Transcript: [this is an experiment using Dragon Speak and my own editing]

[Dies Irae chant intro]

Hello and welcome to STUMP — death and taxes

This is Mary Pat Campbell, also known as meep, the MP portion of STUMP.

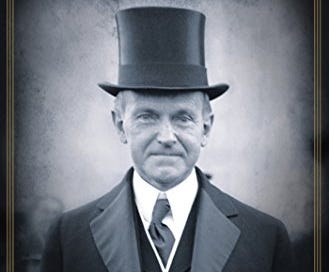

The STU part — That's the silent partner, and for today, Presidents' Day, I want to celebrate “Silent Cal” that is President Coolidge from 100 years ago.

Yes, I know Presidents' Day is about Washington and Lincoln and it got squished together in one holiday. But when you name it Presidents' Day, then I'm gonna pick the president I want. Because I'm all about death and taxes, I’m gonna pick Coolidge. And no, it's not because of death. And of course, Coolidge became president because he had been vice president to Warren Harding, and Warren Harding dropped dead. Therefore, Coolidge became president.

He also ran again under his own steam and was elected president as well. So he legitimately became president, in terms of… well, he legitimately became president in terms of — somebody died and then also I don't want to talk about Coolidge in that he died not too long after he stopped being president, which is actually pretty common historically, though not lately.

Those are the mortality aspects of the presidency. I will talk about another time, but that's not appropriate for today.

I want to talk about Coolidge because of his special way he dealt with public finance in that he made things better. That's not necessarily unique to Coolidge, but he really really focused on that. He was a post-World War I president and in the Republican Party in World War I. As was usual from wars, obviously, the government debt went up — a lot of you know a lot of expenditures occur because of a war — a lot of bonds had gotten issued, and he wanted to reduce the federal debt.

So what exactly did Coolidge do?

He was president from 1923 to 1929. Harding was elected in 1920. So he started his term in 1921, so Harding was President from 1921 until August 1923 when he died. And then Coolidge picked up in 1923, then was elected and then ran through 1929.

Okay, so what exactly was special about Coolidge.

Now there were a couple of incidents with regards to Coolidge in finance — one I remember from some Churchill biographies that I read with regards to between World War I and World War II, kind of blaming — not not exactly blaming America for Germany getting into money woes, out the hyperinflation yadda yadda between World War I and World War II — there were all sorts of problems in Europe that led to World War II …and that Coolidge supposedly retorted, “they hired the money, didn't they?” — with regards to being recalcitrant in helping the English the Europeans to refinance bonds that the maybe the American government or Americans held from World War I before America entered World War I. Now I did. I really don't think that was a deciding factor. Now, it didn't help. I agree. That said, that was more of a foreign policy thing than a public financing thing. In my opinion, so that was in it.

There was also an issue with regards to farm subsidies, so he actually Coolidge himself came from a farm family and I will read this off of the Wikipedia article. Be skeptical if you need to with regards to this quote . So supposedly Coolidge had said “Farmers never have made much money. I do not believe we can do much about it.” But that kind of attitude — not about the farm subsidies in particular, but what could the government do, and what should the government do. There's only so much we can do. Let's focus on what the federal government should be doing.

And in the case of public finance, what had happened before he became president, was that the federal government debt that had run up due to World War I, and his focus was let us get that debt down. If you get the federal debt down, that will provide more flexibility for basically the rest of the economy to be able to do stuff, because then you don't have the specter of debt hanging over it.

They really wanted to increase federal revenue, pay down that debt; they had issued a bunch of bonds so let us, but we know pay down those bonds, get that debt down. How are we going to increase revenue?

So he listened to the Secretary of the Treasury, whose Andrew Mellon, you may be familiar with that name — Carnegie-Mellon — if you Carnegie-Mellon University. You may have heard of it. The Secretary of Treasury — keep up with,, the going to put scare quotes when it can you hear it —

“Scientific taxation”

and if you hear a government — you know anybody—put slap the word “scientific” in front of a political term, be very very wary; though in this case, it actually worked out.

Now, stop me if you've heard this before. Here is the concept. If you reduce the tax rates in these, and was in the tax rates, and these are marginal rates, which I'm not about to describe right now. So if you reduce the top marginal tax rates, the tax revenue — the actual amount of money the federal government will collect from the federal personal income tax — will go up.

Remember this is in the 1920s. You may have heard about this from “voodoo economics” — Ronald Reagan era. I was a little kid during the Reagan era, but I remember that debate that “oh, if we reduce the tax rates, and we do the tax reform, that the tax revenues will go up”.

It does sound like, you know, it does sound ridiculous from a mathematical point of view. You do rates. The percentages go down, but the tax money goes up? How does that work? In the concept — If you think the incomes don't change — how would it work? it wouldn’t work. No, it wouldn’t, but so go again and read from the Wikipedia article.

Remember that Coolidge became president in 1923. Harding, who he was VP for, became president in 1921 and he ended in 1929. So by 1929 the marginal tax rate for those with incomes over a hundred thousand dollars, and I assume this was the top tax bracket, was 24% — the federal government collected more than $1 billion in personal income taxes, In 1929. And then over 65% of those taxes were collected from that top tax bracket.

In 1921, so that starting with Harding, The tax rate on peak and that top tax bracket was 73%. So 73% versus 24%, but the federal government collected a little over 700 million dollars in income taxes of which 30% was paid from that top tax bracket.

Now you could say, well, maybe it's inflation. Okay, maybe it's inflation. But maybe it's also when the tax rate is that high, when it's 73%, first you do everything to avoid legally paying those taxes.

But also when you're that rich, you also have a choice — don't work. If you know you're up that high and you're going like “Oh I could I could work hard and earn $10,000 more. But wait, 73% of it is going to government. will why do that. Let's just go take a vacation.”

And that's where it it's not that all is going to be equal, you're not going to have the same amount of income being earned.

So it is a win-win. The government gets more, people make more money because they have an incentive to make more because they keep more of it. So they keep 76% versus the government gets 76%. It's very different.

All that said, you know, you can't really give Coolidge all the credit — we like to do the Great Man Theory of history in this that or the other, it was a group effort. Obviously, it has to go through Congress, and the Republican Party was in on the deal.

It was not an all-at-once thing. It didn't go straight from 73% marginal rate to the 20 whatever, to the 24% marginal rate.

And also when I was talking about the concept okay, you get more revenue. It's a little more obvious when you have just an egregiously high tax rate like 73%. When we’re tinkering at say 24% versus 26% versus 30% versus 15%. There is a point past which obviously it is not going to have a huge amount of effect on the amount of income people are going to make, and the government will have less revenue at a certain point when you drop tax rates. You know. People are going to do their thing, and inflation and other things will also have effects. So sorry — that's real life. It gets messy.

I like Calvin Coolidge as a person, and I think he had an interesting life. And he did other things before he was president. Alas, he didn't do a lot after he was president because he died in 1933, as I said a lot of presidents used to die., well, not only in office, but soon after leaving office. People didn't live very long, especially men, back in the day.

So I hope you enjoyed this.

This is been a little experiment. I don't know if I'll do more of these podcasts but we’ll see and try to do a transcription will see how that goes as well

So hope you enjoyed this, see if I can find the little clip of Dies Irae to go along with my death and taxes theme and hope to see you next week with another one, we’ll see how it goes

[end of Dies Irae chant]

I also recommend Amity Shlaes’s biography on Coolidge:

No, it’s not an academic biography (which one reviewer seemed to have expected, for some reason). It’s intended for people who want to know what he was like as a person, as well as to get an idea of some of his policies.

I think it’s a good idea to look at what the politics were like 100 years ago, but you need to not impose current concepts on them first. Compare/contrast is useful, and I especially like making compare/contrast for public finance.

![Coolidge by [Amity Shlaes] Coolidge by [Amity Shlaes]](https://substackcdn.com/image/fetch/$s_!nhxw!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fc93464eb-46a9-4872-903b-3a0ab454f91c_329x500.jpeg)

Share this post