Nibbling at the Problem: Chicago Adds $306.6 Million to the Pension Pot

It's better than nothing - and it's a real contribution. I think.

26 January 2024 press release from the mayor of Chicago: City Of Chicago Demonstrates Commitment To City Workers With $306.6 Million Advance Pension Contributions

Mayor Brandon Johnson and the City of Chicago proudly announce a significant milestone in the city's commitment to its workforce and pensioners – a $306.6 million advance payment to the City’s four pension funds. This strategic move, executed under the Johnson administration’s first annual budget, reflects a dedication to the financial well-being of essential City workers and a commitment to fiscal responsibility.

….

The advance contributions, in addition to the City's statutorily required annual contributions, signify a proactive approach to boosting the financial position of the pensions. This commitment aligns with Mayor Johnson's vision for a fiscally responsible City, and with the recent revision to Chicago’s outlook from stable to positive by Moody's Investor Services. Moody’s positive outlook stems directly from improved pension contributions and positive financial trends. Chicago’s commitment to pension policies, stable reserves, and enhanced financial operations are key factors. The City’s substantial economic base and reduced structural deficit demonstrate notable strengths, acknowledged through more than a dozen other credit upgrades over the past 18 months, by Standard & Poor’s, Fitch Ratings, and Kroll Bond Rating Agency.

….

The Advance Pension Payment policy is projected to reduce pension contributions by approximately $3 billion over the next 30 years. This commitment to funding discipline ensures that promised benefits can be paid and the City can proactively address the legacy of underfunding the City’s pensions, promoting intergenerational equity. Mayor Johnson's passion for investing in people is evident in the City's sound fiscal policies and management of long-term obligations.

I skipped over all the politician quotes and it looks like this is a real contribution and not pension obligation bonds (but I may be making an incorrect assumption here.)

Pension fund allocations:

Policemen's Annuity and Benefit Fund of Chicago: $79.9 million

Fireman's Annuity and Benefit Fund of Chicago: $28.3 million

Municipal Employees' Annuity and Benefit Fund of Chicago: $178.1 million

Laborers' and Retirement Board Employees' Annuity and Benefit Fund of Chicago: $20.3 million

So some immediate questions came to mind, because I actually knew the high-level answers immediately and how to get the answers as well:

What actually are the statutorily required annual contributions?

Are those statutorily required annual contributions related in any way to the actuarially required contributions? You know, the ones that actually would be related to a good fundedness?

Basically, how much do these payments really move the needle on fundedness of the Chicago pensions?

I ask because the Municipal fund in particular has been in a dire state, and the one threatening to run out of cash for some time. Is this enough to pull it out of its asset death spiral?

Statutorily required payments for Chicago funds in 2024: $2.7 billion

I found the Fiscal Year 2024 budget forecast from September 2023. This is on page 20:

Mind you, this is a projection. They’re assuming the total contribution would be $2.7 billion in total.

Yes, $306.6 million is 11% on top of the prior projected contribution. That is substantial… for one year.

But how much does it really help in the long run?

How much should they really be contributing? More than $3 billion/year

From that same budget forecast, page 20:

In 2015, the State passed a new funding formula for the

City’s PABF and FABF, establishing five years of increasing

fixed contributions set in statute between 2015 and 2020,

after which the City’s annual payment is based on an

actuarially calculated contribution designed to bring the

two funds to a 90 percent funded ratio by 2055. Similarly,

the funding formula for the City’s MEABF and LABF was

revised in 2017 to establish a five-year period of increasing

fixed contributions between 2017 and 2021, after which

the City’s annual payment will be based on an actuarially

calculated contribution to bring the two funds to a 90

percent funded ratio by 2058.

90 percent funded ratio is not fully funded. That is not an appropriate target.

And a target that far in the future as well is also not appropriate. You want the retired lives to be fully covered (whups), and the unfunded liability for the not-yet-retired lives to be amortized over the period until they’re retired…. well, that’s not really realistic for the Chicago funds, but that’s what the targets should be.

If you’re going to push your target well after retirement for all those currently working for Chicago, it should be to a 100% target at least.

But look — as I pointed out in one of my many “how screwed is Chicago?” posts, the city pensions have been extremely poorly funded for a long time. It’s going to take a lot of extra money to get out of this hole.

Let’s look just at MEABF, the largest of these funds in number of participants.

This is what the funded ratio has been doing:

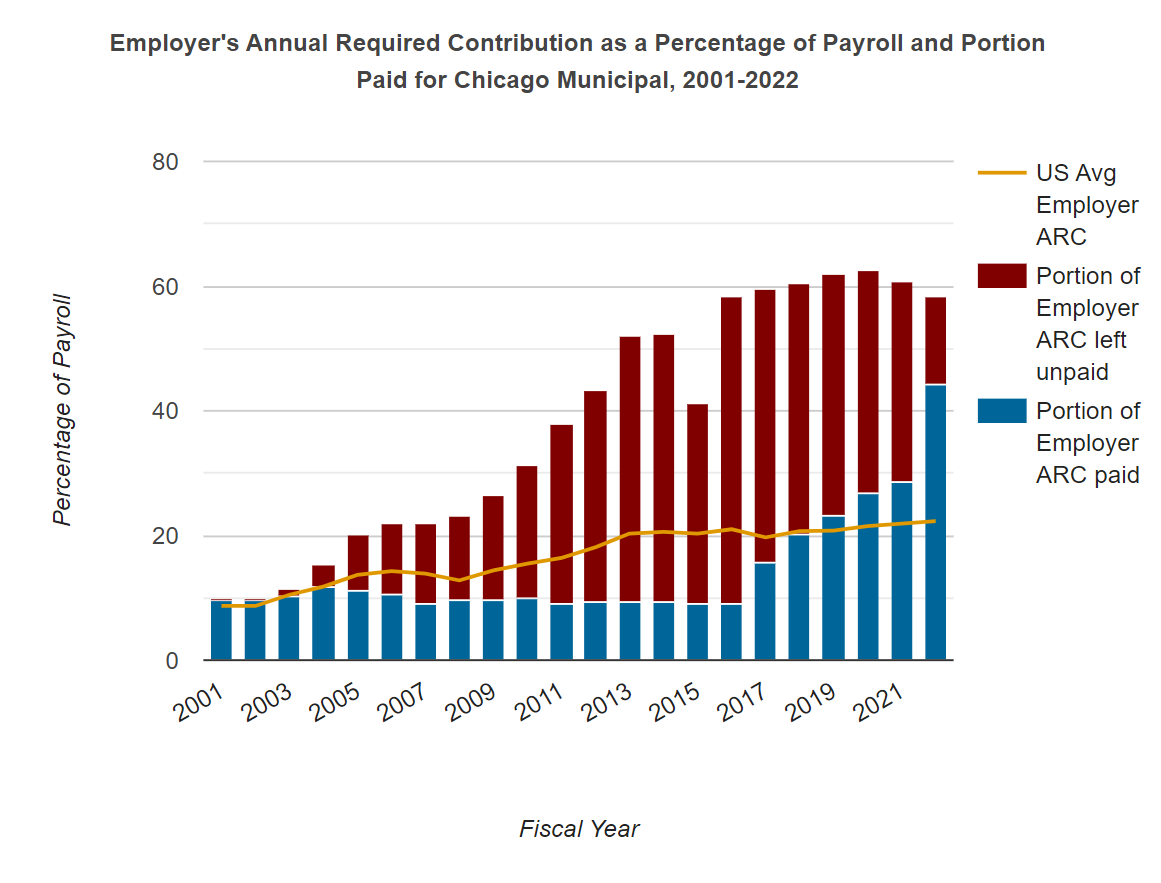

And now let’s take a look at the contribution history that got them there:

The actuaries do warn

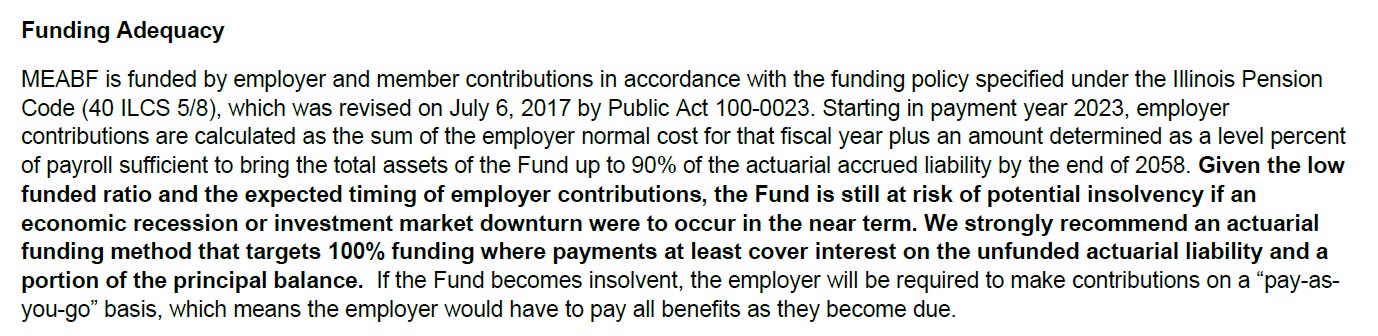

Let’s see what the last actuarial report had to say, for MEABF, valuation date Dec 31, 2022. The report itself was dated May 11, 2023.

This is on PAGE 2:

I TOLD YOU SO.

Page 9:

“[H]aving to liquidate invested assets at inopportune times to pay monthly benefits due to the current low funding level” is also known as the ASSET DEATH SPIRAL.

MEABF Estimate: Still $100 Million Too Little for ONE YEAR

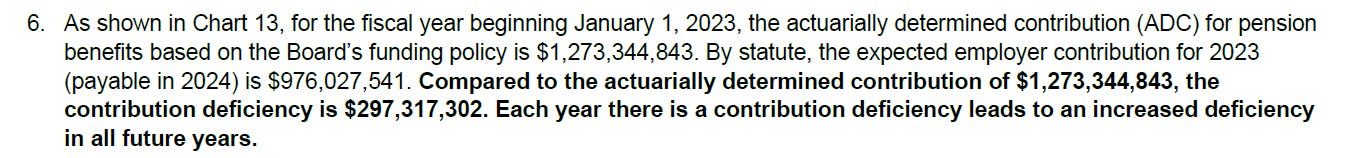

This is from page 10:

Here we go. Let me simplify.

The “actuarially determined contribution” is an amount that is to cover pension benefits earned that year as well as the amount of unfunded pension liability to be amortized that year.

The way to measure both bits has squishy bits in terms of assumptions and parameters - but for ADC, you can’t pick something other than full-fundedness. Like, you can’t pick a 90% fundedness target 40 years from now.

The actuaries calculated an ADC of $1.273 BILLION for MEABF, but that the statutorily required contribution is only $976 million.

So there was a difference of $297 million.

Let’s look above:

Municipal Employees' Annuity and Benefit Fund of Chicago: $178.1 million

So we’ve got a $297 million shortfall, let’s subtract off the $178 million they’re putting in…

Now they’re only short by $119 million!

That’s one year.

ONE YEAR.

Saving money by paying one’s debts!

They’ve got to keep increasing their contributions. They’re still over $100 million short, just for MEABF.

Yes, I understand that the politicians have got to make this look as good as possible, but let’s consider the following scenario:

I have a bunch of employees I pay by PUTTING IT ON MY CREDIT CARD.

And now I need to pay that credit card balance down.

If I were to fully pay off my balance in 30 years, I’d need to pay $1,273 just this year, but I was planning only to pay $976.

But hey, I scrounge in the couch and am going to throw in $178 additionally (and maybe a dime I found).

Think of all the savings in interest charges I won’t have to pay over the next three years because of that extra! To be sure, I didn’t pay enough to pay down the balance in 30 years, but it’s better than my original plan.

I’ll be 90% of the way there! Maybe!

Savings!

Maybe I shouldn’t live beyond my means!

GOOD LUCK CHICAGO!

YOU NEED IT!

Related Posts

Feb 2023: Podcast - Chicago Mayoral Race: Good Luck Dealing With the Pensions

Mar 2023: Public Finance Spotlight: Wirepoints

Jul 2023:

Chicago Pensions: Drowning, Not Waving

Let’s see the latest news about Chicago pensions: Yvette Shields of Bond Buyer: Investment losses sting Chicago pensions, 2022 balance sheet Investment losses last year eroded funding ratio gains achieved a year earlier by Chicago's pension system, casting a shadow over a healthy pickup of taxes on the city's audited financial results.

Aug 2023: Who will bail out Chicago?

Jul 2023: Taxing Tuesday: Income Tax for Chicago?

Jun 2020: Polities Under Fiscal Pressure: Chicago and Cook County

Jan 2024: Oh Woe, Chicago: How Will the Pensions Flow?

Apr 2023: My Condolences to Brandon Johnson, Next Mayor of Chicago

May 2023: Podcast - Spending Dreams of Chicago Mayor Brandon Johnson and Waking to Reality