Quick-Takes: Mortality Update, Meep's Math Matters, and a Few Bailout Reactions

Plus - videos! [a couple from 2007]

It wasn’t a great week last week: it started badly, and ended badly. If I disappear for about a week, that’s generally what happened. I have a chronic pain situation due to nerve damage, and it’s not terribly controllable.

But now for happy stuff: death!

Mortality update

I do think we’ve passed our last big spike of COVID-driven deaths, and yes, that third spike killed far more people than that first spike. Part of that is just because, finally, COVID hit all of the U.S. The first wave hit extremely hard in NYC, and was concentrated around that city. The second wave was more diffuse, and along the south (from east to west), during the summer. The third wave hit the northern midwest first, but it was pretty much everywhere, and those that missed earlier waves got hit fairly hard.

I will be revisiting this pattern later.

Return of Meep’s Math Matters

I am working up to some serious results with respect to both mortality and finance, but I need to build up our concepts and language. You may know the following already (basic rules of probability, and a few concepts of discrete and continuous probability, as well as the Gaussian distribution):

I originally started Meep’s Math Matters waaaaay back in 2007, when I started doing video lectures for actuarial exams, and decided to do a few “fun” math videos on the side.

There have been a lot better math explainers that have come on YouTube since 2007, but I have particular things I want to show you, which is why I have rebooted my series.

In the meantime, here is one of my favorite discrete math concepts, which has a lot of interesting results: the pigeonhole principle.

Pension bailouts: more to come?

Well, they shall certainly try.

But I want to remind everybody the reality of the size of the bailout of multiemployer pensions v. other obligations:

As I mentioned in my prior post on the bailout:

The total MEP unfunded liability is 8 times that of the bailout bill amount

The total public pension unfunded liability is 22 times that of the bailout bill amount (this happens to be the same as the total American Rescue Plan Act of 2021)

The total Social Security shortfall is almost 200 times that of the MEP bailout bill

A few remarks — the total public pension unfunded liability (using the discount rates they themselves use, that is, too high, and thus valuing the unfunded liability too little) is the same size as the full American Rescue Plan Act of 2021 — that is, $1.9 trillion.

That is not how much is getting shoveled to the various state and local governments.

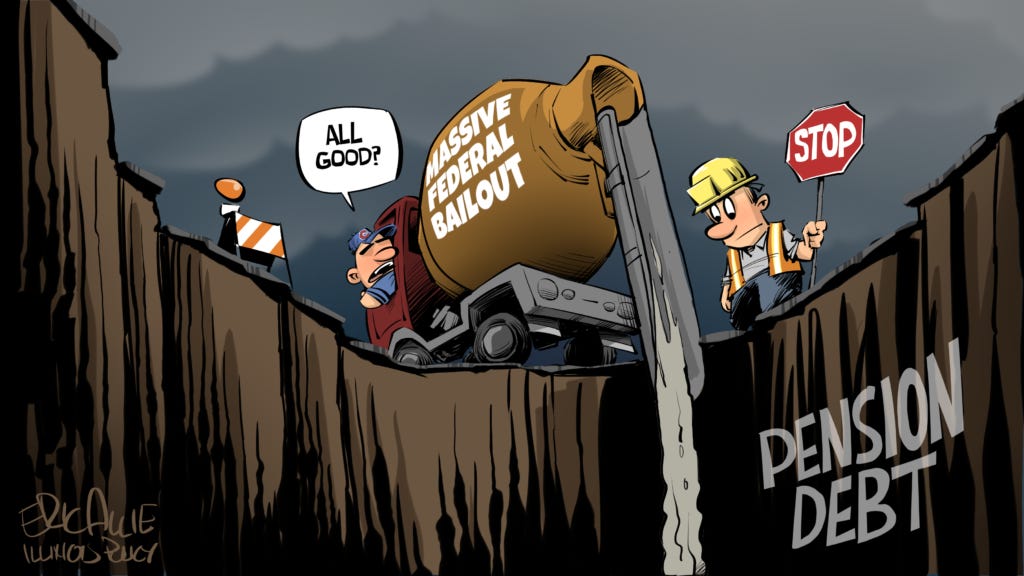

As Eric Allie draws (re-published with permission):

I will be coming back to this image, because the amount of taxpayer funds shoveled into the maw of Chicago and Illinois, while eye-popping to individuals, is far from the over $100 billion they need to fully fill their pension holes already accrued.

(and those holes are only going to get worse, the way they’re going)

John Bury has already caught the first MEP to withdraw its application for benefit cuts due to the bailout bill.

I expect the ones yet to go through the whole process will be soon behind, and those that already cut benefits will likely be asking to un-cut those benefits, I bet. I’m not sure how that’s supposed to “work”, but if the bureaucrats can’t figure that out, they will soon be bureaucrats moved to somewhere very disagreeable.

I have caught many more pieces on the MEP bailout, and will likely be revisiting the issue as the funds get doled out. I want to know how quickly that paltry $86 billion gets used up.

Coming attractions

I have multiple posts in draft, and this is contingent on me continuing in good health.

But this is what I plan on looking at:

Mortality analysis of COVID waves and severity

Bailout provisions for state and local governments

Location of deaths (hospital v. home, for example)

More data visualization

We will see how far I get.