Chicago is My Kind of Town to Beat Up On: No Chicago-Centric Posts in 2022

Other stuff going on in that year

I’m back home now, but Stu has surgery tomorrow, and radiation treatment and more between White Plains and Manhattan over the next several weeks (whee), so I’m still frazzled. So yes, I’m still beating up on Chicago (from the past.. until I get to the 2024 entry).

I haven’t forgotten about mortality trends, Ohio & Minnesota teachers’ pensions, and all the rest… I will be getting back to those.

But for now: let’s see why I didn’t beat up on Chicago in 2022

Prior posts:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

2019: Chicago is My Kind of Town to Beat Up On: 2019 Edition

2020: Chicago is My Kind of Town to Beat Up On: The COVID Era

2021: Chicago is My Kind of Town to Beat Up On: The Payoff! Year

So, for 2022, I had no Chicago-centric posts, but that doesn’t mean Chicago got zero mentions.

Chicago Mentioned in 10 Posts… an All-Time Low?

I haven’t checked 2023 yet, but I believe this is a low for me.

In 2022, I had 149 total published posts.

62 were Mortality with Meep posts.

42 were the podcast — STUMP: Death and Taxes.

Of the ten posts that mentioned Chicago, only five had substantive enough mentions, I think. Let’s review.

1. Ken Griffin Leaves Chicago and Takes Citadel With Him

This was a podcast episode:

I contrasted how Illinois treated its high-flyer taxpayers and how Connecticut treats its (very few) billionaires.

This reminds me of a post I did for Taxing Tuesday years ago: idea of thank you certificates to the top taxpayers. Evidently, this is a thing in India and China:

But seriously, wouldn’t it be great to have an annual award ceremony celebrating the biggest taxpayers for a specific polity? [yes, some would decline, so let that lay low. But others may welcome the attention.]

Make it a gala event! Show the love!

It reminds me that the top public people in the Roman Empire would fund public buildings and entertainment, and get their names plastered all over it. Maybe we should do that with the government budget as well. Give the top taxpayers a menu of choices, based on their amount — they could be the sponsor for the state patrol that year, say, or the state subsidy for UConn.

I think Connecticut would be a great state to try that out with first, given all the really rich folks there and how difficult a time the state is having with taxes. Let’s think outside the box!

I think that would be kind of cool, actually.

I am biased, because I am a big fan of art museums, and am a member of the Wadsworth Atheneum in Hartford. Let’s be serious — because the Met in Manhattan wouldn’t take all of JP Morgan’s stuff, the Wadsworth got a lot of nifty art, JPM (or his estate) got a nice tax break, and I have enjoyed my art breaks.

Here is a different picture from one of my Wadsworth art breaks:

Yes, the Morgan Great Hall is named after the Morgan you think. I liked sitting in there and relaxing.

A huge reason that there is a bunch of art for people to enjoy in a public museum in Hartford is tax breaks for rich people.

2. Teachers Agitate for Remote Schooling… AGAIN… As their School Systems are Losing Students

This is not Chicago-specific, but Chicago specifically had (and has) horrifically-funded pensions and really lost a lot of students through the pandemic, and not because COVID (or other things) killed them off.

10 Jan 2022: While Teachers Agitate for Remote Teaching, They Should Remember Their Pensions

Nutshell of my argument below:

Some teachers unions, such as in Chicago, are pushing for remote schooling as omicron cases of Covid spread

These are primarily in Democrat-run cities/areas, and politicians there are having short-term panics re: 2022 elections

There is a longer-term danger to teachers’ pensions, as many of these are underfunded and depend on growing tax bases

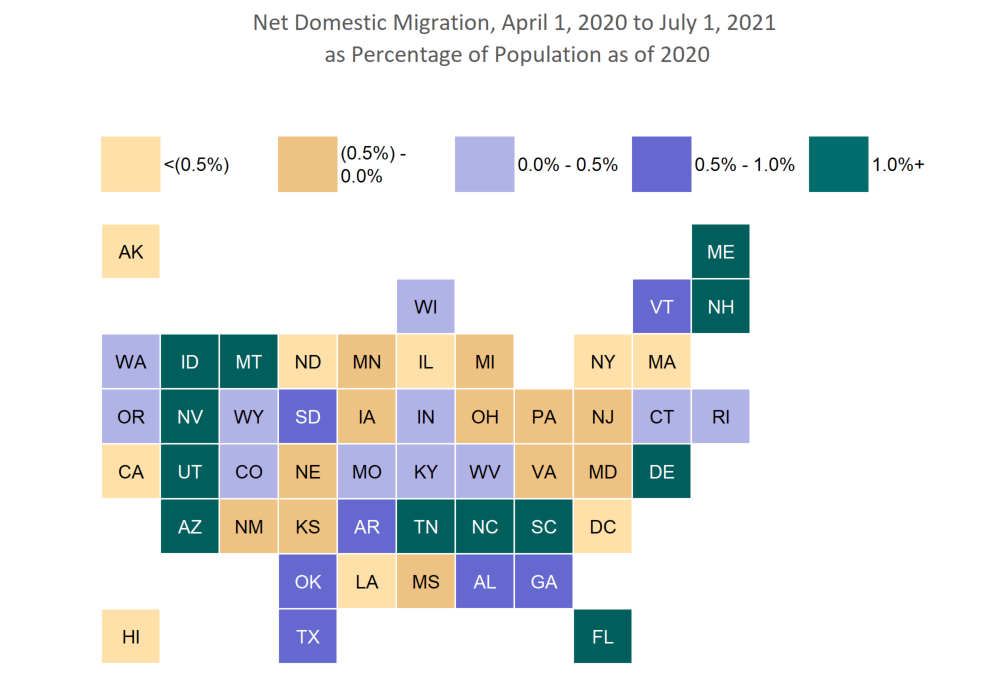

We’ve seen many of these places lose population due to people simply moving (not just dying)

Teachers and their union representatives need to think longer-term — they may minorly reduce a short-term risk of a disease most of them (vaccinated) can deal with, while greatly increase the risk of undermining the future of their pension funds

Hmmm, that’s one of the weird tile grid map setups I tried out. I threw that one out later. (Also, a weird colorway. I was doing a lot of experimentation.)

Why do people live in high-tax locations?

I can answer for myself, as I live in one of the highest-tax areas in the U.S. In my location, I am getting services for the taxes I pay. I pay out the wazoo for services, and I expect to get service for said out-the-wazoo amounts being paid.

This is an old graph, but the proportions hold up for pre-pandemic times, in terms of employee count:

About half of full-time equivalents of state and local government employees throughout the U.S. (in 2014) were K-12 education people. Another 15% were higher education. Education is a huge component of U.S. state and local government services.

And in some locations, people are seeing that they’re essentially getting nothing of value in education. In these places, vouchers aren’t on offer or charter schools, usually, so sometimes they just withdraw their kids entirely from the public school system, or move somewhere else, where they can get value from the local public schools.

In many of the same cities where taxpayers notice that little K-12 education is going on, they’ve noticed that policing, or at least prosecution of crimes, has also been obliterated.

What, exactly, are they paying taxes for? Garbage pick-up? Could they get a discount on our taxes, then?

As for me, I’m still getting what I am paying for. My local school district has been doing a great job balancing the risks, in my opinion, and has demonstrated they know that the students really need to be in school in person when possible.

I’m not the one moving to Florida or Texas (yet) because I think local public employee unions have over-reached.

However, I think the teachers’ unions in various places do need to think about their long-term strategies, or they may find that they may go the way of the private sector unions as well, with their pensions along with them.

Once you’re at the point where you’re shouting that the pension promises were guaranteed, to taxpayers that left decades before, well, look to Detroit.

That’s the good version of what can happen.

You don’t want to see the bad version.

I didn’t pull a quote here, but in my local school district, they prioritized students with IEPs (like my son, who is autistic, and no, not high-functioning) to go back to in-person instruction ASAP during the pandemic.

I live in New York. (which is, again, why I like beating up on Chicago.)

3. Philosophizing on Public Finance

In the following, New York City is a bigger problem than Chicago… (kind of):

29 Jan 2022: Original Sin (or Pandora's Box) and Public Finance and Pensions

Financial state of the cities – got worse

Truth in Accounting has released their annual report on the financial state of 75 large U.S. cities (don’t go looking for NJ cities, btw, because they don’t behave well in their financial reporting — now there’s a surprise.) Here’s a link to their 2022 release.

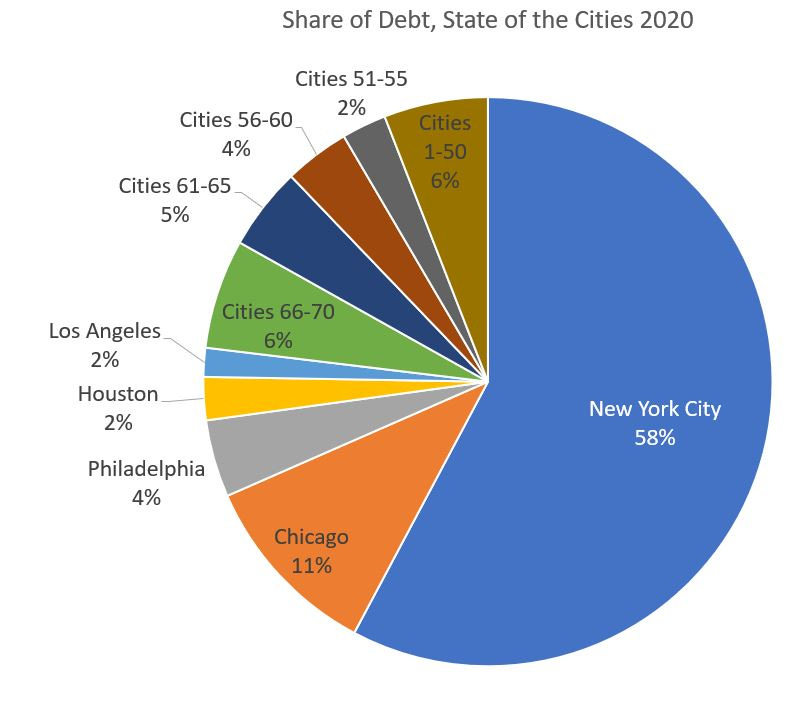

I wrote about the report two years ago, and while I do not like pie charts in general, I think this one tells the story I want to tell from the 2020 report:

Yes, New York City’s debt by itself was about 60% of the entire report’s debt. In the report released in January 2020, before the pandemic hit. New York City, the city very dependent on tourism and the financial sector, and specifically, people living in Manhattan and paying taxes to NYC.

Do you think it got better in the 2022 report?

The answer we’re looking for is no. Indeed, it’s so bad, they had to break the scale on which they graphed all the cities’ taxpayer surplus/burden, because otherwise, you’d barely get to see the others.

Here’s top 5/bottom 5 graphed:

The next bit is not about Chicago per se, but I’m going to quote it anyway.

Because it is eternal:

Innovative ways to fund the public pensions and retiree healthcare: fund them when you made the promise

This brings me to the next item.

I didn’t comment on it at the time, but back in September 2021, a competition for Innovative Public Pension Funding Strategies was announced, which may or may not have closed recently. I had gotten some notice that they had extended time on applications, which is almost always an indication of a pitiful number of applications. Or they weren’t happy with what had been submitted.

I have submitted applications to competitions/requests for papers like these in the past (you can see some of that work in these posts: A Proposal: Restructuring Current Public Pensions Through Municipal Bankruptcy and Causes of Public Plan Insolvency: On Public Pension Valuation — this went over like a lead balloon), but I didn’t even bother with this one.

Because this was my innovation:

ACTUALLY FUND THE PENSIONS AT THE TIME YOU MAKE THE PROMISES.

DON’T PROMISE WHAT YOU ARE UNABLE TO FUND.

That would definitely not have been a popular “innovation”.

However, it would have been quite the breakthrough.

I am skipping over the bullshit “innovations”.

I will quote the Chicago-specific stuff:

Please stop making it worse

The issue is that I knew the worst plans, the worst places, the worst politicians would all be getting together to make things worse.

We saw that with New York City above. NYC didn’t do anything in particular to make things worse, exactly (other than the whole “let crime run rampant” thing — that doesn’t exactly tell the people with money to stick around). They just didn’t do much to make anything better. A bunch of money dropped on them… and pretty much no improvement in the balance sheets.

But Chicago — oh, Chicago and Illinois:

Illinois State Senator Robert Martwick (D-Chicago) is pushing ahead with legislation that, according to a Bloomberg report, could increase Chicago’s police pension obligations by another $3 billion in total through 2055. An earlier city estimate put the cost at $2.1 billion. Senate Bill 2105 would do that by removing a birthdate restriction on eligibility at age 55 for a 3% automatic annual increase in retirement annuity.

Where would Chicago get money to cover the additional liability? No answers.

It’s a repeat of a similar bill Martwick championed for the Chicago firefighters’ pension, which was signed into law by Gov. JB Prtizker in April. As reported by Crain’s on Wednesday, the cost to Chicago of that new law has now been estimated at $700 million, which will require additional annual contributions from city taxpayers estimated to start at $16 million in 2022 and ramping up to reach $24 million by 2055.

I’ve written about the Chicago police and fire pensions and the Chicago pensions generally. Many times.

I’m not going to do a Meredith Whitney and predict that the money will run out, because clearly there are plenty of people continuing to throw money at Chicago and Illinois.

For now.

But this is what we’re seeing for the contribution pattern for Chicago Police pensions:

The blue portion of the bars is what was actually paid, the red portion the unpaid. As it stands, even before a benefit boost, they’re approaching 90% of payroll as “required” contributions. And they’re not even making 80% of that.

A benefit boost would make that red bar even higher, obviously.

The money does run out, eventually. The balance sheet issues for the pensions points to future cash flow problems. The contribution requirements now, which are not being met, point to future cash flow problems.

The problem is that future problem does get closer and closer.

And because they tell themselves they’re being “clever” and “innovative”, they bring that future disaster ever closer.

So that’s something for us to look forward to.

In any case, I will be returning to blogging on mortality for my next posts, looking to the happier topics of external causes of death, like suicide, homicide, drug overdoses, and motor vehicle accidents.

At least in those cases, nobody is fooling themselves that they’re making innovative or clever choices.

The next two will be mortality-related.

4. Gun deaths …. homicide, suicide, or other — depends where you are

This isn’t really about Chicago, but about “gun deaths”.

Most gun deaths in the U.S. are suicides. This has been true for a very long time, at least since handguns have existed. I would rather not explain why this is true. You can look at the link to see recent history. That’s for the whole U.S.

It is very geography-dependent, though.

In 2022, John Legend thought it wise to bring up “gun death” rates, when he looked at total deaths via gun, as opposed to gun homicides.

1 Jun 2022: Misleading Gun Death Stats: "Gun Mortality" State Rankings

John Legend looks to total gun deaths for rankings

The reason this came up is due to the usual Memorial Day weekend slaughter in Chicago, and John Legend’s prohibition over discussing it:

A lot of “what about Chicago?” in my mentions whenever I talk about guns. We all want Chicago to be safer but please see the list of states with the highest gun mortality rates. See how far you have to go down to get to Illinois. Link - cdc.gov/nchs/pressroom…Legend links to the CDC page and its ranking of total gun death rates.

You will see that Illinois is very far down on that ranking list.

Because many of the states ranked high on that list have high gun suicide rates. Once we remove the suicides, and focus solely on the homicides, the ranking changes quite a lot.

Other than tile grid maps looking different from standard geographic projections, you’ll see that the west looks very different from before. Gun suicide rates tend to be relatively high in the west.

Illinois is very different in this ranking, because it’s tilted more towards homicides compared to suicides.

As for the states that disappeared from the tile grid map, they had so few gun homicides they were “suppressed” (so they had fewer than 10 gun homicides in 2020). They have low gun suicide and homicide rates.

Again, why are we mixing the intents?

Now, I’m not expecting John Legend to realize that a lot of the states are high-ranked for gun deaths due to high gun suicide rates. It’s not his area of expertise. He doesn’t know why that table was misleading.

But the CDC knows the difference, and I really don’t see the helpfulness to talk “gun mortality”, when suicide is of a different nature from homicide, especially when guns are involved.

As I mentioned in the prior post, those who know better should stop mixing risk classes like these. Suicide and homicide are very different in age profile, no matter the method, and those who work at the CDC very well know that.

I’m glad the CDC provides data sets I can rely on, but I am very unhappy they are presenting “firearm mortality” as a ranking table and map in a misleading way.

SHAME.

5. Motor Vehicle Accident Deaths… But Chicago’s Contribution is Red Light Cameras/Speed Cameras

1 Mar 2022: Motor Vehicle Accident Deaths: High-Level Trends, 1968-2020, Part 1

Motor Vehicle Accident (MVA) deaths jumped up a lot in 2020, and remained elevated in 2021, but that’s not the Chicago angle.

Here’s the Chicago angle:

Speed cameras are not about improving safety

However, one of the proposed fixes is speed cameras, and, well, I’m going to link to a few interesting stories and then say one more thing.

14 Feb 2022: Are Speed Cameras Racist? – New analysis shows that camera placement is equitable — but road designs aren’t

11 Jan 2022: Chicago’s “Race-Neutral” Traffic Cameras Ticket Black and Latino Drivers the Most

There are loads more articles where those two came from, but I picked the two that did the original research; the others tend to be derivative, and just look for people to quote.

This is my main comment: the traffic cameras/speed cameras/red-light cameras generally aren’t there to improve safety, and research generally has shown they don’t improve safety.

They’re generally there to raise revenue.

But yes, they’re catching people who speed. But have you ever dealt with a speed trap? I grew up in the south, and I have stories of being tailed by a cop car as the posted speed limit dropped from 35 mph to 25 to 15. For 2 blocks. That’s how they make money.

Anyway, maybe there’s something federal that can go on here, but these places, like Chicago, are still known for their level of corruption. I highly doubt any money spent on better traffic design would actually go to traffic safety. Rather, some well-connected people would be compensated and maybe some traffic lights get replaced. Oh, and they get some speed cameras.

So here’s hoping to some more traffic-choked roads, slowing down the speed demons, and getting the motor vehicle accident death rates back to a more reasonable level.

Which is not zero.

The increase in MVA deaths in 2020 had nothing to do with increased driving. Fewer miles were driven in 2020.

MVA deaths actually decreased for those over age 65. They also decreased for minors.

It actually increased for working-age adults, especially at the younger end. In NHTSA reports, the increased MVA deaths were associated with increased speed (and alcohol use).

That said, speed cameras (and red light cameras) were not shown to be related to the reduction in MVA deaths or even MVA incidence. Their only point was revenue.

It’s up to the voters to decide if that’s a good enough reason.

(Yes, there’s a racial/ethnic angle to these pieces, related to where these cameras were placed.)