Ohio STRS Update for 15 July 2024: More Legislative Action, Advisor Resignation(s), Research on Public Pension Asset Returns

Don't assume that the issue is asset-side shenanigans, as it may all be a wash

I will focus this post on news updates for Ohio STRS since my last post (and the list of Ohio STRS posts will be at the bottom of this one).

My next post/podcast will be focused on the research I will link here, as it is related to some of the claims being made around the proposed asset strategy going forward, that supposedly would yield better returns than the current strategy.

Ohio Legislative Action (or Proposed Action) on Ohio STRS

Ohio State Representative Proposes Consolidation of State Pension Systems

ai-CIO, 12 July 2024:

Controversy continues to roil the State Teachers Retirement System of Ohio, and the fund’s board is divided between two factions, including a reformer faction that wants to switch the fund’s assets to passive index funds.

The reformer faction also seeks to implement more cost-of-living adjustments for fund beneficiaries and is critical of tens of millions of dollars set aside for investment staff bonus compensation, something the board of STRS rejected for fiscal 2025.

At a Monday meeting of the legislative oversight agency, the Ohio Retirement Study Council, state representative Phil Plummer proposed consolidating the five major state pension systems in response to some of the STRS governance issues.

The council advises the state legislature on benefits, funding, investments and administration of the plans, which include: the State Teachers Retirement System of Ohio, the Ohio Public Employees Retirement System, the School Employees Retirement System of Ohio, the Ohio Highway Patrol Retirement System and the Ohio Police & Fire Pension Fund.

….

Bethany Rhodes, director and general counsel of the Ohio Retirement Study Council, noted that any merger of the pension funds would look more like a receivership, in which the board of one pension fund would run the others. “If you were to put STRS with PERS, the PERS board would effectively run STRS, until such time as they can be merged in,” Rhodes said.

The Pension Plan Database adds plans by size (these have been added manually, so they prioritize). The Highway Patrol plan is much smaller than the other 4.

As big as Ohio STRS is, Ohio PERS is even larger in terms of number of participants and assets.

No legislation has been introduced to merge the systems. A spokesperson for SERS Ohio told CIO the proposal is unnecessary, as “the problems [the] proposed solution seeks to address do not exist at Ohio SERS,” the spokesperson said. “Our financial condition is solid. We have reduced liabilities and improved our funded status. And we have not requested, and do not need, additional employer contributions. There is nothing broken at SERS that needs to be fixed.”

Ohio SERS is even smaller than PERS and STRS. They would rather not lose their autonomy because STRS cannot keep it together.

Following the reinstatement of Steen to the board, STRS investment consultant Aon abruptly resigned. STRS board member Steve Forman, a reformer, resigned at the end of June, following a meeting of the STRS board.

Additional: [covering the same issue, in a different tone]

8 July 2024, News 5 Cleveland: Ohio lawmakers propose removing board members from teachers’ pension fund amid controversy

Ohio lawmakers are the latest to join the governor and attorney general in trying to prevent reform-minded educators from taking control of the retired teachers’ pension fund. They have proposed removing the elected members from the board.

This comes as the state alleges the State Teachers Retirement System board leaders are involved in a public corruption scheme.

In a meeting Monday [July 8], the Ohio Retirement Study Council (ORSC) discussed solutions to the "STRS turmoil," as co-chair of the committee state Sen. Mark Romanchuk (R-Ontario) called it.

You can read more by Morgan Trau there.

Ohio STRS Resignation

Another one, that is.

Chaos continues with Ohio teachers’ pension fund as second advisor quits

15 July 2024, Ohio Capital Journal:

A second major consulting group has quit working with Ohio’s controversy-ridden retired teachers’ pension fund, another blow to the already chaotic system.

….

McLagan, a data and analytics company, had been providing compensation advice and research to STRS.

“While we appreciate the opportunity to provide STRS with compensation advisory services under a new SOW, we are unable to assist at this time with the request for the July 19, 2024 Board meeting,” McLagan said in a July 10 email we obtained.

A special board meeting had been scheduled to go over compensation on July 19.

“McLagan has partnered with STRS for over 20 years and we will continue to support STRS with respect to past deliverables if there are any questions with respect to McLagan’s work,” the exit letter states.

Although the company did not provide any reasoning, it should be noted that they specifically consulted on performance-based incentives (PBIs). In June, the STRS board blocked staff from getting these PBIs, which can be referred to as bonuses.

Oh, about that July 19 Board Meeting:

Public meeting notice for July 19, 2024

The State Teachers Retirement Board will convene a special meeting at the STRS Ohio offices, 275 E. Broad Street, Columbus, Ohio 43215. Level A of the STRS Ohio parking garage will be available for visitors to park free of charge. If those spaces are filled, nearby public surface lots, parking meters and garages are available for a fee.

Not news, but I will not be there.

But you can check some of the topics of discussion, such as:

Performance-Based Incentive (PBI) Discussion*CE

Audit Committee Composition

Audit Committee Meeting (30 Minutes)*

Investment Committee Meeting (1 Hour) - Agenda Topic: Reference Benchmark

I will note that PBI discussion counts as board continuing education credit. Hmmm. I wonder if it would count as continuing education credit for me?

(note: it would not count as continuing education credit for me. Though I would find it very interesting.)

Acting Executive Director Message

I’ll link to this in this post, and will address a few items in the upcoming podcast episode:

10 July 2024: STRS Ohio Update From Acting Executive Director Lynn Hoover

I am dedicated to conveying your perspectives with legislators, State Teachers Retirement Board members and other stakeholders. STRS Ohio staff has ongoing conversations with state lawmakers and will provide legislators with all requested information as they continue their discussions about governance of the pension system. I am committed to working together, which is paramount for our system as we move forward. Active teachers have described their current classroom environment being dramatically different from when they started teaching. The retirement system’s benefit changes — which were needed for the stability of the fund — have created hardship for some of our members; and retirees on a fixed income have been hit especially hard.

Compounding this hardship, misinformation about STRS Ohio has caused frustration, uncertainty and fear for our members. It is disheartening that society is filled with polarizing views on about every aspect of our lives, and your pension fund is unfortunately no different. I encourage you to be thoughtful and selective in how you obtain information about STRS Ohio.

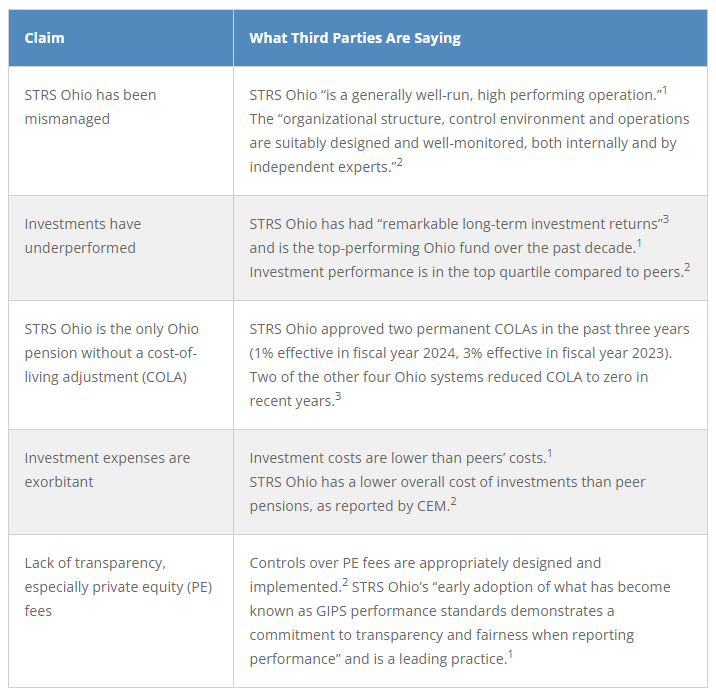

Here are some comments that I’ve heard that can be answered in the following chart:

The three sources she links to are these:

1Fiduciary Performance Audit From Funston Advisory Service

2Special Audit from the Ohio Auditor of State

3Ohio Retirement Study Council Historical Experience Report

I will have my own comments later, but it’s not about the truthfulness of the above statements.

In the meantime, let’s go to academic research on public pension investments, related to all the above, which I will be using in my future podcast episode.

Asset Return Research from Boston College

How Do Public Pension Plan Returns Compare to Simple Index Investing?

June 2024, by Jean-Pierre Aubry and Yimeng Yin

Key Findings:

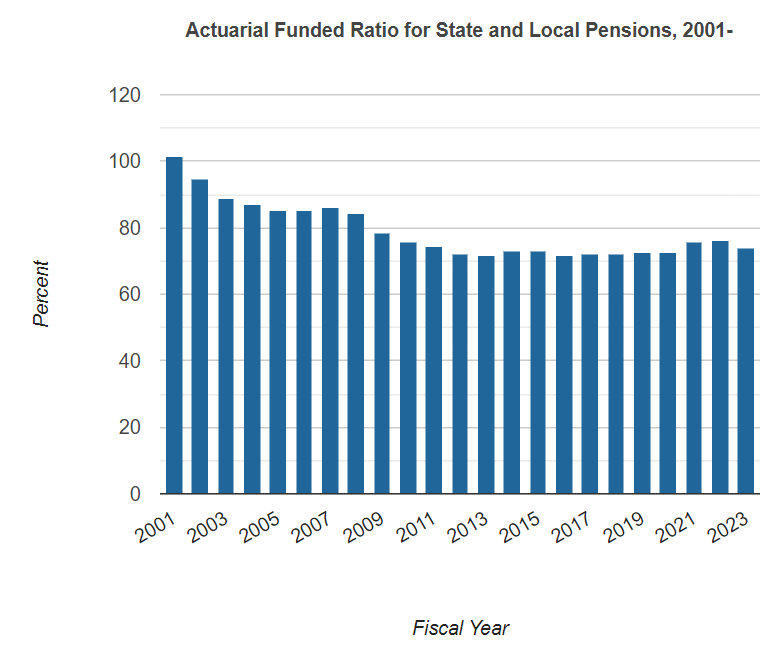

Public pension plans are increasingly relying on alternative investments and active management.

But how does plan performance compare to a simple 60/40 index over various periods from 2000-2023?

Over the full period, plan returns are virtually identical to the simple index strategy, but plans have done much worse since the Global Financial Crisis.

If the current approach doesn’t yield higher long-term returns, a strong argument can be made for sticking with a simple, transparent strategy.

Here are the key graphs from the report:

In Figure 1, one sees an increasing allocation to “alternatives” as fixed income and traditional equities (aka publicly-traded stocks) decreased as a percentage of public plan portfolios.

This is what I have graphed, too. (I will add 2023 in my podcast update)

Next figure:

This graph compares the performance of the PPD “portfolio” against a 60% equities/40% fixed income indexed portfolio.

I will do a deeper dive as to what this means in the podcast, but for the time being, note that for the full period, there’s essentially no difference. Three basis points per year over 24 years does not make a big difference.

It’s not why we’re seeing this:

More on that another time.

Prior Ohio STRS posts

(update a little late)

6 May 2024: Public Pension Governance Drama in Ohio

10 May 2024: Ohio Pension Drama Continues: Investigation Called on "Hostile Takeover"

16 May 2024: Ohio State Teachers Pension Drama Continues! Board Turmoil!

17 May 2024: More Ohio STRS Commentary: Alternative Assets in Pensions, Anonymous Memos, and Teachers Pensions in General [corrected/updated on May 22]

1 June 2024: Corrections and Clarifications on Ohio STRS: Audits and Investments

27 June 2024: Ohio STRS Drama Continues: No Bonuses and Board Member Resigns