Looking at the 2025 Social Security Trustees Report, which yet again shows a different exhaustion date for the Trust Fund. I address the recent increase, then drop, of Social Security payments, and as well as the revenue decrease to Social Security in the Big Beautiful Bill.

Let’s look at Social Security change (not reform) proposals, too. Something will be done… but likely not until the Trust Fund is nearly exhausted. Both benefit cuts and revenue increases seem likely…but maybe some targeted benefit increases as well.

Episode Links

Interlude: Social Security Benefit Spike and Drop

BEA: National Income and Product Accounts, Monthly, 2024-May 2025

Trustees Report

The 2025 OASDI Trustees Report

The 2025 OASDI Trustees Report, officially called "The 2025 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds," presents the current and projected financial status of the trust funds.

The Trustees Report includes many tables containing historical data and projections. For convenience, we provide the reader with links to view all of these tables in one place, without the accompanying text of the report. Note that the tables in the report generally present results only for every fifth year. Therefore, we also provide links to supplemental tables by single year for readers requiring more detail. Reference should always be made to the published report for context and explanation of terminology.

Projections of the OASI Trust Fund (just Social Security retirement fund operations by itself)

I think the Trustees' Report figures are somewhat busy, so I’ve re-plotted them in Excel.

WSJ, 18 Jun 2025: Social Security’s Potential Insolvency Date Moves Up One Year

WASHINGTON—With an aging U.S. population and a smaller share of American workers who pay into it, Social Security could become unable to pay full retirement and disability benefits in 2034, one year earlier than reported last year, the program’s trustees said Wednesday.

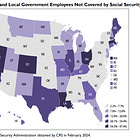

The Social Security outlook worsened for several reasons, according to the report. Notably, in a bipartisan vote, Congress changed benefit formulas in a way that is providing more money to certain public-sector workers, including many teachers, firefighters and police officers.

In many cases, those retirees had faced limits on benefits because they worked for part of their careers in jobs outside the Social Security system. In addition, the government adjusted its expectations for fertility rates.

Without congressional action in the next decade, elderly and disabled Americans who receive Social Security could see their payments reduced by 19% in 2034, the report found. To shore up the system, lawmakers could raise taxes, reduce benefits or reach an agreement that combines both measures.

“It’s a problem that the Trump administration and the Congress need to get their arms around,” said Wendell Primus, a visiting fellow at the Brookings Institution.

OASI Trust Fund: Income and Cost History

Proposals for Social Security Reform

26 Jun 2025, Andrew Biggs: Fix Social Security, Reduce the Trade Deficit

Say, imagine a high-income couple, retiring in 2025 at the full retirement age of 67. Together, they’ll collect $94,836 in annual Social Security benefits. (I kid you not.) Assuming they each live an additional 15 years and ignoring interest, that’s $1.4 million in benefits they’ll get from Social Security.

Now, imagine that couple’s Social Security benefits were reduced. Is it plausible that they wouldn’t save more to make up the difference?

It’s not, and research from various countries concludes there is a substantial trade-off between government pension benefits and personal savings. In the table below I summarize some of their findings.

….

Note that this trade-off isn’t dollar-for-dollar. Low-income individuals don’t seem to respond very much to changes to government pension benefits. If you reduce future benefits for low-income working Americans, they don’t increase their savings very much – probably because they have so little income to save, and because they may be less financially informed regarding the benefits they would receive in the future.

That’s why we have a Social Security program in the first place: to ensure a decent retirement income for people who otherwise wouldn’t save much on their own.

But middle- and high-income households treat government pensions more as part of their overall retirement savings portfolio. They have a rough idea of the income they need in retirement as well as the income they’ll receive from Social Security. If Social Security benefits are increased, they’ll save a bit less on their own; if benefits are cut, they’ll save a bit more. (Retirement ages may also be affected, but I’m trying to keep things simple.)

January 2025, NIRS: Roadmap for the Program’s Future

The report finds:

Americans are united in support of Social Security. Across party lines, generations, income, and education, Americans value Social Security and see it as the cornerstone of retirement security. Just four percent of Americans say it will not be important to their income in retirement.

Rather than closing Social Security’s financing gap through benefit reductions, Americans strongly prefer bringing more revenue into the system. Eighty-five percent say we should ensure benefits are not reduced, even if it means raising taxes on some or all Americans. The most strongly preferred of all options tested is eliminating the cap on payroll tax contributions for those earning more than $400,000 per year. Additionally, Americans across all groups, including a majority of Republicans, say they are willing to pay more themselves by gradually increasing the payroll tax rate to strengthen the program’s finances.

Americans are broadly opposed to benefit reductions. Given a broad set of options to address Social Security’s financing gap, respondents reject benefit reductions such as further increases to the retirement age or switching to a slower cost-of-living adjustment.

Americans want to strengthen Social Security benefits. They support several targeted improvements including adding a caregiver credit for workers who take time out of the workforce to care for young children and a “bridge benefit” to protect from the early claiming reduction of those in physically demanding jobs who may be unable to continue working up to full retirement age.

Americans need and value Social Security’s disability benefits. Ninety percent of Americans say that they will need Social Security’s disability benefits if they become disabled and unable to support themselves through work, and only four percent support cutting disability benefits. The survey also finds strong bipartisan support for updating outdated rules in Supplemental Security Income, including its $2,000 asset limit.

More specific on the numbers:

● Eliminate the payroll tax cap for earnings above $400,000. The existing cap, currently at $176,100, would be preserved, while those making more than $400,000 per year, and their employers, would contribute to Social Security via payroll taxes on wages above that amount. Those affected would not receive additional benefits. This policy option was the most popular of all policy options tested.

● Gradually raise the payroll tax rate from 6.2 percent to 7.2 percent for both employers and employees. A worker earning $50,000 per year would contribute an additional $42 per month. This policy option was nearly as popular as reforming the payroll tax cap.

● Adjust the annual cost-of-living adjustment (COLA) to more accurately reflect inflation and the spending habits of older Americans.

● Provide a caregiving credit for people who take time out of the workforce to care for children under 6 — a group of workers who receive significantly lower benefits than other workers under current law.

● Provide a bridge benefit for older workers with a history of physically demanding work, to protect them from Social Security’s early retirement reduction.

● Reduce benefits for beneficiaries with higher incomes in retirement. The preferred package also included an option to reduce Social Security benefits for beneficiaries whose retirement incomes, not including Social Security, are $60,000 or more per year, or for married couples, $120,000 or more per year.

PDF of report on general population attitudes

26 Jun 2025, American Academy of Actuaries: Highlights from the 2025 Social Security Trustees Report

WHAT CAN BE DONE

The Trustees report shows it is unlikely that demographic or economic experience will extend the life of the reserves much beyond 2034. Therefore, policy changes will be necessary to address the impending depletion of the reserve fund.

Lawmakers have a range of policy options that could close or reduce Social Security's short-term and long-term financial shortfall. Policy options include increasing system revenue, decreasing system benefits, or a combination of both.

Ideas for increasing revenue include increasing tax rates on all workers, removing the cap on taxable wages, and increasing taxes paid by high-wage earners.

Ideas for decreasing benefits include gradually raising the full retirement age to reflect increased longevity, increasing the number of years used in the Average Indexed Monthly Earnings (AIME) calculation, and changing the inflation index used to adjust benefits.

Implementing changes sooner rather than later will allow more people to share in the needed revenue increases or reductions in scheduled benefits. The chart to the left indicates the percentage of the 75-year deficit “solved” by a few selected reform changes. Check out the Academy’s Social Security Challenge for further explanation.

American Academy of Actuaries’ Social Security Challenge

Other Social Security Posts

6 Jan 2025: Social Security Tinkering: No, It's Not Been Made Fairer (or More Solvent)

30 Aug 2024: Podcast: Social Security and Election 2024

7 Nov 2022: Podcast: Social Security Politics

10 Feb 2025: On Social Security Old Age Benefits Fraud(?)

17 Feb 2025: Visualization of Social Security Fraud(?): A STUMP Geeking-Out Special

13 Jun 2022: Podcast: Social Security Trust Fund Running Out

27 Feb 2023: Podcast: Doing the Math on Social Security and Medicare

6 Sept 2021: Social Security: Benefit Terminations and the Trust Fund Running out

18 Mar 2024: Podcast: Retirement Age, Life Expectancy, and Social Security

June 2018: Social Security and Medicare Trust Funds – What’s Real? – lots of graphs!

July 2017: Social Security: The Annual Trustee Report – Cash Flows, Tardiness, and Other Views – more graphs! [I like graphs]

May 2018: A Modest Social Security Proposal – spoiler: move the minimum eligibility age up from 62 to 65.

January 2017: Actuaries on Social Security: Bruce Schobel on Reforms, Robert Myers on History, and Richard Foster on Medicare/ACA

Share this post