In which I talk about how insurance companies (and especially life reinsurance companies) investigate mortality trends in their own business, and why individual life insurance and group life insurance differs. Yep, it’s wonky! There are differences due to age ranges in the business, sex ratios, geographic coverage, and all sorts of reasons — check it out!

Related links

Society of Actuaries Experience Studies

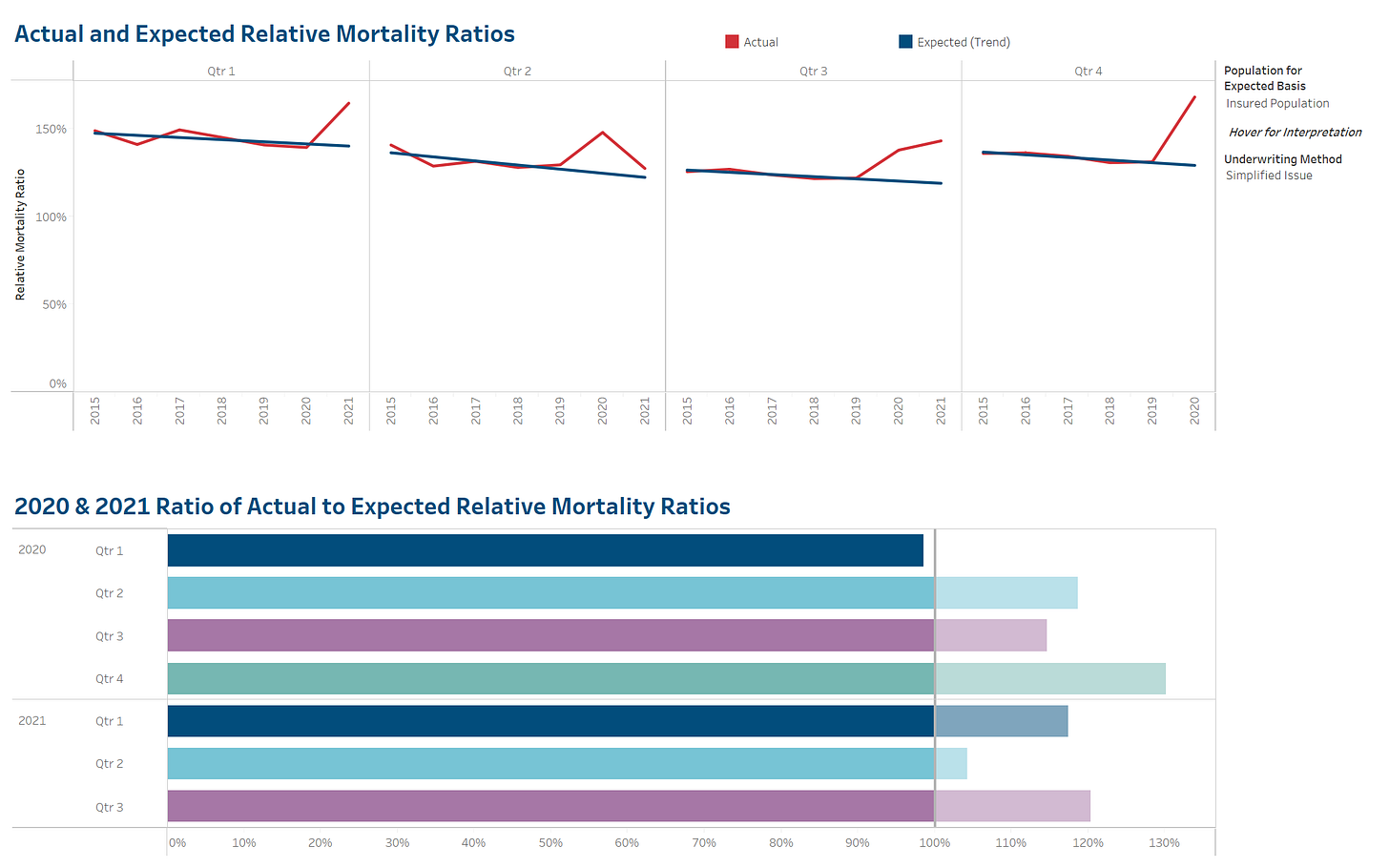

U.S. Individual Life COVID-19 Mortality Experience Study – Third Quarter 2021 Update

This is based on individual life insurance mortality experience, splits out by different products, and shows experience going back to 2015 so one can compare

There is a Tableau dashboard one can investigate: [this is just a snapshot]

Group Life COVID-19 Mortality Survey - Updated through March 2022

Group life is not as fancy - they just get a pdf report.

“Grey” collar is not industries that are more like services — retail, lighter manufacturing (pharmaceutical manufacturing, for example), wholesale trade, etc. There’s more person-person interaction, and you have to work more in person, unlike white-collar jobs, which are more likely to be able to be done at a distance.

One thing to note — all these “excess mortality” rates are relative to expected for that group. So these ratios don’t tell you what the absolute mortality was.

I’ll come back to this report in the future, because the group life report is the one many people are misinterpreting.

Share this post