In which I review recent back-and-forth over Congressional Budget Office and Social Security Trustees projections of Social Security and Medicare solvency, as well as comments over tax increases and/or benefit cuts to shift to sustainability. Because nobody is really disputing that the programs as currently constituted are going to be able to last longer than a decade as-is.

Episode Links

Social Security/Medicare Projections

A Crash Course in Social Security’s Funding Woes, John Manganaro, Think Advisor, 26 Jan 2023

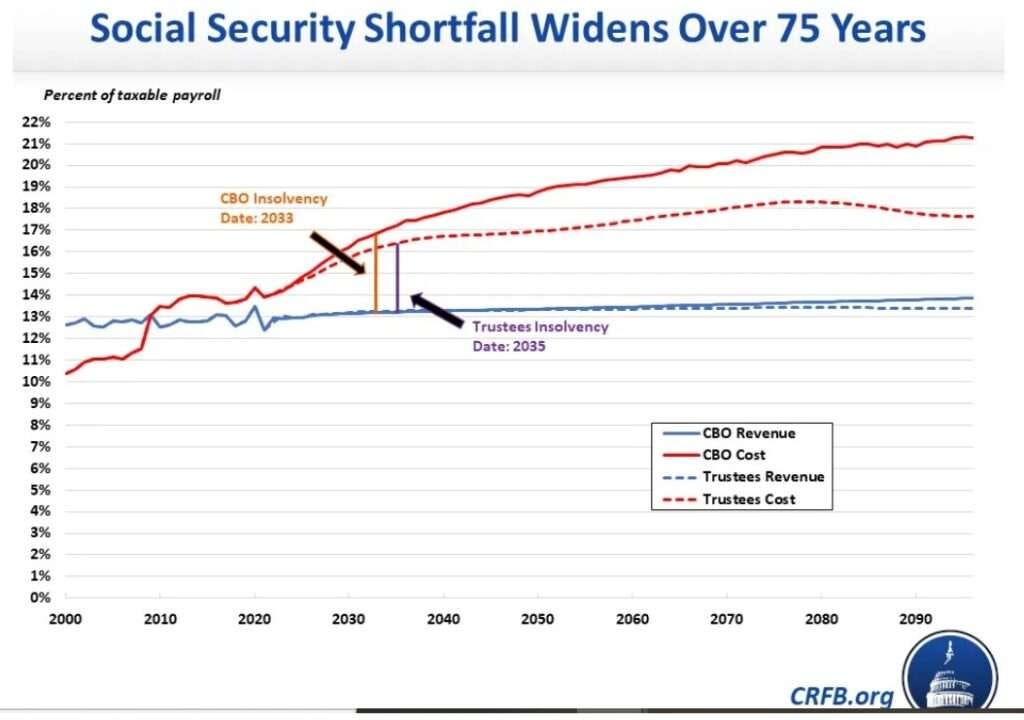

The Committee for a Responsible Federal Budget has published a new analysis that compares the Social Security solvency projections of the Congressional Budget Office (CBO) and the Social Security trustees, finding there is substantial disagreement in key aspects of the two organizations’ outlooks.

In addition to comparing the two solvency projections, the CRFB analysis also offers a blueprint for restoring Social Security’s long-term financial health, pointing to a variety of possible tax increases or benefit formula adjustments that could be undertaken, either alone or in concert, to put Social Security on a sounder financial footing.

Ultimately, the CRFB analysis warns that legislative action is sorely needed in the coming years, as the projections of both the CBO and the Social Security trustees firmly agree that benefit cuts are in store given current funding levels. At some point in the early to mid-2030s, benefits could be cut 20% to 30%, or more, for the typical retiree, and time is quickly running out to act.

CBO: Only a Decade Until Social Security Insolvency, CRFB, 23 Jan 2023

The Budget and Economic Outlook: 2023 to 2033 Visual Summary, CBO, Feb 2023

New York Times Op-Eds and Letters, plus rebuttal

Why Medicare and Social Security are Sustainable, Paul Krugman, NYT, 21 Feb 2023

So why does the C.B.O. project continuing budget pressure from aging? Because it assumes that life expectancy, specifically life expectancy at age 65, will keep rising. That has certainly been true in the past, but given America’s mortality problems, I’m not sure that it’s safe to assume this trend will continue at past rates.

….

Anyway, C.B.O. projections now show social insurance spending as a percentage of G.D.P. eventually rising by about 5 points, which is still a lot but not unimaginably large. And here’s the thing: Half of that is still the assumed rise in health care costs. And there are things we can do to control costs that don’t involve cutting off Americans’ benefits. Bear in mind both that U.S. health care is far more expensive than that of any other nation — without delivering better results — and that since 2010 we’ve already done quite a lot to “bend the curve.” It’s not at all hard to imagine that improving the incentives to focus on medically effective care could limit cost growth to well below what the C.B.O. is projecting, even now.

And if we can do that, the rise in entitlement spending over the next three decades might be more like 3 percent of G.D.P. That’s not an inconceivable burden. America has the lowest taxes of any advanced nation; given the political will, of course we could come up with 3 percent more of G.D.P. in revenue.

Biden's Promises on Social Security and Medicare Ignore Financial Reality, Brian Riedl, NYT, 23 Feb 2023

The president's implication that full benefits can be paid without raising taxes for 98 percent of families has no basis in mathematical reality. Imagine that Congress let the Trump tax cuts expire, applied Social Security taxes to all wages, doubled the top two tax brackets to 70 and 74 percent, increased investment taxes, imposed Senator Bernie Sanders's 8 percent wealth tax on assets over $10 billion and 77 percent estate tax on estates valued at more than $1 billion, and raised the corporate tax rate back to 35 percent. Combined federal income, state and payroll marginal tax rates would approach 100 percent for wealthy taxpayers, and America would face among the highest wealth, estate and corporate tax rates in the developed world.

Yet total new tax revenue -- 4 percent of G.D.P. -- would still fall short of Social Security and Medicare shortfalls that will grow to 6 percent of G.D.P. over the next three decades. Not even halving the defense budget would close the remaining gap.

More realistically, if these programs aren't reformed the middle class will have to shoulder the burden, just as it does across Europe. And the burden is huge: Closing with taxes the aforementioned Social Security and Medicare shortfalls would more plausibly mean raising the payroll tax by nine percentage points and imposing a 20 percent value-added tax. Taxes haven't been raised that sharply since World War II, back when tax revenues consumed a much smaller share of our economy, and there were many more untapped revenue sources.

Letters in response to Brian Riedl’s Op-Ed, NYT, 27 Feb 2023

Paul Krugman Says Social Security Is Sustainable. It's Really Not. Eric Boehm, Reason, 23 Feb 2023.

First, he says the CBO's projections about future costs for the two programs might be inaccurate because the agency is assuming that health care costs will continue to grow faster than the economy as a whole. At best, that means postponing insolvency by a few years. The structural imbalance between revenues and outlays means that depletion of the trust funds is a question of "when" and not "if," as this chart from the Committee for a Responsible Federal Budget makes clear.

American Academy of Actuaries Social Security Game

No, they didn’t ask me about how to properly host and embed videos.

Look ma, I saved Social Security solely through increasing taxes! A lot!

Share this post