Other People's Money: ESG, Public Pensions, and the Principal-Agent Problem

And it's really other-other people's money

Pensions & Investments: North Carolina passes Republican bill blocking ESG investments

The North Carolina Legislature passed a bill to block state entities from considering environmental, social and governance factors when making investment and employment decisions, sending the Republican-led bill to Democratic Gov. Roy Cooper.

The state Senate passed the bill Tuesday in a 29-18 vote, with all Republicans voting for the bill and all Democrats voting against it, after clearing the House in May.

Under the legislation, the North Carolina state treasurer would be able to evaluate investments based only on "pecuniary factors," which the bill text defines as factors with a material impact on an investment's financial risk and return. The bill also bars state agencies from using ESG criteria to make decisions related to hiring, firing or evaluating employees, as well as awarding state contracts.

North Carolina Treasurer Dale R. Folwell, who is also running as a Republican gubernatorial candidate for 2024, said he supports the bill.

"As keeper of the public purse, my duty is to manage our investments to ensure that the best interests of those that teach, protect and serve, as well as of our retirees, is always our focus," Mr. Fowell said in a June 6 news release.

"There is no red or blue money at the treasurer's office, only green," Mr. Fowell added.

“Pecuniary factors” is not a new term of art, by the way.

Before I start, all the disclaimers and claimers:

I am not a lawyer, enrolled agent, yadda yadda.

I am a life actuary, and I am familiar with high-level aspects of ERISA versus public pensions (which I’m about to describe) and the concept of fiduciary duty

Fiduciary Duty, ERISA, and Pecuniary Factors

This is going to be super-simplified.

The core concept is that there are agents who are acting on behalf of principals.

To make it really simple, the agents are playing with Other People’s Money.

Okay, not exactly like that. (Man, I loved the 80s. Of course, I was a little kid.)

The principal-agent problem is a tough one, as the agents tend to have the expertise, and the principals don’t.

One of the many ways to deal with this is through third-party regulation — that is, if you have a private employer and employees, you can have the government step in as a regulator to define something like fiduciary duty to align agent interests with principals.

One of the fiduciary duties, for instance, of an investment advisor for a retirement fund, would be to only consider pecuniary factors in selecting assets. As opposed to, say, the assets chosen are run by the best buddies of the investment advisor.

In the private retirement savings space, ERISA was developed and adjusted over the years. Notice I said: private. It protects employees in the private sector, whether in defined benefit or defined contribution retirement plans.

It doesn’t do crap for state and local government employees.

That’s federalism, you see. State and local government employees need to get protected by state legislatures, by having them defining fiduciary duty there.

Interlude: Cigarette Companies as ESG Champions

Washington Free Beacon: How Tobacco Companies Are Crushing ESG Ratings

S&P Global made headlines this month when it gave Tesla, the world's largest manufacturer of electric cars, a lower environmental, social, and governance score than Philip Morris International, the maker of Marlboro cigarettes.

The electric car company, whose CEO, Elon Musk, has become a culture-war lightning rod, earned just 37 points on the 100-point scale compared with the cigarette giant's 84.

ESG ratings are supposed to guide investors, and their money, toward ethical enterprises. But Big Tobacco has lapped Tesla in the ESG ratings race more than once: Sustainalytics, a widely used ESG ratings tool, gives Tesla a worse score than Altria, one of the largest tobacco producers in the world. And the London Stock Exchange gives British American Tobacco an ESG score of 94—the third highest of any company on the exchange's top share index—while Tesla earns a middling 65.

How could cigarettes, which kill over eight million people each year, be deemed a more ethical investment than electric cars? It may have something to do with the tobacco industry's embrace of corporate progressivism.

You can go to the link to see how absurd the specific scoring is (and you can decide for yourself whether Tesla should be scored higher or lower than Altria).

This is something that actually made me laugh just due to an order-of-magnitude mistake:

Update, 12:32 p.m.: An earlier version of this story incorrectly stated that Philip Morris sold six billion cigarettes last year. The correct number is 600 billion.

Somebody got a talking-to over that one.

By the way, to do a head-to-head comparison, about 1.35 million people die in vehicular accidents worldwide in a year.

That’s not exactly a fair comparison for Tesla, per se, but that gives you a starting point.

But more to the point: the investment managers are supposed to invest to support pension benefits. Is this ESG score relevant to either Tesla or Altria?

ESG Equity Returns Pre-Pandemic Were Not Great

This is from Harvard Business Review, so I assume they’re not terribly happy about this: An Inconvenient Truth About ESG Investing

In a recent Journal of Finance paper, University of Chicago researchers analyzed the Morningstar sustainability ratings of more than 20,000 mutual funds representing over $8 trillion of investor savings. Although the highest rated funds in terms of sustainability certainly attracted more capital than the lowest rated funds, none of the high sustainability funds outperformed any of the lowest rated funds.

That result might be expected, and it is possible that investors would be happy to sacrifice financial returns in exchange for better ESG performance. Unfortunately ESG funds don’t seem to deliver better ESG performance either.

Researchers at Columbia University and London School of Economics compared the ESG record of U.S. companies in 147 ESG fund portfolios and that of U.S. companies in 2,428 non-ESG portfolios. They found that the companies in the ESG portfolios had worse compliance record for both labor and environmental rules. They also found that companies added to ESG portfolios did not subsequently improve compliance with labor or environmental regulations.

….

The conclusion to be drawn from this evidence seems pretty clear: funds investing in companies that publicly embrace ESG sacrifice financial returns without gaining much, if anything, in terms of actually furthering ESG interests.

Here is something more to the point:

THAT’S NOT THE POINT OF PUBLIC PENSIONS.

The OTHER people’s money…if they’re still there

Let’s pretend that the funds did achieve improved ESG results, even though the financial results did suffer (as expected, because reducing the universe of assets from which you choose will by necessity make the optimum in the smaller set possibly smaller than the global optimum).

Huzzah! Improved social goals! Yadda yadda!

But, what’s this?

An eroding funded ratio?

So… um, we can just look to the taxpayers to make up for disappointing investment returns!

Hmmm, let’s see.

Will the taxpayers be there to fill the holes?

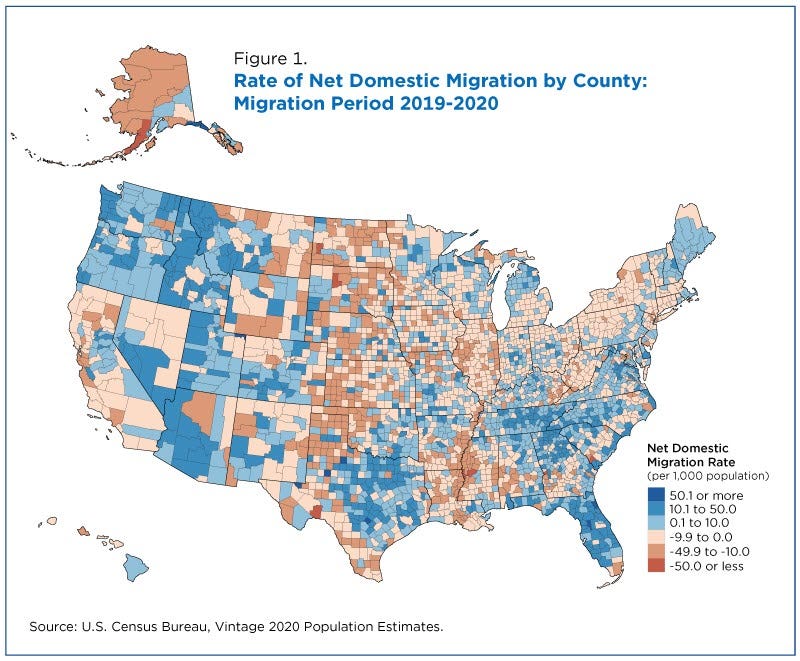

Morgan-Lewis, a law firm, has been updating a map which states have been passing legislation supporting or opposing ESG for their pension funds. I will not reproduce it, as I don’t mess with lawyers (often), but let’s just say, the states are what you think they are.

Well, California and Illinois (to name two states) — do you think the people leaving your states will make up for your pension plan losses?

Oh, and sorry my folks in Tennessee. I know the Yankees are swamping you. I can also see most of North Carolina has also been overrun. OH NO! THEY’RE INVADING AGAIN.

But look at that RED RED California and Illinois.

That means people are LEAVING.

Pecuniary Factors

Let us focus.

Public employees and retirees, more than anything else, want to make sure they get paid. If they’re not getting adequately paid during their working years, they always have options: striking or working elsewhere. They can withhold their labor, and the chances are that others will also not work for the public employers being so stupid as not to pay current employees enough.

However… retired employees can’t strike. They can’t threaten to work elsewhere.

They are really dependent on the public pension funds actually being there.

If the agents have decided to indulge themselves with ESG to give themselves the warm fuzzies, and, as a result, the investment results are deficient….where does that leave the principals?

I have held onto the example of the jerk at Calpers who said 10 years ago:

Joseph Dear, the chief investment officer of the California Public Employees’ Retirement System (CalPERS), called its green energy investments "a noble way to lose money."

The admission came shortly after CalPERS officials voted to divest from high-performing investments in companies that manufacture firearms, fueling criticism that the organization’s investment decisions are based on political factors, rather than a determination to maximize returns.

According to Dear, CalPERS’ $900 million green energy investment fund has produced an annualized return of negative 9.7 percent.

"We're all familiar with the J-curve in private equity," Dear said at the Wall Street Journal’s ECO:nomics conference this week. "Well, for CalPERS, clean-tech investing has got an L-curve for ‘lose.’"

THAT WAS NOT HIS MONEY TO LOSE.

If Elon Musk took his own money and lost it on ESG bets that didn’t work out, well, that’s on him. If he wanted to frame it as a noble way to lose money, again, that would be on him.

However, Joseph Dear took the money intended to back the pensions of California employees. And piss $1 billion away, claiming it was a noble thing to do.

I will be charitable — I think what happened was that he thought that investment would pay off, but it didn’t.

Then he decided to lie.

He tried to turn his mistake into a noble choice.

There are other ways to characterize his decision, but you know — he could just say that investments are uncertain, he thought it would do well, etc. And he was wrong.

But no, he had to claim it was a noble way to lose almost $1 billion.

Of other people’s money.

Related Posts

April 2014: Public Pensions and Blacklists: Harmful to the Pensions

Dec 2016: Calpers: Moving Targets, in More Way than One

Aug 2017: Public Pension Assets: Divestments for Everybody!

Oct 2018: Calpers Quickie: President Pushed off the Board Due to ESG Over Pension Security

Oct 2015: Public Pension Follies: Divestment! Divest from All the Dirty Things!

June 2018: Around the Pension-o-Sphere: Divestment, Janus, and More

March 2018: Divestment and Activist Investing Follies: Don't Let the Evil Ones Bank! Also more Pension Divestment Idiocy