Oh Woe, Chicago: How Will the Pensions Flow?

Illinois groups plead for sense from a nonsensical administration and the cupboard is bare

Today, some groups came together for a press conference after putting out an open letter yesterday, calling on Mayor Brandon Johnson to please get some principles in dealing with the sorry state of Chicago pensions.

Here’s the Press Conference:

The Proposal: Listen to the Actuaries

Now, they don’t mean me (not me, specifically, that is). But a report commissioned by the Society of Actuaries some years ago: TEN YEARS AGO

Let me go to their open letter first, with their summary of the recommendations:

We urge you to ensure your Working Group considers the below elements while crafting final recommendations. The elements are informed by the 2014 Blue Ribbon Panel Report written for the Society of Actuaries (SOA).

A requirement to have any proposal scored by independent, professional actuaries.

A requirement to reach and maintain 100% funding for all plans within 20 years.

A requirement to reduce the burden on the next generation of taxpayers by adopting a level-dollar amortization schedule.

A moratorium on any benefit increases until plans are 100% funded.

A requirement to enroll participants in Social Security if Tier II plan provisions are found to be in violation of ERISA.

A ballot initiative for a constitutional amendment that replaces the current pension clause, giving the General Assembly the power to improve the retirement security of public sector workers while reducing the pension burden on taxpayers.

I agree with all of their proposals, and I have a few short comments right now that I may expand on in future posts.

For now, I will link to old posts, as I have written about these issues for years.

But here is the nutshell version.

The core of Chicago’s pension problem:

Overpromising benefits

Underpaying for those promises

That is fairly simple how they got to where they are today, but dealing with it given where they are now is a real bear because there are loads of stakeholders, legal obligations, and more.

BAD choices have consequences.

100% funding target

Ah, yes. The funding target, and within 20 years (not 30 - longer than the average time to retirement of active employees, and of course if we weighted by those already retired….) — I could get sucked down a very deep hole, but an amortization period of 20 years might actually be liberal in terms of first principles, and not conservative.

But the main thrust is that 100% is the proper funding target. Totally agree.

Not 80%.

I will dig out two of my old posts:

May 2020: STUMP Classics: What's So Bad About 80% Fundedness?

The above post was an edited version of something originally written in NOVEMBER 2014. I noted that things had gotten much worse over the decade since I had originally written my first piece.

September 2020: The End of an Era: Where are the 80% funding myths of yesteryear?

By September 2020, I realized I no longer had to fight against the 80% fundedness myth.

(Mind you, I wouldn’t be surprised if it came back. But it has been dead for 4 years. I have had my news search set and never canceled, and it’s all been false positives.)

But the point is that anything less than a 100% fundedness target is an indication that one does not intend to fully pay benefits.

Ohhhh, but we must! cry the disingenuous politicians — we are required to! It was promised to pay the pension benefits!

“So where is the money coming from?” I ask.

“That’s the problem of the people of tomorrow…” and the politicians disappear in a puff of smoke.

But even if the politicians did not explicitly set targets of less than 100%, the actual contributions being made were such that it was obvious they did not have 100% targets.

State Constitutional Amendment in Illinois

Let me cut right to the chase: a state constitutional amendment is required in Illinois to allow for even the barest of adjustments of public pensions.

May 2015: Illinois Pensions: How Did We Get Here? The 1970 Constitution

This is the relevant section of the 1970 Illinois State Constitution:

SECTION 5. PENSION AND RETIREMENT RIGHTS

Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.

That section has not been amended since 1970.

There was a brochure that went out with the 1970 constitution to get it to pass — there was a lot in there, and much supporting material for all sorts of things.

Within the brochure is this explanation of Section 5:

This section is new and self-explanatory.

Mmmmm.

In May 2015, the reason I was writing about the 1970 Illinois state constitution (which is the one still in effect) was an Illinois Supreme Court ruling regarding retiree health coverage.

Let us ignore the absurd 2015 ruling, which only added to the need for amending the 1970 Illinois state constitution, but consider this 2013 Chicago Tribune article:

Pension debate at 1970 Constitutional Convention echoes in today's crisis

Green said the wording of the pension clause was modeled after that added to the New York Constitution in 1938 to prevent that state’s Depression-era lawmakers from cutting money owed pension programs. He said in New York it had led to full funding of pension programs.

But then, in a perhaps fateful declaration foreshadowing the present crisis, Kinney went on to stress that sponsors intended to protect benefits but did not consider their proposal a full-funding mandate. “It was not intended to require 100 percent funding or 50 percent or 30 percent funding or get into any of those problems,” she said.

In short, state and local governments would be required to keep their pension promises but not be required to sock away enough money to cover payments years into the future. When it came to funding, officials of both parties in Illinois took significant advantage of the escape clause, helping them skate by for decades without having to make politically difficult decisions on raising revenues or cutting services to meet pension obligations.

In May 1971, just weeks before the new constitution would go in effect, an official state pension oversight panel of lawmakers and laymen issued a report warning that the new pension safeguards were a mistake.

I added the emphasis.

So, all this constitutional requirement has done is made it such that one may not alter the promises.

However.

It has had no enforcement mechanism — nothing that actually makes the promises more likely to be fulfilled.

Chicago and Illinois more broadly have some of the worst-funded pensions in the country.

Running out of sponsors

As I asked in one of my top posts of 2023, Who Will Bail Out Chicago?, and I went down the possible list:

Illinois — deep in debt itself and in no condition to bail out Chicago

Federal government — interest rates are increasing on its own debt and it’s got some other priorities than bailing out the deadbeats

So I proposed aliens. No, not the human kind pouring over the southern (or even northern) border. The extraterrestrial kind. If they existed. To pull in the tourists.

But none of these are going to save Chicago. So how dire is the situation?

Because here is the problem. The reason I updated my pension projection tool was so I could use it.

The following is a single set of assumptions and only one Chicago plan. I will do future posts with more plans, and fully geeking out.

Chicago Municipal Pension

Here are the real historical stats:

I want you to look at one set of stats: the contribution growth rates.

15% per year increases in contributions for the last 10 years? 23% per year for the last 5 years?

Do you think that’s sustainable?

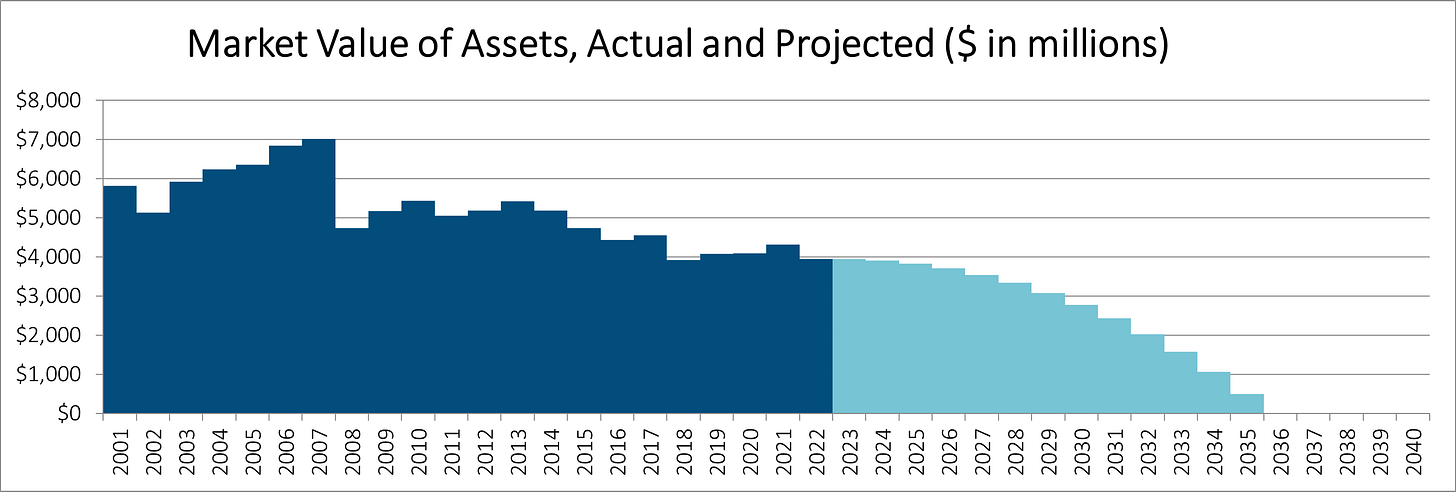

Let’s look at a very simplified projection I did, which includes the very real historical increase of contributions to the pensions.

To make it simple, in FY2018, the contributions were about $500 million (actually $488m), and for FY2022, they were over $1 billion (actually $1.14B).

The contribution doubled in 4 years.

Do you understand why the city is casting about to see if they can stiff somebody else with the bill?

Money Runs Out With Modest Assumptions

I am keeping this very simple for now:

First, yeah, I know this is unrealistic. The whole model is simple so one can capture certain dynamics. It’s a toy model.

However, second, continuing to increase the contributions is not sustainable for Chicago. You can’t squeeze out more tax revenue (though many are delusional about that), and good luck trying to get the Chicago public employees to contribute more (hey, maybe you can do it). So I will hold contributions at the FY2022 level.

Third, the benefit growth rate has been fairly steady for years. So I did keep that at a non-zero level.

This is what happens with this extremely simplified model:

The cash runs out.

This is the danger of deliberately underfunding the pensions for decades.

That is the record from the Public Plans Database. As you can see, the contributions made (blue), have been well below the contributions they could have been making (the full height of the red bars).

Even with the pinch of the FY2022 contributions, that’s only 76% of the contribution they supposedly should have made.

And… even that target was probably too low.

Because of the amortization horizon, and some other nerdy stuff that has some decidedly non-nerdy consequences.

Asset Death Spiral Threatens Chicago Pensions

Chicago Municipal (or Chicago MEABF) has been on the edge of an asset death spiral itself for some time.

I created the pension projection tool in the first place to test Chicago MEABF to death, way back in 2017.

Actually, in my first base case, I had the money running out in 2024. That didn’t happen due to the ramp up in contributions since 2017.

In geeking out, I noticed that increasing the contributions by 10% per year would save Chicago MEABF under certain assumptions:

The historical record ended with FY2015 at the time. you can see the contribution rate was essentially stagnant in reality at the time. The benefit growth rate was higher than we’ve seen recently.

But you can see that because of so many years of undercontributions in the past, Chicago has to put in much higher contributions now to escape the asset death spiral:

cash flows from contributions and investment income too small to cover promised benefit payments… so:

have to liquidate pension assets to pay benefits

as a result, there are a smaller amount of pension benefits to generate invesment income….

…so one needs to contribute more to cover the next period’s benefits

…but you can’t contribute that much, so you contribute what you can (go to top step and continue until assets run out, and then you have not enough resources to cover benefits)

Asset death spirals do not occur by accident.

Chicago’s has been decades in the making.

Lack of interest in the press until it’s a complete disaster

Going back to Wirepoints, Ted Dabrowski quoted an unnamed reporter:

Pensions? One reporter I talked to recently told me, “When pensions start coming in on buses every hour, then we’ll cover them.”

This is referring to Texas (and sometimes Florida) sending illegal migrants coming over southern points of entry up to Chicago, New York City, and other areas that had proudly claimed themselves sanctuary cities for illegal aliens when it cost them nothing. It makes for great political theater.

But the issue with pensions and public finance in general is that it is a very slow-moving monster.

Until, all of a sudden, it’s no longer slow-moving. At that point, it tends to be a disaster. Kind of like tectonic plates and earthquakes.

I’m not a journalist, “just” a hobbyist, and I’m very patient.

(Yes, other things are going on, but this post is long enough already.)

I’ve been watching specific pension systems, waiting to see what happens to them. Chicago’s pensions are in pride of place.

I have seen what happened to other pensions. When the assets run out. One can wait for the bodies to pile up, to be sure. There will be lawsuits. But will there be money?

The ultimate problem Chicago has is that they overpromised past employees (and current employees), and those promises have never been changed.

While not changing those promises, Chicago (and Illinois as a whole in a bit), have thrown in grossly inadequate amounts to support the promises they made.

That’s the past.

How Chicago is going to deal with the future…

…well, I’m only 2 years older than Brandon Johnson.

I think we’re going to get to see together how that works itself out.

Superb MEEP!!!