Chicago is My Kind of Town to Beat Up On: 2019 Edition

We've definitely come to a middle of my beating up on Chicago

The Week in Meep has been pre-empted by my retrospectacle (yes, I meant that autocorrect) on Chicago through the archives of STUMP.

Prior posts:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

Let’s see what the Chicago of 2019 had in store.

Corruption and Chicago?! SHOCK!

I had a multi-parter to start off the year with Chicago, because there were some doings with respect to some aldermen.

Part 1, 28 Jan 2019: The Undeniable Corruption of Chicago and Illinois: Effects on Public Finance, part 1

I have not been writing about the arrest of Alderman Ed Burke of Chicago, the revelations of a retiring Alderman, Danny Solis, having been the person to wear a wire (possibly to escape his own comeuppance by the hands of the feds?), etc. This is generally not the sort of thing I write about.

But I do write about money, especially public finance. And Burke definitely had his fingers in a bunch of pies. And it seems many other people have been, as well.

This can get unwieldy rapidly, so let me focus on a couple items today: the alderman wearing a wire (Solis), restrictions on aldermanic jobs, and Ed Burke’s brother Danny.

I’m not going to copy over the whole post. Solis wore a wire for two years, recording conversations for a federal investigation. The other Chicago alderpeople were not too pleased about this.

Ed Burke especially.

My comment:

Putting the nicest face possible on it, people say things face-to-face that they don’t want recorded because, get this, they may be talking about somebody else and don’t want that somebody else to hear what they said. That requires no illegality at all. Innocent people being recorded do have every right to feel betrayed.

However.

This is Chicago. And the people being recorded are in their office as public officials. They can have secret conversations, but this is not a personal trust being betrayed. They should expect people looking over their shoulders when working in the “public trust”.

I deem that the expectations that no one is watching (except us chickens) provides a spur for corruption. It can start with a regular old political tit-for-tat… and then morph into something else entirely.

One of the items that was current, while Rahm Emanuel was still mayor, was some ethics reform for the aldermen. There were issues re: outside jobs of the aldermen, and conflicts of interest. They did not want to ban outside business altogether, but there were getting to be some iffy situations.

Fine, outside jobs are okay.

But isn’t it interesting how many of them have jobs/connections they get money for, that have connections to government? Are there no jobs for them that aren’t government-related?

I ask you, Mike Madigan — yes, Illinois legislature, not Chicago alderman, but his practice has to do with arguing with the government re: property tax bills. Seems he should either decide to be in government or make money off arguing with government… not both.

I did end up talking about pensions (go to the original post to see how I ended up there):

What will happen with MEABF when the money runs out? Well, maybe the people will continue to get their pensions. For a while.

But I am sure that the people making the rules will always make sure they and theirs will be taken care of first.

And maybe others will get what’s left over.

Because it seems to me that neither Chicago nor Illinois lawmakers and executives have felt like there is someone looking over their shoulders, that they will ever be held accountable for the financially ruinous decisions they make.

It would be better if all of them acted as if they were surrounded by people wearing wires… and really, given current smartphone (and smartwatch) tech, they really should have been assuming as such all this time.

Part 2, 1 Feb 2024: The Undeniable Corruption of Chicago and Illinois: part 2 - Workers Compensation Fund

I am skipping over my Workers Comp explainer as well as the Chicago alderpeople having to give up control of the Chicago Workers Comp fund because of the exposed corruption.

WHY WAS BURKE RUNNING THE CHICAGO WORKERS COMP FUND?.

Forget about Burke specifically — why did anybody think it was legit to have the Chicago aldermen run an insurance program? Yes, I know the Chicago workers comp fund is supposed to cover people who work for the city of Chicago, but neither do we expect governmental entities to even run their own health insurance programs, or property insurance programs, etc. Why not just bid it out to actual insurance companies?

Workers compensation sometimes runs as state funds (whether to cover public workers only or all workers)… but that’s not what is done in Illinois in general. In general, they have private insurers, which are then overseen by the state department of insurance. Indeed, Illinois just tried created a state Workers Comp fund last year:

….

WORKERS COMP IN CHICAGO V COOK COUNTY V ILLINOIS

A Chicago Tribune Editorial from August 2018:

It might be tempting to brush off a lawsuit filed recently against Chicago Mayor Rahm Emanuel and Ald. Ed Burke, 14th, as politically motivated.

Two longtime critics of City Hall accuse Emanuel and Burke of violating Illinois law and the state and U.S. constitutions. The alleged infraction? Allowing Burke, through the City Council Finance Committee he chairs, to administer the city’s workers’ compensation program. The suit argues that the program, which costs taxpayers at least $100 million per year, according to a 2016 inspector general report, should be run by a City Hall agency, human resources professionals or the Law Department.

The suit says the current arrangement — which is spelled out in the Chicago Municipal Code — is unconstitutional because it assigns executive functions to the legislative branch. We’ll leave that question to the courts. There’s zero doubt, however, that vesting complete control of the workers’ comp fund in a single committee chair, shielded from oversight, is a terrible idea.

So it’s in the Chicago Municipal Code.

When did it get put in there, and who put it there?

Burke’s role as the gatekeeper of workers’ comp benefits for the entire city of Chicago invites cynicism, and rightfully so. The lawsuit alleges that Burke, who has chaired the finance committee for 33 of the last 35 years, leverages his position to load up his staff with patronage workers. The role also allows him to dole out favors as he determines the outcomes of hundreds of cases of city workers who claim they were injured on the job.

Burke has been around for at least 33 of the last 35 years…oh, wait, he’s been an alderman for 50 years. Just remember that for later.

Just wow. 50 frickin years.

I’m still appalled.

By comparison, Cook County’s workers’ comp committee, chaired by County Board member Tim Schneider, R-Bartlett, reviews and signs off on decisions that are made by experts in the county’s risk management department and the state’s attorney’s office. Schneider doesn’t have a staff. He isn’t negotiating compensation decisions. And the committee and its cases are open to the scrutiny of the county inspector general and the public. Cases that require a settlement eventually come to the full County Board for approval.

At the state level, it’s similar. Lawmakers who head up House and Senate committees on public health or transportation or education don’t actually administer programs in those subject areas. The agency heads and staff who work for the state of Illinois do.

I prefer having insurance run by insurance companies – involving people who actually know how to balance solvency and competitiveness. State workers comp funds have a bad habit of needing to get bailed out. There are reasons, including the political drive to underprice the risks… and assuming everybody else will pay when it goes wrong.

Okay, this part was really long. I dug into the municipal code and yadda yadda.

I just want to return to Burke being an alderman for 50 years:

It mentions “prior code”, using very different numbering. But the latest dates mentioned in the code text itself are in 1936, and I believe this part of the code hasn’t been revised since then, given what I’ve seen in other bits of the code that have been revised in the past 50 years.

So that lets Burke off the hook, given he didn’t become an alderman until 1969….and he was born in 1943 (wait a sec… he became an alderman when he was 25?!).

Burke succeeded his father in local politics, first as Democratic Committeeman and then as alderman from the 14th Ward.7 After the elder Burke died in office of cancer on May 11, 1968,15 Edward Burke took leave from his job as a policeman to replace his father as Democratic committeeman for the 14th Ward.16 Though not a precinct captain, Burke won election to his father’s committeeman seat in a secret vote of 65 precinct captains, defeating a veteran precinct captain by just 3½ votes.79 At 24, Burke was the youngest person in Chicago’s history to become a ward committeeman,917 a position he has held ever since.

So he was elected at age 24, and was in office at age 25.

I mean, he had been getting away with it for fifty years! How dare anybody question his right to all this money?

(Yes, he has only been the head of the Committee of Finance for only 33 years or so, but who’s counting?)

Dear lord, Chicago. You really do exceed New York, doncha.

Part 3, 2 Feb 2019: The Undeniable Corruption of Chicago and Illinois: part 3 - Who Sent You?

I’m not going to quote the pieces of all the connections between the various Chicago and Illinois Democratic politicians.

Here is the bottom line:

But my point isn’t so much that Burke has an iffy past (hey, maybe it’s just that Chicago color), but that there’s no way anybody could have gotten very far in Chicago politics without knowing Madigan, Solis, and Burke… not to mention the Daleys. They all know each other.

Nobody got anywhere in Chicago politics without being sent.

….

As long as there’s no oversight to huge $$ projects in the city, even if you pry free the old folks, it will still be a draw for the corrupt.

So perhaps the federal investigation may help bring in the oversight that Chicago needs, but the FBI is in very low reputation right now, no matter your politics. I assume that Burke will be re-elected to his aldermanic chair, I assume he will vigorously fight any criminal trial and may legitimately get off; I assume Mike Madigan will continue to hang on until mortality finally gets him; and I assume the Daleys will always be with Chicago, until Chicago collapses under its own financial failure.

Nobody ever accused me of being an optimist.

The FBI’s reputation hasn’t improved since 2019. I don’t think that’s news.

Part 4, 6 Feb 2019: The Undeniable Corruption of Chicago and Illinois: part 4 - Unpaid Vendors Program

This is where it spread to outside Chicago to the state at large. And it was about something that confused me from my pre-STUMP days. [so there are dead links]

In my prior corruption post, we had the following story:

Brian Hynes: The political insider in the middle of FBI’s Solis investigation

Over the past decade, attorney Brian F. Hynes has gone from being a clout-heavy lobbyist to running a business that’s making him a fortune off of unpaid bills owed by the state of Illinois.

Over the past decade, attorney Brian F. Hynes has gone from being a clout-heavy lobbyist to running a business that’s making him a fortune off of unpaid bills owed by the state of Illinois.

….

Hynes’ name repeatedly pops up in a 2016 FBI affidavit obtained by the Chicago Sun-Times that authorities filed to win approval for search warrants for Solis’ home and offices after secretly listening in on thousands of the alderman’s cellphone calls.The affidavit outlines a series of financial transactions an FBI agent says show that Solis was getting money from Hynes in exchange for the alderman supporting development projects — an assertion Hynes denies.

“It doesn’t surprise me that I’m mentioned there,” Hynes says in an interview with the Sun-Times. “I talked to Danny all the time. He called me and asked for advice. If there’s 20,000 phone calls, I’m probably on 3,000 of them. He was and is a friend, and I tried to help him.

….

Hynes has found himself in the midst of a political scandal before. He drew the attention of federal investigators for arranging for then-Gov. Rod Blagojevich’s wife Patti Blagojevich to receive a $40,000 commission in 2003 from a real estate deal on which she did no work, court testimony showed.Hynes never was charged in the scandal but has a close relationship with Antoin “Tony” Rezko, the political fixer who went to prison for attempting to extort money from businessmen seeking deals including pension investments from the state.

….

Nine years ago, Hynes went into business with Solis’ sister Patti Solis Doyle, a former campaign honcho for President Bill Clinton who later was a top adviser to Hillary Clinton. They set up a company that fronts money to vendors that are owed by the state of Illinois, collecting the interest when the state eventually pays up.Hynes says the alderman’s sister left the company in the fall of 2016, shortly before Hillary Clinton lost the presidential election to Donald J. Trump.

Now, that was a piece of information I didn’t know, as I did not understand how so many vendors to Illinois kept doing business with the state, when they weren’t getting paid their bills for months.

AN OLD MYSTERY NOW SOLVED

I was writing about this even before Rauner became governor, and before STUMP came into being.

Back in 2013: No, Really, Illinois Vendors – Require Cash

As per yesterday, it’s not an accident that Illinois has almost $10 billion in unpaid bills.

It’s their actual budget policy:

….

Look, Illinois is telling you ahead of time that you are at the end of the queue. State workers will get paid before you do (let us ignore pensions for right now). All sorts of money will get slushed around, and as a matter of course, if they can screw suppliers, they will screw suppliers.The accounts payable for Illinois has only increased in the past year, even given the “temporary” tax hike. It seems unlikely that that balance is going to go down, which means whoever still has bills outstanding when the state finally explicitly starts defaulting on liabilities is going to be left in the lurch.

So take that into consideration when doing business with Illinois.

What I didn’t realize was that some players were “advancing” the payments to the vendors… and that because they always built in interest to pay for the overdue bills, the money people who made it work knew they had a pretty sweet “guaranteed” interest rate.

April 2013: Illinois Vendors and Other Operating Expenses to Go On Credit Card

After last month’s posts, Illinois Vendors, Ask for Cash on the Barrelhead and No, Really, Illinois Vendors — Require Cash, we see there may be good news for vendors currently owed money from the state of Illinois.

They’re going to put it on the credit card:

….

Having to issue long-term bonds to pay operating expenses is a REALLY BAD SIGN.Long-term, general obligation bonds, from principles of sound finance, should be issued only for capital expenditures. Chances are pretty good that this backlog does not represent capital expenditures.

Now, issuing debt for operating expenses is not necessarily bad — if it’s short-term debt and it’s just a timing of cash flow problem. For example, I have a very lumpy cashflow stream in and out. I will have cash inflows twice the usual some months, and outflows (such as this month) much greater than usual. The fluctuations in the inflows and outflows do not match, so sometimes the credit card bills for groceries do not get paid off for a month or two.

But I’m not trying to refinance my current grocery bills with a 30-year loan.

…..

At the time, I couldn’t understand why vendors kept doing business with Illinois.

In some of the cases, I understood that the vendors did not have much choice: Illinois was their only “customer”.

But I couldn’t see how these businesses, especially the ones where Illinois was the sole customer, kept going.

I didn’t know about Mr. Hynes’s company, though I should have guessed something like that existed.

….

VENDOR PAYMENT PROGRAM

It’s all so regular now – it’s even got its own webpage, all official and everything, with various companies qualified to front money to the vendors while they await full payment.

We don’t need to take a look at all these companies. This is the one founded by Brian Hynes.

Let’s check his press!

From July 2013: Vendor Payment Program still has only one purchaser

In late 2011, the state set up a program to help businesses and other vendors caught up in the government’s chronic late payment of bills. Called the Vendor Payment Program, it allows qualified contractors and not-for-profit organizations to quickly get most of the money they are owed by the state, and all of it eventually. Money is paid to the vendors by a private firm that is then entitled to whatever penalty payments are owed by the state, as well as the amount originally owed to the vendor.

…..

Nearly two years into the initiative, though, only one private firm has been certified by the state to buy the vendor invoices — Chicago-based Vendor Assistance Program LLC.The program is run through the Department of Central Management Services.

“Vendor Assistance Program, LLC is currently the only company authorized by CMS to facilitate this program,” said CMS spokeswoman Anjali Julka in an emailed statement. “To date, CMS has met with more than 20 companies regarding the (program) and several have expressed an interest in joining the program. CMS anticipates announcing several new participants in the near future.”

Meanwhile, Vendor Assistance Program LLC said business is going well and expected to get better.

…..

No savings to stateThere are conditions on which vendors can take part in the program. For example, medical assistance invoices do not qualify. Bills must be eligible for late-payment penalties, and they must be at least 90 days past due.

The CMS website for the program — illinois.gov/cms/business/VendorPayment/ — says the process is initiated when a vendor registers with a qualified purchaser. At this time, that is VAP.

The agreement calls for the purchaser to immediately pay the vendor 90 percent of what the state owes. CMS says payments are made about seven to 10 days after a purchaser agrees to buy an invoice.

The remaining 10 percent is paid when the state pays the purchaser the full invoice amount plus any late-payment penalties that are due. Under the state’s Prompt Payment Act, a bill not paid within 90 days is subject to an interest penalty of 1 percent a month on the unpaid amount.

The program doesn’t save the state money, because it would owe the late-payment penalties to the vendors rather than the purchaser of the invoices. However, the program does allow the vendors to get paid more quickly than they otherwise might have been.

Indeed.

Let me assume that compounds normally.

A 1% per month charge will compound to 12.7% in a year. You see any government interest rate that high? A 1-year rate at 12.7%?!

THAT’S A PRETTY SWEET DEAL, EH?

….

Now, let’s be fair: 13% per annum interest rate ain’t Mafia-level rates. But then, the Mafia assumed that sometimes they wouldn’t get paid.

Here was the state comptroller’s report — you know, Susana Mendoza, one of the many candidates for mayor of Chicago.

I found another story where Brian Hynes was specifically named, from April 2018 – Illinois’ Late Fees Skyrocket Over Past 3 Years

Illinois has racked up more in late-payment fees in less than three years than it did in the 18 years combined, according to a report released Tuesday, and some major creditors say they’ve waited more than a year to receive the interest they’re owed.

The report by state Comptroller Susana Mendoza found that the $16 billion in past-due debt that piled up during a two-year budget stalemate comes with a steep price. Since July 2015, Mendoza reported, prompt-payment penalties have totaled $1.14 billion, $100 million more than the total from 1998 up to then.

…..

Earlier Monday, private companies, which have kept government vendors afloat by paying their bills and relying on state reimbursement with interest, told lawmakers they’ve waited months for late-penalty payments, threatening the program.…..

Vendor Assistance Program, one of the qualified purchasers, began buying overdue vendor invoices even before the program was authorized by state law in 2012. Founder Brian Hynes said that since 2010, his firm has financed $4 billion but received only $65 million in prompt payment penalties and is awaiting $250 million more.“At some point,” Hynes said, “you have to remember that these qualified purchasers helped sustain the state through a difficult time.”

In any case, this is not necessarily a case of corruption (with respect to Brian Hynes specifically)…but if you’re dealing with an iffy payor, it does help to kick back a little money, to campaign funds.

To be sure, I did a little digging on opensecrets.org, and the donations don’t seem excessive to me – I’ve done digging for others before, and Brian Hynes’s donations (and some are listed from Florida, and some from Illinois) don’t really add up to a huge amount. Maybe he bundles – this record wouldn’t tell me so.

But just be thinking: these interest penalties are a lot higher than the 1-year borrowing rate, even for Illinois.

Where there’s money…

13 Feb 2019: The Undeniable Corruption of Chicago and Illinois: News Round-up

13 Feb 2019: Chicago and Illinois Corruption Followup: Lawsuit Involving the Unpaid Vendors Program

20 Mar 2019: The Undeniable Corruption of Chicago (and Illinois): Some Followup on Brian Hynes

Chicago Mayoral Race 2019

In the 2018 version, I mentioned that Rahm Emanuel bowed out. So a bunch of others were up… and all I cared about was public finance and pensions:

4 Feb 2019: Chicago Mayoral Race: What Do The Candidates Say About Pensions?

In general, I’m not going to quote the candidates, but my reaction comments:

Issue 1: pension obligation bonds

So, in general, I’m liking what I hear from the candidates on POBs — they are a bad idea in general, and I think they’re a horrible idea for Chicago specifically (they really do not need additional leverage on their balance sheet at this time.)

The only answer I really didn’t like was Mendoza’s, which was essentially contentless re: the POB question…and she should know better.

I’m also a bit wary of Gery Chico’s “I want to know more” statement. I would hope you’d know enough to see that more debt is a bad idea.

The ones that got into details – like Lightfoot and Vallas – seem to understand how many problems there are with Rahm Emanuel’s proposal.

Oh, and LaShawn Ford — it is not clear to me that he understands the magnitude of the numbers involved, but he wasn’t the only one with TIF comments. I haven’t done a deep dive into all of Chicago’s finances (I just want to look at the pension piece).

And… okay, I don’t really know any of these politicians well enough to see if Jerry Joyce’s comment: “I would only consider a pension bond if the federal government would avail Chicago its full faith and credit”….whut? Is this some kind of joke?

The federal government did not bail out Detroit. You’re not going to get a federal bailout for a POB. JEEZ.

Issue 2: “Should city employees and annuitants be required to contribute more toward and/or accept lesser benefits as part of stabilizing pension finances?”

So … basically they all understand that there’s no changing the benefits for current retirees and workers without a state constitutional amendment… and Daley is the only person pushing for such an amendment (this obviously would need support from the state legislature).

Now, some of them go with what should and what ought and talking about blame… but some of us who think that benefits will have to be reduced (or there will be definite municipal bankruptcy) don’t think that it’s the workers’ and retirees’ fault, any more than I think it was the workers’ or retirees’ fault when Detroit went bankrupt.

“Deserve” has nothing to do with it.

It’s has to do with what Chicago will be able to afford.

A few of them do understand that, as they talk about different benefits for new entrants.

But the city pensions aren’t pushing only 25% fundedness because of future workers.

The problem has already accrued over decades. Many of us are very skeptical that Chicago will be able to actually fulfill those old promises, no matter what’s deserved.

I point out this:

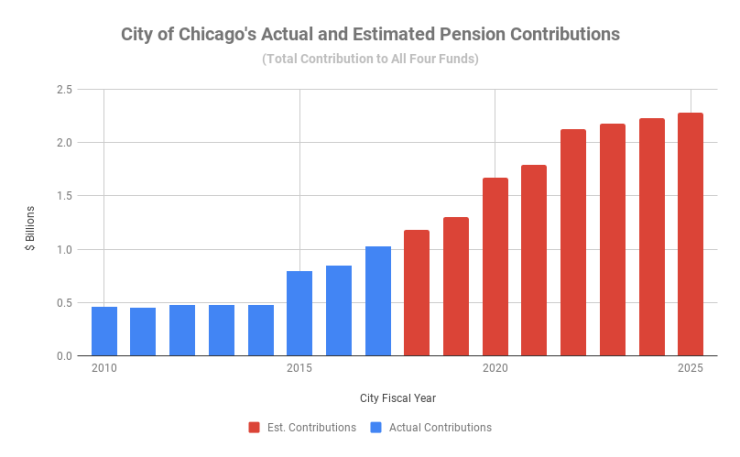

I actually dug up the numbers from the CAFR. It’s worse than a 30% increase in one year. It’s a doubling of the contributions over five years.

[By the way, the combined funded ratio for FY2018 is estimated to be about 26%. Looks like they’re using a horizon of about FIFTY YEARS to try to get the pensions to 90% funded — not even fully-funded in a HALF CENTURY.]

But here’s the deal: they are at least trying to front-load the contribution increases (though they’re trying to get around that by doing fake contributions — aka pension obligation bonds).

FY2019 — 16% increase

FY2020 — 10% increase

FY2021 — 28% increase

FY2022 — 7% increase

FY2023 — 19% increaseafter which the 2% increases into eternity

From FY2018 to FY2023, we see a cumulative 108% increase in pension contributions.

Do you think that’s going to happen?

I don’t.

By FY2024, they’re looking at an over-$2 billion contribution to the pensions — and that’s assuming everything behaves nicely (no stock market tumble, for example).

Did I mention that the “Corporate Fund” of Chicago had about $3.8 billion in revenue? There’s other stuff, but let’s just say, order of magnitude, a budget of about $10 billion.

You really think they’re going to allow for pension contributions to go from $1 billion to $2 billion in the space of 5 years? You think that’s politically doable?

I don’t.

Again, this is what I’m looking at for the Chicago mayoral race for 2019.

The next mayor of Chicago has a huge challenge, and the corruption probes will not help.

More mayoral race posts:

26 Feb 2019: Deal-Making: New York, Amazon, Chicago, and Corruption

27 Feb 2019: Chicago Run-off: Preckwinkle and Lightfoot

3 Mar 2019: Chicago Mayoral Race: Screwed No Matter Who You Choose, Thanks to Unfunded Pensions

So.

Chicago voters.

Here is your bottomline: neither of the mayoral candidates in the run-off know how to deal with the ginormous financial hole Chicago faces.

Frankly, I think Rahm Emanuel is getting out now because he knows the shit will actually hit the fan, money-wise, in the next mayoral term. Sure, there were other issues for him in getting re-elected, but I think if the money could hold out, he would have run for mayor again.

I don’t think the money is going to hold out very well over the next 5 years for Chicago.

I could be as wrong as Meredith Whitney – after all, I thought Rahm was a fool to rush in where a Daley ran away – but I do not see Chicago getting repaired in its finances in the next mayoral term. Even if Pritzker is governor, the state of Illinois is unable to bail out Chicago. It has some pretty bad money issues of its own.

And I highly doubt the feds will bail out Chicago (they didn’t do a damn thing for Detroit while Obama was President… so why would Trump do a damn thing… or even the next president, should a Democrat win?).

Anyway, I do need to run the numbers again, but I highly doubt the reality for Chicago will be much changed.

I forecast pain.

While, of the two, Lightfoot seems the less involved in the long-standing Chicago corruption….that will not fix the inherent financial weakness of Chicago’s government.

Look, I’m not wishing ill on Chicago. I just think ill is coming to Chicago. I didn’t have any hand in the decades of deliberate pension underfunding.

I didn’t cause any of the pain that will be coming to Chicago, and I don’t glory in it.

But I am extremely angry at the people who have tried to minimize the repercussions that are the extremely foreseeable results of deliberate policy.

I will pray for your souls, those of you who are responsible. You really need it.

Look, none of us knew COVID would be hitting the next year and that the federal government would shortly be throwing cash at everybody.

Though, that money is going away right now (and causing trouble for Chicago right now).

25 Mar 2019: Chicago Update: Fun In Store for the Next Mayor — that post gives you an idea of what we thought would hit Chicago

5 April 2019: Congrats to the New Mayor of Chicago, I Guess — and Lori Lightfoot would be the person who had to deal with it

18 May 2019: Public Finance Round-Up: Trade-offs, Chicago, Pensions, and More

GOOD LUCK TO CHICAGO’S NEW MAYOR

It’s a sucker’s game, at this point, to become the mayor of Chicago. I wish Lori Lightfoot well, as she’s going to be having a hell of a time. She does have the opportunity to be like Giuliani in getting things cleaned up… but I don’t think the crime problem is going to be cleaned up by her. The finance situation….sorry, also no.

The one thing she might be able to fix is the little fiefdoms of the aldermen, given that yet another alderman has been arrested. (Okay, he’s a soon-to-be ex-alderman in any case.) Currently, 4 Chicago aldermen are out on bond.

But the biggest problem of them all is the money. Yes, pensions are a huge part of that.

Let me just pick one of many stories to quote on the situation Lightfoot is facing:

Pritzker Toilet Shenanigans

This is all about Illinois Governor Pritzker, not Chicago per se.

30 Apr 2019: Taxing Tuesday: Feds Take an Interest in Chicago Shenanigans?

This has to do with the Pritzkers removing all the toilets from one of their properties, so they could get a lower property tax rate (while the property was getting renovated).

[“writting”? Whatever.]

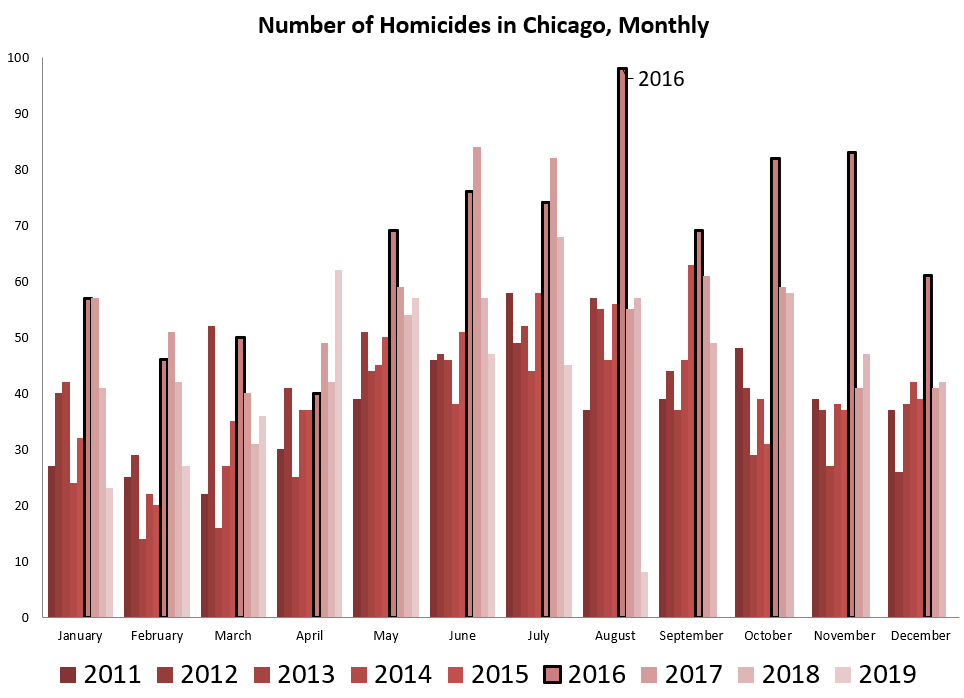

Chicago Homicides

5 Aug 2019: Mortality with Meep: Chicago Homicides

Wrap-Up

A few more posts:

10 Dec 2019: Taxing Tuesday: Taxes for Old, Taxes for New? — MORE TAX PAIN TO COME TO CHICAGO

14 Feb 2019: The Stupid Idea That Will Not Die: Universal Basic Income Might Come to Chicago

10 Sep 2019: Taxing Tuesday: Chicago Wants All The Money

29 Oct 2019: Taxing Tuesday: California Wants All the Money, Chicago Needs All the Money — CHICAGO NEEDS THE MONEY BECAUSE APPETITES ARE ENDLESS

21 Sept 2019: Chicago and Illinois Update: Summer 2019 Catch-Up Edition

THE STORY, IN SHORT: CHICAGO AND ILLINOIS FINANCES ARE SCREWED

Let me set the scene. I’ve blogged extensively about both Chicago and Illinois finances since the beginning of this blog.

These finances are not appreciably better than the last time I blogged about it. Both Chicago and Illinois have amassed ginormous pension obligations, not to mention that they’ve been having to issue bonds to cover other operational costs (people keep forgetting pension contributions are operational, not capital, costs).

While both the city and state look to increase taxes to cover some of these legacy costs, as well as to feed whatever goodies-packed agenda the new mayor of Chicago (Lori Lightfoot) and new governor of Illinois (JB Pritzker) have in mind. While they are attempting to tax, the Illinois taxpayers are increasingly becoming ex-Illinois taxpayers.

The following things have happened this summer: [edited to focus on Chicago]

New mayor Lightfoot took a look at Chicago finances, “hinted” at a state bailout, and new-ish governor Pritzker said no. She has tried this a couple times.

Chicago teachers are threatening a strike. Because money. Which we know Chicago is flowing in.

Both the city and state CAFRs were late. The city’s was late by about a week or so. The state’s… I believe it was over a month.

There is no way in hell Chicago can cover the pension contribution schedule that Rahm Emanuel had agreed to when he was mayor. Nor pay whatever the teachers want. Forget about the other public employee groups.

Pritzker has been hawking a progressive income tax for the state, which requires amending the Illinois state constitution. The state income tax is currently flat rate, as per the constitution.

Some have noted that if you’re going to open up the state constitution for amendment, why not amend the pension protection clause? As things stand, even COLAs and co-pays can’t be adjusted, even decades before someone retires.

I believe that covers most of the finance-related bases.

This was Chicago finance in 2019.

The situation sure didn't get better. When does it crash is always the question?