Chicago Is My Kind of Town To Beat Up On: 2016 edition

Only a week to go... I had better hurry this retrospectacle up

(Yes, I know what I wrote.)

It’s a week until the DNC starts, and I have yet to get 2016-2023 of beating up on Chicago to get done… so let me get cracking!

January 2016: Straight Out of the Gate

4 Jan 2016: What Governmental Bankruptcy Looks Like: Today Puerto Rico, Tomorrow Chicago!

That early entry was mostly about Puerto Rico’s financial messes, but I ended talking about Chicago:

Puerto Rico is chump change next to Chicago and Illinois. I will come back to that another day.

There are parties interested in making sure that bigger fry than Puerto Rico won’t be declaring bankruptcy.

And parties interested in making sure that they will.

No clue how that will end, but I will bet it won’t be resolved this year.

That was an easy bet.

5 Jan 2016: Borrowing for Operational Costs is a Bad Idea: Detroit and Chicago Schools

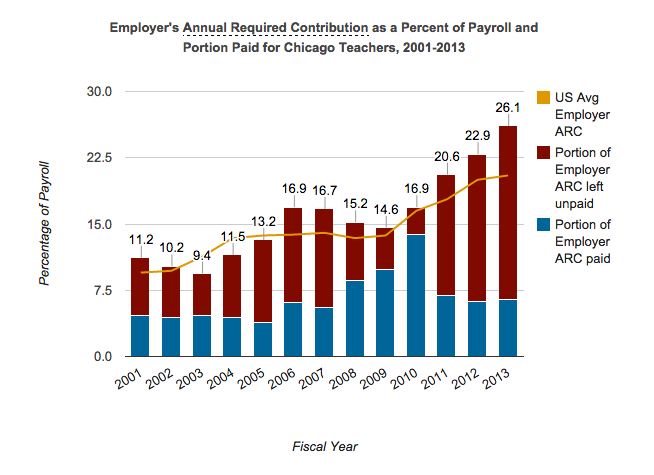

I have covered the Chicago Public Schools fiscal problems before, and to make things simple I will merely copy the Public Pensions Database graph on contributions:

Before we dive into their current $$ trouble, let’s look at their enrollment figures:

CPS Enrollment Falls by 6,000 Students, Adjusts School Budgets

By Tanveer Ali and Joe Ward | September 25, 2015 5:00pm | Updated on September 25, 2015 7:38pm

CHICAGO — Enrollment in Chicago Public Schools dropped by more than 6,000 students this year compared with last, according to figures released by the district Friday.

The number of students enrolled across all CPS schools dropped to 367,499, from 373,087 last year. That number is based on attendance numbers from the 10th day of the 2015-2016 school year.

Unlike the past two years when budgets were based on projected enrollment rather than actual enrollment, CPS is adjusting individual school budgets this year based on the 10th-day enrollment.

Some of that 6000 drop may be a result of overly “optimistic” projected enrollment numbers in prior years.

There is a lot going on with Chicago right now, what with Rahm Emanuel being taken to task for the coverup in the killing of Laquan Macdonald, as well as an airing of long-simmering grievances re: Rahm, but the superbig problem looming is the Chicago Public Schools finances.

….

The problem that Puerto Rico, Chicago, and Detroit all have is that they’ve borrowed money for operational costs in the past… assuming they could afford to charge other people, that is, future taxpayers, to pay for the past operational costs.

But those future taxpayers did not appear. There are fewer of just the base population (CRAP!) and then you find out so much of the base population is poor and don’t actually pay taxes (DOUBLE CRAP!), so they do the big deer eyes at other other people — taxpayers elsewhere.

In the case of Detroit and Chicago, they’re trying to get their states to bail them out. Puerto Rico is going one better, and trying to get something from the federal government.The problem that Puerto Rico, Chicago, and Detroit all have is that they’ve borrowed money for operational costs in the past… assuming they could afford to charge other people, that is, future taxpayers, to pay for the past operational costs.

But those future taxpayers did not appear. There are fewer of just the base population (CRAP!) and then you find out so much of the base population is poor and don’t actually pay taxes (DOUBLE CRAP!), so they do the big deer eyes at other other people — taxpayers elsewhere.

In the case of Detroit and Chicago, they’re trying to get their states to bail them out. Puerto Rico is going one better, and trying to get something from the federal government.

Now, Michigan has been bailing out Detroit, because the deal is that while Detroit has been losing population, Michigan as a whole has been increasing.

Illinois had been shoveling money at Chicago, but you may have heard that there’s a Republican as governor now, and he and the Democratic legislature are at loggerheads re: the state budget.

To be sure, Pritzker came in later, but even he has limits on how much money he can shovel at Chicago, which we’ll find out as we come to 2024.

6 Jan 2016: Governor Bruce Rauner on Recent Illinois Issues

This one was different — I actually typed up a transcript of Republican Governor Rauner talking about Illinois issues in a press conference. Here is the part where he was talking about Chicago:

[RAUNER] You’re going to hear very shortly, I’m sure that the mayor of Chicago is going to come out very shortly and start saying: it’s Springfield’s fault that Chicago Public Schools are in trouble.

And let’s be clear: Chicago Public Schools are in dramatic trouble, as is the city, but the schools are worse.

(4:01)

[RAUNER] It’s outrageous, what’s happened to the schools of Chicago. It’s a tragedy for the children and for the parents, the city of Chicago.

I personally have spent decades and significant personal resources trying to help the schoolchildren in the city of Chicago and to improve the schools. They’re looking at a disaster somewhere in the next 9 months, in the Chicago public schools.

The mayor will attempt to blame Springfield, and say “Springfield owes it to us, to send us lots of cash, and to take our pension liability off our books.”

Let me be clear: that is fundamentally wrong, fundamentally not true.

It is accurate that Chicago is the only community that pays its own teachers’ pensions, that’s true. But that’s been true for over one hundred years.

And Chicago, as much as they’d like to deny, and we’re going to … Chicago gets $600 million more for their school district than other comparable school districts based upon the number of students and the number of students in poverty.

(5:01)

[RAUNER]…to more than make up for the fact that Illinois doesn’t pay the teachers pensions in Chicago like it does for other communities.

So for them to say “Hey, you owe it to us, it’s Springfield’s fault, pick up our pension liability, and let us kick the can on the rest of our pension liability”

No. No. Not happenin’.

We’ll work together, cooperatively, if the city is helping us reform the state, we’ll work together to solve some problems.

If Chicago is either opposing reform for the state, which so far they are, or staying silent, and letting the Speaker block reform, no, I’m sorry, we’re not doing things to help the city of Chicago. As much as I would like to… and believe me, no one would like to more than me, but it’s not gonna happen. … You’re going to hear it now, very soon, and this is a critical time.

(5:45)

[crosstalk]

[RAUNER] One of the reasons I’m cautious and optimistic we can get some reforms, is because, you know what, Chicago has been so financially mismanaged — they have been doing for years, on a small scale, what the Speaker is trying to get the state to do right now. And we’re not gonna go down that road.

Making that transcript was a lot of work. I love that I have otter.ai to make transcripts for me. The reason I typed that press conference up was so I could quote my own transcript.

14 Jan 2016: The State of Chicago: Deep in the Suck

CHICAGO TAKING ON MORE DEBT

Oh yay. Just what Chicago needed. More debt to pay for other debt.

Junk-rated Chicago is returning to the municipal bond market to cover mounting pension obligations, even after a record property-tax increase.

The city is selling $500 million of general-obligation bonds to refinance existing securities and cover some debt-service bills, according to Bloomberg. The federally tax-exempt securities are being offered at a top yield of 4.93%, which is about 2.3 percentage points higher than benchmark debt.

….

CHICAGO PUBLIC SCHOOLS IN CRAPPY POSITION

….

STATE BAILOUT?

Maybe the state will pony up!

Or….maybe not.

Gov. Rauner Says CPS Shouldn’t Expect Money From Springfield:

….

RUNNING OUT OF OTHER PEOPLE’S MONEY

So we’re looking at an upcoming teachers strike as well as a continuation of Laquan McDonald-related protests as the weather gets warmer.

Even if Rahm is forced out… what are they going to do? Rauner didn’t say he’d give Chicago more money if Rahm was out. The bond market hit Chicago with 4.875% yields (yes, that’s high — 2.29 percentage points over other munis)….and they’re looking to issue billions more later this year.

You think the bond market will be happy with a Rahm replacement?

I don’t see Rahm leaving absent a perp walk. It could happen, but I think it unlikely.

So you’re stuck with him, Chicago. And he’s stuck with you.

And all y’all are stuck with a huge money hole.

What are you going to do?

That was just the January posts.

Some Public Pension Philosophy and Chicago

5 Feb 2016: The Meaning of the Word "Fault": Chicago Pensions Edition

I’m going to go on a little philosophical discourse for a moment, jumping off from a comment from one of the real people behind The Big Short:

….

I want you to think about a theoretical situation.

Let’s say you are living a lavish lifestyle, racking up debt, paying just the interest (and maybe a little bit of principal, but only because that’s forced as part of minimum payments), and you are able to coast for a while.

Every week you buy $10 in lottery tickets, because your “plan” is to win the lottery, pay off your debts, and then live even larger.

But each week, you don’t win the lottery or you just get one of the booby prizes (like 5 “free” lottery tickets).

Eventually, you go bankrupt, unable to pay your minimum payments on debt, maxing out all your credit cards, and just plain out of cash.

So you sue the guy who sold you the lottery tickets.

It’s his fault, you see. You had a plan and the reason the plan didn’t work was because the guy who sold you the lottery tickets must have cheated you somehow.

Right?

WHAT DOES “FAULT” MEAN?

Now, it’s not a perfect analogy for what I’m getting at.

But when one’s financial “plan” had a very low probability of occuring, or if you don’t take into account very likely outcomes, it’s your fault for making the decision. It’s not the responsibility of the lottery ticket seller to remind you each time that your expected return is negative. You should have known that already.

Even if the lottery ticket seller says “hey, ya never know” and promotes the very improbable and very attractive upside, it’s still your fault if you shoved a bunch of money into the lottery.

Obviously, I’m trying to liken this to public finance and especially public pensions. The various governmental actors decided to give higher benefits, decided to invest in risky assets, decided to speculate with interest rate derivatives. And, most importantly, they decided to underfund the pensions even with all their lovely “plans”.

Unless there was outright fraud, then it is the fault of the pension plan sponsors and trustees that the pensions are in a poor condition. (Let’s not count out fraud, of course. But it doesn’t require fraud to explain the poor pension performance.)

So the Chicago teachers union has decided to try to Alinsky the banks on the other side of some interest rate swaps that are part of Chicago’s current leverage. Sorry, but I don’t think targeting the banks is going to help y’all right now. People can see what a bad actor Chicago had been even without the interest rate swaps. It’s just one of the very many shenanigans going on, and pretending they didn’t know the potential risk in interest rate swaps is idiotic given the Orange County experience.

If they were ignorant of the Orange County experience, then I say they were too ignorant to hold their positions.

So which is it, guys:

the deciders were ignorant and duped with the interest rate swaps, thus unqualified to hold their positions, and therefore at fault for taking a position they shouldn’t have; or

they did understand the derivatives transactions, and therefore are themselves at fault for making that decision

Either one is possible to me.

….

Now, it is possible there are shenanigans going on with the banks. I assume it will come out in the case.

But it might turn out that Chicago took a bad bet — a bet they didn’t have to make.

They decided to make it.

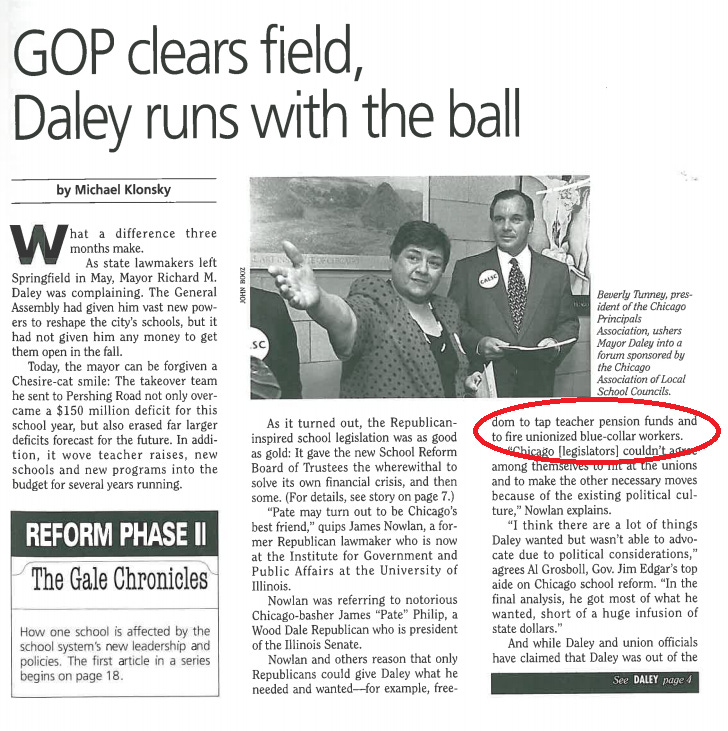

If one looks at the rest of the piece, I pull out news pieces from the Daley years….from the front page of a 1995 newsletter:

and the continuation on page 7:

As I wrote in 2016, instead of fully-funding the teachers’ pensions, they used the budget on putting cash in the teachers’ hands right then.

They assumed the teachers would get their pension benefits in the future, even if they didn’t fund the pensions in the 1990s.

Yeah, I don’t want to hear how it’s the banks’ fault.

You guys decided. Daley decided. The teachers asked for, and got, higher pay in the mid-1990s (with the expectation of high pensions decades later) with money taken from the budget that should have gone into funding the pensions.

And now your pension fund is in an execrable state.

Decisions have consequences. Quit blaming the banks.

Chicago Teachers Non-Strike

As with every year the Chicago Teachers Union have a contract up for negotiation, they threatened to strike if they weren’t made perfectly happy.

Here’s the timeline.

In the spring, the Chicago Teachers Union (CTU) called for a Day of Action! (this was the shot across the bow to warn about the potential strike in the fall).

They were angry that Chicago was going to start imposing the statutorily-required employee contributions to their own pensions, which had been picked up (kind of) by the city/state.

Oh, and that Day of Action was on April Fools Day. Yes, Really.

28 March 2016: Chicago Watch: What'll It Be, Teachers?

A few weeks ago, the Chicago Teachers Union voted to strike or walkout or something on April 1.

….

I thought the timing was pretty bad, given the obvious “April Fools” caption that will be on news photos.

I’m sure someone already has a bunch of “We’re No Fools” signs printed out and ready to go for their rally on Friday.

But given last week’s ruling by the Illinois Supreme Court, the timing is doubly worse.

DO YOU THINK PUBLIC OPINION WILL SIDE WITH YOU, TEACHERS?

So here’s the deal. Chicago taxpayers learned that essentially nothing can be changed on pensions, except to ratchet ever-upwards. COLAs are baked into the pie (very expensive), I’m still not sure what the promise is re: retiree health care (I would rather not get started in that quagmire… the one that everybody said would be the easiest to change ad hoc), you can’t get rid of early retirement, yadda yadda.

And you think your bitchery over having to pay your statutorily required contribution is a bridge too far?

2 Apr 2016: Chicago Day of Action Round Up, and Where's the Money?

3 Apr 2016: Chicago Day of Action: Some Fliers

Just a recommendation to the protestors — you need to focus. You have the following enemies list:

Wall St. Banks

Ken Griffin

McDonald’s

Rahm Emanuel & Bruce Rauner together

You guys need to focus. Alinsky’s Rule for Radicals has this recommendation: “Pick the target, freeze it, personalize it, and polarize it.”

The advice isn’t to pick multiple targets, many of which have little to do with each other. Pick one. You’re all over the place.

Nothing came from the “Day of Action”. It was intended to show the impact and threat of the real strike in the fall. But it didn’t move anything.

So the summer was waiting time, and come back-to-school time, the strike threat was back:

24 Aug 2016: Do the Hokey-Pokey: Chicago Public Schools Strike Threat and Debt

It’s back-to-school season… you know what that means: time for teachers to train to strike!

Not sure why they need to train to use the chants they always use, but the last “day of action” was less than productive (from the Chicago Teachers Union point-of-view), so let’s see if they’re changing things up:

27 Sept 2016: Get Ready for the Next Chicago Teachers Strike!

“The Chicago Teachers Union said Monday that 95 percent of members who participated in a poll last week have agreed to authorize a strike this fall.”

….

So I guess we need to wait to see if they actually strike. In October. Right before Presidential elections. I’m sure the Democrats would love that.

The strike, remember, is primarily over a cut in teacher total compensation, via the teachers having to make a 7-percentage point increase in pension contributions, which is a fairly large pay cut. Chicago had been picking up that bit, as the teachers were supposed to have been making those contributions before. As in, years ago.

After all the drama…. strike averted.

14 Oct 2016: Chicago and Illinois Update: Strike Averted, but At What Cost?

So there was a last-minute deal with the Chicago Teachers Union earlier this week. There are various aspects to this deal, but I’m interested in the pension-related stuff.

….

So here’s the deal: there were already very expensive promises being made in Chicago. They added a little more with the early retirement incentive. They didn’t make it any cheaper by making veteran teachers pay the portion of contributions that all other employees make.

….

Other 2016 Chicago Posts

Just some quick links without quotes or much commentary

2 Feb 2016: Chicago Doings: The Storm Before the Storm

3 Feb 2016: More on the Chicago Schools Situation

16 Feb 2016: More Chicago Public Schools: Budget Cut and Trying to Negotiate from Position of Weakness

20 Feb 2016: Public Pensions and Finance Round-up: Saturday, Feb 20 (has Chicago items)

9 Mar 2016: Chicago Watch: What's the Leverage When There's No Money?

11 Mar 2016: Illinois Weekend Watch: Round and Round While We Wait for a Strike

17 Mar 2016: Chicago Watch: Throwing Rahm Under a Bus, Plus Swaps

24 Mar 2016: Chicago Watch: Money Money Money...also, there went their plans

26 Mar 2016: Chicago Watch: Reactions to Loss of Pension Court Case (and other stuff)

12 May 2016: The Connections Between Detroit and Chicago Public Schools

20 May 2016: Around the blogs: Mish and 538, Bury and Central States, Glennon and Chicago

24 May 2016: A Deal, But No Grand Bargain, in Chicago — short comment: a lot of people liked to refer to Detroit and its “Grand Bargain” in its bankruptcy workout. Chicago folks keep bringing it up. They don’t have art to hold ransom.

8 July 2016: Chicago and Cook County Update: Tax Bills are Coming

7 Oct 2016: Chicago Public Schools: Who is Profiting?

5 Aug 2016: Pensions Weekend Wrap-Up: Chicago, the Actuaries, and New Jersey

9 Aug 2016: Chicago Update: Pensions, Taxes, and Bonds

15 Sept 2016: Pension Quick-Takes: Chicago, Houston, Chile, and More

23 Oct 2016: Chicago Update: Is It Rauner's Fault?

4 Nov 2016: Public Finance: Raining on Chicago's Parade

11 Dec 2016: Chicago Public Schools: Bonds, Budgets, and Tax Bites

12 Dec 2016: Chicago Retiree Healthcare: Some Are Out of Luck (for now)

14 Dec 2016: Chicago Public Pensions: Diversity Day!

16 Dec 2016: Chicago Teachers Pensions: Questioning Assumptions

Prior Posts: