On Social Security Old Age Benefits Fraud(?)

Plus other fraud - and what this may all really be about

Look, there are all sorts of possibilities, but:

I can believe that about 12 people in the records are listed as being over 150 years old and receiving Social Security old-age benefits.

(He may also have been joking.)

The above is a video of Republican Senator John Kennedy from Louisiana, from December 11, 2024.

Here is the claim he is making:

6.5 million 112+-year-olds on Social Security? Are you sure?

(And I have a lot to say about the Deaths Master File, which he talks about, but that intersects w/ my paying day job, so nope, not talking about that.)

Sen. Kennedy discusses various pension and benefits fraud, but he claims the SSA has 6.5 million people over 111 years old in its system. I think there may be an interpretation problem.

Let’s check the numbers, first going to the Social Security Administration for their beneficiary stats.

Social Security Beneficiaries Stats by Age

Page: Number of Social Security Beneficiaries by Age

Monthly benefits are payable from the Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) Trust Funds. Growth in the number of beneficiaries over time may be seen in a graph for broad classes of beneficiaries.

Using the form below, you can see the number of currently paid beneficiaries by age. Just select the type of beneficiary and click on "Go." Privacy consideration—if there are only 1 or 2 beneficiaries in a given table cell, we show a value of 0 for the number of beneficiaries and show no benefit amount.

….

Benefits in current payment status at the end of June 2024

I will focus solely on the number of beneficiaries (including retired workers).

First, let’s look at the totals before we break them out into groups:

This is numbered in thousands, so only 6 million people in total are receiving Social Security benefits, aged 85 and over. This is all types (including disability).

If that is the case, how are there supposedly 6.5 million 112+-year-olds on Social Security? Where is Sen. Kennedy getting his number?

But let me break out that 6 million. There are multiple types of people receiving Social Security payments, and only some of them will be aged 85 and over:

Aged widow(er)—must be at least 60 years old

Young widow(er)—must have a child under age 16 or a disabled child in his or her care

Parent of deceased worker—must have been dependent on worker and be at least 62 years old

There are child beneficiary categories… and there’s a wrinkle there (because my son is in this category, and I found they didn’t split out ..)

Okay, there’s a whole ASOP 23 problem going on, but I believe I can figure out enough.

I put the links to each of the tables, and alas, some don’t split out the 85+ age group, partly because that group isn’t meaningful for that group.

Here is what I got:

There may be a timing issue of June 2024 vs. December 2024, as some of the data said December and some June.

The main issue may be that some of the “children of deceased workers” who are disabled themselves (such as my own son) may be in there.

The difference is on the order of 114,000 people. This is just the 85-year-old and older group, though.

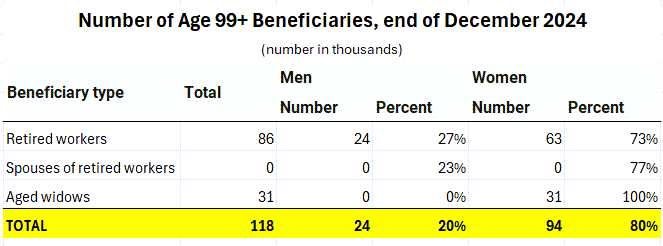

Here is my estimate for the 99+ year-old group:

There aren’t millions of centenarian beneficiaries from Social Security. There are about 118,000.

Now, where is the information on all these supercentenarians in the system?

What May Be Going On: Multiple People Using the Same SSN

There does seem to be some quality control issues within the SSA:

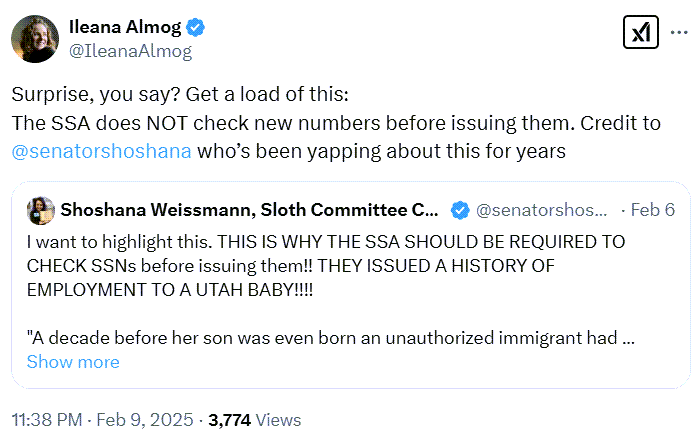

It is not clear to me that there are a bunch of 112+-year-olds receiving benefits. Though it was not only Shoshanna going off about benefits fraud, credit fraud, and more.

(…that is an odd story, and awful quality control, if true.)

But noting the anecdote above (true or not) and the news story below, you see why none of the very basic database hygiene methods have been pursued in the SSA — because everybody knows it would uncover loads of illegal aliens using fraudulent SSNs for employment (and other purposes).

5 Feb 2025, Deseret News: Lawmakers look at ways to prevent child identity theft

Workforce Services data identified nearly 8,000 Social Security numbers being used under 3 to 10 last names for employment purposes out of 1.9 million workers in the state.

….

The initiative to relax E-Verify requirements was motivated by evidence that E-Verify was overly burdensome for small businesses that lack human resources departments and that E-Verify did not yield significant results because unauthorized immigrants could simply forge another Social Security number or try again at a different employer, according to former Sen. Curtis Bramble, R-Provo, who was floor sponsor for HB116.

“That was the argument, that it just was a program that was very costly, very administrative-overhead heavy with very little actual benefit,” Bramble said.

….

Around 10 states require most or all employers to use E-Verify. Another two dozen states have no E-Verify requirements at the state level. And two states, California and Illinois, restrict the use of E-Verify by employers.

Representatives of the construction and agricultural industries in Utah spoke against the bill during Wednesday’s hearing, saying that the enforcement of E-Verify by federal authorities would exacerbate workforce deficits and increase prices of food and homes.

“This has significant impacts on the construction industry and many other industries that employ people who do not have proper documentation,” said Robert Babcock, the president of the construction law firm Babcock Scott and Babcock. “We already have a workforce shortage, if you drive those out of the business, where are they going to be replaced?”

If it were simply a matter of fraudulent benefits, they probably would have shut that down years ago.

It’s a matter of wanting to keep “people who do not have proper documentation” as employees. Or tenants. Or other situations where SSNs are requested.

There were going to be no kudos for any employee who cleaned up the database, any database, that highlighted problems with SSNs, if what the upshot was going to be pointing a neon sign at a bunch of illegal aliens and disallowing them from following through with the intended activity, whether employment, renting, what-have-you.

So the various people having their credit ruined all these years, and their Social Security record messed up, have been “isolated problems”, you see. Nothing can be done. Oh, woe. [wringing hands]

But now you can see why some are panicking, when someone who can come through with a team who can clean up databases might get a hold of such a database.

They’re not concerned about privacy, per se.

They’re concerned that a system that has been insecure from the beginning, on purpose, is made secure. They wouldn’t like that one bit.

On Pension Fraud in General

I’ve written about and done podcast episodes on this issue.

Here’s a non-exhaustive list:

Sep 2024: Ig Nobel 2024 Winner: The Secret to Long Life is Lying About Your Age...Or Not Reporting Your Death

Jan 2024: The Sentinel Effect, Centenarians, and Pension Fraud

Aug 2019: Mortality with Meep: How to Get Lots of Supercentenarians? Pension fraud!

Aug 2010: Son stores dead mom in backpack and related pension fraud tales

To be sure, this sort of fraud is not what makes defined benefit pensions or Social Security programs expensive. The fraud in the U.S. is likely a teensy part of the programs.

That does not mean it’s worthless to audit and clean up these systems. There can be all sorts of benefits to cleaning up the databases.

There is a reason that the New York State Comptroller on the regular announces that somebody is charged with pension fraud. Here is the most recent:

31 Jan 2025: DiNapoli: Ithaca Woman Charged With Stealing Nearly $70,000 in Pension Payments

New York State Comptroller Thomas P. DiNapoli, Tompkins County District Attorney Matthew Van Houten and the New York State Police announced the arraignment of Sharon Collins, 73, of Ithaca, New York yesterday for allegedly stealing $69,481 in state pension payments meant for her deceased husband.

The amount involved is puny compared to the NYSLRS, which has over $200 billion in assets. It has over 470,000 retirees & beneficiaries. Almost $12 billion was paid out in one year’s worth of benefits according to the 2022 ACFR.

The NYSLRS has a high funded ratio, partly because the state tells the local employers the contribution levels they must make every year, and they must make it.

What helps build trust is that everybody knows that everybody is doing their part to make the system work. It helps that fraud is cracked down on.

The first step in reforming Social Security is to make sure that the small amount of old age benefits fraud is cut down upon. It’s not because it will save a lot of money.

There haven’t been many stories on that fraud — because nobody has been looking for it.

There will be fraud - not to the level of 6.5 million 112+-year-olds, I’m willing to bet. Even though the amount of fraud to be cleaned up in Social Security old-age benefits will be small compared to total benefits, we have to clean it up before we ask people to pay higher taxes or to take lower Social Security benefits to make it sustainable.

Most people can’t “math.”

Most people don’t understand how million, billion, and trillion all compare with each other.

People do understand feeling like suckers, and they don’t like it.

So let’s fix that bit before asking them to sacrifice.

My pet peeve with anyone, especially politicians, using statistics is the lack of rigor they follow before making whatever conclusions. State your sources, assumptions and describe the process you used to substantiate your conclusions. Also acknowledge and own any weaknesses there might be in your process.

MEEP- these are all careful steps which you take when laying out your analyses and conclusions.

Just an appreciative Engineer!! Thanks

I wouldn't just assume Senator Kennedy is wrong without asking for clarification about where he got those numbers.

As we are learning more and more every day, the US government is a big cesspit. It wouldn't surprise me one bit if the social security office has one set of statistics it shows people and another set that determine which checks are cut. Those kickbacks have to come from somewhere and that part of USAID's $50 billion that is stolen only goes so far...

Elon Musk put out an X post that said the treasury department NEVER says no to an outgoing check request. A lot of them have no documentation attached. No social security number if it's going to a person, no notation as to what department is funding it. He is suggesting that that should change.

And surprise, surprise, a district judge put an EX PARTE order out at 1AM on Saturday morning stopping any Trump appointed officeholder, even the secretary of the Treasury, from looking at Treasury numbers. I wonder what they want hidden?