Podcast Related Links

Mark Glennon at Wirepoints on Ken Griffin: The Illinois Political Establishment’s Shameful Response To The Departure Of Ken Griffin And Citadel

On a wall in Ken Griffin’s office at Citadel in Chicago, I’m told by people who worked there, hangs a thank you note from a six-year old. Like many kids that age, he was enthralled by prehistoric creatures so he wrote to thank Griffin for funding Evolving Planet, a permanent wing in Chicago’s Field Museum.

The six-year old was my son, who asked if he could write it after my wife had taken him for what must have been the fifth time to the exhibit.

I was proud that he had the simple decency to feel a need to thank somebody.

I wish I could say the same about the Illinois political establishment’s send-off to Griffin and Citadel, who are leaving for Florida. There was no decency in any of it.

This reminds me of a post I did for Taxing Tuesday years ago: idea of thank you certificates to the top taxpayers. Evidently, this is a thing in India and China:

But seriously, wouldn’t it be great to have an annual award ceremony celebrating the biggest taxpayers for a specific polity? [yes, some would decline, so let that lay low. But others may welcome the attention.]

Make it a gala event! Show the love!

It reminds me that the top public people in the Roman Empire would fund public buildings and entertainment, and get their names plastered all over it. Maybe we should do that with the government budget as well. Give the top taxpayers a menu of choices, based on their amount — they could be the sponsor for the state patrol that year, say, or the state subsidy for UConn.

I think Connecticut would be a great state to try that out with first, given all the really rich folks there and how difficult a time the state is having with taxes. Let’s think outside the box!

I think that would be kind of cool, actually.

Another Wirepoints piece, by Ted Dabrowski and John Klingner

Illinois has been bleeding its wealthiest residents for years. Now it’s Ken Griffin’s turn to leave

IRS migration data shows between 2012 and 2020, 80,900 tax filers with $200K-plus incomes left Illinois for other states, but only 40,900 similarly-wealthy people moved in. (The IRS only began breaking out its data by income brackets in 2012.)

That means a net 40,000 wealthy tax filers have exited Illinois in the last nine years.

In the most recent year of data alone, a record net 8,000 wealthy residents left and took $5.6 billion in income with them.

But that’s just the losses for one year. The problem with losing people and their wealth is that one year’s loss doesn’t just affect the tax base the year the income is lost, it also impacts all subsequent years. The losses pile up on top of each other, year after year.

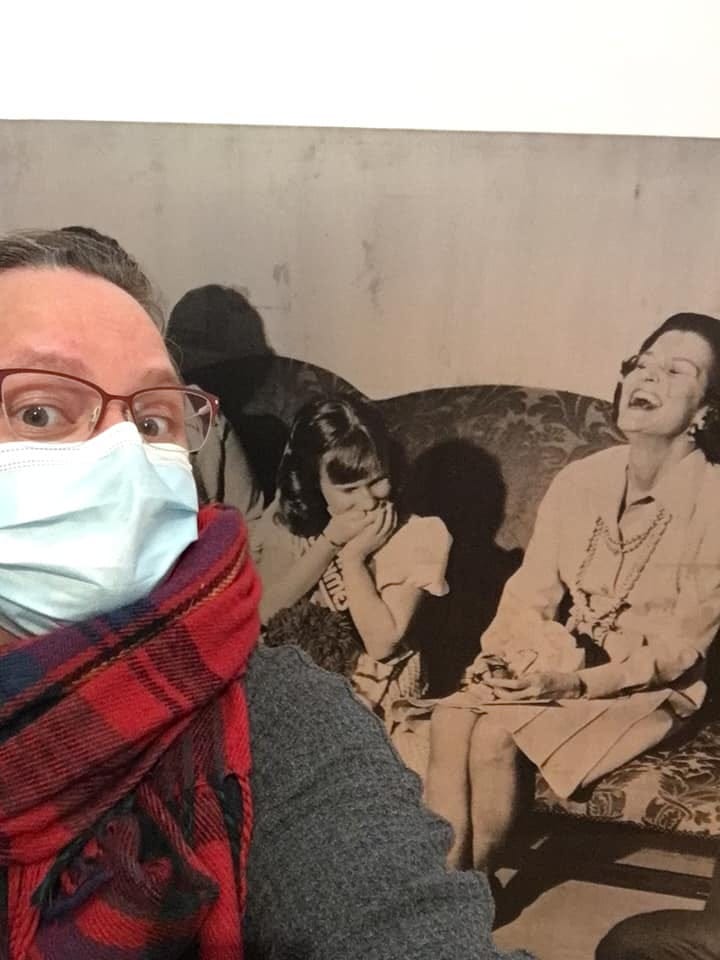

Finally, I mentioned the Wadsworth Atheneum, which is right across the street from the office where I work (when I’m in Hartford (yes, I live in Westchester, NY and work in Hartford. I’m nutty.)) It takes pride of place in my Art Break album on Facebook, as I’m a member and often go there to chill:

Love hanging out with the art. Thanks, rich folks!

Share this post