monthly costs for her son’s care, her mortgage, insurance and other bills.

“It’s eating me up alive,” said Westbrook, who has seen her monthly pension drop from about $2,400 to $1,900 and is paying $788 a month for medical coverage. “Every month I’m robbing Peter to pay Paul.”

Westbrook worked for the city of Detroit for 33 years before retiring in 2010 as the city struggled with its finances.

Ms. Westbrook had retired when she was about 58 years old, after 33 years of service [this article was from 2018]. That is quite young to retire, but I am sure that it was within the promises made by Detroit.

A promise Detroit had no business making.

Many people were hurt by Detroit’s bankruptcy: bondholders (and, again, many of those bondholders would have been just as sympathetic as Ms. Westbrook), taxpayers, residents, retirees, employees.

….

IT CAN BE WORSE THAN A PENSION CUT

The Detroit situation was pretty bad for retirees.

At least the Detroit retirees had a pension fund with some assets in it. Assets that neither city nor bondholders could grab.

It can be even worse.

In Prichard, Alabama, the assets completely ran out.

….

And by “failed to make pension payments”, they don’t mean that the sponsor didn’t make contributions to add to the pension fund.

It’s that the retirees did not get any payments at all.

That lasted longer than 6 months, by the way.

….

NO PENSIONS AT ALL IS A POSSIBILITY

Ten years ago, this is what I wrote:

Guys. I mentioned the Pritchard thing back in 2009 when it started happening [there was a funny asset-side thing, too, so it also appears in my “Harvard bet the milk money” thread]

And fancy that. The money isn’t magically appearing.

I bring up Pritchard every time someone wants to be blase about the government fulfilling its promises. Guess what? Once the money runs out of the pension fund, these pensioners may very well end up with =nothing=, as opposed to the haircut PBGC-covered pensions do. People seem to think that the money will get sued into existence. Or that the generation not receiving the services of those already retired are at all interested in paying for them and current public employees.

That’s why I laugh every time people drag out “We’re indebting our children/grandchildren!” rhetoric. You’re making the assumption that the kids will pay the debt. I’m thinking not.

So, what was that about government not going out of business? Even if that were true, they don’t need the services of the already-retired.

And this is what I’m bringing up now. This is why I’m quoting all the stories about the retirees getting hit, with deeply cut or no payments at all.

Given the demographic trajectory of many cities and states, there won’t be enough in taxpayer money to fulfill these promises if you didn’t save up ahead of time.

….

HOW PRICHARD ENDED

In May 2011, they came to an agreement. It had been over a year and a half of no pension payments at all. Ultimately, 19 people died in the interim.

We never learned the terms of the settlement. It was done out of court, and the municipal bankruptcy was denied because Prichard had no bonded debt.

….

THE GOAL: FULFILL REASONABLE PROMISES IN A REASONABLE WAY

….

SOME PENSION PROMISES ARE UNREALISTIC

….

As I’ve said many time, reality always wins over law.:

Because they thought that pensions could not fail in reality, that gave them incentives to do all sorts of things that actually made the pensions more likely to fail. Because, after all, the taxpayer could always be soaked to make up any losses from insane behavior.

But, no, they can’t be.

….

REFORM THE PENSIONS FOR THE PENSIONERS’ SAKE

All of these are setting up the pension funds for failure. This affects people’s lives.

Retirees getting their benefits cut is a moral issue.

Pretending that the benefits will be paid because it’s written somewhere, without actually putting aside enough money to pay for those benefits… well, that’s essentially deliberately setting up retirees to get their benefits whacked.

Some pension funds may be able to retrench via increased taxes, if their holes aren’t too deep. I do recommend switching to a risk-sharing set-up, so that some retirement income is guaranteed and some will go up and down in order to maintain true intergenerational equity.

But many — such as Kentucky, Illinois, New Jersey, Chicago — will have to make substantial cuts to current pension participants in order to avoid fiscal disaster. Their current crop of politicians are in denial.

Making comments such as “The fantasy of a constitutional amendment to cut retirees’ benefits is just that – a fantasy. “ is implicitly stating that you are just fine with the pension money running out and then benefits getting cut. And hoping that you’ll be dead before that happens.

Note that I named specific systems — and Chicago is one of the most strained systems.

COVID and Rumors of Bailouts

As COVID hit and stayed, with multiple waves of deaths, people freaking out, and lockdowns galore, various groups went cap-in-hand to the federal government.

In particular, the states and cities had a big ask for money, and various cities claimed that people wanted them to die if you didn’t shovel huge loads of cash at them.

Illinois very specifically asked for $10 billion to shore up their pensions.

30 April 2020: State Bankruptcy and Bailout Reactions: No Pension Bailout, No State Bankruptcy Contingent

To remind you of the situation: Illinois asked for money from the feds, and specifically, some to pay for their pensions. McConnell replied no pension bailouts for you, but hey, what about state bankruptcy?

There have been reactions. I’m in the group I’m covering today.

Here is my stance: no COVID-19 relief funds are for paying for pensions, specifically, the unfunded liabilities built up over decades. [For most of the U.S. public pensions, they built it up over the past 20 years, as most were fully-funded in 2000. For the worst-funded pensions, it reaches before 2000, and sometimes to before I was born in the 1970s.]

In addition, no, Congress shouldn’t try passing some sort of legislation allowing for a bankruptcy process for states.

Now, this post is about digging up what I had to say about Chicago, so let me skip ahead to that.

What About the Cities?

So above I mentioned the states needing a pension bailout [and they’re not going to get it]. What about cities in that state?

Luckily for them, they do have access to Chapter 9 bankruptcy processes.

While New York State’s pension funds are topped-up, the city funds are almost as bad as Illinois’s. And let’s not talk about Chicago.

The thing is, of course, that many of these cities are not allowed to declare bankruptcy without approval of their state legislatures, as mentioned above. Chicago and New York City are in such a position. Cities in places such as California can decide to do it on their own.

Of course, there are consequences to declaring bankruptcy, but there are also consequences of running out of pension money and not being able to pay your bonds.

Back in January, I looked at Truth in Accounting’s State of the Cities. Here we go:

Unsurprisingly, both New York City and Chicago are at the bottom of that list.

27 Jun 2020: State Bankruptcy and Bailout Reactions: Chicago Pleads, Bailouts Rationalized, and Bailouts Rejected

No, COVID didn’t cause Chicago’s financial woes

It just made them worse. A lot worse.

…..

@PolicyQuantsPhD Chicago's decades of deliberate underfunding of pensions, following iffy fiscal practices [parking meter deal? swaps?], etc. has nothing to do with COVID. Those were all deliberate choices Current economic turmoil makes their condition worse, but it was horrible alreadyLet’s see what we were reacting to:

Chicago will be faced with a series of “really, really difficult or impossible choices” without another round of stimulus money to replace revenue lost during the coronavirus pandemic, Mayor Lori Lightfoot said Monday [June 8].

Chief Financial Officer Jennie Huang Bennett reiterated that the stay-at-home shutdown of the Chicago economy triggered by COVID-19 would cost the city “in excess of $500 million” this year — and pegged the 2021 shortfall at “upwards of $1 billion.”

Huang Bennett reiterated the long-term cost to Chicago would depend on how quickly the local economy bounces back and how much revenue replacement money is earmarked for cities and states in the next wave of stimulus money coming from the federal government.

“We are going to need some level of federal funding to help support us during this time frame, which is appropriate. I mean — what we’re facing by way of COVID and the revenue losses and also many of the expenditure increases are … the result of a one-time event that you would never have expected over a lifetime,” the CFO said during a conference call.

Already, Chicago has received $1.13 billion in federal stimulus money, but only to cover expenses tied to the city’s response to the pandemic. None of it will replace lost revenues.

There is plenty more, but I think we can cut it off here. I will write more about Chicago later, but just wanted to get it out there.

If you were in a bad fiscal position before COVID, after so many years of good economic environment, there is no doubt: after COVID, you’re in a horrible situation. No kidding.

It is grimly amusing to me of the various states and cities crying about their revenue loss, and pretending they would have been just fine if it weren’t for that darn COVID.

29 Jun 2020: Polities Under Fiscal Pressure: Chicago and Cook County

Let me sample from a recent interview with Lori Lightfoot in the NY Times

Q: Let’s talk about the city’s financial situation. You’re facing a near-billion-dollar budget gap. That would be hard to address during an affluent time. How do you address it now? It’s certainly not a problem you can tax your way out of. Is there a path forward that doesn’t involve bankruptcy?

A: We’re not looking at bankruptcy. Bankruptcy is when there’s no other hope. We have a lot of other hope. We’re probably looking at a billion dollars of potential revenue impact, but I believe this as a governing principle: We can’t ask people to sacrifice when we as a government haven’t sacrificed on our own. Right before April, we stood up a $2 million fund to help people pay their rent and their mortgages. Within days, we had over 83,000 people apply for 2,000 grants. The need now is even that much greater than it was before. Going to people and saying, “I know you may not know where your next meal is coming from, but by the way we need to tax you more” — I can’t take anything off the table, but we have other tools in our tool kit.

Q: What are the other tools?

A: This problem is so enormous that the only place that we can look to is the federal government. We need the federal government’s help to restore revenue loss. What we’ve gotten so far, and I’m incredibly grateful, is only for reimbursement for Covid-related expenses. It doesn’t begin to scratch the surface of what the need is across the city. We’ve got to continue to support our safety-net hospitals, our Federally Qualified Health Centers — all those component parts that are going to be necessary not only now but, God forbid, if we get a second surge in the fall. Also, we’ve got to put people back to work; our restaurant industry has been decimated. My list is long. I feel like I’ve got one of those old-timey scrolls and I’ve let it go and it keeps going and going. But we need help.

Q: How optimistic are you about getting it? I ask that question in light of the rhetoric we’ve seen suggesting that the fiscal problems of Democratic-run cities and states are of their own making — that you’ve got to reap what you’ve sown.

A: Yeah, I’ve seen that. I’ve had some goofy Republican senators take shots at Chicago. I’m like: “I don’t even know this person. What the hell is this?”

At a town hall in May, Senator Martha McSally, an Arizona Republican, said, “This is not the time for states and cities … who have mismanaged their budgets over the course of many decades, for them to use this as an opportunity to see you, as a taxpayer in Arizona, as a cash cow for them in whatever city you want to talk about, whether it’s Chicago or New York or whatever.”

I’m like, really? In the middle of this pandemic, when people were scared, you saw that unity was helpful. Now some people feel like the storm has passed — it hasn’t — and you’re seeing partisan divides rear their ugly head. But we need to take the approach of the government being a catalytic force for making the recovery more V-like instead of U-like and accelerating that recovery as appropriate. I say “as appropriate” because we still have to make sure that we’re keeping people safe.

Well, I’m very skeptical you’re going to get that hole filled in 2020 from the federal coffers. There may be something. But it won’t be $1 billion.

I do like how Lightfoot doesn’t even try to lie here, that Chicago’s finances were just fine before COVID hit. Many cities and states have tried that lie…. and maybe she has tried it elsewhere. I haven’t read every story about Chicago finances recently. I’ve been a bit busy.

But that “we have a lot of other hope” is founded on….what, exactly? Maybe she’s hoping Biden wins the election, and the Dems sweep House & Senate, and then money time!

Well, you’ll have to wait til 2021 for that, then. You ready to sweat out the rest of 2020 with nothing?

Well, guess what happened.

Ah, but this isn’t the 2021 post. We can wait for that big money drop then.

The inevitable crash: not caused by COVID

Let’s look at my 2019 post again, about what the (then) next mayor would have to deal with. The prior mayor, Rahm Emanuel, really did try various things to fix the pensions, which is pretty much the biggest financial problem Chicago has. But deals were knocked down by the unions, courts knocked down other changes, and then Rahm kind of gave up. And didn’t run again for mayor. (That was probably more due to the murder of Laquan McDonald, and more specifically, the squashing of evidence in that case, than due to the money problems.)

[My 2019 post also has me losing it at somebody on twitter for claiming the pension didn’t have to be funded. But you can go to the post to read that bit.]

Here was my conclusion:

Look, I’m not wishing ill on Chicago. I just think ill is coming to Chicago. I didn’t have any hand in the decades of deliberate pension underfunding.

I didn’t cause any of the pain that will be coming to Chicago, and I don’t glory in it.

But I am extremely angry at the people who have tried to minimize the repercussions that are the extremely foreseeable results of deliberate policy.

I will pray for your souls, those of you who are responsible. You really need it.

Now, maybe they’re “lucky” that bad fortune has hit all cities and states. Perhaps a little bit of federal bailout will occur just so that everybody gets a little taste.

However, even if the feds filled the entire hole of Chicago’s revenue, even for a few years, Chicago would still be in trouble.

The COVID-revenue drop just makes the reckoning sooner.

Again, we know some money came, and I know what they did with it (some of it). I also know what they’re facing this year.

Waiting for the Election (and a Bailout): 2020

2 Nov 2020: Reading the News with Meep: Waiting for a bailout, NYC pension reform, Illinois finance, and more

There was no stimulus/bailout bill before the election, and everybody is waiting to see the composition of White House/House of Reps/Senate to figure on the odds of getting a lame duck session stimulus/bailout, wait for January 2021, or realize that the various financial profligates had best learn to deal without more bailout dough.

Still, some are commenting on the bailout bills that had already passed and were signed, and Pelosi’s wishlist from the HEROES Act [passed the House, not going anywhere in Senate].

….

Illinois finance containment area: you know the drill

One of the biggest “waiting for a bailout” offenders is Chicago and, of course, the legislature of Illinois. They’ve never made a difficult decision, and they’re waiting to see if the suckers, um, I mean, voters, take the bait and vote in the “we’ll keep defining ‘rich’ down til we get enough dough” state constitutional amendment.

Yvette Shields: Without touching rating, S&P gives Chicago something to think about

Financial Advisor: Chicago Poised For Painful Choices To Close Record Budget Gap

Illinoisans Apparently Seeing That ‘Fair Tax’ Is The Wrong Amendment On The Ballot – Wirepoints

Reason: Illinois’ Governor Begs Citizens To Let Government Tax Them Even More

Fred Klonsky: ILLINOIS TRS INVESTMENTS WITH LEON BLACK’S APOLLO GLOBAL. “WE HAVEN’T DISCUSSED IT YET.”

Elizabeth Bauer: Whatever Happened To Illinois’ Plan To Fund Pensions With Asset Sales? Not Much, It Turns Out.

Ted Dabrowski and John Klingner at Chicago Tribune: Commentary: A 60% tax hike on Illinois’ richest won’t be a free lunch for the rest of us

Elizabeth Bauer: Lightfoot Again Calls For Pension Reform – And It’s Time To Fish Or Cut Bait

Wirepoints: A preview of Chicago’s 2021 budget: more taxes, phantom savings and no reforms. – Wirepoints Quicktake

Eric Allie on Fair Tax proposal: Dracula and Hellraiser (he had more, but those were my two faves)

Yvette Shields: Chicago rating outlook gets Fitch Ratings cut to negative

Greg Hinz at Crain’s Chicago: What the heck is going on at the Chicago Teachers’ Pension Fund? – sounds like the drama at Calpers, but even pettier

I think the credit rating agencies are also waiting to see what falls out of the election for potential of at least a teeny-weeny bailout for places like Illinois and Chicago.

It doesn’t fix their long-term problems. The borrowing they’ve been doing from TALF barely makes a drop in their huge unfunded liabilities.

It was just a holding pattern then.

19 Nov 2020: Reading the News with Meep: Pay-as-you-go Retiree Health Care, Taxing the Rich, New Jersey Debt, and More!

That last item is about the Chicago Teachers Pension Fund, and let me give you a taste:

Nearly half the leadership staff at the Chicago Teachers’ Pension Fund alleges discrimination and other ill-treatment by a few of the fund’s board trustees, according to a lawyer representing them.

“It’s been a racially hostile environment for some time, sort of conjoined with intimidation, bullying and harassment,” alleged Michael Leonard, a Chicago attorney hired by four of the fund’s leadership staff and a former top staffer who recently exited. All requested, through Leonard, that their names not be used.

Well, if a lawyer is representing them in an employment dispute, I highly doubt their names are going to be secret for long. In general, legal proceedings are a public matter.

In any case, there are plenty of people already on the record:

Problems at the pension surfaced in August when the president of the fund’s board, Jeffery Blackwell, went public with a host of criticisms directed at the board’s trustees. “For the last year and a half I have been witness to some of the most abhorrent, disturbing and despicable actions by former and current trustees on this board,” Blackwell said in a statement at the beginning of the Aug. 20 trustee board meeting, citing “a culture of intimidation, intentional misinformation, discrimination, slander, misogyny, fear-mongering, blatant racism, sexism and retaliatory actions from trustees towards staff and vendors.”

Here is the Public Plans Database page for the pension, and the pattern there is really not good. One doesn’t need a bunch of pension trustees and staffers having this level of interpersonal conflict.

There is other weirdness that has been going on in Illinois pensions (beyond the expected super-underfundedness) which has not been made public (yet), and I keep scanning various sites for even gossip. I guess somebody got some lawyers to sew up all the gossip tight….

I forget what that gossip was (I only ever link to public info, so ….)

Closing up the Year with Chicago Homicides

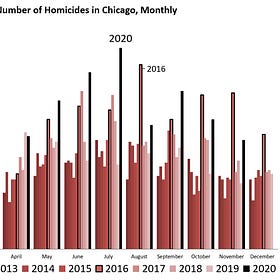

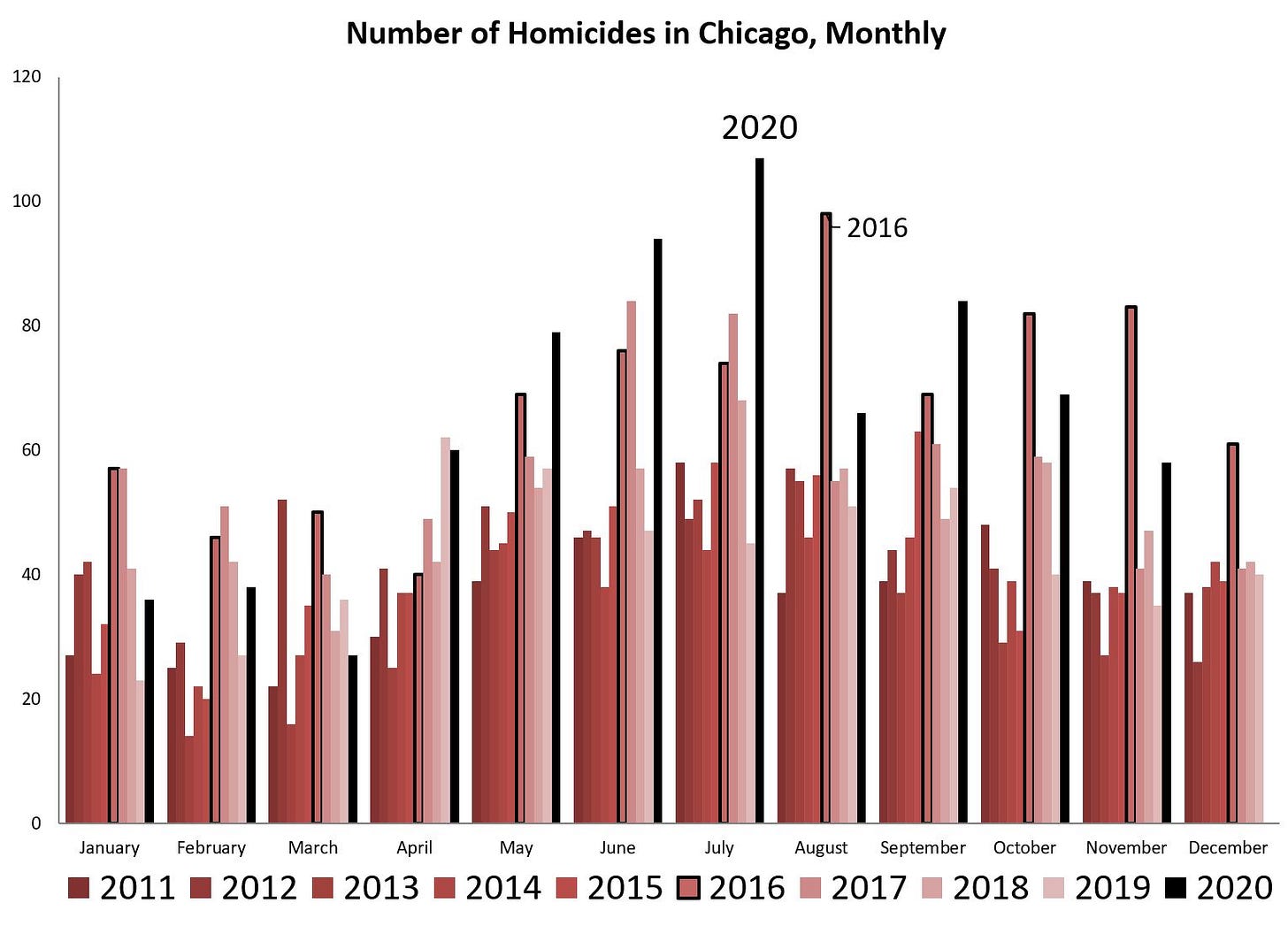

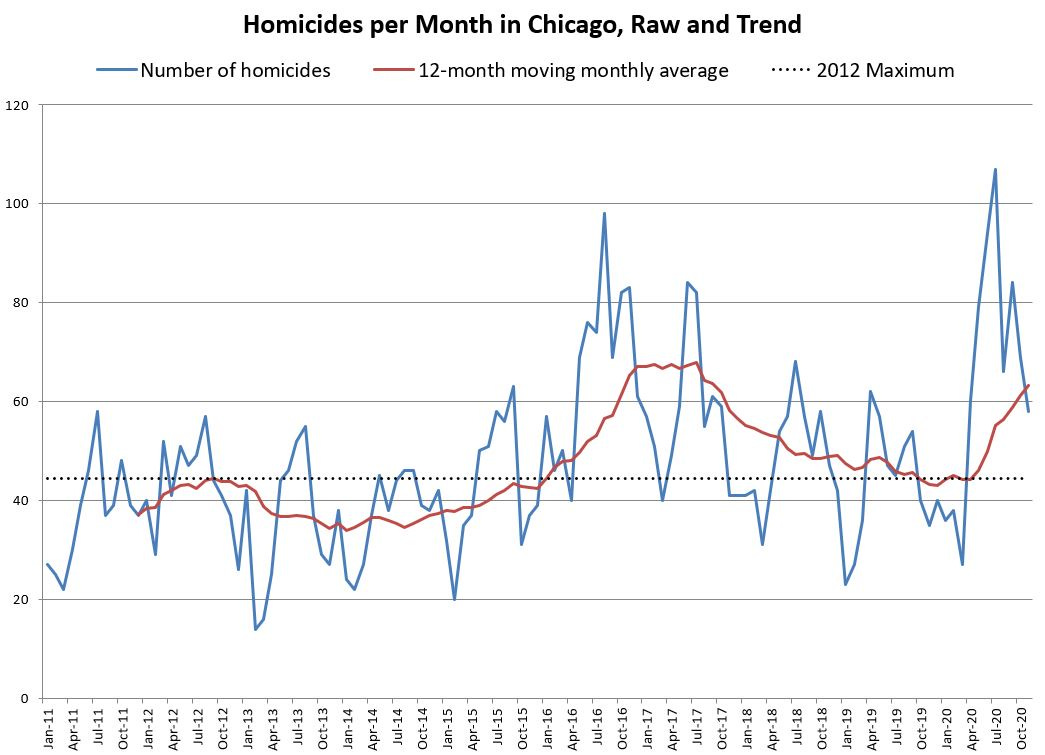

Just an FYI, this was not unique to Chicago: homicides jumped up in 2020 compared to 2019. So did other external causes of death: drug overdoses and motor vehicle accidents.

Chicago Homicides Quick-Take: 2020 is as Bad as 2016, Just More Concentrated

I’m trying to tease apart all the sources of extra mortality for 2020, and while digging through my old files, I found my old posts on Chicago homicides:

Whoa, check out that spike.