In which I discuss some of the fiscal plans for Chicago of the new mayor Brandon Johnson and some of his political friends… and the constraints they will labor under: a population that has already shrunk and a significant revenue target that has already threatened to up stakes and move out of Illinois entirely.

Episode Links

Earlier STUMP post:

Did New Chicago Mayor Brandon Johnson Inherit The Worst City Pensions in the Country?

UPDATE AND SPOILER: THE ANSWER IS YES. YES, HE DID. Brandon Johnson was sworn in as Chicago mayor on May 15, and I already sent my condolences when he “won” the election. It’s not much in the way of winning when you have to deal with the disaster that is Chicago pensions.

8 May 2023, WBBM: Brandon Johnson inheriting some of the nation’s worst-funded pensions, finance expert says

1 May 2023, The 74: New Chicago Mayor Brandon Johnson Inherits America’s Worst Teacher Pension Mess

Comparing the city-only plans:

On Proposed Taxes

Mark Glennon, Wirepoints: Echoing Scarface, ‘First We Get the Money,’ say Mayor Johnson’s allies with $12 billion financial plan, and here comes Angela Davis – Wirepoints

Two Chicago interest groups that are major allies of Mayor Brandon Johnson published Wednesday what they want Johnson to pursue for new taxes: a city income tax, a wealth tax, a “head tax” assessed per worker on employers, a digital ad tax, a jump in the tax on jet fuel used at Chicago’s airports, a progressive increase on real estate transaction fees on sales over $1 million. The new taxes would total $6.8 billion according to the plan, and would be coupled with supposed savings of $5.1 billion that would be redirected to other spending, totaling nearly $12 billion.

For a little perspective, the tax increase would be even bigger than Chicago’s near-$5 billion Corporate Fund, the main operating account in the city’s budget.

You gotta hand it to today’s left when it comes to the path to power. The title on their proposal is “First We Get the Money: $12 billion to fund a just Chicago,” echoing the wisdom in a famous line in the movie Scarface, “First you get the money, then you get the power….”

Andrew Stuttaford, National Review: Chicago: Pork Bellies to Flee the Sinking Ship?

Sometimes the golden goose escapes the knife and moves to Florida. Among the tax proposals (increases, not cuts, in case you were wondering) being put forward by Brandon Johnson, Chicago’s new mayor, is one for a financial-transactions tax, at a rate of $1 or $2 for every “securities trading contract”.

….

Such taxes are not a good idea at the best of times, but to propose them for the embattled city that still hosts the Chicago Mercantile Exchange, well . . .

How does that advice about stopping digging go again?

On Population Migration

Bryce Hill, Illinois Policy: 85% OF ILLINOIS COMMUNITIES LOSE PEOPLE IN 2022; CHICAGO LOSES 33K

1,108 Illinois communities of all sizes shared in the record loss of more than 104,000 residents in 2022, according to new Census Bureau data. Chicago lost 32% of the state’s total.

Illinois’ population loss hit more than 85% of its cities, towns and villages in 2022, but 32% of the state’s 104,437-person loss came out of the city of Chicago, new Census data shows.

Population decline in Illinois is spreading, now affecting more than 85% of communities throughout the state and hitting communities of all sizes. There were 1,108 of Illinois 1,296 incorporated places that lost population in 2022, according to data released May 18 by the U.S. Census Bureau.

I didn’t mention the following graph:

But note that this is a one-year change. One percent does not sound like a very large loss, but if it continues over a decade… that will have a large impact.

On Illinois Shorting Pensions

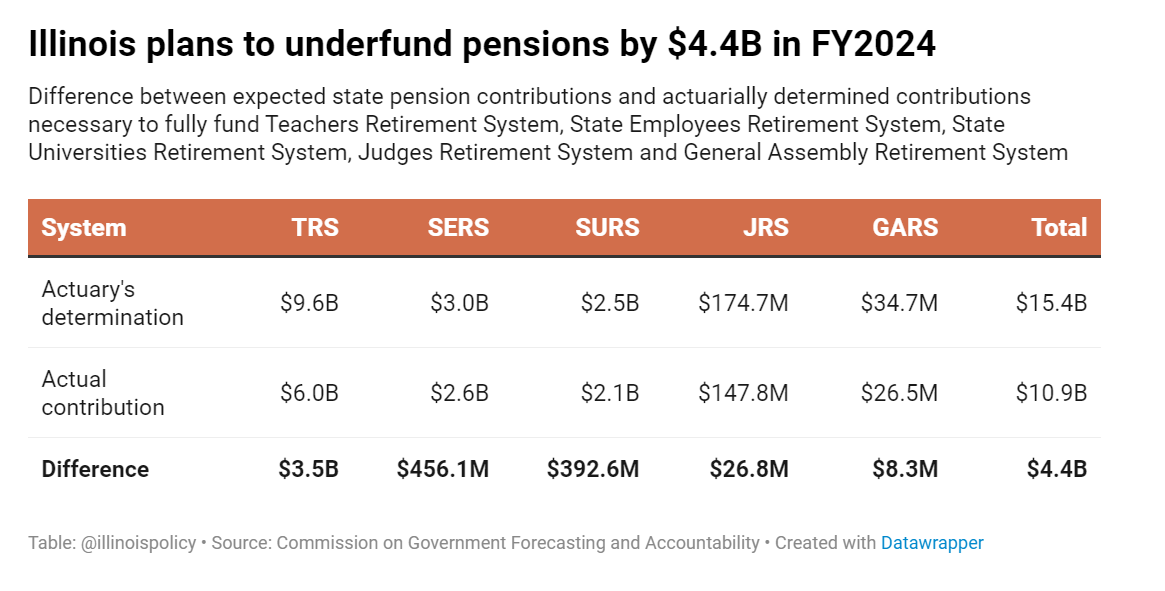

Illinois Policy: LAWMAKERS PLAN TO SHORT PENSIONS BY $4.4 BILLION IN 2024 BUDGET

No matter what rhetoric about passing a balanced budget comes out of Springfield, the state budget will automatically be unbalanced because of inadequate pension contributions.

As lawmakers work to finalize a budget leading up to their final scheduled session day on May 19, they plan to short pension funding by $4.4 billion.

That means the budget they pass automatically will be unbalanced despite what Gov. J.B. Pritzker will assuredly claim. He’s claimed that every year, and did so in his 2024 budget proposal.

2017: Geeking Out (and Illinois Pensions): Fixing a Graph and Assigning Blame for Underfundedness

That was in fiscal year 2016. Every single year, for every Illinois state pension fund, they never gave full contributions.

Thus, the largest single contributor to underfundedness has been deliberate underfunding.

I should update that graph. Upcoming….

Share this post