One of my features for 2023 is highlighting sources I’ve used for public finance and pensions.

Prior posts:

January: Liz Farmer

February: Public Plans Database

This month, here is one of my big sources to give me context to the public finance problems of Chicago and Illinois: Wirepoints, started by Mark Glennon, and joined by a team over the years.

Wirepoints: How a New Yorker can Cover Illinois Public Finance

I dug through my emails and posts, and I see that I first became aware of Wirepoints back in 2014.

The first appearance of Wirepoints on STUMP was a post where Mark Glennon hosted a post by an Illinois actuary. This was the Wirepoints post:

Inadequate Actuarial Work meets Underfunded Pensions and Poor Journalism – Tia Goss Sawhney, DrPH, FSA, MAAA

This article is in response to a recent article in the Forest Park Review, Police and fire pensions in the healthy zone, BGA report: Relative to neighbors, Forest Park funding above average [1] and the rebuttal article in WirePoints, Bad Pensions Meet Bad Journalism: An Example and a Lesson [2]. With one minor exception, discussed below, the WirePoints article presented a good analysis of the health of Forest Park’s pensions using the information readily available to the public. Unfortunately the information readily available to the public is limited with respect to both quantity and quality and actuaries, my professional organizations and peers, are responsible for a portion of the inadequacy. Unfortunately, the outlook for too many pensions only worsens with better actuarial work and more transparency.

….

In all fairness, Forest Park is an extreme example of questionable actuarial work (though its reported unfunded liabilities on a percentage basis are pretty typical for Illinois municipal pensions). Based on a review of his work for seven Illinois police funds I filed an Actuarial Board of Counseling and Discipline (ABCD) report against their actuary, Mr. Timothy Sharpe [8]. My complaint is with respect to both assumptions and the overall quality of his actuarial communication. The complaint, filed in March, remains under investigation.

Sawhney (and others) had submitted a variety of complaints against Tim Sharpe… and it took a number of years. But if you want to see what ultimately happened, you can look here and here.

But that was just the beginning of my references to Wirepoints on STUMP.

Wirepoints on STUMP

230 of my posts since 2014 have linked to Wirepoints.

Some of that was due to WP linking to me (more anon), but often it was because they were a source of information on Chicago and Illinois politics.

Some Aggregation: Chicago, Illinois, Soda Tax (tee hee) — Wirepoints was a common source for many of the posts linked in the aggregation posts.

I’m in New York. I’m originally from the southeast before I moved here - the Carolinas, Georgia, and Maryland. I have no personal Illinois ties.

And some people have asked me — why am I blogging about Chicago and Illinois’s public finance issues?

Because they’re really hideous, that’s why.

While New York City has some problems, it has nothing on Chicago, and New York state can’t compare to Illinois’s structural problems, finance-wise. I could dunk on New Jersey, but where’s the fun in that? Everybody in New York does that!

[and I’ll be linking to a New Jersey resource later in the year]

Wirepoints Highlights

Email round-up

Wirepoints has several features, and the best part is the daily email. (That link takes you to a sign-up for their mailing list.)

You get their daily round-up, with the selection of stories — local media, Wirepoints exclusives, and more.

Wirepoints Exclusives

Wirepoints was originally Mark Glennon, but there are other people now.

Ted Dabrowski and John Klingner have provided a lot of quantitative research and commentary, with a lot of focus on pensions. Here is a post from December 2022:

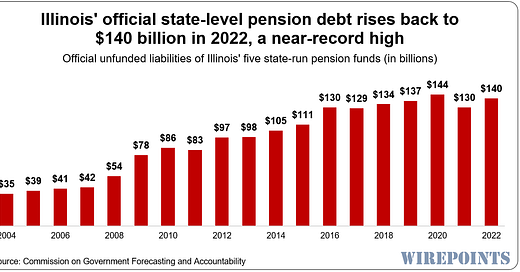

Illinois pension debts jump back up to $140 billion, state shortchanges its annual contribution by $4.4 billion

What the market giveth, the market taketh away.

Illinois state’ pension debts jumped back to near-record high of $140 billion in 2022, largely due to the funds’ poor investment performance. Both the stocks and bond markets had negative returns, worsening the state’s unfunded liability by $10 billion.

More importantly, this year’s preliminary pension report from the Commission on Government Forecasting and Accountability published the fact that Wirepoints has been harping on for years: that Illinois continues to far underpay what it should to the state’s five state-run pension funds. The latest projections for 2024 show the state will underfund the plans by $4.4 billion. More on that later.

2022’s worsening pension losses come after the previous year’s once-in-a-generation market-rally helped shrink the state’s unfunded liability to $130 billion in 2021, down from a record $144 billion a year earlier.

Mark Glennon has been a long-time help in navigating the tax and political landscape of Illinois and Chicago. Here is a recent piece on property tax:

There’s an invisible line item coming to many Illinois property tax bills for low income housing

Most Illinois property owners probably don’t know, but their property tax bills may now effectively contain an invisible line item for funding affordable housing. Statewide authorization for that is now going into effect at least in Cook County.

To address Illinois’ affordable housing problem, Illinois enacted a new law in 2021 called Affordable Illinois that includes property tax cuts of up to 35% for apartment owners that commit to maintain certain levels of affordable units in their property. The tax cut is achieved through a reduced assessment.

It’s just now being implemented in Cook County, which apparently is the first county, and it’s already being trumpeted as a success, as in this recent Chicago Tribune column and here in The Real Deal. Details on the program are here.

He will also do very punchy, quick pieces, like this recent one:

Citadel’s Ken Griffin highlights yet another Pritzker whopper – Wirepoints Quickpoint

Gov. JB Pritzker told the world during the World Economic Forum’s January meeting in Davos Switzerland that billionaire Ken Griffin and his company up and left because of sour grapes over an election Griffin effectively lost to Pritzker.

It’s a claim Pritzker has made often that the press hasn’t challenged. At least one columnist, Rich Miller, has repeated it. His Twitter post and headline said, “After apparent spectacular political failure, Ken Griffin takes ball, goes home to Florida.”

It’s not true, and was never credible. Griffin had made the decision to move to Miami long before anybody had a handle on the election results.

….

But Citadel had already signed for its $363 million April acquisition of the land for its new headquarters back in April, so the decision to leave surely was made before then. The election results weren’t known when Citadel was making that decision.

Eh, politicians lie for effect. Whatcha gonna do.

I see that the Wirepoints crew has hired a new communications director. Howdy, Kathleen!

Wirepoints links STUMP (and others)

One of the great things, though, is that Wirepoints compiles relevant news sources, as well as many commentators on the politics and public finance of Chicago and Illinois.

This came into great help when I had my really fun time with the Cook County Soda Tax (RIP, soda tax).

But I have had a great appreciation for the links Wirepoints has given to me over the years, and I’ve had loads of links and quotes. Thanks for the link on the Lori Lightfoot win post! (whaddya mean, a loss? she clearly won!)

One of my favorite quotes of me on Wirepoints:

Pritzker Administration sloughs off Illinois pension liabilities passing $500 billion mark, dissembles on pension crisis again – Wirepoints

Mary Pat Campbell, a widely read actuary, called Illinois’ buyout program the “shammiest of shamtaculars.”

A wealth of history and context

A lot of the Chicago and Illinois news that Wirepoints compiles does not (currently) touch upon finance, which is fine, but I know I can always dip back in at any time and search the archives to keep track of trends.

When it comes to public finance, one can see the disaster coming from far, far away.

Wirepoints has helped give me more detail on the players, and the specific tactics being tried out so I don’t look like a complete ass from the East Coast when I write about the Midwest.

So if you want to know about one of the most important incipient public finance disasters…. check out Wirepoints!

As an ex-IL but with friends still there it is great to read the great analysis from WP. Also, great to read the in-depth analysis from Mary. Thanks to all for keeping us informed.

Thank you, Mary Pat. I had to learn about pensions from scratch, made possible largely by your generosity with your time talking to me. We will continue to pick your brain when we fear we are getting over our heads. - Mark Glennon