Post-Election Public Finance and Pension Round-Up

Ignored during the election, the bills are coming due for Chicago, Illinois, Minnesota, and others

John Bury selected this clip well:

This came from a larger segment on Meet the Press, in which Bernie Sanders talked about the Democratic Party’s losses in the most recent elections. See more in Bury’s post: We’re Not Talking About Defined Benefit Pension Plans.

Bury had a follow-up post: The Issues That Were Important To Me

Pretty much nobody addressed the public finance problems, running from local level up to the federal level.

There had been an attempt to claim this-that-and-the-other would threaten Social Security (I sure saw those ads, as I was in one of the few competitive Congressional districts). Still, nobody had been putting out proposals that would raise taxes enough (or cut benefits enough - or some combination) in order to avoid Trust Fund exhaustion within the next decade.

So let’s jump into the issues.

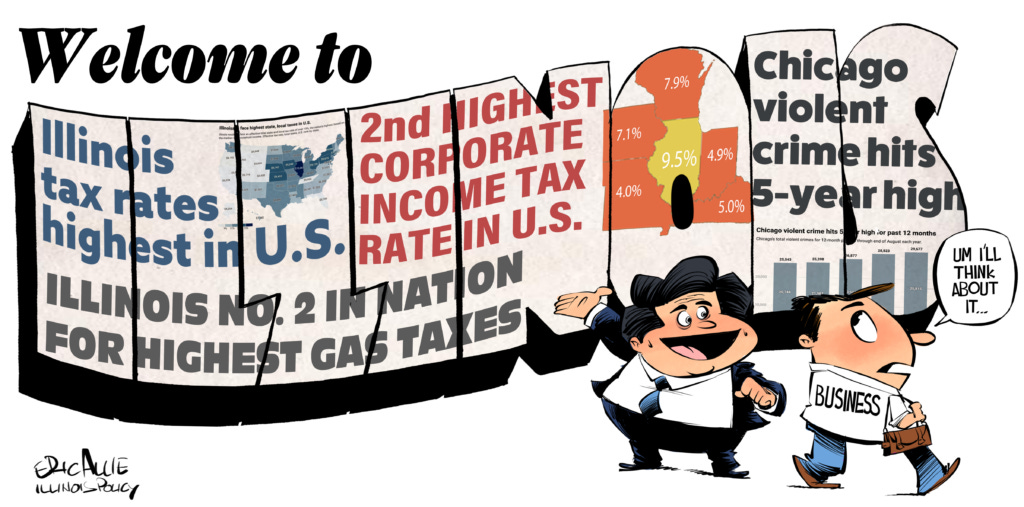

Illinois and Chicago: Awful Short-Term Pain

I don’t need to keep pointing out that various highly Democratic Party-dominated areas, such as Illinois, had top politicians posturing that they would… resist? Stand firm? Remain committed to the policies that didn’t win them the 2024 elections? I don’t care.

Here’s Illinois Governor JB Pritzker doing his thing:

You can go to that tweet to see multiple people (including me), pointing out there may be some money issues in trying to make good on that pledge.

(“competent governance”?!)

No, Illinois is not likely to be giving Trump’s administration some shining contrast. Maybe there will be some Democratic-Party-run state with such an example, but not Illinois, and certainly not with Chicago as its most significant city.

Austin Berg at Pirate Wires: Is Chicago About to Hit Rock Bottom?

Though Chicago is the nation’s third-largest city, when it comes to overlapping crises across public safety, municipal finances, city corruption and (most ominously) population, the scale of Chicago’s problems dwarfs that of its peers. Once America’s fastest-growing city, Chicago is now the slowest-growing major city in the U.S. since 2000, having lost 1 million residents since peaking at 3.6 million in the 1950s. Its population now hovers around 1920s levels.

Nowhere is this more evident than in the city’s schools, one-third of which are less than half full. Frederick Douglass Academy High School on Chicago’s West Side was built to hold more than 900 students. Last year, it served just 35 students, nearly two-thirds of whom were chronically absent. Despite this, the school still employs 23 full-time staff members and spends more than $68,000 per student annually.

The city’s finances are in a similar state of crisis. For decades, Chicago politicians cut deals with government unions to boost pension benefits far beyond their willingness to hike taxes to fund those benefits. Those same leaders used money meant for pension contributions to juice pay raises for government workers and fund pet projects. Chicago now holds more pension debt than all but seven American states. Over 80% of Chicago’s property tax levy goes to pensions. And of the overall city budget, pensions and debt service eat 40 cents of every dollar — a far higher share than any other big city in the country. In order to plug annual budget gaps, past administrations have taken to selling off city assets like the parking meters. Billions of dollars in federal aid during the COVID-19 pandemic allowed the city to avoid confronting its debt and inflate spending even further, with the city’s total budget ballooning to $16.6 billion in 2024 compared with $10.7 billion in 2019. The expiration of federal aid has blown a billion-dollar hole in next year’s budget.

The budget problem, specifically, has been easy to foresee. It’s not like it came out of nowhere.

The pensions problem has been hanging over Chicago for the decades it has been deliberately overpromising and undercontributing.

Just as the state has been doing with its own pensions.

Chicago cannot look to Illinois for a bailout, as Illinois is also broke.

This past summer, I ran a multipart series looking at my 10+ years coverage of Chicago’s (mainly financial) issues:

2014: Chicago Is My Kind of Town To Beat Up On: Previews for the DNC

2015: Chicago Is My Kind of Town To Beat Up On: 2015 edition

2016: Chicago Is My Kind of Town To Beat Up On: 2016 edition

2017: Chicago Is My Kind of Town To Beat Up On: 2017 edition

2018: Chicago Is My Kind of Town To Beat Up On: 2018 edition

2019: Chicago is My Kind of Town to Beat Up On: 2019 Edition

2020: Chicago is My Kind of Town to Beat Up On: The COVID Era

2021: Chicago is My Kind of Town to Beat Up On: The Payoff! Year

2022: Chicago is My Kind of Town to Beat Up On: No Chicago-Centric Posts in 2022

2023: Chicago is My Kind of Town to Beat Up On: New Mayor, Same Problems in 2023

2024: Chicago is My Kind of Town to Beat Up On: Wrapping Up for 2024

It will surprise nobody that Chicago is still stuck in a mire, with the current mayor not quite seeing the reality that his dreams of throwing money at his buddies in the teachers’ union won’t quite work when the money has run out.

Chicago Sun-Times: Wall Street sounds the alarm about Chicago finances

Standard & Poor’s has put Chicago on a “credit watch,” which could raise the interest rate the city pays by about one-quarter of a percentage point. And with the city planning to refinance $1.5 billion in bonds, even that slightly higher rate could cost taxpayers $4 million a year over 40 years.

The bond rating that determines city borrowing costs stands a “one-in two-chance” of being lowered in the next 90 days because of Chicago’s “heavy reliance on one-time” revenue and a “politically charged standoff” between Mayor Brandon Johnson and the City Council, a Wall Street rating agency warned this week.

Standard & Poor’s decision to place the city on what it calls “credit watch” — even while reaffirming the city’s BBB+ rating — could raise the interest rate by roughly one-quarter of one percentage point. While the market will “assume” the city’s rating has been lowered even before that actually happens, a municipal bond expert said, the impact will be relatively negligible on $110.5 million in general obligation bonds.

Here is the city’s own tracking of ratings, updated as of a year ago:

The bit bracketed in red are below investment grade (BIG) ratings, and you can see Moody’s had placed Chicago in the BIG bucket for many years.

Keeping this simple: while Chicago is currently rated Investment Grade (IG) by the major rating agencies, they could slide back into BIG territory for some rating agencies depending.

BIG bonds have much higher interest rates, which would greatly hike up financing costs for Chicago.

16 Nov 2024, WSJ Editorial: America’s Worst Mayor Keeps Losing

On Thursday the City Council met in special session to block the mayor’s plan to use a $300 million property tax increase to balance the city’s budget. The vote was unanimous, 50-0, so is Mr. Johnson getting the message yet?

With the public rebuke looming, Mr. Johnson equivocated Tuesday, claiming his proposal was merely to “get people’s attention.” “As a public school teacher,” Mr. Johnson said, “sometimes we do things to get people’s attention. And so now that we have the attention of everyone, I’ve said from the very beginning, this is a proposal. . . . I’m a collaborative mayor.”

Chicago’s 50 adult aldermen may be less amused at being compared to children. The mayor backed off the property tax because he knew he was going to lose, and he’s losing often these days.

In March voters rejected a Johnson-supported referendum to increase the city’s real-estate transfer tax on properties valued at more than $1 million. Mr. Johnson’s plan to use a high-interest loan to fund excessive contract demands from his benefactors at the Chicago Teachers Union led to the mass resignation of the Chicago school board.

….

Eek, but please. In 2023 the Chicago budget was about $17 billion, up from some $11 billion in 2019. From 2019 to 2024, the Chicago Public Schools added almost 7,000 employees while CPS enrollment declined by more than 30,000 students. The Covid boom in federal money was meant as temporary relief but has become entrenched in higher spending benchmarks.

Chicago is also confronting the rolling scandal of its underfunded pensions for government workers and big payments are always coming due. Chicago’s pension debt is now $37.2 billion, almost $2 billion more than in 2023 and the share of the city’s budget going to pension payments has more than tripled to 23.2% of net appropriations from 6.8% in 2014, according to the Illinois Policy Institute.

Chicago is coming to the end of the line on borrowing money for current costs.

Mayor Johnson may get the message when he goes to the bond market and finds the costs are way too high.

That snotty “Stop asking who’s going to pay for it” from the CTU leader won no friends. Mayor Johnson and his CTU buddies may find nobody is willing to pay for all the goodies they “negotiated” between themselves… and they will end up with less than they started with.

More Chicago and Illinois finance stories:

Yahoo Finance: S&P Warns It May Downgrade Chicago’s Credit Rating Amid Budget Fight

Wirepoints: Pritzker admin’s past and future spending excesses mean $23 billion in upcoming deficits – Wirepoints

Capitol News Illinois: Pritzker’s budget office projects $3.2B deficit in early look at upcoming fiscal year

The Center Square: Illinois quick hits: Illinois pension liability 2nd worst in U.S.

Yahoo Finance: Chicago mayor’s $300M property tax hike faces strong headwinds as council pushes for budget cuts instead

Illinois Policy: Vallas: Chicago Transit Authority is city’s 3rd budget crisis

Public Pensions Stories: Some Selections

Here is a selection of post-election items:

Edward Siedle: Minnesota State Pensions' ESG Policy Is Deeply Flawed

Second City Teachers: Open letter to all CTPF Trustees: Explain the High Fees

Joshua Rauh at Hoover: State Pension Contributions and Their Impact on State Budgets

Ropes & Gray: The New Battleground in the Fight over ESG’s Role in Public Pension Investments: The Courtroom

National Association of Plan Advisors: What a Possible GOP Election Trifecta Means for Retirement Policy Issues

P&I: State treasurer elections bring change, status quo for pension funds, ESG

Kansas Reflector: Kansas GOP senator wants state to invest $1 billion to boost pension system’s bottom line

Michigan Fox 47: State legislators considering reintroducing pensions for corrections officers

Toledo Blade, Jim Provance: Has dam broken on higher employer contributions for public pensions?

CT Post: Bridgeport may lose new assistant police chief three months into tenure - the pension connection: the person was collecting a pension from a different job, which would have to be suspended while working at Bridgeport

WFAA ABC: Dallas Police and Fire Pension System wins case in legal fight over funding plan — the pension fund wants higher contributions to get to full fundedness faster, the city of Dallas wanted lower contributions

Missouri Independent: Missouri state pension board bans use of fund for political donations - this was in reaction to some public pensions using funds to support ballot propositions (which were related to funding public pensions, so it’s not as if they were supporting random stuff)

Fitch Ratings: U.S. Pension Liability Burdens Rebound Even as More States Contribute

Overall long-term liability burdens rose among U.S. states in fiscal 2023, reflecting a rebound in pension liabilities, even as outstanding direct debt fell, according to Fitch Ratings in its latest annual report.

Coming off of the very strong market rebound following the pandemic, less robust pension asset returns in 2022 resulted in the median ratio of state pension assets to Fitch-adjusted liabilities falling significantly in fiscal 2023, to 66% from 73.5% the previous year based on data from states’ annual comprehensive financial reports (ACFRs, or audits). Pension data in state ACFRs generally lags actual pension system results by one year.Well, this explains why I’m still not getting any “80% funded is just fine!” stories.

Vatican Pensions: A Different Kind of Sovereign

This is not a U.S. public pension, but a different kind of “public”: the Holy See at Vatican City.

Pensions & Investments: Pope warns of 'serious' imbalance in Vatican pension fund, names sole administrator

The Vatican’s pension fund faces a “serious prospective imbalance” that will only get worse if an intervention is not staged, Pope Francis warned the College of Cardinals in a letter.

In an effort to deal with urgent structural measures necessary to make the pension fund sustainable, the Pope appointed Cardinal Kevin Farrell as sole administrator of the fund, according to a translation of the letter. Among his responsibilities, Farrell is president of the committee for investments.

In the letter to the College of Cardinals — made up of his advisers and collaborators — Pope Francis asked for support for a “new and inescapable path of change” to address challenges in the retirement system and to ensure the economic sustainability of the Catholic Church’s central governing body and Vatican City, known as the Holy See.

Letter from Pope Francis (auto-translated via Google):

With this letter, I intend today to draw your attention to another issue that is particularly close to my heart, since we are faced with serious and complex problems that risk worsening if not dealt with in a timely manner. I refer to the management of our Pension Fund, already considered among the central issues of economic reform, being a subject of “concern” to successive Popes since its establishment.

All of those who over time have examined this matter have been responsibly inspired by the concern to ensure a fair pension model for the community in the service of the Holy See and the State, and to fulfil the moral responsibility to provide decent benefits to those who are entitled to them, compatibly with the economic resources available. To this end, various studies have been carried out from which it has been derived that the current pension management, taking into account the available assets, generates a significant deficit.

Unfortunately, the figure that now emerges, at the conclusion of the latest in-depth analyses carried out by independent experts, indicates a serious prospective imbalance in the Fund, the size of which tends to increase over time in the absence of intervention: in real terms, this means that the current system is not able to guarantee in the medium term the fulfilment of the pension obligation for future generations. We are now all fully aware that we need urgent structural measures, which can no longer be postponed, to achieve sustainability of the Pension Fund, in the more general context of the limited resources available to the entire organization, and appropriate pension coverage for present and future employees, in a perspective of justice and equity between the different generations. These are not easy decisions that will require particular sensitivity, generosity and willingness to sacrifice on the part of all.

In light of this and all things considered, I wish, therefore, to inform you of my decision, taken today, to appoint His Eminence, Kevin Cardinal Farrell, as sole administrator for the Pension Fund, believing that this choice represents, at this time, an essential step towards meeting the challenges that our pension system faces in the future. While I have appreciated the thoughtful contributions made by those who have dealt with this delicate matter over the years, I now believe that it is imperative that we move through this new phase, which is fundamental to the stability and well-being of our community, with promptness and unity of vision so that the necessary steps are taken with urgency.

The Pillar: Francis names Cardinal Farrell as Vatican ‘pension czar’

Pope Francis announced Thursday that he has appointed Cardinal Kevin Farrell as the sole director of the pension fund for the Holy See, covering former employees of both the Roman curia and the Vatican city state.

….

Cardinal Farrell, who has an MBA from the University of Notre Dame, has been named by Francis to an increasing list of sensitive curial appointments over the course of his pontificate. In 2016, the pope named him to lead the Dicastery for Laity, Family and Life, and named him camerlengo of the Roman Church in 2019.

In the wake of the Secretariat of State’s financial scandal, in 2020 the pope named Farrell to lead the Vatican’s Commission for Reserved Matters, which oversees investments and expenditures touching sovereign or confidential diplomatic matters — replacing Cardinal Pietro Parolin, the Secretary of State.

The financial scandal being referred to has been well-covered by the Pillar. One of the biggest reasons I subscribe to The Pillar is their coverage of Vatican finances.

The Vatican and finance has popped up at least twice on STUMP before:

The Vatican pension fund itself covers only the people who have worked for the sovereign that is the Vatican. These aren’t the diocesan pension funds, though some of those have come under stress, too.

There are also other scandals surrounding “church plans”, as they are not covered by ERISA.

Here in New York, a hospital that had been run by a Catholic diocese, and then sold, had a pension fund that was underfunded and went bankrupt. Here is a recent story on the problem: Six years and still no pensions for St. Clare’s hospital workers

This is why you want pension funds fully-funded, y’all.

ABC: Pope warns the Vatican pension fund needs reform; employees demand transparency

Already, Francis has cut the salaries of cardinals by 10%, suspended some seniority bonuses, trimmed special stipends for Rome-based cardinals and begun charging some market-rate rents for their apartments.

….

The Association of Lay Vatican Employees, the closest thing the Vatican has to a labor union, voiced alarm at Francis’ warning about their pensions, insisting that lay employees had already sacrificed enough in his cost-cutting initiatives and that the Vatican leadership should listen to workers’ concerns.

“Salaries have not been indexed to the cost of living, while rent increases for Vatican properties have been related to inflation,” the group said in a statement that also called for the Vatican to make public the pension fund’s balance sheet.

Noting that Francis frequently preaches about the need to give workers dignified wages and pay special attention to the needs of families, the union said employees were “exhausted by cuts and especially by the lack of responses to their legitimate request to be heard.”

The Vatican has some 4,500 employees, around 3,100 of whom work for the Holy See bureaucracy and the rest for the Vatican city state itself, in the museums and other offices that run the territory. The union counts some 700 lay employees.

A comment on this:

As recently as 2015, the pension fund had insisted it was in sound financial health, and that it was expected to top 500 million euros by the end of 2015 after having started out with the equivalent of 5 million euros in 1993.

Yeah, about that. The people in 2015 who were saying that were at the heart of the recent Vatican financial scandal. In 2015, Cardinal Pell was raising alarm about the pension fund. In 2015: Vatican pension fund insists finances are in decent shape

Pell was tasked last year by Pope Francis to put the Vatican’s finances in order after years of mismanagement, waste and scandal. Francis gave him broad powers, and Pell got widespread support for his reform efforts by cardinals who received a closed-door briefing from him last week, the Vatican spokesman said.

But questions have also swirled about the scope of his power amid resistance from the Vatican legal office to his proposals for sweeping oversight and management authority in the statutes for his Secretariat for the Economy.

He also raised eyebrows by boasting in an essay that he had “discovered” hundreds of millions of euros that were “tucked away” in sectional accounts that didn’t appear on the Vatican’s balance sheets.

In fact, the money was well known, and both Pell and the Vatican subsequently clarified that nothing illicit was going on: Much of the money was a reserve fund established by Pope Paul VI and held in the Secretariat of State to be used for extraordinary expenditures or shortfalls.

Notice that only Pell was named in the piece and the various Popes, not the other people who were claiming the pension funds were okay.

I have a feeling some of those people were also involved in the dodgy investments that blew up and the first hints were even coming out in 2015. But that’s for another time. I have a feeling the Vatican pension fund issue will be coming back as people find their benefits cut.

Additional: Pope says Vatican's pension fund faces 'serious imbalance'

The headquarters of the Catholic Church comprises two entities: the internationally recognised sovereign entity of the Holy See and the Vatican, a 108-acre city-state within Rome.

They maintain separate budgets, and Vatican City income, including from the popular Vatican Museums, has often been used to plug the Holy See's deficit, which according to Italian media stood at around 83 million euros ($87 million) last year.

So that complicates oversight of the finances.