Public Pensions and Assets: Divestment from China, ESG, and Crypto

Looking at only one side of the balance sheet

In my prior post on public pensions, I looked at the general state of public pension news following the U.S. elections.

However, let’s focus just on investment-related issues, as many organizations know that ESG (Environmental, Social, Governance) principles around evaluating investments may not be so popular anymore as part of the fiduciary requirement.

Governance, in terms of appropriate oversight from boards of directors, in terms of independent directors, appropriate expertise, etc., shouldn’t be thrown out with the ES parts (and there are still appropriate ES dimensions — say, you might not want to invest in a company using slave labor for manufacture.)

But let’s see what has been happening recently in the public pension investment world.

Divestment from China

P&I: Texas Gov. Greg Abbott directs all state agencies to divest from China

Texas Gov. Greg Abbott has directed all state agencies to divest from investments in China.

In a Nov. 21 letter to agencies, Abbott said he is directing the agencies to divest because the Chinese Communist Party’s “belligerent actions across the Southeastern Pacific region and the world have increased instability and financial risk to the State holding investments in China.”

He also cited what he believes is the likelihood of financial risk rising further because “Chinese aggression against the United States and its allies seems likely to continue.”

The largest pension fund in Texas has already taken steps to reduce its exposure to China via a strategic asset allocation study earlier this year, citing geopolitical concerns. At its July 19 meeting, the board of the $202 billion Texas Teacher Retirement System, Austin, changed the benchmark for its overall public equity portfolio to the MSCI ACWI IMI ex-China/Hong Kong index.

This is the letter, dated 21 Nov 2024, and I’m quoting it here for convenience.

Dear Chairmen and Executive Directors:

Security of Texas and Texans is of utmost importance. That includes the financial security of Texas state investments. Threats to that security can come from foreign adversaries, including the Chinese Communist Party (CCP), whose belligerent actions across the Southeastern Pacific region and the world have increased instability and financial risk to the State holding investments in China. As Chinese aggression against the United States and its allies seems likely to continue, the financial risk associated with holding investments in China will also rise. Therefore, all investments of state funds in China must be evaluated and immediately addressed.

This is not the first time I have raised concerns about this looming threat. In 2023, I encouraged Vanguard to create new emerging market funds isolated from the risk posed by the CCP so that Texas would have an option to protect our citizens from exposure to the CCP without jeopardizing our financial returns. Also, this year, I instructed The University of Texas/Texas A&M Investment Management Company (UTIMCO) to divest from China.

To further this goal, I direct Texas investing entities that you are prohibited from making any new investments of state funds in China. To the extent you have any current investments in China, you are required to divest at the first available opportunity.

Texas will defend and safeguard itself and our public treasury from any potential threat, including those posed by the CCP.

If you have any questions, please reach out to your assigned Budget and Policy Advisor.

Sincerely,

[Greg Abbott signature]

Note that this is not the only CCP-related directive from Gov. Abbott recently. On November 20, he released this: Governor Abbott Issues Executive Order Protecting Critical Infrastructure From The Chinese Communist Party, which related to cyberattacks against infrastructure.

Before that, there was this: Governor Abbott Issues Executive Order Hardening State Government From The Chinese Communist Party, and before that: Governor Abbott Issues Executive Order Targeting Chinese Communist Party’s Harassment Of Texans.

Now, you may think this is a bit overblown, but that’s probably because you’re not the one targeted by the CCP for harassment or kidnapping. You can read about such activities from ProPublica: Operation Fox Hunt: How China Exports Repression Using a Network of Spies Hidden in Plain Sight

In 2019, an immigration judge in New York granted political asylum to a former social security clerk from Beijing. The young clerk had landed on Fox Hunt’s most-wanted list, but he argued in U.S. court that his former bosses in China had framed him for embezzling about $100,000 after he denounced their corruption. Despite the judge’s ruling, he remains under federal protection because of ongoing harassment by Chinese government operatives.

Former Assistant Attorney General John Demers, who led the National Security Division of the Justice Department until last month, said China sets a dangerous precedent when it pursues expatriates here, violating U.S. laws and abusing human rights in both countries. (Demers declined to discuss the prosecution in New York.)

“If proceeds of corruption are laundered here, from China or any other country, we will investigate and, if we can, prosecute,” Demers said. “But some of these people didn’t do what they are charged with having done. And we also know that the Chinese government has used the anti-corruption campaign more broadly within the country with a political purpose.”

The global Fox Hunt campaign, he said, reflects “the authoritarian nature of the Chinese government and their use of government power to enforce conformity and repress dissent.”

Now, Gov. Abbott may be positioning himself for a current role in the upcoming Trump administration, for a future run for higher office, or reacting to actual problems in one of the largest states in the U.S. both by population and area.

Texas is not the only state getting into China divestment.

Kansas divested from China… and so much more: Kansas pensions divested $300 million from 'countries of concern'

Kansas pensions are divested from all but one adversarial nation following the legislature’s passage of the Countries of Concern Divestment Act.

The bill, which passed earlier this year without the governor's signature and had large majorities in the House and Senate, directed state-managed funds to remove any investments held in China, Cuba, Iran, North Korea, Russia and Venezuela. Countries of concern are determined by the United States Department of State, though not all were singled out for disinvestment.

Since the bill passed, the fund liquidated 12 securities from 10 companies subject to divestment. Total investments in countries of concern was $294 million, which is about 1% of the fund’s total investments.

Alan Conroy, executive director of KPERS, on Wednesday told the Joint Committee on Pensions, Investments and Benefits that the fund is now in compliance with the law. There were two countries of concern that the state held an interest in, Russia and China, which includes Hong Kong.

There is one pending divestment in a Russian country.

….

Liquidating those investments cost the state a 0.216% fee on the nearly $300 million, which came out to about $635,000.

It’s a one-time hit, of course.

If it were an ongoing cost, one would want to consider the options to reduce the costs, but as a one-time transition cost, it is not necessarily large.

Climate Action 100+: Public Pensions Respond

Climate Action 100+ is a … well, this is their description about themselves:

Climate Action 100+ is an investor-led initiative to ensure the world’s largest corporate greenhouse gas emitters take necessary action on climate change in order to mitigate financial risk and to maximize the long-term value of assets.

If you go to that link, which lists the steering committee, you will see the CIO of Calpers is listed.

In July, some Republican House members sent letter to the signatories (or ex-signatories) to CA100+: Jordan and Massie Demand Information From Over 130 Companies Surrounding Their Involvement with Woke ESG Cartel Climate Action 100+

Today, House Judiciary Committee Chairman Jim Jordan (R-OH) and Subcommittee on the Administrative State, Regulatory Reform, and Antitrust Chairman Thomas Massie (R-KY) demanded information from more than 130 U.S.-based companies, retirement systems, and government pension programs about their involvement with the woke ESG cartel Climate Action 100+.

In June, the Committee released an interim staff report titled, "Climate Control: Exposing the Decarbonization Collusion in Environmental, Social, and Governance (ESG) Investing," which details direct evidence of a "climate cartel" consisting of left-wing activists and major financial institutions that collude to impose radical environmental, social, and governance goals on American companies.

The Committee continues to examine whether existing civil and criminal penalties and current antitrust law enforcement efforts are sufficient to deter anticompetitive collusion to promote ESG-related goals in the investment industry. The over 130 companies, retirement systems, and government pension programs with membership in Climate Action 100+ must answer for their involvement in prioritizing woke investments over their own fiduciary duties.

I went looking through their 394-page compiled letters to see if they asked anything different of the public pension funds than they did of general asset managers, and no, they did not. It was a simple mail merge generation of these letters.

Here is some text from the letter sent to Calstrs:

To further its investigation, the Committee requests that California State Teachers’ Retirement System answer the questions below and provide the following information:

1. Under Climate Action 100+’s recently announced Phase Two, investor signatories “ask companies to not only disclose but to implement robust transition plans and to take action with a wider set of stakeholders to address the sectoral barriers to the net zero transition.”6 Specifically, investor signatories are required to “[t]ake action to reduce greenhouse gas emissions across the value chain.”7 How does California State Teachers’ Retirement System plan to engage the Climate Action 100+ focus companies in its portfolio to “[t]ake action to reduce greenhouse gas emissions across the value chain”?

2. What requests will California State Teachers’ Retirement System make of the Climate Action 100+ focus companies in its portfolio to “[t]ake action to reduce greenhouse gas emissions across the value chain”?

3. What tactics will California State Teachers’ Retirement System use to encourage the Climate Action 100+ focus companies in its portfolio to agree to its requests?

4. How does California State Teachers’ Retirement System plan “to take action with a wider set of stakeholders to address the sectoral barriers to the net zero transition”?

ease provide responses to the Committee’s requests as soon as possible, but by no later than August 13, 2024, at 12:00 p.m.

Further, as a Climate Action 100+ signatory, the Committee has reason to believe that California State Teachers’ Retirement System may be in possession of documents and communications related to Climate Action 100+’s collusive activity. Accordingly, the Committee requests that California State Teachers’ Retirement System preserve the following materials:

1. All documents and communications referring or relating to the company’s role as an investor signatory of Climate Action 100+;

2. All documents and communications referring or relating to the company’s coordination or interactions with Climate Action 100+, investor signatories, or focus list companies; and

3. All documents and communication referring or relating to the company’s efforts to advance ESG-related goals.

Responsible Investor reported on some of the responses to these queries:

19 Aug 2024: US Pension funds react to Republican probe of Climate Action 100+

16 Sept 2024: More US state pension funds respond to Republican CA100+ probe

The responses aren’t that interesting, and RI blocks copying their text (fair enough).

Of the state pension funds responding that were still involved with CA+, they were all sure to emphasize fiduciary duty, and that they were pursuing CA100+ strategies with long-term risk-adjusted returns in mind.

Because if they give any other answer… fiduciary duty comes into question.

In some of the cases, the queried asset managers withdrew from CA100+. Perhaps they rethought whether the link to their fiduciary duty was strong enough.

But in the case of many public pension funds still in CA100+, they are committed to the cause.

In particular, I saw LACERA (Los Angeles County Employees Retirement Association) had vigorously defended their involvement in responding to the query, so I looked for material on their website. Any group that had spent so much time in response probably had public material on their association - and I was correct.

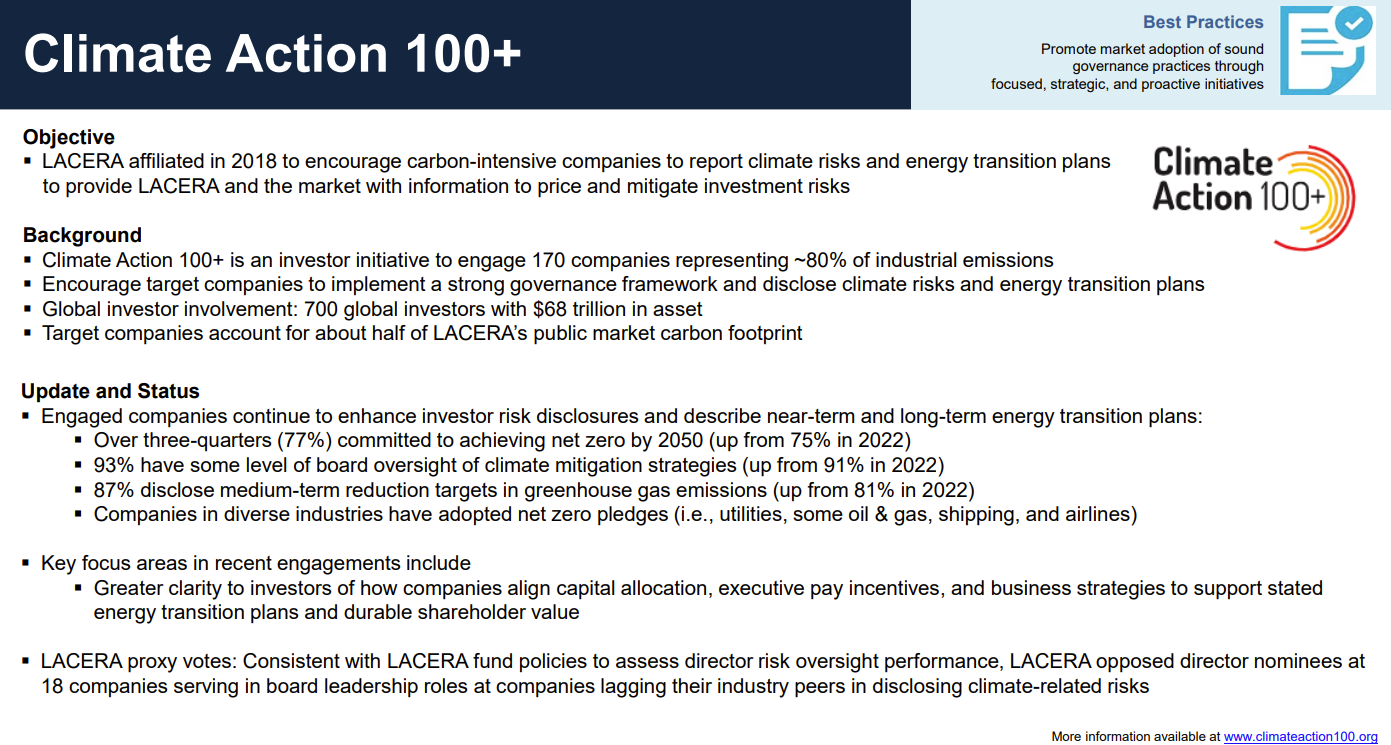

In their October 9, 2024 regular meeting of the corporate governance committee of the LACERA Board, they included material on CA100+ as part of their key engagement and stewardship initiatives:

I will note that different investment organizations have various levels of involvement with CA100+.

Comparing Approaches: Divestment vs. Activist Investors

CA100+ takes a better approach to ESG than what I used to see with divestment campaigns. As an activist investor, especially as an equity investor, you can influence via one’s votes as a shareholder. Institutional investors such as pension funds banding together in their votes on key ESG proposals engage in these issues, and can influence the companies in which they invest.

If they were divested from these companies, they could not influence.

If one looks at the divestment from China situation, that can also be a prudent move, if one sees that as an investor, one has no serious way to influence management, given the reality of the situation of companies with their management in China.

Voice of America: China's local police seizing assets, demanding payments amid economic downturn

As China’s economy struggles and economic pressures constrain local government budgets, law enforcement officers have been using flexible legal codes and financial punishments to fill government coffers, analysts say.

Reports circulating on Chinese social media detailed nearly 10,000 incidents in which companies in Guangzhou province alone had their assets frozen or removed from bank accounts by police. Zhang Ke’s business is one of them.

….

Teng Biao, a visiting professor at Hunter College, told VOA that “offshore fishing” does not properly enforce laws across provinces but rather generates revenue for police and local governments.

"A lot of private enterprises, including many small business owners, are facing an extremely bad legal and political environment. There are so many gray areas in China’s legal system that it’s almost impossible for businesses to fully align with the law. Combined with China's imperfect and distorted market system, it is very easy for the police to find an excuse to crack down on the entrepreneurs,” he said.

That’s about small businesses, not publicly-traded companies traded in foreign stock exchanges (or sovereign debt).

However, this gives an idea of the current risk. It might be best not to be exposed to that risk at all.

RELATED: Girard Miller: Public Pensions and a Chance to Damp Down the ESG Wars (I think Girard has good ideas here — there are relevant aspects in ESG that shouldn’t be thrown out.)

But jumping gears back to divestment, back to one of my least favorite people in this world, Brad Lander. The NYC Comptroller proposed not investing in certain kinds of fossil-fuel-related assets: NYC comptroller proposes stopping pensions’ private market investments in fossil fuels

The Bureau of Asset Management at the Comptroller’s office will work to research and develop the policy language for the exclusions and are expected to present it to the trustees of the pension funds in “early 2025,” according to Lander’s blog. That presentation will also include an assessment of the decision’s projected impacts and implications.

The exclusions announced Tuesday are a part of the funds’ Net Zero Implementation Plans, and Lander said in the blog that diverting future investments from such infrastructure will “help mitigate the systemic risks that climate change poses to the global economy and to New York City’s public pension funds.”

“Climate risk is financial risk, and we have a fiduciary duty to our beneficiaries to take that risk seriously as we make long-term investment decisions,” Lander said. “The impacts of the climate crisis are playing out in real time, with more frequent hurricanes, flash floods, intense heat waves, and deteriorating air quality jeopardizing our planet and our portfolios.”

The funds first approved a divestment from fossil fuel reserve holdings in their public equity portfolio in 2018 and completed that process in 2022. The boards voted to exclude upstream fossil fuel investing in their private market portfolios in 2023, the same year the net-zero implementation plans were adopted.

The funds’ net-zero plans require annual disclosure of scope 1, 2 and 3 emissions; scaled up investments in renewables and climate solutions; and engagement with portfolio companies and asset managers to reduce emissions. The funds’ holdings in energy and climate solutions have grown to $11 billion since 2021, according to the comptroller’s office. Lander introduced shareholder proposals this past spring to have major banks disclose their ratio of clean energy to fossil fuel financing. The Royal Bank of Canada, JPMorgan Chase and Citibank each agreed, while votes on the proposal failed at the other major U.S. banks.

Lander’s Oct. 22 announcement was lauded by a number of local and national climate and energy-focused nonprofits. His blog included quotes from local leaders of environmental groups including 350, New York Communities for Change and Climate Families NYC.

This “net zero” investment goal makes sense if you think the government will ban such items, thus you will lose all value on your investment. That would be looking after your fiduciary duty.

Of course, if “net zero” goes nowhere over your investment horizon, you may have just missed out on some juicy private equity returns that your underfunded pensions could have used.

A Sierra Club endorsement isn’t exactly adding contributions to those pensions when you missed out on returns.

Crypto in Public Pensions

Ted Siedle: Remember When Cryptocurrency Was Sold To State Pensions As ESG?

Senator Katie Muth, a Board Member for the $40 billion Pennsylvania State Employees’ Retirement System (PSERS) will never forget the first meeting of the pension board she attended and the ESG presentation she heard which included cryptocurrency as a solution for the un-banked in African countries.

“I was really looking forward to the ESG presentation but was very confused as to how blackbox fake currency could improve the lives of people suffering from economic hardship on the continent. The un-banked need equitable financial opportunities—not the opportunity to be scammed and further exploited by tech-savvy Westerners.”

She was on the board, and I’ve never been… but seriously, the crypto bros will jump on any fad to make a sale.

Thanks to massive political donations by the crypto industry, brace yourself for a surge of crypto creeping into our nation’s state pensions—this time around, more openly and without the rosy, bogus ESG justifications.

Well, actually, it’s been there. If you scroll down to my older posts, you will see my comments from 2022 re: the public pensions that took losses from the FTX disaster.

But I have picked up on crypto in pensions stories in the last few months, and one friend asked me about crypto in a public pension fund:

4 Nov 2024: Michigan state pension fund reports $11 million exposure to Ethereum ETFs

22 Nov 2024: State pension plans can adopt crypto more easily than private plans

Florida already holds about $800 million in crypto-related investments in its portfolio, but the state’s Chief Financial Officer Jimmy Patronis said he would “not be shocked to be able to see that growing under a Trump administration in the near future.”

Patronis hit out at crypto skeptics during a CNBC interview on Thursday, saying that those not paying attention to crypto were making a “mistake” and suggesting that Miami could become the “crypto capital of the world”. He has also recommended that the state retirement system direct a portion of its funds into crypto.

The state pension fund in Florida has $180 billion in it:

https://publicplansdata.org/quick-facts/by-state/state/?state=FL

https://publicplansdata.org/quick-facts/by-pension-plan/plan/?ppd_id=26

The crypto being $800 million is 0.4% of the fund. That is not much.

Yeah, I bet Patronis expects the crypto allocation to get bigger under Trump, because the pension fund as a whole will get bigger. They want a certain allocation to higher-risk assets.

Looking at their allocations, they're slightly lower than average for public pensions for alternative assets, but not by much:

The largest pension fund in Florida has $180 billion in it:

https://publicplansdata.org/quick-facts/by-state/state/?state=FL

https://publicplansdata.org/quick-facts/by-pension-plan/plan/?ppd_id=26

I think having 0.4% of the fund in something crazy is no big deal. I could see them getting more crypto because the fund has gotten bigger, and they want a certain allocation to higher-risk assets.

Looking at their allocations, they're slightly lower than average for alternative assets, but not by much:

I'm going to guess their crypto is in the hedge fund portion (11.4%) of the allocation. Maybe their private equity portion (9.4%).

You can argue that these holdings in alternative assets are inappropriate for public pensions in general (and I have, when they cannot get adequate oversight in their professional management and their board of trustees), but I assume they can get competent people in Florida. Florida is a state with a lot of resources.

Older Related Posts

ESG/Divestment

Jan 2023: Kentucky Asset Manager Warning: the ESG Brou-Ha-Ha Continues

Nov 2022: ESG and ERISA: Pity the Poor Tort Lawyers Their Lost Business as Biden Gives a Safe Harbor For Now

2017: Public Pension Assets: It's Not Your Money to Play With, Pension Trustees

2017: Priorities for Pension Funds: Climate Change or Solvency?

2018: Divestment and ESG Follies: A Lack of Humility - Tobacco, Climate Risk, and More

2018: Divestment and ESG Follies: Mandating Women on Corporate Boards

2023: Other People's Money: ESG, Public Pensions, and the Principal-Agent Problem

April 2014: Public Pensions and Blacklists: Harmful to the Pensions

Oct 2018: Calpers Quickie: President Pushed off the Board Due to ESG Over Pension Security

Oct 2015: Public Pension Follies: Divestment! Divest from All the Dirty Things!

2022: Podcast - Public Pensions, ESG, DeSantis, and The Catholic Church

Crypto/Alternatives

2023: Choices Have Consequences: Public Pension Investments in Alternative Assets

2021: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

2020: Public Pensions, Leverage, and Private Equity: Calpers Goes Bold

2018: Alternative Assets and Pension Performance: A Dive into Data

2014: Public Pensions Watch: Don’t Go Chasing Waterfalls….or Alternative Asset Classes, pt 1 of many

August 2014: Public Pensions Watch: Dallas Pension Learns About Concentration Risk

September 2014: Public Pensions and Alternative Assets: Dallas Shows How It Can End

2017: Public Pension Assets: Our Funds were in Alternatives, and All We Got Were These Lousy High Fees

2015: Reddit-Public Pension Connection: Alternative Assets and Risk

2014: Public Pensions Watch: More Reactions to Calpers Pulling Out of Hedge Funds

2014: Public Pensions Watch: Alternative Assets, pt 8 of many — New Jersey followup