Related Links

The twitter thread starts here:

Key tweets:

From the legal filing:

Next tweet:

Image again:

SEC press release of the fine:

https://www.sec.gov/news/press-release/2022-84

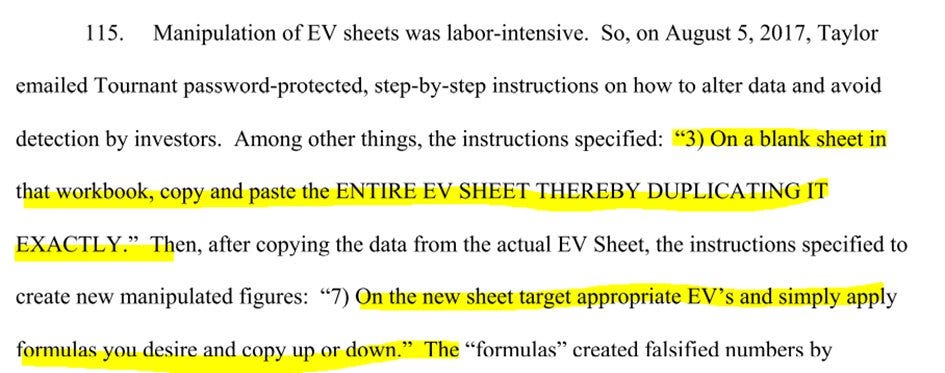

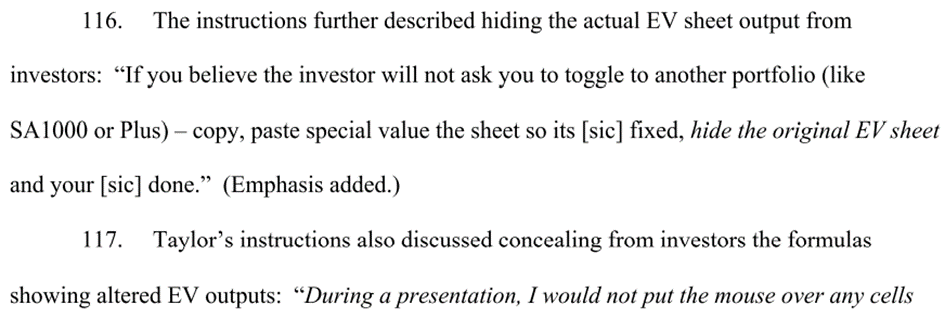

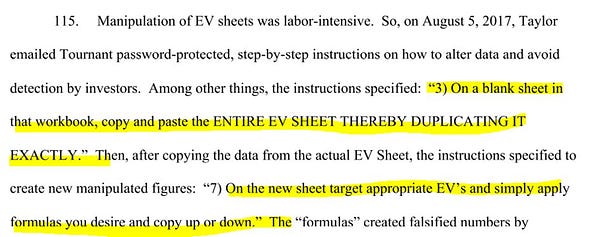

Defendants reduced losses under a market crash scenario in one risk report sent to investors from negative 42.1505489755747% to negative 4.1505489755747% -- by simply dropping the single digit 2. In another example, defendants “smoothed” performance data sent to investors by reducing losses on one day from negative 18.2607085709004% to negative 9.2607085709004% -- this time by cutting the number 18 in half.

Reuters coverage:

Architect of Allianz fraud made $60 mln as he lied to investors, U.S. says

Tournant, with Allianz Global Investors since 2002, founded the so-called Structured Alpha funds in 2005. They were marketed in particular to typically conservative U.S. pension funds, from those for labourers in Alaska to teachers in Arkansas and subway workers in New York.

The funds used complex options strategies to generate returns.

…..

Tournant "deceived the funds and their investors by understating the risk," the indictment reads.

In one example, Tournant and another fund manager took daily risk reports provided by a sister company and altered 75 of them before they went to investors. The effect was to reduce projected losses in stress scenarios.