Public Pension Roundup: Bailing out Pensions, The Return of Pension Envy, Kentucky Lawsuit, and more

Email subscribers: Come to the substack page for the full post

This will be an all-public pensions post (and yeah, there is Illinois content. You have been warned.)

Return of Money-Palooza Monstrosity?

With the White House, House of Reps, and Senate on the Dem side, we will likely get a return of the Money-Palooza Monstrosity, but I imagine there may be changes reflecting what has already gone before and also changes reflecting that Pelosi et al knew the first bill was never going to get passed.

Here is what Mark Glennon had to say: The sweet smell of federal bailouts for Illinois, Chicago and other broke states and cities came quickly last night – Quicktake

Democratic control of the United States Senate had barely seemed apparent at 11 p.m. last night. But Anne Caprera, Gov. JB Pritzker’s Chief of Staff, knew exactly what it meant and tweeted it out: The bailouts are coming.

With the presidency and both houses of Congress now in their control, nothing stands between American taxpayers and the insolvency of Illinois, Chicago and other failing states and cities (assuming Jon Ossoff holds his thin lead in the Georgia senate race).

Well, there is something that stands between, and it’s that there’s not enough money to shovel into the black hole of Illinois.

Yes, I know the MMT folks think the sky’s the limit on cranking up the money machine, but actual historical experience has shown that some pretty bad things can happen if you just let the money printer rip.

I think that yes, there will be a Money-Palooza Monstrosity 2: Electric Bugaloo, but that the amount and how it’s distributed may be very different from the 2020 bill. The most Illinois and the like can hope from such a bill, I think, is one year’s worth of revenue.

That doesn’t fill up much of the over $100 billion hole in the pensions.

Trying to dig up pension envy again: a fisking

The following piece is ultimately about trying to persuade people that yes, it’s fine to bail out states and local governments who have huge pension holes.

I think this sort of “help” is not what Pelosi et. al. need in getting the Moneypalooza swallowed. I don’t think they want it pointed out that specific states need help a lot more because of their public pensions. I think they’d rather just convince people that it’s just fine to shovel money at state/local governments in general. Let’s not single out Illinois, please.

Richard McGahey at Forbes: Public Pensions Aren’t Causing State And Local Budget Gaps—The Pandemic Is

In the drama over the federal Covid-19 relief legislation, Republicans led by Senate Majority Leader Mitch McConnell (R-KY) rejected state and local budget aid, claiming it would be used to bailout badly managed states, including their public employee pension systems. Although Democrats offered a bill preventing that use of federal funds, McConnell still refused to compromise. Why are Republicans so opposed to public pension funding?

Because it’s not the responsibility of the federal government, and the huge public pension holes were built over at least 20 years, and in the worst cases, since the inception of those pension plans?

To gain insight on this, I spoke with Forbes contributor Teresa Ghilarducci, one of the nation’s top economists on pensions and retirement policy. (Full disclosure—she also is my wife.)

BWA HA HA HA HA. Oh, this is going to be good.

She thinks it might be popular to oppose public pensions because of what she calls “pension envy”—as private sector workers have lost pensions, public employees are now the most likely to have them. 91% of state and local public sector workers have access to pension plans compared with 67% of full time private sector workers.

Oh yes, the cutesy “pension envy” term. From me in 2015:

DON’T POKE THE BEAR

Didn’t think all those cutesy-poo “Pension Envy” barbs wouldn’t come back to bite, eh? (tee hee. Aren’t we clever? “Pension envy” sounds like penis envy! tee hee)

If public employee pensions and other benefits soak up more taxpayer money to the detriment of current services (and they have been), guess who is going to be just fine with retirees soaking up some of that pain?

That was specifically about California, but that’s true for state/local pensions in general.

The use of the term “pension envy” may get one booked as a talking head on MSNBC (I have no idea), but it’s not a great political persuader for the people who are having to pay the benefits.

Note that we are not talking about the situation of hiking up taxes in Illinois to pay for Illinois pension benefits now that were earned 30+ years ago. We are talking about asking the taxpayers in all those other places, who can’t even be said to have benefited from that 30+-year-ago service. [Mind you, it is a bit iffy to ask people to pay for pension benefits that were earned before said taxpayers were born, but we will just take it as an axiom and move on for now.]

Many states don’t need extra help for pension contributions now. Who does? Illinois, New Jersey, Kentucky, Chicago… you know, those places that explicitly decided to spend money on things other than pension contributions for decades. Why should the rest of us pay for all sorts of goodies, like guaranteed 3% compounding COLAs, pension spiking, backDROPs, etc., that many private pensions never had.

Back to the Forbes piece. I’m skipping over the “pension envy” bullshit to get to the explanation as to why profligate states and local governments should pretend their fiscal problems are caused by the pandemic, as opposed to just falling off the cliff they were already running towards.

In April, McConnell said he would refuse to fund states to help solve “problems that they created for themselves over the years with their pension programs.” This is part of the Republican narrative that that financial mismanagement generally, and pension problems specifically, are a blue state and Democratic issue. But it’s a bipartisan problem. In fact, McConnell’s home state of Kentucky is one of the worst funded state plans in the nation.

Yes, I totally agree with him there. This isn’t a partisan thing. This is a local politics thing, and buying votes via shoving money at public employees (and underfunding the pensions because that’s the easiest place to short in the short term.)

This does not exactly argue that the federal government should shove money at state and local governments. Some states that have had long-standing Republican governments have poorly-funded pensions. I wouldn’t term Kentucky a Republican state (if you’d like to see its pattern since 1792. Interesting mix, especially the last 40 years). Some Democratic states have pension funds very well-funded indeed.

Republican and Democratic governors alike govern states with well-funded pension plans. Democrats in New York, North Carolina, and Wisconsin, and Republicans in Tennessee and South Dakota all have well-funded plans.

That is correct. And then we have cities like Chicago and New York City with deeply underfunded plans.

Again, what does any of this have to do with convincing the entire country to cover for the specific ailing spots… which didn’t get that way by accident. Their fiscal distress is an extremely foreseeable result of the deliberate choices they made. COVID just sped up the schedule a little.

Both Democrats and Republicans at one time or another have underfunded the pension promises they made to public employees. Those promises were made to get taxpayers loyal public employees without having to pay much up front in salaries. Good pension plans kept public employees in their jobs, helping reduce costly turnover.

This is making a claim without much support.

A few counterexamples: Unequal Pay: Public vs. Private Sector Compensation in Connecticut, Right-sizing Illinois state government’s payrolls, and At $140,000 Per Year, Why Are Government Workers In California Paid Twice As Much As Private Sector Workers?. I could dig up more, but you get the point. If you want to make the case that public sector employees have low salaries compared to similar private sector workers, you have to support that. The pension and health benefits (pre- and post-retirement) more than swamp any “underpaid” aspect, even if they were underpaid salary-wise.

In any case, he’s still not making the case that there is something extraordinary about the particular states/localities with deeply underfunded pension plans, that magically got that way because of the pandemic. And that we want “loyal” public employees. Perhaps we’d like some of the unfireable folks to go away.

But again, this is all about choices that state and local governments made. It’s not a federal issue that, say, Chicago overpays its employees in salary and benefits.

About 6,000 public sector retirement systems exist in the U.S — 299 state-administered plans and 5,977 locally-administered plans, many of them very small. And the most important variable determining whether pensions are adequately funded is how economically healthy the state. After all, the size of a mortgage doesn’t determine household financial health—it’s the ratio of the mortgage payments to total income. In the same way, the fiscal health of the pension sponsor determines whether the costs of funding the pension plan creates fiscal stress for the state.

Ah, this sounds sounds like he buys into the pay-as-they-go is just fine line… as long as the governments are healthy! And it’s totally accidental that Chicago and Illinois and New Jersey and New York City are not healthy! It’s an Act of God!

As opposed to noting that one should make sure pensions are fully funded as benefits are earned, because future taxpayers may not be there. Because you can’t assume the polity will continue to grow, and you can’t artificially goose it.

And there isn’t much sign the stress is severe. Between 2001 and 2019 the required contribution to all-state and local plans as a percent of all state and teachers plans rose from about 1 percent of revenues to 3.8% of revenue.

The estimated total pension fund shortfall is less than 0.2 percent of projected gross state product over the next 30 years for most states, and less than 0.5 percent in states with the largest shortfalls. State and local pension problems have been seriously misrepresented in public debates. And since blue states have higher economic growth rates than red states they have a stronger ability to sustain its pension debt.

Excellent. Then they don’t need the federal funds to shove into the pensions! They’ve got the economic growth! Their state GDP can cover the cost. Ta da.

Attacks on public employee pensions also are seen as part of a larger attack on public employee unions, who tend to be politically Democratic. Teachers and other public employees have been targeted by conservative funders and activists for years, and undercutting their pensions can be seen as another battle front.

McConnell successfully blocked any significant relief to states and cities in the latest bill, and there’s not much hope that incoming President Joe Biden will be able to get more aid absent a Democratic takeover of the Senate. But states and cities are suffering from the pandemic recession’s impact on their economies and budgets, not because of poor management. And instead of attacking public employee pensions, we should be finding ways to get decent retirement coverage for all Americans.

Well, thanks, McGahey, for getting your wife to comment on this stuff. Because it helps to spread the blame for incoherence around. Yes, I know the states/localities would love more dough, but the Dems might have more “fun” stuff in mind to spend the money on rather than throwing it into a hole in Illinois or New Jersey.

McGahey didn’t make the case that it is uniquely the pandemic stressing the localities/states with deep pension underfunding. The connection here is extremely tenuous. The localities worst-hit for tax revenue, from what I can see, are tourism-dependent areas. It makes sense — various taxpayers have had federal funds shoved at them, which, theoretically, would go into local expenditures. But if far fewer people are traveling, then the governments dependent on revenue from outsiders will be worst-hit.

Perhaps we’ll get a Return of Money-palooza Monstrosity hitting Biden’s desk in a month, but there may be bumps even with a barely-Democratic Senate and barely-Democratic House.

Note that Pelosi had to make accommodations for COVID-“quarantining” members so she could be re-elected as Speaker. Democrats are holding on by their fingernails, and buying off states and electorates that are solidly Democratic is not smart strategically if Pelosi and Schumer don’t want to sing their swan songs in 2022.

On the Public Pension Reform Community

For the record, I’ve talked with a lot of people in the “public pension reform” racket (as it were), and yes, a lot of us are conservatives or libertarians. But not all.

Many of the places where the pensions cause the most fiscal pain are all-Democratic in their political structure, and as the money runs out, they realize that something must be done. Gina Raimondo in Rhode Island made choices in Rhode Island. Jerry Brown tried to make changes in California. Rahm Emanuel has called for fundamental change, as Chicago is doomed without it (not to mention Illinois).

No, we’re not all saying that traditional public pensions need to be replaced with 401(k)-like plans. I have argued for a risk-sharing solution that promises lifetime income.

Those asking for a state/local pension bailout are going to find that Democrats will not be able to fill the holes. There will not be enough money to do more than to provide a year’s worth of contributions. They will not be able to pay off their unfunded liabilities. Just a small percentage.

So yes, I expect some sort of bailout. No, I don’t expect that the worst states and cities will be fully bailed out. I think their structural problems will persist, and that in a short time Medicare and Social Security will grab much higher priorities than feeding the appetite of deeply underfunded public pensions.

Economic impact of DB pensions, without comparing against the alternative

In the annals of “not this bullshit again”, we get NIRS’s report: PENSIONOMICS 2021: MEASURING THE ECONOMIC IMPACT OF DB PENSION EXPENDITURES

EXECUTIVE SUMMARY

Defined benefit (DB) pension benefits not only provide a secure source of income for many retired Americans, they also contribute substantially to local, state, and national economies. DB pensions play a vital role in sustaining consumer demand that ultimately supports millions of jobs.

Virtually every state and local economy across the country benefits from the spending of pension checks. For example, when a retired nurse residing in the state of Wisconsin receives a pension benefit payment, s/he spends the pension check on goods and services in the local community. S/he purchases food, clothing, and medicine at local stores, and may even make larger purchases like a car or laptop computer. These purchases, combined with those of other retirees with pensions, create a steady economic ripple effect. In short, pension spending supports the economy and supports jobs where retirees reside and spend their benefits. Pension expenditures may be especially vital to small or rural communities, where other steady sources of income may not be readily found if the local economy lacks diversity

Squinting… squinting…. I’m looking for the explanation of why there’s supposedly more of an economic effect from these payments compared to letting taxpayers keep more of their own money.

“When a taxpayer residing in the state of Wisconsin has less money taken from their income, s/he spends their money on goods and services in the local community. S/he purchases food, clothing, and medicine at local stores, and may even make larger purchases like a car or laptop computer.”

There is nothing magic about the theoretical retired nurse.

Each time I see this same kind of report, I look to see if they compare the results to individuals from whom the money was taken to provide these benefits, if only they got to keep more of their money. But hey, maybe it just was excluded from the executive summary.

So I dug into the paper to find this in the methodology section:

To measure the economic impacts of retiree expenditures made out of benefits paid by DB pension plans, the input-output modeling software, IMPLAN, was used. IMPLAN was first developed in the 1970s as part of a USDA Forest Service project to analyze the economic effects of local land management projects such as timber, mining, and recreation activities. Since that time, IMPLAN has been used by industry and government analysts throughout the country to assess economic impacts of highly varied local community development projects. These studies include many recent economic impact studies of pension benefit payments from state retirement systems.

Between the time NIRS’ original Pensionomics study was published in 2009 and the release of this report,3IMPLAN underwent significant modeling changes. Due to these changes, results of the current study are not directly comparable to those of 2009 study, and the reader should avoid drawing conclusions based on such comparisons. …… Detailed information on our data and methodology and further discussion of these differences appear in the Technical Appendix.

So a few comments (and don’t worry, I’m not going to sample from the Technical Appendix):

1. That the IMPLAN model was originally used for evaluating the economic impact of land management projects does not mean it’s irrelevant for the DB pensions evaluation. Heck, I just used a mortality model to fit to CFR data, and that functional form works for a lot of things.

2. Of course, there could be weaknesses to the model that make it unfit for this purpose, or even if the structure is fine, the parameterization could be questionable. Basically, I’m not saying either yay or nay on this approach.

3. But reading through the full paper, it’s not clear to me that they’re comparing modeled impact of DB expenditures against the counterfactual of no DB expenditures. Because the proper comparison is not DB pensions versus nothing. It’s DB pensions (funded by taxpayers for public plans, paid by employers/employees if private) versus those cash flows were redirected into DC plans or taxpayers get to hold onto their money, or whatever is a realistic alternative.

For this third point, let’s just think on public pensions – I saw “tax impact” and thought they were going to subtract off the taxes needed to support the public pensions.

Evidently, that’s not what they do.

4. Tax Impact: Economic activity of all kinds—receiving pension income, earning wages, producing profits, selling goods and services—provides the basis for the tax revenues that are required to fund government services. To calculate the impact that pension payments have on tax revenues, we first calculate the taxes paid by beneficiaries directly on their pension benefits. Then, using IMPLAN, we calculate estimates of taxes attributable to the economic activity that results when retirees spend their after-tax pension checks, and in all subsequent rounds of spending. This includes all corporate, property, and business taxes that are generated through each spending round.

So they’re not comparing the tax cost to fund these pensions in the first place, and how letting taxpayers be taxed less contributes to the local economy. Noted.

Basically, they’re trying to capture retiree spending impacts, period, without reference to where the money came from that provided the retiree’s income.

For crying out loud, I’m very pro-reliable retirement income, but how reliable is a DB pension if the sponsors are bankrupt and the payments can’t be supported on a pay-as-they-go basis?

In the press release I received promoting this report and an upcoming webinar covering the highlights, this point was made:

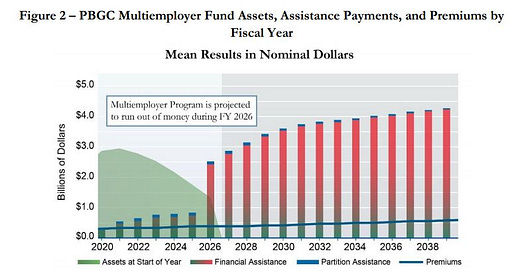

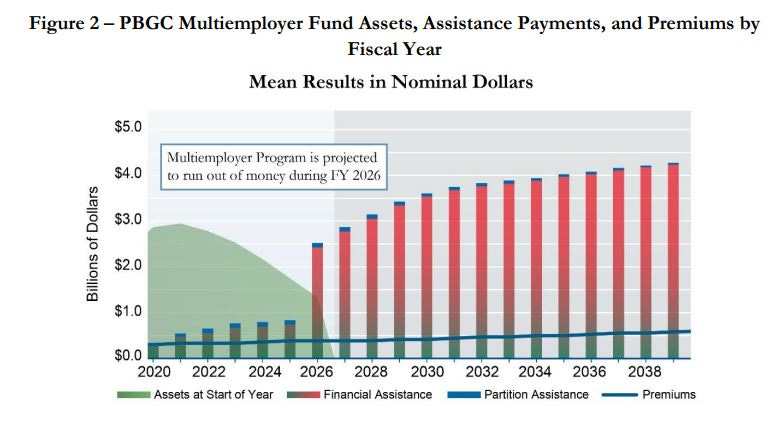

$578.7 billion in pension benefits were paid to 23.8 million retired Americans, including:

$308.7 billion paid to some 11.0 million retired employees of state and local government and their beneficiaries (typically surviving spouses);

$105.9 billion paid to some 2.6 million federal government beneficiaries;

$164.1 billion paid to some 10.1 million private sector beneficiaries, including:

$44.2 billion paid out to 3.8 million beneficiaries of multi-employer pension plans, and

$119.9 billion paid out to 6.3 million beneficiaries of single-employer pension plans.

I will note that at least one of those sources is very shaky.

If you’re wanting to point to the value of reliable retirement income, maybe don’t point to a program that’s going to fail in a few years without a massive bailout. That doesn’t sound reliable at all.

ai-CIO: US Pension Spending Supports $1.3 Trillion in Economic Output

Kentucky pension asset management lawsuit back

naked capitalism: Mayberry v. KKR Is Back as Attorney General Intervention Approved, Beneficiaries’ Counsel Files Third Amended Complaint

In 2017, eight plaintiffs filed a derivative lawsuit on behalf of the spectacularly underfunded and incompetently/corruptly run Kentucky Retirement Systems, the public pension fund for the State of Kentucky (see former board member Chris Tobe’s Kentucky Fried Pensions for lurid details). The filings alleged breach of fiduciary duty and other abuses by three hedge funds operators, KKR/Prisma, Blackstone, and PAAMCO, in the sale and management of customized hedge funds with too-cute names like Daniel Boone. The fund managers had promised the impossible, high returns with low risk, when KKR’s and Blackstone’s SEC filings correctly depicted the very same offerings as high risk. Not surprisingly, the hedge funds markedly underperformed investing in stocks, leaving the pension funds’ beneficiaries in a worse position than had it gone with traditional strategies. Because Kentucky has strong statutory fiduciary duty standards and the conduct outlined in the initial filings looked egregious, the case was primed to shake up the public pension world.

I’ve looked at Kentucky pensions before, which are grossly underfunded, their governance has been troubled, and the investment performance has been below peers.

Back to the story:

Even though, in a surprise move over the summer, the Kentucky Attorney General, who had refused to join the case all these years, decided to intervene after the Supreme Court ordered that the complaint be dismissed.

…..The US Supreme Court had ruled that a pension loss had to be particularlized, as in the plaintiffs had to have suffered an actual loss. The Kentucky Supreme Court ordered that Mayberry v. KKR be dismissed because the pensions were as of now still being paid in full and even if the pension assets were fully depleted, the State of Kentucky had made a “solemn promise” to honor the pension commitments.

Yeah, it will be legally ugly if public pension beneficiaries can’t sue until the states/other governmental entities stop paying full benefits after assets run out, because they’re unable to pay. At that point, trying to claw some extra money out of asset managers will probably not fill the hole; if the state of Kentucky can’t manage to fully pay pensions, a private asset management firm is unlikely to be able to, either.

The response in the Second Amended Complaint was to eliminate three of the original plaintiffs and add three new ones and refocus the argument on benefits paid out of the pension fund which were not subject to state support and ones that the beneficiaries had paid for from their wages: the cost-of-living adjustments, the health benefits, and the “hybrid” plans for employees that started after July 2014.

So that bit will be ongoing. For now, at any rate.

I will be very interested if they’re able to claw anything out of the hedge funds. (Next up: actuarial firms!) This has been a common claim of people like Chris Tobe and Edward Siedle, as opposed to overpromising benefits and deliberately underfunding the plans. In the case of Kentucky, there was a long-standing policy of underfunding, and it still was in an asset death spiral for Kentucky ERS when they finally decided to try to fully-fund the pension.

So far, what I’ve seen is investment underperformance, which doesn’t require anything illegal. By definition, unless everybody performs the same, somebody is going to be below average. I agree that public pension plan fiduciaries are often inept themselves in protecting the interests of plan participants…. but it’s not like you can claw a lot of money out of the Board of Trustees.

Leftover public pension news

I have loads of public pensions links right now, and no good place to keep them, so let’s hit it!

[The post is too long for email, so come to the substack page to see the additional links]

Activist investing from public pensions

ai-CIO: State Treasurers File Shareholder Action over Alleged Gilead Price Gouging

P&I: N.Y. comptrollers’ proposals target Amazon, 4 others – first, they are referring to both state & NYC comptrollers, and the state comptroller went after Amazon and NYC comptroller went after American Airlines, Dell Technologies, Kroger Co. and The TJX Cos. They are wielding power as the sole fiduciaries of the state and city pension funds, respectively.

ai-CIO: NYS Pension Fund Calls for Civil Rights Audit on Amazon

Daily Poster: End Dark Money Now – scroll down to where Andrew Perez and David Sirota call for pension funds to throw their weight around for political ends

NY Comptroller: New York State Pension Fund Sets 2040 Net Zero Carbon Emissions Target

ai-CIO: CalSTRS Pressures Exxon to Be More Climate-Friendly, Backing Outside Directors Slate

Other public pension asset management issues

ai-CIO: CalPERS Not Ready to Pick CIO

Yves Smith at naked capitalism: CalPERS Making It Impossible to Hire Competent Chief Investment Officer

Reason: Pension Debt Grows as Public Pension Systems Post Low Investment Returns for 2020

ai-CIO: Breaking News: Kentucky Retirement Systems Names Steven Herbert New CIO

Penn SERS Redefines Fixed-Income Allocations in Liability-Driven Push

On fundedness trajectories

Milliman: 2020 Public Pension Funding Study

ai-CIO: Public Pensions Fail to Rebound with Market Rally – on results from the Equable Institute

ai-CIO: Texas Sees Sharp Rise in Troubled Funds – featuring “infinite amortization”

Pensions for teachers: Why taxpayers, not educators, will pay more for weak investment returns

Oroville Mercury-Register: Chico council considering final options for repaying staff pension debt burden – looking at a POB, of course

Illinois Commission on Government Forecasting and Accountability: Special Pension Briefing

Wirepoints: Same old bad news in new 2020 Illinois pension report belies far worse reality – Wirepoints on the above pension report

Other public pension items

reason: Best Practices in Incorporating Risk Sharing Into Defined Benefit Pension Plans

Ted Siedle at Forbes: Providence Pension Could Bankrupt Rhode Island City

Marc Joffe at Reason: West Virginia’s Pension Reforms Offer Lessons For States and Cities

Burypensions: Peeking at NJ Pensions

ai-CIO: Public Pension’s Share of Government Spending More Than Doubles in 16 Years – from 2.3% in 2002 to 5.2% in 2018 (and it’s still not enough)

ai-CIO: Restoring Pensions from 401(k) Plans Could Cost San Diego Millions

Reason: The Gold Standard In Public Retirement System Design Series

Equable: State of Pensions 2020

Illinois Policy: PENSIONS SET TO CONSUME 29% OF ILLINOIS’ BUDGET AMID $7 BILLION DEBT INCREASE

Illinois Policy: PRITZKER CALLS FOR $700M IN SERVICE CUTS, SILENT ON PENSION REFORM

Wirepoints: Same old bad news in new 2020 Illinois pension report belies far worse reality – Wirepoints

Valuewalk: These pension reforms are needed to deal with the crisis

P&I: Illinois Senate votes to remove age restrictions for Chicago Firemen’s COLAs

Inside NOVA:MCA voices concern about viability of FCPS pension program

Chicago Sun-Times: Illinois Senate passes firefighter pension bill over mayor’s strenuous objections

Times Union: Cuomo: Pension system errs, but retired teacher must pay

For that last item — I despise Cuomo (no further disclosure needed), but let’s try to be fair:

For retired teacher Katherine Sweeney, Gov. Andrew M. Cuomo is the Pension Grinch.

The governor this week vetoed a bill that would have corrected a $63,000 series of errors the New York State Teachers Retirement System made in calculating the 76-year-old Otsego County resident’s pension.

The New York State Teachers Retirement System admitted to making the errors when Sweeney retired in 2004. Since discovering the mistake in 2017, the pension system has been reducing her monthly pension check to make up the difference.

Because the errors were by the state, state legislators last session passed a bill to restore her original payments of $2,671 per month. The pension system has been reducing that an average of $524 per month. The bill received near-unanimous support.

But Cuomo in his veto message said making such a change would be an “unprecedented” move that would set aside the law that allows a person to go to court and fight a government decision such as Sweeney pension’s reduction.

The hell?

Sweeney, Cuomo said, should have filed an Article 78 lawsuit against the state to deal with the error.

Wait, is this the argument?

“She chose not to bring such a proceeding,” the governor wrote in the veto message.

“Public retirement systems must correct pension benefit errors and collect overpayments from members or beneficiaries as a requirement

of their fiduciary obligations. This bill would set aside this law, which the courts have consistently affirmed,” Cuomo added.

Okay, if this is his serious argument (and yes, I know, it’s basically an argument from staffers who are lawyers), then I do not want to hear any bullshit from Cuomo re: New York needing a bailout from the federal government.

I’m feeling particularly saucy right now, so I’m going to quote from the Gospels, not that Cuomo is at all familiar with them.

From The Gospel of Matthew, Chapter 18:

23 Therefore is the kingdom of heaven likened unto a certain king, which would take account of his servants.

24 And when he had begun to reckon, one was brought unto him, which owed him ten thousand talents.

25 But forasmuch as he had not to pay, his lord commanded him to be sold, and his wife, and children, and all that he had, and payment to be made.

26 The servant therefore fell down, and worshipped him, saying, Lord, have patience with me, and I will pay thee all.

27 Then the lord of that servant was moved with compassion, and loosed him, and forgave him the debt.

28 But the same servant went out, and found one of his fellowservants, which owed him an hundred pence: and he laid hands on him, and took him by the throat, saying, Pay me that thou owest.

29 And his fellowservant fell down at his feet, and besought him, saying, Have patience with me, and I will pay thee all.

30 And he would not: but went and cast him into prison, till he should pay the debt.

31 So when his fellowservants saw what was done, they were very sorry, and came and told unto their lord all that was done.

32 Then his lord, after that he had called him, said unto him, O thou wicked servant, I forgave thee all that debt, because thou desiredst me:

33 Shouldest not thou also have had compassion on thy fellowservant, even as I had pity on thee?

34 And his lord was wroth, and delivered him to the tormentors, till he should pay all that was due unto him.

I am a New York taxpayer, and I understand not wanting to give a pension higher than earned to people.

However, Cuomo is claiming a deep need for the state to get money from the federal government.

It might be a good idea to demonstrate the behavior you’d like to see from those higher up on the funding ladder.