In this episode, I talk about two odd last-minute campaign pitches from the White House to bolster the Democratic Party's chances in the 2022 elections. The first was a boast about 2022 COLAs being the highest in a decade (actually, the highest in 40 years), and the second has to do with Republicans going to cut Social Security benefits. '

The first is an odd claim, as it highlights recent inflation. The second may be true but seems unlikely, as most politicians of any party have avoided doing anything about Social Security unless they’re forced to. But as the Trust Fund has now started going cash flow negative, perhaps they’re forced to…

Episode Links

Social Security COLAs

COLA history under the bill signed into law by Nixon. Prior to 1975, the COLAs were set ad hoc by Congress via legislation.

Have a graph:

You have to go back 40 years to get COLAs as high.

The kerfuffle over a later tweet:

Twitchy: White House excitement over Social Security check increases may not be the FLEX they think it is

Politico: White House deletes tweet after Twitter adds 'context' note

Snopes: Did 'Biden's Leadership' Play Role in Social Security Increase for 2023?

Social Security Reform

Here’s where the claim for Medicare and Social Security cuts are coming from: Republicans Plan to Use Debt Limit Leverage to Reduce Social Security, Medicare: Report

Shrinking the safety net: One option reportedly being discussed is raising the eligibility age for Social Security and Medicare, the two largest mandatory spending programs. Each faces financial squeezes in the coming years as the baby boomers age and continue to retire. Under current rules, the Social Security system would be forced to cut benefits starting in 2034, while Medicare could run short of funds by 2028.

I know I’ll be coming back to this, but depending how you define the Boomer generation, almost all of them are Social Security eligible already. Any eligibility rule changes are going to be hitting Gen X (yay!) at the oldest, not Boomers.

Anyway, the original piece is at Bloomberg Government, and I am skeptical of this being anything more than a bargaining chip at this point. We will see what actually happens.

But my characterization is more-or-less correct — make Congress have to vote to keep the benefits going with the same levels, instead of making it automatic as before. That’s the true bottom line.

2022 OASDI Trustees Report, plus spreadsheets, etc. https://www.ssa.gov/OACT/TR/2022/

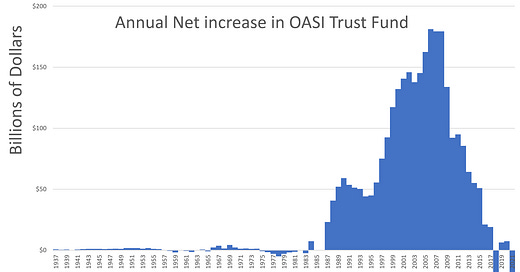

I am graphing the net change in the OASI (that’s the old age benefit part) Trust Fund, year-over-year.

I think you can easily see all those glorious years the Boomer payroll taxes were being stuffed into the Trust Fund… but really flowing right out into current spending for other goodies.

And you can see when that reversed and is now negative, and will continue to be negative until the Trust Fund is exhausted, in the early 2030s.

Share this post