With the Democratic Party VP nominee pick, some were trying to make hay over Tim Walz having no apparent stock ownership. However, between Walz and his wife, they have four traditional pensions, and these pensions do have stock (and other) financial markets exposure. In fact, I looked at one of these pensions earlier this year: the Minnesota Teachers Fund… and Walz is the chairman of the board of that fund. Let’s look at the components of their wealth and aspects of this fund.

Episode Links

WSJ: Tim Walz’s and JD Vance’s Personal Finances Couldn’t Be More Different

Tim Walz doesn’t own a home or many investments outside of pensions and a college-savings plan, according to past financial disclosures and tax returns. Getting elected vice president as Kamala Harris’s Democratic running mate—a job that pays $235,000—would mean a more than 50% pay bump.

….

Tim and Gwen Walz together earned $166,719 before taxes in 2022, according to a tax return that year. About $116,000 of that came from Tim’s salary as governor. The governor’s salary has since increased to $149,550, according to the Minnesota Legislative Reference Library.

A little over $51,000 of the couple’s income came from Gwen’s work as an educator, which she reported as a self-owned business. She has worked at Augsburg University since 2019, where she has taught education and served as a special assistant to the president.

The couple, who have two children, had a 529 plan, worth between $1,001 and $15,000 in 2019, according to a financial disclosure Walz filed for his final year as a House representative. They also held two life insurance policies totaling $30,002 to $100,000.

The couple is largely relying on pensions to fund their retirement, based on his disclosures. They have four pensions with an estimated lump sum value of between $81,000 and $215,000, as of the 2019 filing.

Survey of Consumer Finances

Survey of Consumer Finances landing page

Before-tax family income by percentile of income

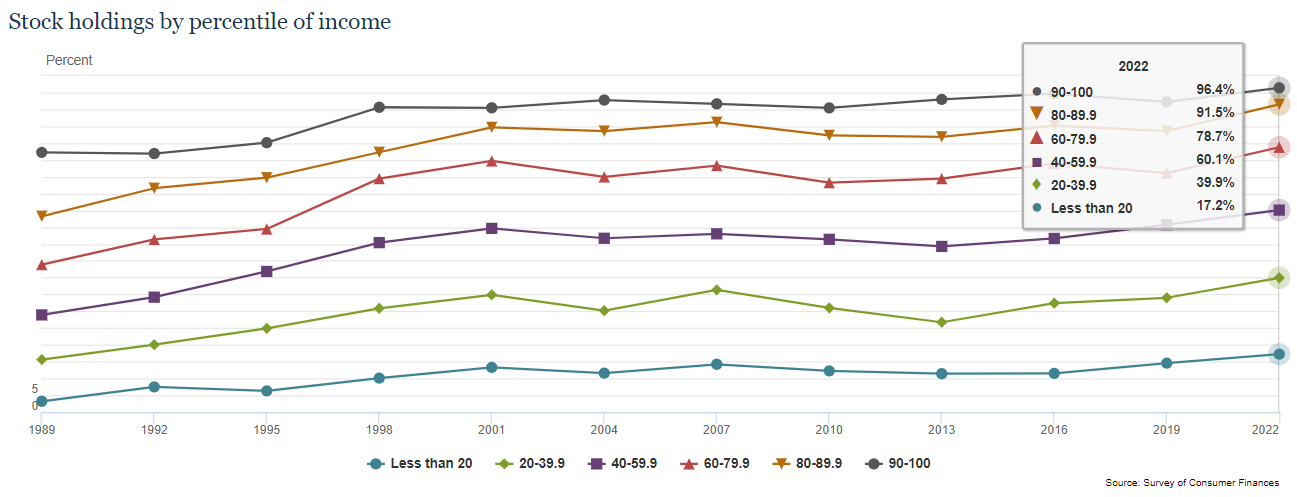

Stock holdings by percentile of income

Ed Seidle and the Minnesota Teachers Pension

4 April 2024: Minnesota Teacher Pension Forensic Investigation Invites Whistleblower, Expert And Public Participation

18 Jul 2024: Toledo Blade Exposes National Effort to Undermine Investigations Into Public Pension Wrongdoing

31 July 2024: Minnesota Governor Walz Warned Of "Many Serious Risks" Facing State Pensions Under His Watch

On March 11, 2024, Jay Stoffel, the Executive Director of the Teacher Retirement Association of Minnesota—a state pension with $28 billion in assets—blasted out an email entitled “An Important Matter” to all trustees of the TRA Board and staff. This same alarming email would, within days, be sent by him to state legislators and officials, including the offices of Governor Walz, Attorney General and Legislative Auditor. (Walz, as Governor has long been chairman of the pension board and the Attorney General is also a board member.)

A “situation” posing “many serious risks to the agency and pension fund” had arisen which they “should be aware of and concerned about,” Stoffel wrote.

The seriously risky situation Stoffel was warning Governor Walz and others about was a proposed forensic investigation into potential mismanagement or wrongdoing at the pension, conducted by a nationally-recognized expert and commissioned by educators who were participants in the pension.

That’s right, the impending “grave danger” was: State workers and retirees who contributed their hard-earned savings to the pension and whose retirement security was potentially at risk—the very same individuals for whose exclusive benefit the plan (under applicable law) is supposed to be managed—were fundraising to get a “second opinion.”

Worse still, the opinion they were seeking was that of a seasoned forensic investigator of their own choosing.

10 Aug 2024, NY Post: Teachers’ Minn. pension fund under Tim Walz ‘cooking the books’ by vastly underreporting fees: ‘Madoff miracle’

A Minnesota retirement system for public school teachers under Gov. Tim Walz is “cooking the books” by vastly underreporting annual fees paid to Wall Street investment managers — and posting near-impossible gains tantamount to a “Madoff miracle,” a top pension investigator said.

The state-run Teachers Retirement Association, or TRA, has publicly disclosed less than 10% of an estimated $2.9 billion spent on fees in the past 10 years, said Edward Siedle, a former US Securities and Exchange Commission lawyer and independent pension investigator.

The TRA also posted gains claiming it beat its own custom benchmark over periods of one, five, 10, 20 and 30 years by exactly 0.2%, which Siedle called “virtually impossible.”

Teacher testimony linked from NY Post piece: dated 7 Feb 2024

My name is Katie Dickerson and I am 55 years old and have been teaching for 31 years. 28 teaching in Hopkins and 3 in NH. As I’am getting closer to retirement I realize the state never made improvements to our retirement system. Not only do we have a high contribution rate to TRA, but we don't have a rule and are forced to work many more years unless we are willing to be hit with huge penalties. This is not how I ever imagined educators would be treated.

Toledo Blade Editorial: 18 July 2024

A cursory look at the Minnesota Teachers Retirement Association leads to the conclusion they’re either a world class pension or they’re cooking the books. Minnesota reported investment fees on the $26.7 billion teacher pension fund of $24.1 million. The teachers fund has a $6.6 billion private equity portfolio that would be expected to pay at least $132 million a year to fund managers. Moreover, a comprehensive study of 54 public pensions from 2008 to 2023 conducted by investment expert Richard Ennis shows fees average 1 percent of assets under management. By that metric Minnesota Teachers Retirement Association would be expected to pay over a quarter billion dollars a year to fund managers.

The national response from public pension advocacy agencies reflects the crisis these incredibly noteworthy numbers create. Either Minnesota has a special deal with Wall Street paying fees 90 percent under the going rate or an investment board made up of the governor, attorney general, secretary of state, and auditor, has massively massaged the truth.

A long term look at Minnesota’s pension math is just as perplexing. The teachers retirement fund purports to beat a composite index they created by 0.2 percent measured over 1, 5, 10, 20, and 30 years. The odds of that level of consistency over each measure of time are infinitesimal.

Earlier STUMP Podcast

Public Pension Problems -- Proposed Solutions, But Will They Fix Anything?

Let’s look at the condition of Minnesota Teachers, Connecticut state funds, and Chicago pensions, and three different (actually more) proposals to fix what ails these systems.