Ohio STRS Drama Continues: CIO and Acting Executive Director Resign... In Time for Retirement from Ohio PERS

Also, prior activist director's term runs out, a vote-of-no-confidence fails in a tie, and potential increase in employer contribution rate

Sorry, while Stu’s radiation treatment was going on, there was some pension governance drama in Ohio. Let me catch you up.

26 Sept 2024, ai-CIO: STRS Ohio CIO, Acting Executive Director Resign

Matt Worley, CIO and deputy executive director of investments of the State Teachers Retirement System of Ohio, and Lynn Hoover, its acting executive director and CFO, both submitted their resignations to the system’s board on Wednesday.

Worley’s and Hoover’s resignations are effective March 31 and December 1, respectively, a spokesperson for STRS Ohio confirmed to CIO.

March 31…. of 2025?

That’s quite the lead time. But we will see the reason for these in a moment.

Lynn Hoover picked the December 1, 2024 date because it’s tied to years of service for retirement eligibility:

“I am writing to inform the board of my plan to retire on December 1, 2024, as Chief Financial Officer and Acting Executive Director,” Lynn wrote in a letter to the board. “I will have 31 years [of service] by that date, and I am incredibly thankful to have had the opportunity to serve Ohio’s educators over the majority of my career. I had planned to work until June 2025; however, the events of last week have led me to reevaluate and announce my retirement.”

Matt Worley, who picked the later date of March 31, 2025, chose his date for the same reason, it looks like:

“I am writing to inform you of my decision to retire from my position as Deputy Executive Director, Investments and Chief Investment Officer,” Worley wrote in his resignation letter. “My last day will be March 31, 2025, and my first day of retirement will be April 1, 2025. As I approach 31 years this coming March, I have been reflecting on the honor and privilege to be a part of STRS Ohio’s journey.”

Both decided to resign not only because they were eligible for retirement, but also after the cost-benefit analysis of doing the job for the offer put forth from the board in terms of incentives.

I will get to those details in a bit — some are old, and some are new.

Wade Steen Out; Prior Executive Director Out

But first, let me back up a week to the regular board meeting from last week, decisions made, things that came into pass that were already expected, some that were unexpected (including the above), and then some comments about Ohio STRS’s next steps.

Lynn Hoover is (currently) the acting executive director. She has been in place while the prior executive director was out while under investigation for various accusations… and it seems that he and the board has come to an understanding:

Morgan Trau at News 5 Cleveland, 20 Sept 2024: Chaos-filled day at Ohio teachers’ pension board leading to even more ethical concerns

It was the expected final day for the State Teachers Retirement System (STRS) board member Wade Steen, but the unexpected dismissal of Executive Director Bill Neville. The day also included an attempt to silence and condemn STRS staff, which failed. As if that wasn't enough — a document I obtained has led to renewed calls for a state investigation into possible ethical violations.

….

It is the end of an era for STRS.

"It's bittersweet — I'm not going to be able to be their voice anymore, so I'm going to miss that," Steen said.

During the full-day long meeting, retirees celebrated Steen — bringing him two separate cakes, balloons, cards and picture frames of him.

This was a disappointing day for retired teachers like Robin Rayfield.

"The best friend any teacher ever had is Wade Steen," Rayfield told me.

Steen was Gov. Mike DeWine’s appointment to the board, but now his chaotic term is finished.

The controversial figurehead had become the leader of the reformers.

After growing wary of Steen's relationship with QED, the governor removed Steen from the board in 2023. Steen sued and a judge reinstated his position in April of 2024.

Then came the whistleblower documents and Yost's lawsuit.

I am going to hold off on linking to the prior posts re: the lawsuits involving Wade Steen. Some are over, some are ongoing, and the ones that are ongoing will be back soon enough.

Wade Steen’s stint on the board is over for now. This was expected, so no big deal.

Moving on to the prior executive director issue:

Rayfield has argued that the real ethical problem is with the former executive director. Neville had been on paid leave for nearly a year while a law firm appointed by Yost investigated allegations of violent outbursts and sexually explicit language.

Last February, the law firm found that many of the claims were unsubstantiated; however, he did have a record of raising his voice, according to the firm.

However, in a near-unanimous vote, the board chose to move forward with an end-of-employment agreement. Steen abstained from voting.

I requested the agreement, but STRS said it hadn't been signed yet, so their legal team did not have it.

Trau did a followup on 24 Sept 2024: Head of Ohio retired teachers' pension fund gets $1.65 million to leave

The former executive director of the Ohio retired teachers' pension fund has received more than $1.65 million to leave the position.

William "Bill" Neville will no longer be working with the State Teachers Retirement System (STRS) effective Dec. 1, 2024. His departure comes after a near-unanimous vote on Friday when the STRS board chose to move forward with an end-of-employment agreement.

Neville had been on paid leave for nearly a year while a law firm appointed by Attorney General Dave Yost investigated allegations of violent outbursts and sexually explicit language.

Last February, the law firm found that many of the claims were unsubstantiated; however, he did have a record of raising his voice, according to the firm.

As a New Yorker, that people are getting het up that he raised his voice… how very midwestern of y’all.

Trau had this piece dated 26 Sept: Both acting head and CIO of Ohio retired teachers’ pension fund resign amid controversy

With these specific details:

The day after an exclusive 45-minute interview with me, State Teachers Retirement System (STRS) Acting Executive Director Lynn Hoover has resigned effective Dec. 1. Chief Investment Officer Matt Worley has also resigned effective March 31.

Both letters to the STRS board came Wednesday evening. Despite requesting to hold off on sharing the information until Friday, the details were leaked to me Thursday morning.

I reached out to STRS, and their spokesperson confirmed the resignations. I am awaiting responses to my questions and records requests.

….

By resigning when they each hit 31 years, they can collect pensions from the Ohio Public Employees Retirement System (OPERS).

….

In my interview with Hoover, we talked about the state of the fund, investment growth and the ongoing controversy — but what she didn't tell me is that she would be resigning the day after our interview.

Both senior and junior staff members immediately reached out to me after this story was published Thursday morning, saying it was a surprise for them, too.

So what happened? Well, on Tuesday, she told me that last Friday hit her hard.

A board member proposed a vote of no confidence for the "direction" that the STRS staff members were going, arguing that they lied to try to get Steen in trouble because they were corrupt.

"It feels like a slap in the face," Hoover told me.

The vote of no confidence went 5-5, so it was “just” for show. But it was an indication of where things could go in future meetings.

This is not what you’d want to be dealing with indefinitely.

It’s all about the COLAs

Whether you’re new to this issue, or you know about this, the core issue is that cost-of-living-adjustments (COLAs for short) have been suspended for Ohio STRS since 2017.

The reason is due to the state of the funding level, part of which is due to low contribution levels.

I did notice the following from the September 2024 Board News:

Employer rate increase initiative: STRS Ohio staff updated the board on the initiative to seek an increase in the employer contribution rate. Since January, the Governmental Relations team has had more than 60 meetings with legislators and staffers to discuss the possibility of sponsoring a bill to increase the employer rate to 18% phased in over eight years. A web page will be publicly available on the STRS Ohio website with more background on why this increase is needed.

This is really what is needed to get the COLAs back.

Ohio STRS Stats quick look

Just grabbing from the Public Plans Database entry for Ohio STRS.

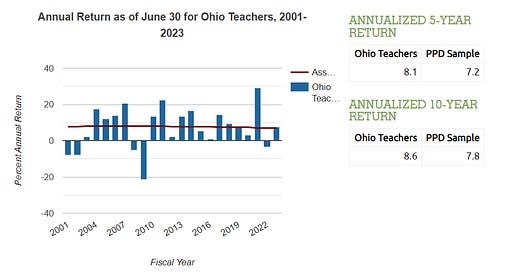

The investment experience of Ohio STRS has been fine.

I will explain this graph in a different post (I’ve mentioned it before), but the only reason the low contributions are “full” contributions are due to the lack of COLAs right now.

I see from the September News: [emphasis added]

Chief Actuary Donald Schley reviewed the history of the supplemental benefit payment that retired members received every year from 1980 to 2000. STRS Ohio paid a total of $700 million over those 21 years, which is a $10 billion impact to assets in today’s dollars due to the effects of lost investment income and compounding.

The Retirement Board can approve a supplemental benefit when certain financial thresholds are met pursuant to Ohio law. Calculation of the possible benefit is based on a recipient’s years of service and years of receiving benefits and would be a different amount than a monthly benefit check. If paid, a supplemental benefit payment would reduce the amount available for board spending in the spring from the Sustainable Benefit Plan.

In October, the board’s actuary will complete the pension actuary valuation, then staff will complete the calculations and a determination can be made regarding a supplemental benefit payment. The board will then decide at its October meeting whether a supplemental benefit will be paid this December.

Alas, this sounds like infamous “13th checks”.

Any supplemental benefits given to retirees remove assets from the retirement funds, which men’s foregone investment returns for future benefits.

Comparing Ohio STRS to Ohio PERS

I thought to do a quick comparison of Ohio STRS funded ratio to Ohio PERS:

Ohio PERS retirees get automatic COLAs, but STRS retirees do not.

And the funded ratios in those graphs reflect the COLAs, whether they have them or not.

If the OPERS retirees did NOT get COLAs, the funded ratio would be much higher.

If STRS had COLAs, the funded ratios for their graph would be much lower (take a look at 2012).

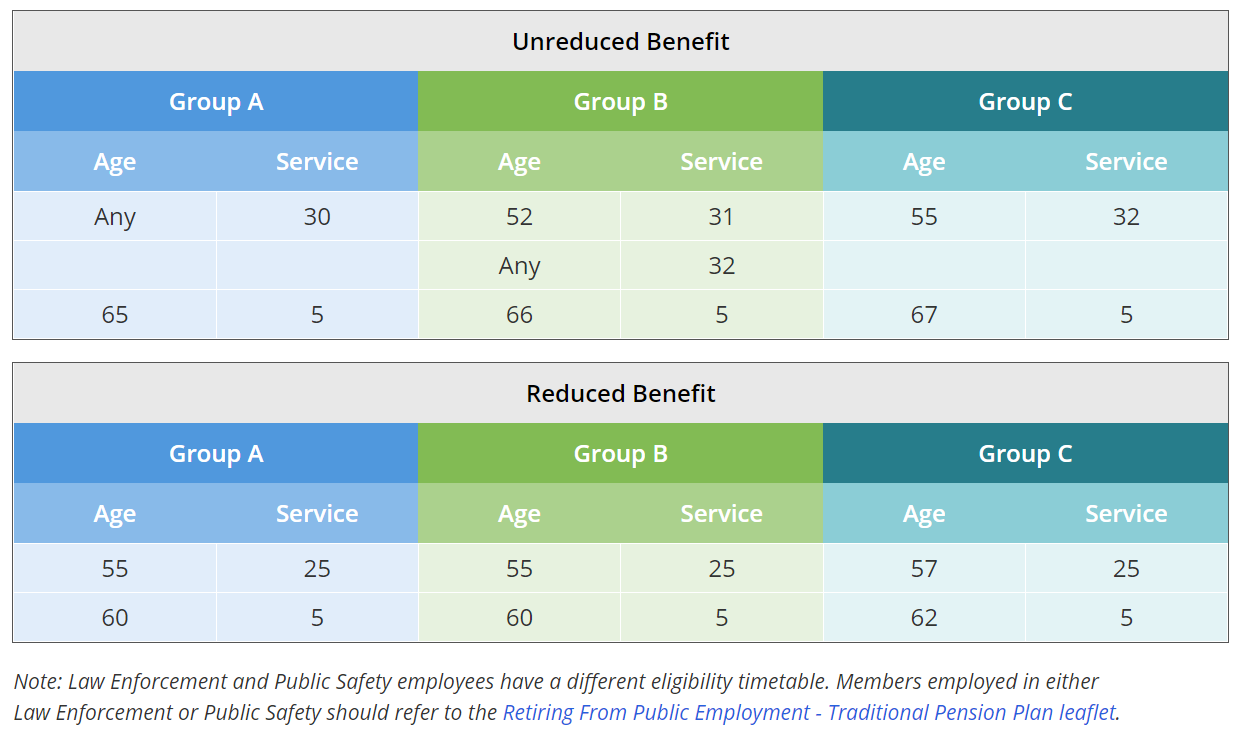

Also, I noticed that OPERS and STRS have different retirement age eligibility requirements.

Given the resignation announcements, both Hoover and Worley must be over age 55 and in Group B.

Ohio STRS had a change in retirement age eligibility: Retirement Eligibility Changes Announced (Effective June 1, 2024)

The current retirement eligibility rule requiring 34 years of service for an unreduced retirement benefit under the Defined Benefit Plan has been made permanent. The requirement was previously scheduled to increase to 35 years of service on Aug. 1, 2028. Eligibility for a reduced retirement benefit has been lowered to 29 years from 30 years of service. The current eligibility for reduced retirement at age 60 with 5 years of service remains the same. This improvement of the retirement eligibility requirements means that some members will be eligible for a reduced benefit at an earlier age. Effective June 1, 2024, eligibility criteria for unreduced and reduced benefits are as follows:

So that’s a bit different as well.

To be sure, I’m not comparing contributions made, what the benefit formulas are, yadda yadda. These are different retirement systems.

It’s just interesting that the Ohio STRS employees are in a retirement system different from the one they’re managing the funds for. A whole principal-agent problem… again.

Other coverage

I do like to go to Morgan Trau as she gets interviews with major players and has been up in this. But obviously, this is big news in Ohio and in the pensions world.

So here is a quick round-up of other outlets: (P&I may be paywalled for some people)

Statehouse News Bureau, Karen Kasler: Top executives at Ohio teachers' pension fund announce exits, continuing chaotic year at STRS

Pensions & Investments, Rob Kozlowski: Ohio State Teachers' top executive and CIO both submit resignations

P&I, Rob Kozlowski: Departing exec director Bill Neville and Ohio STRS agree to $1.65 million buyout

ai-CIO, Matt Toledo: STRS Ohio CIO, Acting Executive Director Resign

Toledo Blade: Editorial: Use STRS town hall well

STRS Ohio Watchdogs: "What are we doing wrong?"

13ABC, Alexandria Manthey: Teachers raise concerns over STRS pension fund

From this last one (26 Sept 2024):

However, the biggest concern for many retired teachers is the cost of living increase they were used to getting each year.

“Last year I got a 1% increase,” Hudson said. “That is an insult.”

In 2017, the Board took away the yearly increase, but since then they’ve passed both a 3% adjustment and another 1%. But, some retired teachers say it’s still inconsistent in their checks.

“We’re just trying to live, and live as comfortably as we can,” retired teacher from Washington Local Schools, Patricia Carmean said. “Without a cost of living, I don’t know what’s going to happen to many people.”

Hudson said he taught for 27 years, and when he retired was promised an increase in the cost of living each year. He says STRS didn’t deliver on their promise.

Another concern is the Employer Rate Increase Initiative. If passed, it would change the 14% rate that employers pay into the pension to 18%, causing concerns that school districts won’t be able to make it up without levying taxpayers.

Okay, y’all — if you want the COLAs, you’re going to need higher contribution rates. There are trade-offs here.

COLAs increase the benefits paid, and accumulate — even if you’re not doing regular compounding of COLAs, it increases cash flows out, which means if you want a sustainable situation, you need to increase the cash flows going in.

Unfortunately, many of the retirees and active employees in the system seem to think there is a magic solution in the investments that will get them the desired result with increased contributions… which is how we got into trouble with alternative investments in other pension funds. That’s why so many public pension funds have been increasing their alternative allocations: they want higher returns and do not want to ask for higher contributions.

It’s not been working out very well.

The lifetime income promise and the automatic COLA promise are, together, expensive, which requires fairly high contribution rates during one’s working life. Sure, if one could guarantee 8% returns, it would be a lot easier, but one can’t guarantee such returns.

Ask Dallas Police and Fire how that one turned out.

It sounds like the Pied Piper on this one is advocating some sort of leveraged strategy, and perhaps the damage would be limited if they screw it up, but leverage can be very dangerous, depending on how it is deployed. It’s just a different kind of alternative.

So we will see who comes in next as CIO and executive director (acting or whatever). The long lead time of these resignations give the board time to find people more to their liking, and, more to the point, people who will be able to deal with how the board has been behaving.

Several public pension funds have had issues in the past in finding executives, such as Calpers, when they have had politically touchy issues to deal with (such as ESG and divestment). This is how you end up with people who lie about their qualifications or have conflicts of interest in these spots. Good luck in your search!

Prior Ohio STRS Posts

6 May 2024: Public Pension Governance Drama in Ohio

10 May 2024: Ohio Pension Drama Continues: Investigation Called on "Hostile Takeover"

16 May 2024: Ohio State Teachers Pension Drama Continues! Board Turmoil!

17 May 2024: More Ohio STRS Commentary: Alternative Assets in Pensions, Anonymous Memos, and Teachers Pensions in General [corrected/updated on May 22]

1 June 2024: Corrections and Clarifications on Ohio STRS: Audits and Investments

27 June 2024: Ohio STRS Drama Continues: No Bonuses and Board Member Resigns

15 July 2024: Ohio STRS Update for 15 July 2024: More Legislative Action, Advisor Resignation(s), Research on Public Pension Asset Returns

18 July 2024: Ohio STRS: Trade-Offs, Alternative Assets, and More

28 Aug 2024: Ohio STRS Drama Continues: Subpoenas Filed Against Some Board Members

Timing is critical?