Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

Also, do they have higher returns? (spoiler: no)

Back in 2017, I made a ranking table of alternative asset holdings by public pension funds.

There have been 4 more years, so let’s update the data.

Prelude: Pennsylvania Pension in Trouble Over Chasing Yield

Frankly, if your pension fund makes the pages of the New York Times, it’s not because things are going well.

NYT: F.B.I. Asking Questions After a Pension Fund Aimed High and Fell Short

The search for high returns takes many pension funds far and wide, but the Pennsylvania teachers’ fund went farther than most. It invested in trailer park chains, pistachio farms, pay phone systems for prison inmates — and, in a particularly bizarre twist, loans to Kurds trying to carve out their own homeland in northern Iraq.

Now the F.B.I. is on the case, investigating investment practices at the Pennsylvania Public School Employees’ Retirement System, and new questions are emerging about how the fund’s staff and consultants calculated returns.

…..

The error in calculating returns was a tiny one, just four one-hundredths of a percentage point. But it was enough — just barely — to push the fund’s performance over a critical threshold of 6.36 percent that, by law, determines whether certain teachers have to pay more into the fund. The close call raised questions about whether someone had manipulated the numbers and the error wasn’t really an error at all.

…..

“If you can’t change the benefits, and you can’t change the contributions, the only lever left for these people to pull is investment policy — that’s it,” said Kurt Winkelmann, a senior fellow for pension policy design at the University of Minnesota’s Heller-Hurwicz Economics Institute. “And that exposes younger beneficiaries and taxpayers to a lot of risk.”

There are many big issues involved in public pension funds getting involved in alternative assets as part of their investment strategy, and you know if you’ve done something where the FBI is taking a look…… well. That’s worse than an actuarial malpractice lawsuit. One is only money. Federal fraud charges are more deadly. To be sure, there may be nothing really untoward, but I will get to that at the end of this post.

In this video, I talk about the current brou-ha-ha over the investments of the Pennsylvania Schools Employees Retirement System (PSERS):

Also in 2017, I wrote about the investments of the Pennsylvania state pension funds. At the time, the Public Plans Database did not have a detailed breakdown of asset allocations as they do now.

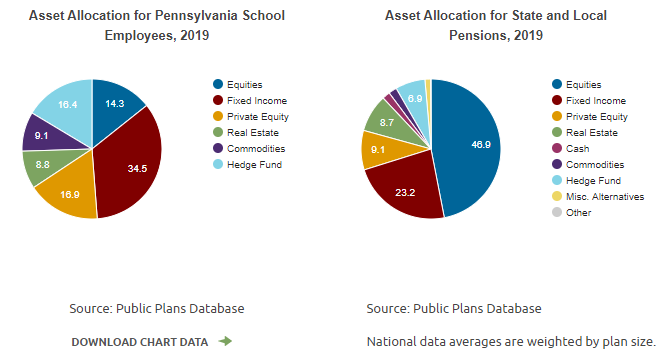

Let’s take a quick peek at the PSERS allocation:

Guys, the pie chart on the left, showing PSERS’s allocation from FY 2019, shows a portfolio that is over 50% alternatives.

Yeesh.

Let’s take a look at a ranking table.

Updated alternatives ranking table, FY 2019

The Public Plans Database, in their interactive data browser has the following asset allocation breakout for plans:

Traditional:

- Equities

- Fixed income

- Cash

Alternative assets:

- Private equity

- Hedge funds

- Commodities

- Real estate

- Misc. alternatives

- Other

So let’s check out who has the highest allocation to alternative assets as of FY 2019. I do have data for some plans for FY2020, but the coverage isn’t great.

Here’s what the top of the table looks like:

The full spreadsheet is here if you want to see where your favorite public pension lands.

Obviously, some of these plans have pooled their investments together, such as Arizona Public Safety and Arizona State Corrections Officers. The allocation is identical each year. For the correlations I am about to calculate, I removed those duplicates.

In some of these cases, there is data missing for that year (such as Virginia RS, which has 41.4% alts in 2017, 0% in 2018, and 43.5% in 2019… obviously the 2018 number is bogus.) I will be averaging over the data, and while that may bias results a little, I don’t think it will be a huge factor.

At the bottom of the list, there are a few plans where we don’t have their 2019 numbers in yet. Those plans will be filtered out for the correlation calculation.

Interlude: the trouble with alternative assets and public pensions

I have no issue with alternative asset classes for institutional investing. Insurers use all these types of assets in their investments (albeit at much much lower levels — but then, they also hold much lower levels of equities.)

The thing is: insurers have regulators looking over their shoulders.

Who are watching the public pension funds?

Boards of trustees, who are often political appointees or there via their elected office. Or people from the public employee unions, who do not necessarily know investments well.

So one often gets additional “oversight” from people like journalists, bloggers (howdy!), think tanks, academics, and more… working from publicly available records.

But when it comes to some of these alternative investments, there is very little transparency to people outside the investment management… and one can’t really trust that the board of directors is sufficient to keep an eye on these things.

It does not help that an institution like Calpers has had a bill being pushed through the California legislature to allow it to make more secretive investments.

Dan Walters: Pending bill opens door to pension corruption at CalPERS

Given its cavalier handling, one might think that AB 386, carried by Assemblyman Jim Cooper, an Elk Grove Democrat, is just another minor change in law. In fact, however, it would allow the financially shaky California Public Employees Retirement System (CalPERS) to semi-secretly lend out untold billions of dollars by exempting details from the state’s Public Records Act.

Potentially it opens the door to insider dealing and corruption in an agency that’s already experienced too many scandals, including a huge one that sent CalPERS’ top administrator to prison for accepting bribes.

Calpers indeed has a sketchy history re: governance. In this post from September 2020, I talk about some of their recent governance issues.

To be blunt: Calpers is a ginormous pension fund, with over $461 billion in assets as of 5/10/2021. A giant pile of money with a bunch of politicians surrounding it is just asking for trouble.

If anything, it needs more transparency, not less.

Yves Smith writes more: Dan Walters, Dean of Sacramento Columnists, Blasts CalPERS’ Corruption-Friendly Secret Lending Bill:

We wrote up last week in part because the Judiciary Committee staff took the unusual step of sharply questioning whether CalPERS could and should be trusted with the powers it would provide. CalPERS wants to make loans and be exempt from disclosure…including who got the loan, in what amount, what the terms were (such as interest and collateral). The latter is important not just to determine if CalPERS is making proper credit judgments but also to see if it is handing out sub-market loans to cronies. There’s a proud history of this sort of thing. Remember, for instance, the “Friends of Angelo” scandal, when Countrywide gave out mortgages on extremely favorable terms to powerful politicians including Senate Banking Committee chair Christopher Dodd (D-CT), and Senate Budget Committee chair Kent Conrad.

Similarly, the reason yours truly has not been an advocate of public banks is they were tried in the US and virtually all failed. Most states and even some cities had them. All save North Dakota’s were eventually shuttered due to large-scale corruption and losses. I have not seen any of the proponents of public banks in the US demonstrate any awareness of their history of becoming piggy-banks for local notables, much the less recommend how to stop that from happening again. What CalPERS is proposing is an even more degraded version of the old, crooked, insider-controlled public banks.

I barely trust any politicians to begin with, but I do not trust political players sniffing around billions of dollars with the thought they can soak the taxpayers if investments go south.

I may be a post-Vatican II Catholic, but I am well aware of the concept of “near occasion of sin”. We really shouldn’t be ramping up the temptation to corruption given the amount of money on hand.

Do alternative assets help bring in outsize returns?

So we know who has the highest allocation to alternative assets — but do they get higher portfolio returns as a result?

In 2017, I found a negative correlation between cumulative return and allocations to alternatives.

Let’s see what we have now — I’m taking a 10-year average allocation to alternative assets against the 10-year return:

And here is the 2001-2019 average annual return (geometric average, of course) against the average allocation to alternatives over the period:

In both cases, there’s a slight negative correlation… but the fit is extremely poor (as measured by R^2).

Essentially, to the extent there are performance differences, the broad variable of allocation to alternative assets makes little difference.

I’m not going to even bother showing you the other scatterplots I made regarding funded ratios and allocation to alternative assets. They were also weakly negative.

My theory was that some pension funds are chasing investment returns via alternative assets, in order to make up for eroding funding status (as opposed to, ya know, increasing the contributions more.)

But if there is a measurable connection, I’d have to measure it some other way… and keeping changing what one measures in order to shoehorn it into a theory is just not how I roll.

Increasing allocations to alternative assets do not bode well

That said, I am extremely unhappy with what is going on with allocations to alternative assets. I’m going to do a jitter plot so you can see what I’m talking about:

What you see in that graph is a data point for each of the plans I know their asset allocation for, with the median, 25th percentile, and 75th percentiles marked out so you can see the allocations increasing.

That pattern does not make me feel good.

Allocating more to alternatives doesn’t seem to get asset managers higher returns. But the group is generally sliding upwards in their allocations, and I’m very unhappy about this.

Alternative assets are “alternative” for a variety of reasons. They tend to be illiquid, and difficult to value. They may record a fair value position for the investments, but you don’t know the true value, usually, until you completely cash out from your investment. Some alternatives require a great deal of expertise to properly manage (forget about valuing). Many alternatives do not scale very well.

Because of all these difficulties, asset managers who specialize in these classes tend to charge high fees. When you look at your net result, maybe you don’t get enough outperformance to justify the risks taken.

As I mentioned above, I have no difficulty with the use of alternative asset classes in general, but a lot of people seem to think risk equates to return. Sorry, no. A very risky investment gets a low price now compared to a less risky asset with the same expected payoff. It’s not that the risky investment inherently will yield you more. It’s that the savvy investor will not bid up the current value of the risky asset above a less risky asset with similar possible payoffs.

Many public pension funds have seen their funded status eroding even for the plans that are making full contributions. Rather than rethink how they’re valuing and projecting these plans, they’d rather chase after investment returns.

Having to acknowledge they’re making very expensive promises is not an option most of them want to take. And investing in alternatives is sexy!

It’s definitely sexier than telling taxpayers (or, worse, the public employees!) they have to put in more money to the pension funds in order to cover these very expensive promises.

Selected posts on alternative assets:

May 2018: Alternative Assets and Pension Performance: A Dive into Data

August 2017: Public Pension Assets: Our Funds were in Alternatives, and All We Got Were These Lousy High Fees

June 2020: Public Pensions, Leverage, and Private Equity: Calpers Goes Bold

August 2014: Public Pensions Watch: Dallas Pension Learns About Concentration Risk

September 2014: Public Pensions and Alternative Assets: Dallas Shows How It Can End