Update on Dallas Police and Fire Pensions: Continuing to Limp Along and Asking For Over $1 Billion

A return of the black hole plan

I had thought the Dallas Police & Fire pension saga had been put to bed. But a recent post by Ted Siedle brought it to my attention that they’re still asking for loads of money to fill their hole.

Dallas Morning News: Staggering taxpayer cash infusion suggested for Dallas Police and Fire Pension fix

Dallas city leaders Thursday received options from actuaries on how to fix enormous unfunded liabilities in the Dallas Police and Fire Pension Fund.

Councilmembers were told a $1.3 Billion cash infusion from taxpayers would set the fund on a much better course, but the total unfunded liability is still $3 Billion.

No one knows where the city can find the kind of cash that was suggested.

….

Police and fire retirees receive no cost of living increases until 2073 and current employee retirement benefits are at risk without major changes to the Dallas Police and Fire Pension Fund.

….

A major increase in employee contributions and a reduction in benefits was part of the 2017 pension fix approved by the Texas Legislature.

There are hundreds fewer employees contributing to the fund than the city counted on.

“One of our issues is we expected that our payroll would go up more than it actually has,” City Councilmember Kathy Stewart said.

For those new to this story, let me bring you up to speed.

Dallas Police & Fire: The Backstory

I last looked in on Dallas Police & Fire in 2017, when the supposed fix was in.

Here are the links [in chronological order]

Aug 2014: Public Pensions Watch: Dallas Pension Learns About Concentration Risk

Sept 2014: Public Pensions and Alternative Assets: Dallas Shows How It Can End

November 2016: Dallas Police and Fire: The Pension that Ate Dallas

December 2016: Dallas Police and Fire Pensions: Beyond the Event Horizon

Jan 2017: Dallas Police and Fire Pensions: Pulling into the Abyss

March 2017: Pensions Catch-Up Week: Dallas Police and Fire

May 2017: Catch-Up Week: Dallas and Houston Pensions – Still A-Roar

June 2017: Houston and Dallas Pension Bills Signed: Now What?

So that’s the whole megillah — but let me give you the nutshell.

Dallas Police & Fire had embedded an insane promise: a fund that promised 8% returns to participants (for voluntary savings) that the retirees could withdraw as a LUMP SUM. That’s on top of regular retirement benefits.

This caused all sorts of problems.

One problem was the actuarial math such that, even with an 8% discount rate, the required contribution rates were quite high.

From the November 2016 post, Dallas Police and Fire: The Pension that Ate Dallas:

The bar was the amount the employers “should” have been paying — about 30% of payroll.

And contrast that against the yellow line, which was the average required contribution for the U.S. for similar sorts of plans (safety officers).

Yeah.

Updated Data to 2021

That was from a post 7 years ago.

Here is the current Public Plans Database page for the Dallas Police & Fire fund.

Something strange is going on there… but that may be related to the changes as noted above. That lump sum benefit was stopped… for new people. But there still was an overhang for the older employees.

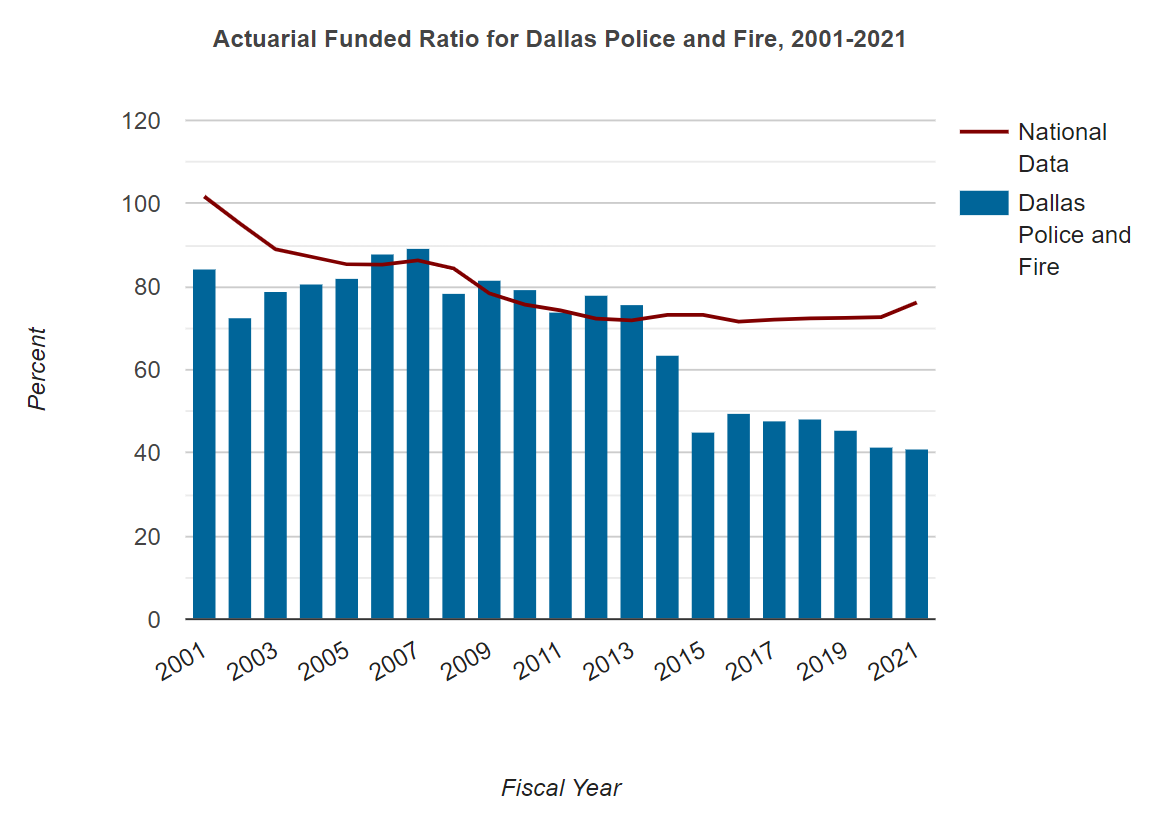

Let’s check out the funded ratios.

The big drop in funded ratios relate to the asset problems I covered earlier (the real estate investments mentioned earlier… and private equity).

But, unsurprisingly, funded ratios did not do much better.

Now they’re in Chicago territory.

Current Fixes?

As mentioned, Ted Siedle brought recent developments to my attention.

Siedle, as he always does, advocates for an asset-side audit. The problem is, that the asset-side shenanigans started decades ago,we all know about it… and so what?

What are you going to do about it now?

As I wrote back in August 2014, I commented on concentration risk in the assets:

Many (most) public pensions have their fiscal year go from July 1 to July 1, so a bunch of financial results come out during July and August. I’ve not been running the stories about “Oh, we had very good results this past year, well above our target return”, because that’s a bit beside the point. The entire market had a good year. Even bonds did well.

But the Dallas Police and Fire Pension Fund did not do well (and the guy in charge, longtime administrator Richard Tettamant, was ousted before this was disclosed, but it was known to be bad as noted above.)

So what sunk the fund? If it couldn’t get above target in a good investment year, that means something had to have performed extremely poorly.

….

Two investments — almost half of the private equity holdings. And private equity is 19% of the portfolio.

Yes, the real estate also went down, but I can’t get away from this. Almost 9% of the portfolio was two underperforming assets. That’s called concentration risk.

That was for fiscal year 2014. The real estate holdings would tank even more soon enough.

We already know these things.

A huge reason the high-risk asset-side strategies were pursued was to try to support the 8% return guarantee (with lump sum withdrawal option.)

No, they weren’t successful.

Maybe… the “guarantees” should not have been made in the first place.

Recent Asset Returns and Allocations

I do see issues with asset-side management for Dallas Police & Fire in recent years, but Siedle is going to have to explain why the vanilla equities/bonds are evil compared to alternative assets now:

Dallas Police & Fire have no hedge funds, private equity, or other general alternative asset classes.

But their 5-year returns leave much to be desired:

I guess they’re missing out by eschewing that sweet, sweet private equity.

Not sure why they’ve missed the post-pandemic recovery. Something may be going on.

Sustainability is the point, not blame

Trying to focus on the blame for something that happened over a decade ago is not helpful now.

The whole point is to set up a sustainable retirement system.

Pension promises are meaningless, if they’re not going to be fulfilled.

The Dallas Police & Fire participants do have some retirement benefits “guaranteed” — but no inflation-adjusted benefits for decades. Because that’s a very expensive guarantee.

Taxpayers may be willing to pony up contributions for their safety officers, if they see the promised benefits as reasonable for the services rendered, and that they also recognize those who have rendered services in the past were promised certain benefits and those need to be paid for.

If there is serious asset management underperformance, that needs to be looked at by trustees. This is not necessarily an audit issue — sometimes people are just unskilled at what they do. And they need to be replaced.

But all of the assumptions need to be questioned when you are considereing whether the pension system is sustainable.