Who will bail out Chicago?

Neither Illinois nor the U.S. federal government are in a great shape

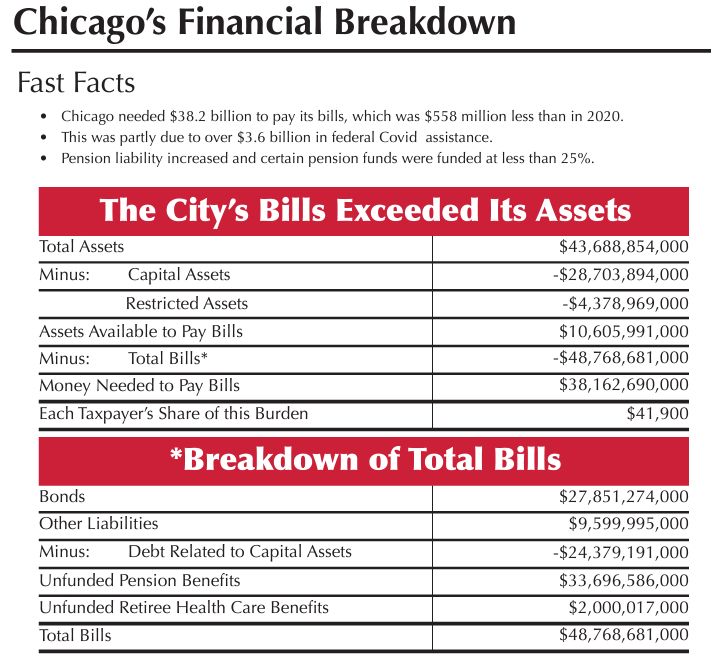

Chicago is deep in debt.

As the Little Red Hen might ask: Who Will Help Chicago Get Out Of That Hole?

I am not going to make the mistake of Meredith Whitney — Chicago, for now, has cash flow, which to politicians means it’s not bankrupt!

Anybody who looks at Truth in Accounting’s 2023 Financial State of the Cities, seeing Chicago sitting at number 74 out of 75 [and yeah, I know NYC is sitting at 75 - I will treat with NYC in time], could say: “Oh, but that’s just a balance sheet! All those debts aren’t due all at once!”

But the problem is this: unlike with NYC, Chicago’s largest debt is unfunded pensions. And that debt just keeps getting larger.

Elizabeth Bauer on Chicago’s Pension Situation

Forbes, 1 Aug 2023: “No Hope In Sight For Chicago’s Worst-In-The-Nation Pension Plans”

Back on July 18, the Equable Institute released the 2023 version of its annual State of Pensions report, which means that, yes, it’s time for another check-in on these infamously-poorly-funded pension plans. Among the wealth of tables is a list of the best and worst-funded of the 58 local pension plans studied, and, yes, you guessed it, the bottom five spots are Chicago plans, with the bottom three at levels far below all others:

Municipal employees, 21% funded,

Chicago police, 21.8% funded, and

Chicago fire, 18.8% funded.

Combined with the Chicago Laborers’ pension fund, with a 41% funded status, the pensions for which the city bears a direct responsibility have a total pension debt on a market value of assets basis of $35 billion. (This data is from the actual reports*, released in May, which doesn’t match the Equable report precisely.) Spot fifth-worst is taken up by the Chicago Teachers, at 42.4% funded, and the first non-Chicago system in their list, Dallas Police & Fire at 45.2%, is twice as well funded, percentage-point-wise, as the Terrible Trio.

The Equable Report is a good, high-level overview of the public pensions in the U.S. — I may do a deeper dive, and Dallas Police & Fire has a really specific history. Choices have consequences, as I’ve said.

These funded ratios are using standards I consider too loose in valuing these promises, as well.

Let’s consider one of the “solutions” to the hideous underfunded situations, as described by Bauer:

What’s more, Ralph Martire and his Center for Tax and Budget Accountability continue to promote what he calls “reamortization” as a solution to the problem, both through an April Chicago Sun Times commentary and through the release of a report, “Understanding – and Resolving Illinois’ Pension Funding Challenges” (which is an update of a prior proposal). This proposal, which is directed at Illinois pensions but is clearly meant based on other comments to be an all-purpose fix, sounds innocuous, as merely a sort of “refinancing” as one might with a mortgage, but it’s really much more as he proposes to

Reduce the funded status target from 90% to 80%, based on the claim that the GAO deems this funded status to be the right target for a “healthy” plan (whether he deliberately misleads or not, he is wrong here, the National Association of State Retirement Administrators or NASRA clearly explained more than a decade ago that 100% funding is always the right target and the only significance of an 80% level is that private sector pension law requires plans funded less than 80% to take immediate corrective action rather than have a long-term funding schedule, and the American Academy of Actuaries more explicitly calls this a “myth”);

Issue large sums of Pension Obligation Bonds, which were questionable already when they first began promoting this but are now a terrible idea with our current high bond rates, all the more so for a low-credit-rating city such as Chicago; and

Move contributions from last day of the fiscal year to the first day, which he argues would be a gain of a year’s investment return while forgetting that it requires the city to have this money on Day 1 and forgo the other uses it would have.

I think my long-time readers know what I think about anything less than a 100% fundedness target.

Especially an 80% fundedness target.

Sidebar on Ralph Martire: 80% Funding Multiple Offender

Unsurprising to nobody: Ralph Martire showed up multiple times in my 80% Funding Hall of Shame. I basically stopped covering this in 2020, because public pension funding ratios had been getting so bad. Maybe they will recover, but it hasn’t happened yet.

In my September 2020 post indicating that I was no longer making regular updates to this list, I had this to say about Ralpha Martire:

I do want to talk about one other person on this list: Ralph Martire.

He is one of my nemeses (pretty one-sided, I’m sure), in that the “solution” he keeps coming up for Illinois is basically rearranging the band members on the Titanic while they’re playing “Nearer My God to Thee”. He often pops up in discussions of Illinois finances. Ugh, he was on board with a pension obligation bond for Chicago back in 2018. Anyway, he is just chock-full of support for ideas that will not change a damn thing in Illinois.

Martire’s last appearance on the 80% Hall of Shame was 2018, in which he tried to shift the blame of the myth onto the CBO. Again, nobody is talking about 80% fundedness in Illinois now (okay, except Greg Hinz, apparently. Someone needs to tell him to stop doing that.)

Illinois is in no condition to bail out Chicago

-sigh-

Do I have to do this?

I suppose.

Let us consider Illinois’s own sorry state regarding state-wide pensions.

I will point out that the above graph shows the “REQUIRED” contributions.

That’s not what was actually contributed. Not even close to what was required.

If they had actually contributed what they were supposed to have, this would not be the most recent reported results:

Illinois Teachers: 42.5% funded (only 62% of “required” contribution paid, most recently)

Illinois Universities: 43.9% funded

Illinois SERS: 41.1% funded

Some years ago, I did a post tracking all the state-level funds and why they fell short:

2015: Illinois Pensions: How Did We Get Here? Development of Unfunded Liability

One of the biggest disputes in the public pensions brou-ha-ha is who is at fault with regards to underfunded pensions.

Mind you, there’s plenty of blame to go around.

But it would be nice to quantify the sources of the underfundedness, wouldn’t it?

I did an update 2 years later.

2017: Geeking Out (and Illinois Pensions): Fixing a Graph and Assigning Blame for Underfundedness

That was in Fiscal Year 2016. The hole was $125 billion then for the state, and that’s not including Chicago’s debts.

The grey bar, which is about half of the hole, is due to DELIBERATE UNDERCONTRIBUTIONS TO THE PENSIONS.

To the state pensions.

So. Chicago. You’re not getting anything extra from the state.

Federal source as a bailout?

Well, it’s a possibility. Federal politicians aren’t known for being particularly intelligent.

They think they can turn on the money printer and buy votes.

However.

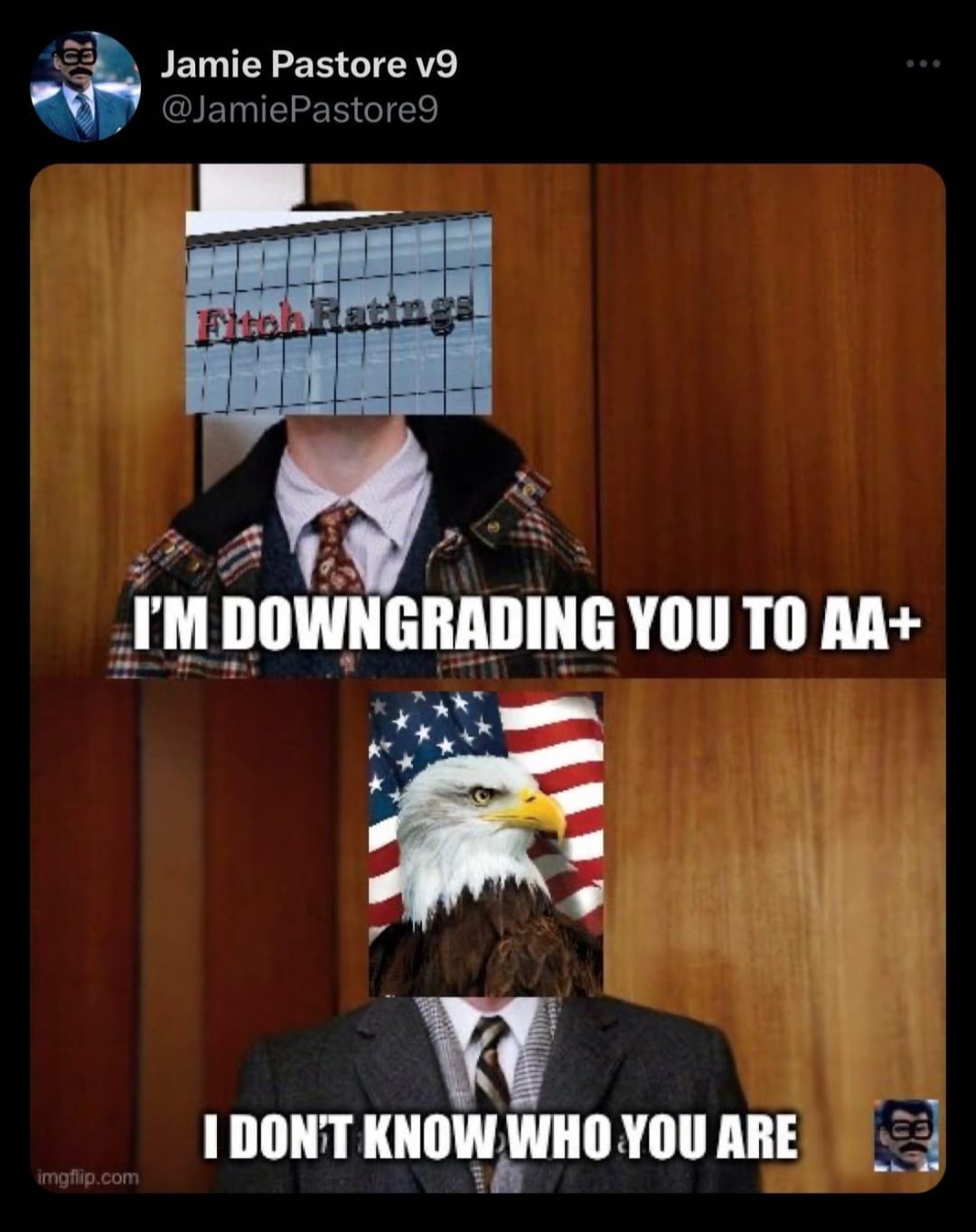

Here is the thing: while Fitch is only the most recent credit rating agency to downgrade the U.S. credit rating for its own credibility reasons, [S&P having gotten there back in 2011], the federal government does not rain bailout money on pension funds randomly.

Back in 2021, the multiemployer pension bailout passed but that was specifically due to Central States Teamsters about to wipe out the PBGC multiemployer pensions program (by 2025 - which had no connection to the pandemic, by the way.) Some kind of bailout was going to pass.

A decade ago, no federal bailout at all occurred for public pensions getting cut in Detroit’s municipal bankruptcy.

Now, the federal government, after having rained down a bunch of cash during the pandemic indiscriminately, and now seeing a demographic disaster approaching [that we have seen approaching for decades] has to deal with: Medicare, Social Security, Medicaid [as many nursing home residents are on Medicaid - not to mention those on dialysis, to mention other conditions], etc.

You think they have spare change for Chicago?

Solution: Aliens

So here’s the solution: aliens.

I hear that there’s been various UFO hearings in Congress. Some people think it’s just a distraction from whatever political target you despise [for convenience], but let’s take it at face value.

If they are ETs that are visiting, I recommend the Chicagoans to be first-movers to take financial advantage. I am giving this advice only once, because otherwise, I am going to go to NYC [and start charging fees for consultation.]

From my sci-fi experience, I have all sorts of ideas — maybe they are underwater denizens, and you should lease Lake Michigan volume to them for berths to them. Maybe you could tax them!

Or, even better — give them tax breaks, and then tax the people who come to gawk at the aliens! Think about it!

Fine, I’m not totally serious but:

if the aliens are actually there, you could make serious money from them and,

you are more likely to get money from aliens to make Chicago solvent than to do it from either Illinois or the Feds.

I feel like we are frogs in a giant pot of water resting on three burners: Chicago, Illinois and America. The flames are turned to different levels. The water is getting uncomfortably warm but the cooks (politicians) keep telling us we are OK and distract us with other issues.

I am not sure when the pot is going to boil, but 2030 to 2035 seems like a good bet and roughly syncs up with Neil Howe’s Fourth Turning timing. The numbers don’t lie. A hard reset appears inevitable and I am not sure owning real estate at ground zero makes much sense.

One thing is certain, the politicians will: continue to ignore the problems before claiming they were completely blindsided, blame the other party or those that came before them, and retire en masse to enjoy their fat pensions, Cadillac healthcare and insider trading profits.