My Condolences to Brandon Johnson, Next Mayor of Chicago

He's in for major pain. Doesn't matter he asked for it.

Congratulations to Paul Vallas on losing the election for mayor of Chicago:

Mayor-elect Brandon Johnson was out Wednesday thanking voters and talking about his agenda and priorities for the city.

With 99% of precincts reporting, Johnson has 51% of the vote with 286,647 votes, with Vallas having 49% of the vote with 270,775 votes.

Phew, that was close. Just a few thousand votes difference.

I’m willing to bet Vallas will be very happy in about a year when he sees the hideous financial mess he will not have to deal with. To be sure, he’s been through some of this before, but I am not sure he really understands how nasty it is.

I am sure Johnson really has no idea how nasty the situation he’s going to be in. He and his union buddies may think there is a big pot of money they can grab at…. I have a feeling they will be corrected in their belief.

Wirepoints on trying to wrest control from Johnson

My first reaction when I heard Johnson won was “Oh goodie, this is going to be a total disaster. I will have loads to write about.” Yes, that’s not very nice, but I’m not a nice person.

The second reaction was “I wonder what Mark Glennon has to say about this”

Mark Glennon at Wirepoints: Four Things Springfield Should Do To Override Brandon Johnson And Salvage Chicago (But Probably Won’t) – Wirepoints

The buck stops with state government when one of its instrumentalities is failing. Chicago, like any Illinois town or city, is an instrumentality of the state and most everything can be changed by state legislation.

Even if Chicago hadn’t elected radically left Brandon Johnson as mayor, state legislation to address the existential threats to the city would have been required. Johnson’s election makes state intervention all the more essential.

….

First, the state should entirely reconstitute Chicago’s school district – start it over from scratch and strip the Chicago Teachers Union of its absurd level of power. It’s surprising nobody noticed that Paul Vallas supported that. In our November 2021 podcast, he said he agrees with the idea of entirely reconstituting the district, which we had written about.

….

Second, the state should enact legislation bypassing Cook County State’s Attorney Kim Foxx on criminal law enforcement.

….

Third, the state should fix or entirely abandon the SAFE-T Act, which would eliminate cash bail statewide and includes other provisions hostile to enforcement.

….

Finally, pension reform is essential to breaking Chicago’s pension death spiral. About 80% of the city’s property taxes goes toward its four pensions, yet they remain grossly underfunded – among the nation’s worst being only 24% funded and with $34 billion in unfunded liabilities – making the pension system “unsustainable in its current form,” as Mayor Lori Lightfoot said.

The first three do have some connections to public finance, but I’m not going to talk about those connections.

The last one is my main interest, and the pension reform is something the state could try out before tackling its even bigger statewide problem. Chicago is in a more dire situation than the state funds, so it would make sense to work on the city pensions first.

This is Glennon’s conclusion:

A day will come when Chicago’s collapse will be so extreme that the public will demand the needed reforms from the state. Unfortunately, we’re apparently not anywhere close to that, so expect nothing.

My own take is similar, but the main take is the state will do nothing because who the hell wants to take responsibility for Chicago?

I’m curious to see if Johnson and crew will try to shortchange Chicago pensions more (say, the teachers’ pensions….) to move money around in the budget.

Because they’re going to find it very difficult to squeeze more money out of the stone of Illinois and Chicago taxpayers. The federal government may or may not be forthcoming with funds (I’m thinking not).

And what about bondholders? Well, they’re not going to be interested in giving money for operational costs, don’t you think?

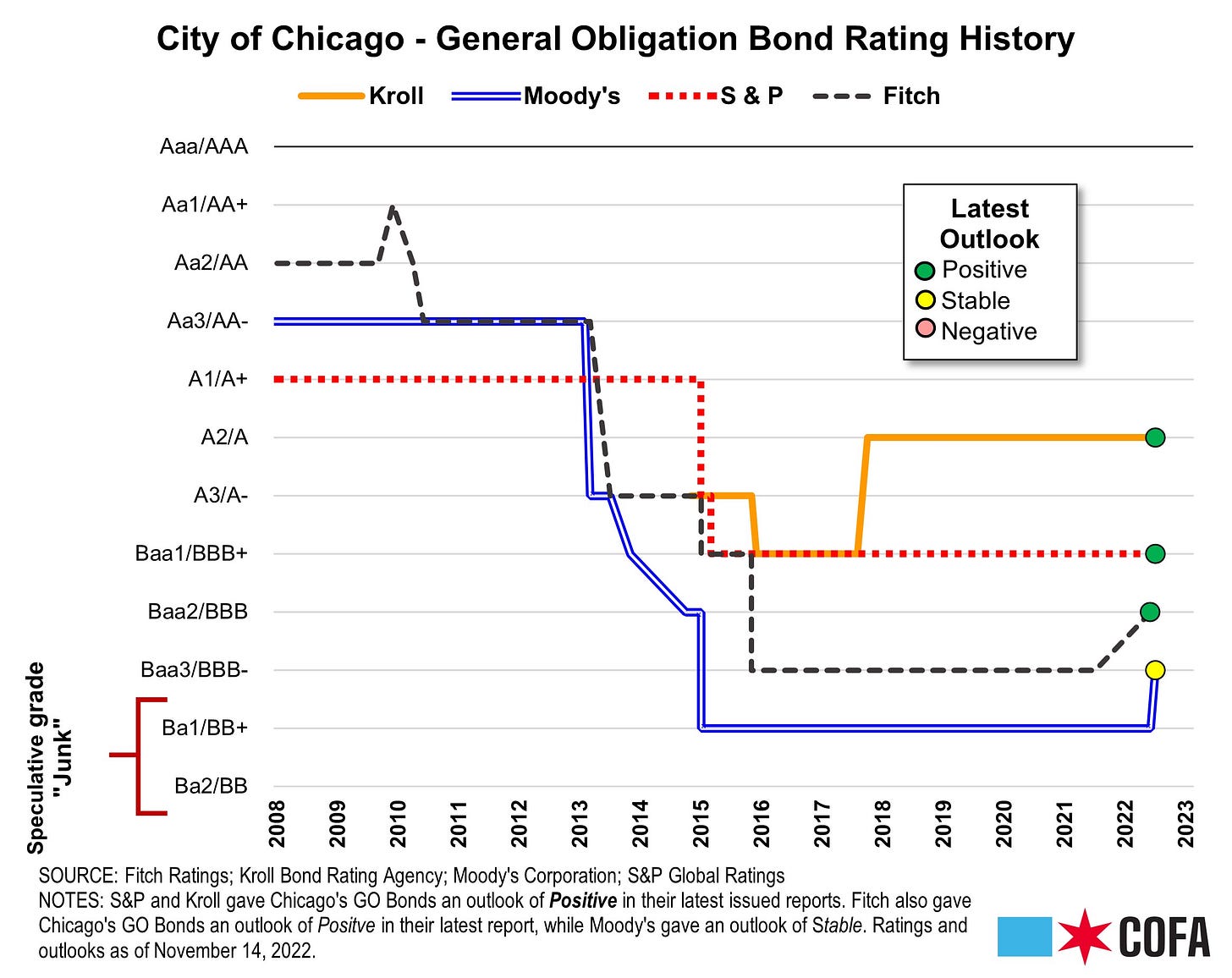

Especially with credit ratings that look like this:

Sure, they’re all in investment grade range now, but if the Chicago government starts spending without the revenue to cover it, those ratings will surely dip back into junk again.

STUMP's history of covering Chicago

STUMP has been around since 2014, so it was after Daley left and Rahm Emanuel was mayor.

I had been blogging elsewhere when Rahm ran, and I had noted that a Daley left voluntarily was the sign that the money was gone and that Rahm should take warning. Rahm did not.

Reaching back to the beginning of the blog, June 2014: Public Pension Watch: Chicago, Not Waving But Drowning

I have thought about these things as some very large public pensions are currently drowning metaphorically, and it’s not clear to me that they realize this. There are all sorts of signs that have been popping up, and today’s clear example is Chicago.

It’s clear to me that Rahm didn’t take the Daley warning seriously when he left his sinecure. Daley realized that the party was over, and the death of fun was on its way. The only reason he would leave was that the money train was no longer choo-choo-ing along. Rahm may have thought that the disaster wasn’t immanent, but, again, Daley wouldn’t have left if the disaster was a safe twenty years away.

So let us look at the extent of the problem:

….

The unfunded liability is an estimate of the pension promise thus far earned that has not been provisioned for (roughly). It has assumptions built in as to when people are actually eligible to retire, and when they are likely to retire. So the unfunded liability, roughly, would be the money you would need if the pension plan were frozen and nobody accrued any more pension benefits, but still couldn’t retire before retirement age.What happens when one has a large unfunded liability, and the “required” contributions aren’t made, is that the unfunded liability generally gets much worse.

Which is what has been happening.

How bad is it? This bad:

That was over a decade ago, that unfunded liability.

Since the beginning of STUMP, Chicago has had to ramp up its pension contributions by a huge amount.

Here is an example, from the Chicago Teachers plan:

Some of the contributions come from the state of Illinois, but most come from Chicago property taxes.

In 2017, I projected Chicago’s Municipal fund running out of assets in 2024. Hmmm. To be sure, they’ve increased contributions since then as well.

But it will be difficult to keep up those pension contributions up if they want to spend money on all sorts of goodies now.

Seems to me those pension fund contributions would be a nice, juicy target for the teachers union. They might prefer to get the money now — they wouldn’t be the first union thinking they can grab money now and still get the pension benefits later.

A partial compilation of Chicago posts (I stopped keeping that list up after a certain point… not that I stopped posting about Chicago).

Have fun scrabbling at the disappearing money

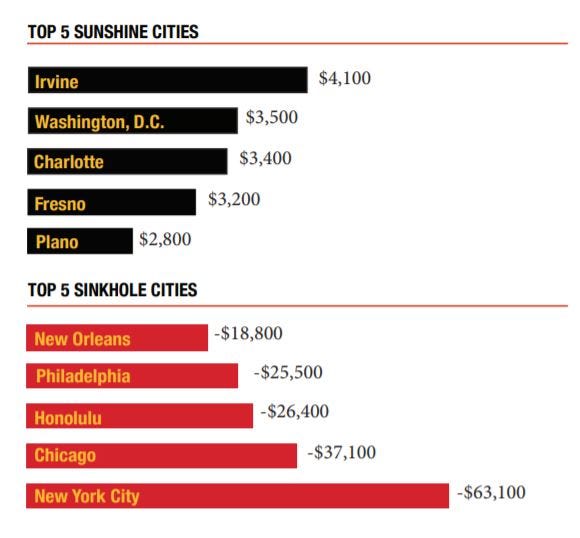

In This year’s Truth in Accounting Financial State of the Cities, Chicago ranks 74th.

Out of 75 cities. (only New York City is worse)

Let’s take a look:

After the Covid-pandemic, in large part due to unrealized gains in stock market valuation of its pension investments and federal government stimulus money, Chicago’s financial condition appeared to improve. Despite apparent improvements, Chicago had a Taxpayer Burden™ of $41,900, earning it an “F” grade from Truth in Accounting.

The city’s pension liability is calculated by subtracting earned and promised benefits from the market value of pension assets. Based on an exceptionally good year in the markets in 2021, the pension assets’ values were high. The result was a dramatic decrease in Chicago’s pension liability and a corresponding decrease in its money needed to pay bills. Even with inflated pension asset values, the city had set aside only 25 cents for every dollar of promised pension benefits and had no money set aside for promised retiree health care benefits.

Chicago’s elected officials have repeatedly made financial decisions that left the city with a debt burden of $38.2 billion. That burden came to $41,900 for every city taxpayer. Chicago’s financial problems stem mostly from unfunded retirement obligations that have accumulated over the years. In 2022, markets produced negative market returns and federal COVID relief waned. These conditions may increase the per taxpayer Tax Burden. Chicago could struggle to maintain current levels of government services and benefits without further negative impact on its financial health.

This is worse than where it was in January 2020, unsurprisingly:

Indeed, this year, to fit the cities on the same scale, they had to break the scale to fit Chicago and New York City on the scale:

I know the struggle.

But that will be nothing compared to the struggle of dealing with the Chicago budget over the next few years.

If Brandon Johnson thinks dealing with a few thousand dollars of unpaid personal bills is difficult, I think he will see some real difficulties in going from his campaign language to reality.

Johnson said while campaigning:

Vallas and his opponent, Brandon Johnson, do not intend to raise property taxes, but Johnson said his plan does include several other tax hikes to increase revenue.

“I don’t know if there is any other mayoral candidate in history of Chicago that has been willing to put up a balanced budget plan before they are elected,” Johnson said.

In his $800 billion tax plan, Johnson proposes bringing back the city head tax, where large corporations who do most of their work in the city will pay a 1-4 dollar tax for each employee. Johnson also pitches increasing the hotel tax, jet fuel tax, a tax on securities trading and increasing the transfer tax on property sold for more than a million dollars.

“All of that gives us the opportunity to eliminate the structure deficit, make critical investments without raising property taxes,” Johnson said.

Johnson insists a city income tax is not part of his plan, while Vallas said the budget can be balanced from within and Johnson said it can only be done with new revenue.

So, in a time when people are skeptical of doing business in person, Johnson is thinking of making it more expensive to go to Chicago.

Hey Nashville, I know you’re already crammed with conventions and conferences, but get ready for some more. (Who the hell wants to go to Chicago?) I hear Charlotte, NC has really been building its financial business, though obviously, we on the East Coast would love that business to come our way. Seriously, people have options other than Chicago. It’s a big country.

[The audit on inefficiencies from Johnson’s campaign website sounds like a real hoot to me, but I would be interested to see if they find anything. That might be a good “pour encourager les autres” exercise.]

Johnson has his work cut out for him. While he’s obviously buddy-buddy with the teachers union, that will get him only so far.

They may not be so friendly when he has tried out his tax ideas (and the inefficiency audit) and the extra money for goodies is not forthcoming.

But hey, maybe it will work. We will see.

The thing that immediately jumped out to me: fewer than 600,000 people cast ballots. Chicago is doomed AND nobody cares.