MoneyPalooza Monstrosity: State and Local Governments Should Pay Down Pension Debt

Paying down high-interest balances with a "windfall"

I haven’t forgotten the MoneyPalooza Monstrosity — while I have addressed the multiemployer pension bailout portion, I have yet to address the much bigger portion, funds going directly to state and local governments.

Issues I want to address:

Fiscal Year 2020/2021 state/local government revenue hits (and specifically, which revenue sources hit hardest)

Equitability of the division of these stimulus funds

On whether recipient states can lower tax rates

But not today.

Today, I want to talk about what state and local governments should do with this money: pay down pension debt.

Basic personal finance tip: pay down highest-interest debt

While my income was too high to partake in this latest money party directly, I did get funds from the prior two rounds (entirely due to having three kids, as my income was still too high for the other portions).

What did I do with that money?

Pay down debt. Specifically, credit card balances. No, I didn’t put the money into my mortgage or HELOC. Unsurprisingly, secured debt has lower interest rates and are over very long terms, with principal being paid down each month.

For credit card debt, it’s essentially an interest-only loan of indefinite maturity, if that’s how I want to treat it.

Checking Federal Reserve statistics, this is exactly what most Americans did last year:

Total revolving consumer debt saw a huge drop of 30.8% in Q2 of 2020

There are arguments to make, based on consumer psychology, whether individuals should pay lowest balances down first, or highest interest rate debt first. There are arguments either way, and I cannot give you advice on that. I don’t know you.

But I know me – and I can take advantage of the numerically optimal route, which is to pay off highest interest rate debt first.

If one does that, one gets more “bang for the buck” – less interest paid out over time, and thus less money paid out over time. But that’s because I don’t need the psychological boost of paying off teeny balances.

And public finance is not about the psychology of paying off teeny balances.

State and local government’s most expensive debt: unfunded pensions

This is why state and local governments need to put this “windfall” into their pension funds: it is the highest interest rate debt they hold.

This is true even for Illinois.

Illinois is the lowest-rated state when it comes to credit ratings, barely hanging onto their investment grade status.

At that rating, last May, Illinois issued $800 million in bonds at 5.85%. That was for 10-year bonds and considered a super-high interest rate on municipal bonds.

What’s the interest they’re paying on their pension debt?

6.75% or 7% — depending on which pension plan. Over 100 basis points higher than their borrowing rate on muni bonds — an entire percentage point difference!

That really racks up over the decades.

If it’s good enough for Pension Obligation Bonds, it’s good enough for real contributions

This is the logic behind POBs (pension obligation bonds).

The argument has been: “Hey! It’s just refinancing our pension debt at a lower rate!”

This is somewhat true on paper.

If a state or local government’s public pension funds have large unfunded liabilities, those liabilities accrue at the assumed rate of return on the assets that should have been there to cover that liability.

When the government issues POBs, the government brings in a bunch of cash at time 0, and also have increased the debt on their balance sheet. But hey, that debt is due in 20 years (or whatever)! (And that debt is not on the pension plan’s balance sheet.)

Now, you may be wondering — hmmm, doesn’t the government set the interest rate on the unfunded liabilities?

Yes, yes it does.

If the government(s) had set their pension discount rate at the same level as their borrowing rate, there would be no good reason for issuing POBs.

But let me not get into that one today.

The point is this: if it makes sense to pay down the pension unfunded liability with muni bonds, thus creating new liabilities and thus new leverage, it makes even more sense to take a “windfall” of cash and pay down the pension debt, which creates no new state/local government liabilities

Lots of unfunded liabilities out there

I grabbed the fiscal year 2019 data from the Public Plans Database, so let’s look at the unfunded liabilities and the assumed rate of return (and thus the interest rate they’re paying on the unfunded liability).

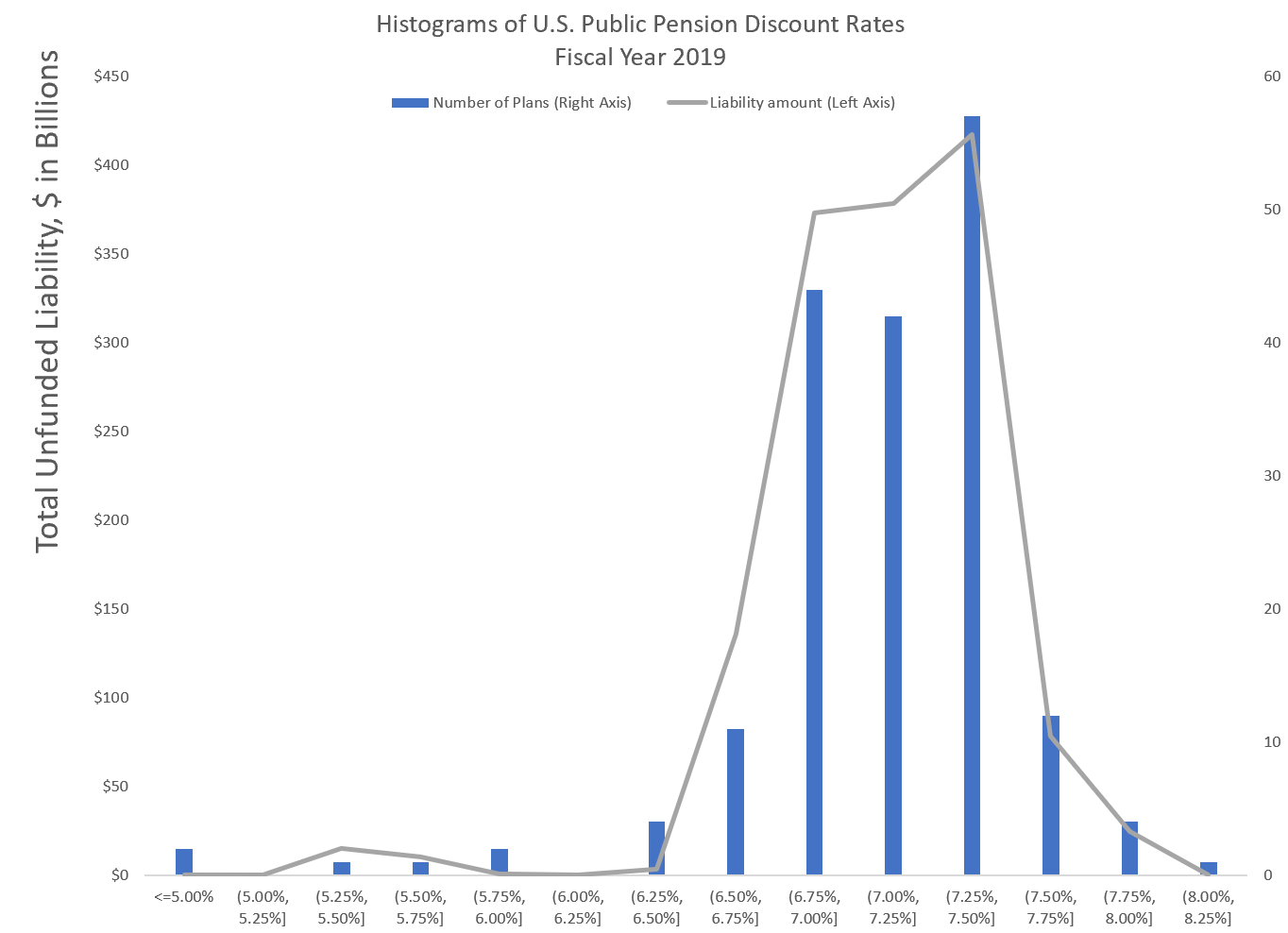

First, let’s look at two histograms — one, based on number of plans using specific discount rates; the other, based on the total unfunded liabilities measured at those discount rates:

In this histogram, you can see most of the public pensions have discount rates 7% or higher. Muni bond rates for similar durations are much lower than 7% right now. Pension debt is a high interest rate debt for states and local governments.

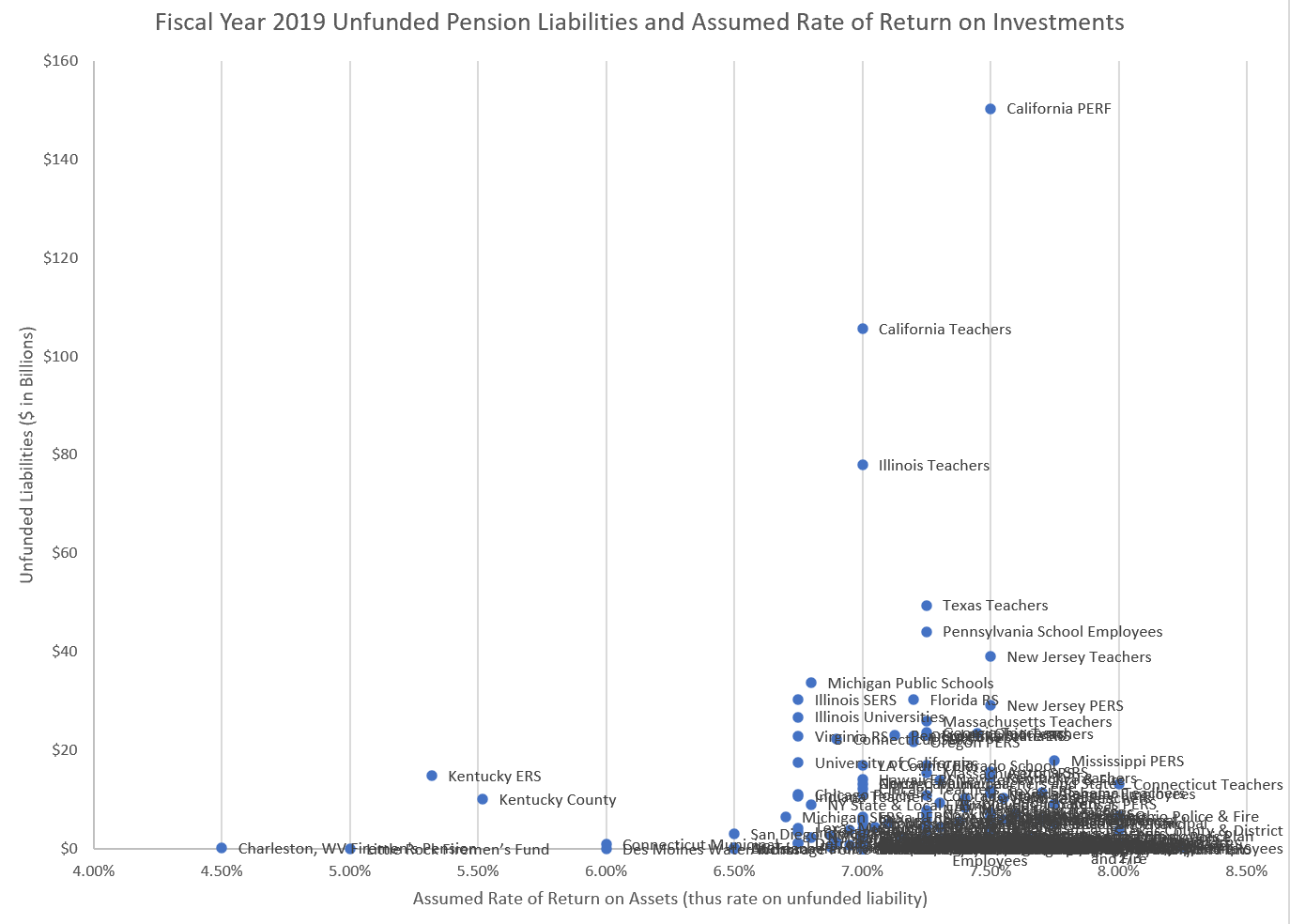

That graph doesn’t indicate which plans have the highest unfunded liabilities. So here is a scatterplot where I’m labeling each point with the plan name:

Now we can see not only all the plans heaped up between 7% and 8% as discount rates, but also which plans have the largest unfunded liabilities.

All have fallen short…. okay, MOST have fallen short

People may squawk about the low tax states/low COVID impact states subsidizing the others, and I will be looking at that in a future post.

But take a big gawk at the Texas Teachers fund on the above scatterplot, Just in amount, Texas Teachers’ unfunded liability is #4 behind Calpers (California PERF), Calstrs (California Teachers), Illinois TRS (Illinois Teachers). This is hardly surprising given Texas is #2 by population.

Officially, Texas Teachers is 77% funded. Calpers is 70% funded. Calstrs, 66%. Illinois TRS, 41% (ugh).

Ignoring Illinois TRS for right now, the fundedness levels for Texas Teachers and Calpers is not that unusual. Most U.S. public pensions are very underfunded right now, even if they “fully fund” their pensions.

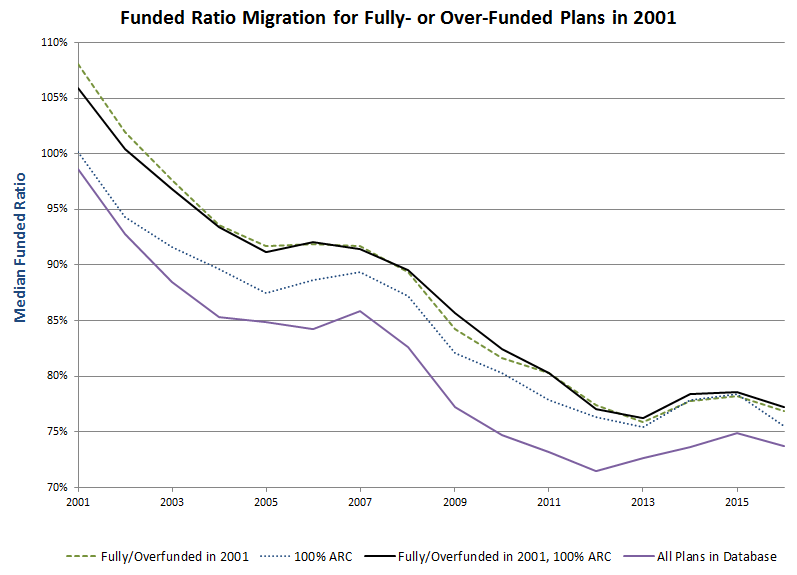

From a few years ago: Public Pensions: Why Do 100% Required Contribution Payers Have Decreasing Fundedness?

That graph goes only to fiscal year 2016, and the funded ratio has continued to drop through 2019. This is not just Calpers — most of the public pensions were over 100% funded in fiscal year 2001, and even the fully-funders have dropped to about 70% fundedness in recent years. Pretty much all states have substantial pension unfunded liabilities.

Texas at least has a Texas-sized unfunded pension problem.

Low tax states also have some serious unfunded pension liabilities

What about the other states that also have no state income tax?

Here are the 7 states with no income tax, and the unfunded liability for their state-level funds:

Alaska: $7.3 billion

Florida: $30 billion

Nevada: $14 billion

New Hampshire: $4.9 billion

South Dakota: 0 — 100% funded! (hmm)

Tennessee: $1.4 billion

Texas: $66 billion

Washington: $4 billion

Wyoming: $2.7 billion

At a later date, I’ll look at the likely division of the state/local stimulus funds, and yes, in a few of these cases, the amount of the stimulus bill will shovel at them will be more than their pension funds. (South Dakota, obviously.)

Great! Then they can get to funding their retiree benefits and replenishing their rainy day funds.

Bottomline: pay off highest-rate debts

But before they do that, they need to pay down their highest-rate debt: the unfunded pension liability.

That liability is accruing interest at higher interest rates than any of the muni bond debt, and it’s not even to cover capital projects!

Unfunded pension liabilities are entirely like credit card balances, where you were paying for an operating expense years ago. You’re not financing over the life of a capital asset — services provided by government employees decades ago were operating costs those decades ago, even if the official accounting did not recognize it as such.

PAY DOWN THE PENSION DEBT.