Chicago is My Kind of Town to Beat Up On: The Payoff! Year

Also known as: putting off the reckoning

I’m on the road right now, taking my middle child to college. I picked up a buddy:

Prior posts:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

2019: Chicago is My Kind of Town to Beat Up On: 2019 Edition

2020: Chicago is My Kind of Town to Beat Up On: The COVID Era

As with 2020, I didn’t have a lot of Chicago-centric posts in 2021.

However, there was a big payoff in the cards… not that it has ultimately done Chicago much good.

January 2021 Hangover

In one of my 2020 posts, I said this:

I do like how Lightfoot doesn’t even try to lie here, that Chicago’s finances were just fine before COVID hit. Many cities and states have tried that lie…. and maybe she has tried it elsewhere. I haven’t read every story about Chicago finances recently. I’ve been a bit busy.

But that “we have a lot of other hope” is founded on….what, exactly? Maybe she’s hoping Biden wins the election, and the Dems sweep House & Senate, and then money time!

Well, the 2020 election did go exactly that way:

14 Jan 2021: Public Pension Roundup: Bailing out Pensions, The Return of Pension Envy, Kentucky Lawsuit, and more

With the White House, House of Reps, and Senate on the Dem side, we will likely get a return of the Money-Palooza Monstrosity, but I imagine there may be changes reflecting what has already gone before and also changes reflecting that Pelosi et al knew the first bill was never going to get passed.

Here is what Mark Glennon had to say: The sweet smell of federal bailouts for Illinois, Chicago and other broke states and cities came quickly last night – Quicktake

Democratic control of the United States Senate had barely seemed apparent at 11 p.m. last night. But Anne Caprera, Gov. JB Pritzker’s Chief of Staff, knew exactly what it meant and tweeted it out: The bailouts are coming.

With the presidency and both houses of Congress now in their control, nothing stands between American taxpayers and the insolvency of Illinois, Chicago and other failing states and cities (assuming Jon Ossoff holds his thin lead in the Georgia senate race).

Well, there is something that stands between, and it’s that there’s not enough money to shovel into the black hole of Illinois.

Yes, I know the MMT folks think the sky’s the limit on cranking up the money machine, but actual historical experience has shown that some pretty bad things can happen if you just let the money printer rip.

Hmmm, I wonder what bad things can happen.

I think that yes, there will be a Money-Palooza Monstrosity 2: Electric Bugaloo, but that the amount and how it’s distributed may be very different from the 2020 bill. The most Illinois and the like can hope from such a bill, I think, is one year’s worth of revenue.

Yes, we’ll see where it lands.

A few other comments from that post targeting Chicago:

Many states don’t need extra help for pension contributions now. Who does? Illinois, New Jersey, Kentucky, Chicago… you know, those places that explicitly decided to spend money on things other than pension contributions for decades. Why should the rest of us pay for all sorts of goodies, like guaranteed 3% compounding COLAs, pension spiking, backDROPs, etc., that many private pensions never had.

….

Republican and Democratic governors alike govern states with well-funded pension plans. Democrats in New York, North Carolina, and Wisconsin, and Republicans in Tennessee and South Dakota all have well-funded plans.

That is correct. And then we have cities like Chicago and New York City with deeply underfunded plans.

Again, what does any of this have to do with convincing the entire country to cover for the specific ailing spots… which didn’t get that way by accident. Their fiscal distress is an extremely foreseeable result of the deliberate choices they made. COVID just sped up the schedule a little.

….

In any case, he’s still not making the case that there is something extraordinary about the particular states/localities with deeply underfunded pension plans, that magically got that way because of the pandemic. And that we want “loyal” public employees. Perhaps we’d like some of the unfireable folks to go away.

But again, this is all about choices that state and local governments made. It’s not a federal issue that, say, Chicago overpays its employees in salary and benefits.

Another “hangover” post in January 2021 related to Chicago and homicides — it was a leftover post on mortality: Mortality Nuggets: Life Expectancy, Worldwide COVID Deaths, Homicides, and More

Chicago — Hey Jackass: 2020 Year Totals

2020 Totals (vs 2019)

Shot & Killed: 719 (+55%)

Shot & Wounded: 3455(+51%)

Total Shot: 4174 (+52%)

Total Homicides: 792 (+53%)

Increases over 50% are substantial, I hope you know.

MoneyPalooza Monstrosity: Not Just About Chicago

It was kind of a big deal. You may have heard about it - March 2021?

26 Mar 2021: MoneyPalooza Monstrosity: State and Local Governments Should Pay Down Pension Debt

Issues I want to address:

Fiscal Year 2020/2021 state/local government revenue hits (and specifically, which revenue sources hit hardest)

Equitability of the division of these stimulus funds

On whether recipient states can lower tax rates

But not today.

Today, I want to talk about what state and local governments should do with this money: pay down pension debt.

….

State and local government’s most expensive debt: unfunded pensions

This is why state and local governments need to put this “windfall” into their pension funds: it is the highest interest rate debt they hold.

This is true even for Illinois.

Illinois is the lowest-rated state when it comes to credit ratings, barely hanging onto their investment grade status.

At that rating, last May, Illinois issued $800 million in bonds at 5.85%. That was for 10-year bonds and considered a super-high interest rate on municipal bonds.

What’s the interest they’re paying on their pension debt?

6.75% or 7% — depending on which pension plan. Over 100 basis points higher than their borrowing rate on muni bonds — an entire percentage point difference!

That really racks up over the decades.

….

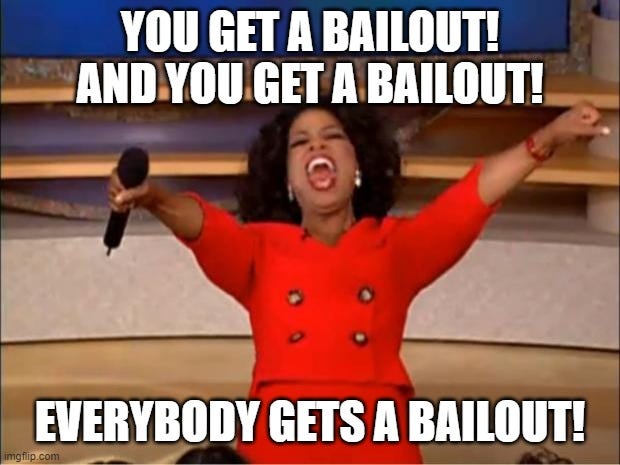

I grabbed the fiscal year 2019 data from the Public Plans Database, so let’s look at the unfunded liabilities and the assumed rate of return (and thus the interest rate they’re paying on the unfunded liability).

First, let’s look at two histograms — one, based on number of plans using specific discount rates; the other, based on the total unfunded liabilities measured at those discount rates:

In this histogram, you can see most of the public pensions have discount rates 7% or higher. Muni bond rates for similar durations are much lower than 7% right now. Pension debt is a high interest rate debt for states and local governments.

That graph doesn’t indicate which plans have the highest unfunded liabilities. So here is a scatterplot where I’m labeling each point with the plan name:

Now we can see not only all the plans heaped up between 7% and 8% as discount rates, but also which plans have the largest unfunded liabilities.

You can barely see Chicago on there, but there are some of its pensions to be seen in the tens of billions of dollars hole area.

If I remember correctly, the states and municipalities weren’t to pay for their pensions with these funds, or provide tax rebates, or yadda yadda, but cash is fungible, and they could at least have boosted their budgets for making pension contributions.

And actually, Chicago did make higher contributions.

The problem was this:

21 Mar 2021: Quick-Takes: Mortality Update, Meep's Math Matters, and a Few Bailout Reactions

Pension bailouts: more to come?

Well, they shall certainly try.

But I want to remind everybody the reality of the size of the bailout of multiemployer pensions v. other obligations:

As I mentioned in my prior post on the bailout:

The total MEP unfunded liability is 8 times that of the bailout bill amount

The total public pension unfunded liability is 22 times that of the bailout bill amount (this happens to be the same as the total American Rescue Plan Act of 2021)

The total Social Security shortfall is almost 200 times that of the MEP bailout bill

A few remarks — the total public pension unfunded liability (using the discount rates they themselves use, that is, too high, and thus valuing the unfunded liability too little) is the same size as the full American Rescue Plan Act of 2021 — that is, $1.9 trillion.

That is not how much is getting shoveled to the various state and local governments.

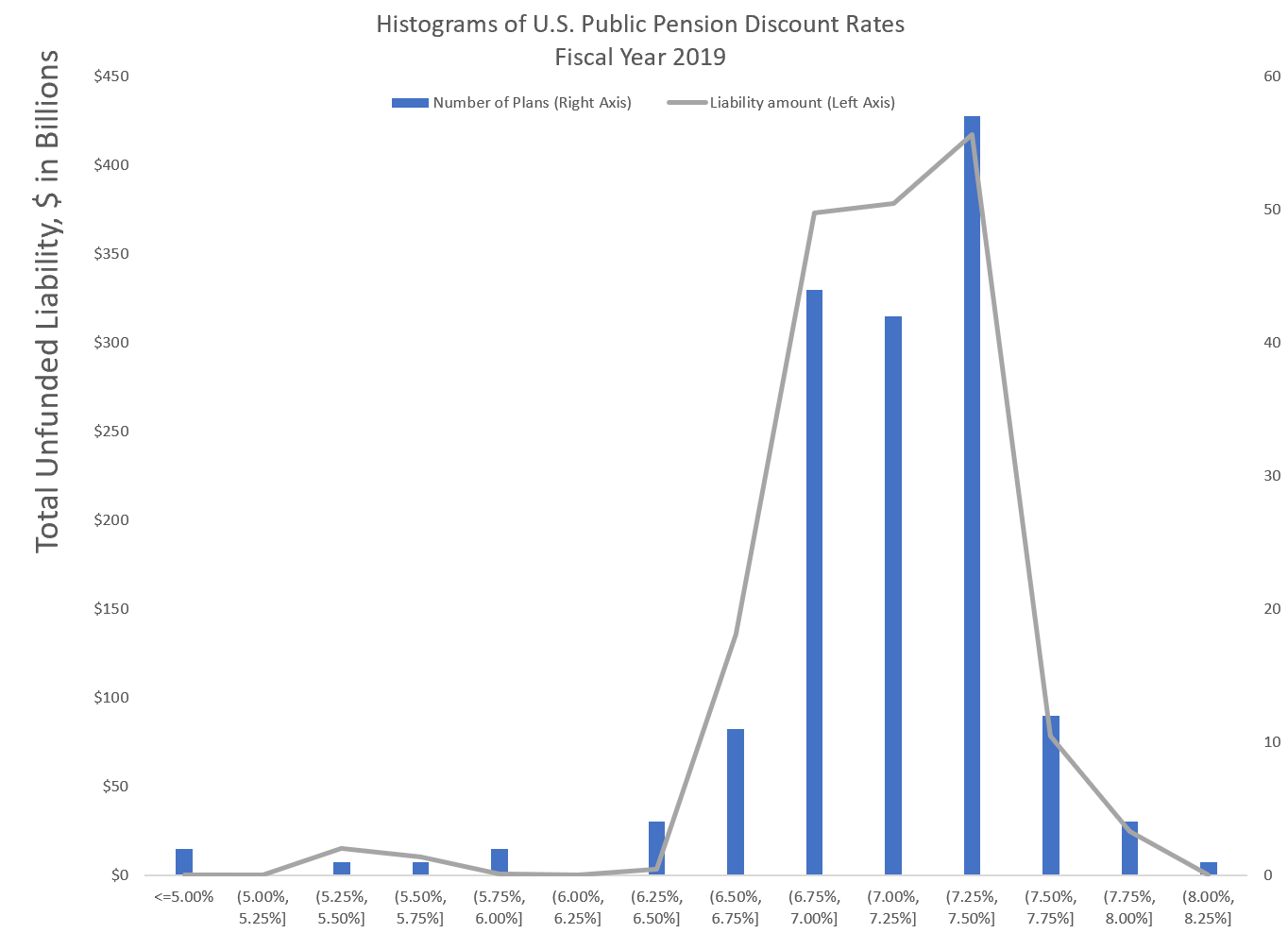

As Eric Allie draws (re-published with permission):

I will be coming back to this image, because the amount of taxpayer funds shoveled into the maw of Chicago and Illinois, while eye-popping to individuals, is far from the over $100 billion they need to fully fill their pension holes already accrued.

(and those holes are only going to get worse, the way they’re going)

I still haven’t gotten to the Chicago punchline. A bunch of money has been shoveled at Chicago (and Illinois) — what has been the result?

Truth in Accounting: Dust Up with National Public Pension Coalition

Again, not strictly Chicago-focused, but I like using Chicago as my example.

10 Jun 2021: National Public Pension Coalition vs. Truth in Accounting: Who is Accurate With Public Pension Unfunded Debt?

zzz

A week ago, the National Public Pension Coalition posted Why Truth in Accounting’s Recent Claims about Pensions are Inaccurate. Back in October 2020, the group posted a similar piece: Texas Stands Up to Truth in Accounting.

There are some major points the NPPC (National Public Pension Coalition) makes in both pieces, and I want to address their main points, as it relates to regular reports that TIA (Truth in Accounting) makes.

….

Okay, so the first main point of NPPC is that TIA is misleading with their balance sheet measure, to be a method for attacking public pensions.

For the most recent NPPC post I linked, they’re reacting to a TIA report on just 10 cities. (as opposed to their bigger Financial State of the States report). Let’s look at what TIA wrote about that and see if they’re emphasizing the public pension burden…. or if they’re doing something else.

….

From a taxpayer point of view, the people who will be asked to fund not only the pensions, but also pay for the OPEBs and pay off the bonds, it doesn’t much matter the mix of the debt. Yes, for some of the cities, the unfunded pensions are their worst debt. But we’ve seen for NYC, the primary component isn’t pensions.

Do you think taxpayers care about this breakout? TIA doesn’t seem to think so, because they break out taxpayer burden by entity, as with Chicago:

Notice they only care about the governmental level/entity, not whether it was pensions or bonding. And I don’t think taxpayers will make much of a distinction, either.

It has nothing to do with blame. It has everything to do with “Can we afford this?”

With respect to fear-mongering, TIA ain’t mongering much. They don’t even emphasize pensions over other debts. The numbers just fall where they do… and TIA isn’t even doing what I would do if I wanted to put the PUBLIC FINANCE FEAR into people looking at the taxpayer burden.

…..

If I really wanted to scare taxpayers, and, more importantly, scare public employees and retirees, I would use estimates of the unfunded pension liabilities more like what the major credit rating agencies use.

….

TIA isn’t using an adjustment of the pension liability numbers. TIA is using the numbers as reported by the government entities.

TIA is not doing anything fancier than taking numbers already in the financial statements and aggregating so that taxpayers can see all of the government financial burdens they need to think about for long-term decision-making.

….

I want to note the explicitly stated goals of both NPPC and TIA.

The NPPC’s about us page:

NPPC believes every American should be able to retire with dignity. Across the country, millions of public employees rely on their defined benefit pensions to ensure they can retire with security. It is NPPC’s mission to protect and advance the benefits of America’s hard-working public employees who deliver the services our communities rely on.

We know that there is no one more interested in strengthening the public pensions system than the public employees who are counting on pensions to retire. After all, public pensions are the only source of retirement for 30% of public employees since they do not receive Social Security.

Founded in 2007, NPPC remains a leading voice on the importance of defined benefit plans. Working with a network of national and state-based organizations, NPPC continues its mission to educate policymakers and the general public on the impact of pensions, not just for the public worker, but for the community and economy at large.

I bolded the key sentence: to protect and advance public employee and retiree benefits

I agree with that mission, but I believe some of their current methods in attaining that goal are not really helpful. For instance, supporting the concept that it’s just fine to underfund public pensions. I will come back to that.

Here is something equivalent for TIA:

What is “TIA”?

TIA stands for Truth in Accounting™, the organization that operates this website. TIA was founded in 2002 to “compel governments to produce financial reports that are understandable, reliable, transparent and correct.” It is a nonpartisan, non-profit organization headquartered in Chicago, Illinois.

There is nothing that would inherently make these organizations oppose each other, based on their stated goals.

Government financial reports that are understandable, reliable, transparent, and correct would be a boon to public employees and retirees as well as taxpayers.

(Forget about bond buyers. They should look out for themselves.)

I would argue that highlighting how much public pensions are underfunded is a help to public employees and retirees, to make them clamor for more full funding of their pensions.

Threatening Chicago Cop Pensions Over Vaccines

This is peak 2021.

21 Oct 2021: Chicago Police: Vaccine Mandates and Pension Threats

This strikes me as deeply unwise:

Chicago police vaccine mandate: New CPD memo threatens discipline, firing for non-compliance

- A second memo, obtained by the I-Team, was distributed throughout CPD Sunday. The latest memo threatens the firing of officers who do not follow the city’s vaccine policy and orders it be communicated to officers at all police roll calls.

“TO BE READ AT ALL ROLL CALLS FOR SEVEN (7) CONSECUTIVE DAYS. This AMC message informs Department members of consequences of disobeying a direct order to comply with the City of Chicago’s Vaccination POlice issued 8 October 2021 and being the subject of the resulting disciplinary investigation. A Department member, civilian or sworn, who disobeys a direct order by a supervisor to comply with the City of Chicago’s Vaccination Police issued 8 October 2021 will become the subject of a disciplinary investigation that could result in a penalty up to and including separation from the Chicago Police Department. Furthermore, sworn members who retire while under disciplinary investigations may be denied retirement credentials. Any questions concerning this AMC message may be directed to the Legal Affairs Division via e-mail,” the memo said.

The part that I’ve bolded is the extremely unwise part.

Threatening public employees’ pensions is the nuclear bomb of municipal politics, even beyond “defund the police” campaigns.

Let me quote from the bottom of the piece:

“Roughly 38% of the sworn officers on this job, almost 40% can lock in a pension and walk away today,” Fraternal Order of Police President John Catanzara, Jr. said.

I will not check his quoted amount. I find it credible, given how low the retirement age generally is for public safety officers.

As it is, the lawyers on both sides are having fun (with a stupid “tell the union leaders none of them can tell union members not to enter vaccine info in the employee portal” twist), and we will see where the legality of the vaccine mandate on public safety officers land.

Public pension forfeiture policies: not all that common

I have no comment on the legal aspects other than this: I have been following news on public pensions for over a decade now, and one of the most contentious issues has been rescinding pensions for criminal officials. As in, people who were actually convicted of felonies, often directly related to their jobs (but not always), and actually in prison.

And many public pension plans are unable to rescind these pensions legally. In reaction to some particularly egregious cases, some state legislatures have stepped in and passed laws allowing it under specific circumstances, but many states have done nothing.

Here is a map from Reason Foundation in 2020 on policy:

And the entry for Illinois in their table of pension forfeiture policies says:

Pension benefits are forfeited for members who are convicted of a felony relating to their service as an employee. The member is entitled to a refund of their contributions.

Now, I’m not going to go into the ins-and-outs of the denial of “retirement credentials”, whatever that means.

While I’m sure Chicago can probably delay the start of retirement for cops who qualify for retirement via their years of service and retirement age, it seems extremely unlikely that it would be legal for them to delay it very long. Forget about rescinding the pensions entirely.

I assume the pension-related threat was simply hot air and an ineffective legal maneuver for now. The lawyers will do their thing, and, if Lori Lightfoot is wise, she will not say anything nor have the police chief say anything threatening the pensions any further than they already have.

Lots of people were doing inane things in 2021.