Corrections and Clarifications on Ohio STRS: Audits and Investments

Special audit, diversification, and investment/ALM

Well, this is interesting.

I updated the prior post here after getting some information:

UPDATED 5/22/2024: More Ohio STRS Commentary: Alternative Assets in Pensions, Anonymous Memos, and Teachers Pensions in General

Yesterday was the second day of the Ohio STRS board meeting, and let me remind you of the story thus far: [skip to the next section if you know the history] Ohio teacher retirees have had no cost-of-living adjustments since 2017, which make active and retired teachers unhappy

But I thought I’d bring this to the fore, pull out some details, and make further comments.

WARNING: This is very much getting into the weeds for the core of this post. This is not “fun” for most people, but this is the sort of thing I do think about often, and it is important.

I will be making additional remarks at the end as to why I feel this is important, in addition to the driving factors in general. I am focusing solely on Ohio STRS in this post, but there will be so many more that will be pulled up in disputes like this in the next decade, and yes, I mean the next decade.

Special Fiduciary Audit

In my post on Ohio STRS from May 17, I misunderstood what type of audit was required of the pension funds in Ohio, and had not been done in the time required.

The normal, annual audits of the pension fund financials have been done every year, and you can see them in the yearly reports compiled on this page:

Let us look in on the 2023 Annual Comprehensive Financial Report, and you can see the independent auditors report on numbered pages 8 and 9 (pdf pages 11 and 12), Crowe LLP. The auditors’ opinion reads:

This is the audit of the financial sTtatements, and one should read this carefully to see what is and is not included in this audit. For example:

Other Information Management is responsible for the other information included in the annual report. The other information comprises the Introduction, Investments, Actuarial and Statistical sections but does not include the basic financial statements and our auditor’s report thereon. Our opinion on the basic financial statements does not cover the other information, and we do not express an opinion or any form of assurance thereon. In connection with our audit of the basic financial statements, our responsibility is to read the other information and consider whether a material inconsistency exists between the other information and the basic financial statements, or the other information otherwise appears to be materially misstated. If, based on the work performed, we conclude that an uncorrected material misstatement of the other information exists, we are required to describe it in our report.

So note what they are not opining on.

You can go back to prior ACFRs and see that there is an independent auditors’ report for the basic financials each year. That has not been lacking.

Within the 2023 ACFR, you will also see this:

Auditor of State Completes Special Audit of STRS Ohio

In December 2022, the Ohio Auditor of State’s office released the report of its special audit of STRS Ohio. The special audit’s findings include, “STRS’ organizational structure, control environment and operations are suitably designed and well monitored, both internally and by independent experts. These experts help assure that STRS follows applicable asset and liability measurement, reporting, investing and cash management laws, professional standards, and best practices. Our conclusions are consistent with the findings of these independent firms.”

The special audit’s findings were also consistent with those of a fiduciary performance audit, commissioned by the Ohio Retirement Study Council, completed earlier in fiscal 2023 by Funston Advisory Services LLC. The fiduciary performance audit found STRS Ohio is operationally excellent with effective operational policies and processes.

This is from numbered pages 5-6 (pdf pages 8-9). This is part of the special audit described.

So there are two pieces to this special audit.

There is the Auditor of State report, found here: https://www.strsoh.org/_pdfs/board/State_Teachers_Retirement_System_of_Ohio_Special_Audit_Report_FINAL.pdf

There is Funston Advisory’s fiduciary audit, found here: https://www.orsc.org/Assets/Reports/1503.pdf

This is the special audit that had not been conducted in many years.

From the Funston report, numbered page ii (pdf page 3): [I added emphasis]

The Ohio Legislature codified the fiduciary audit pursuant to R.C. 171.04(F), “the ORSC shall have a fiduciary performance audit conducted by an independent auditor at least once every ten years of each of the state retirement systems.” We consider the ORSC code to be a leading practice as a mechanism for state oversight of public retirement systems due to its ongoing requirement, as opposed to episodic involvement in many states, as a continuing source of independent reassurance regarding actuarial, investment, and fiduciary performance for the five state systems.

A fiduciary audit was conducted in 2006 and an actuarial audit in 2009. The 2022 fiduciary audit was commissioned by the ORSC through a competitive process that selected Funston Advisory Services LLC (FAS) to perform the audit. The actuarial review is currently underway. Future fiduciary audits and actuarial reviews should be more timely.

According to that language, the fiduciary audit was overdue by 2016.

So yes, this was an oversight and the pandemic has nothing to do with it.

Purposes and Kinds of Audits

There are different purposes for the annual audit of the ACFRs and these special fiduciary audits.

Let’s look at what the Funston report has: (numbered page iv, pdf page 5)

The Purpose of a Fiduciary Audit

Independently assess whether STRS’ current governing statutes, policies, processes and practices enable fiduciaries to fulfill their duties to prudently direct, oversee and ensure effective control of the system. Such an assessment provides reasonable, but not absolute, assurance.

The annual audit concerns whether the balance sheet and income statement numbers are accurate. It’s not a deep dive into oversight and processes.

That’s what this fiduciary audit is about.

The review covered multiple areas, and I don’t particularly want to look at all of these:

(same page as above)

FAS was asked to review six main topics:

1. Board Governance and Administration

2. Organizational Structure and Staffing

3. Investment Policy and Oversight

4. Legal Compliance

5. Risk Management and Control

6. IT Operations

Let me focus simply on the investment policy and oversight for now, and then maybe drop back to the board governance issues.

Investment-Related Findings from the Funston Report

First, very high-level — the fiduciary duties aspect of the board:

I have made the comment myself — there is nothing particularly extraordinary about Ohio STRS assets, especially compared to other public pension funds.

In the report, from the executive summary section: (numbered pages xv-xvi, pdf pages 16-17)

Essentially, they are doing what all the other public pension funds are, but not just with respect to public pensions, but institutional asset management as well.

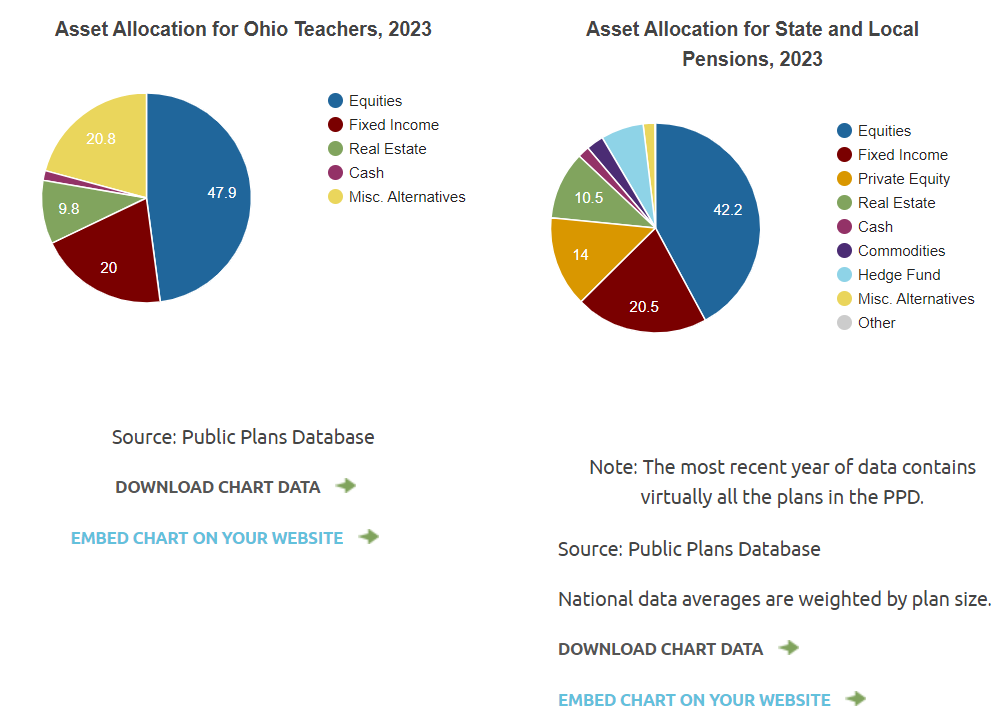

What I see in the Public Plans Database shows the same thing, with regards to investment results:

And the asset allocations are actually not that different:

The “misc alternatives” for Ohio STRS matches up pretty well with, well, miscellaneous alternatives of hedge funds, commodities, and private equity in the overall database. It’s a matter of categorization, really.

Stakeholder Input

One of the interesting aspects of the Funston report is that they did acknowledge the driving force of the dispute: mainly, the retirees and current employees: (numbered pages xix/xx, pdf pages 20-21 — I have a recommendation: start pages at 1, and go from there. None of this “preface numbered pages, etc.” crap. I’m tired of it.)

They also include a narrative (beginning on numbered page vi/pdf page 7) about the history of funded status, how COLAs were cut, and why Ohio STRS participants are really unhappy with all this.

Tough Choices and Difficult Results

Just a short bit from the narrative re: Ohio STRS funding status and the cutting of COLAs (cost-of-living adjustments):

In 2017, the actuary estimated there was a 48% chance the system would be less than 50% funded at some point in the next 10 years. In April 2017, the STRS Board made the difficult but necessary decision to reduce cost-of-living increases granted on or after July 1, 2017, to 0%. This action had the effect of preserving the fiscal integrity of the retirement system, keeping STRS within the state of Ohio’s 30-year funding target and the retirement board’s own funding policy target.

STRS was not alone. NASRA reports nearly every state has modified public pension benefits or financing arrangements, or both, since 2009; lowered benefits; increased employee contributions; generally shifted risk from employers to employees; increased use of hybrid retirement plans; and allowed a limited increase in use of defined contribution plans.

This is a large simplification of what has occurred.

There have been some changes across many states, and the severity of the changes for current employees (and certainly current retirees) has differed greatly.

In some states, the benefits have not been reduced for retirees and employees. Contributions from employees have not been increased. (Benefits for new employees, however…)

In those states and municipalities, the contributions from taxpayers generally have increased… but that’s getting strained.

But the problem is, for the states and municipalities where the benefits have not been reduced, and the contributions from employees have not been increased… the likelihood of fund failure has increased.

So the core problem Ohio STRS has is the same one many public pension plans have: the old promises they have made are really expensive.

Some have tried to get around this issue by increasing the risk in the asset portfolio, and Ohio STRS is solidly at the median for the allocation here.

Others have ramped up the contributions to cover the expense.

Others have reduced the benefits, in terms of what had originally been expected, as with the Ohio STRS COLAs.

But for some plans, they’re just hoping someone will bail them out, because otherwise they will not be able to pay benefits as they come due. And yes, we’ve had examples already of plans where payment failure has occurred.

There is no backstop for public pensions other than the local taxpayers when the funds run out. If the taxpayers couldn’t support the required contributions, they probably can’t support the benefits when funds run out.

So yes, it is very uncomfortable not to have COLAs.

But it is even more uncomfortable not to have even the base benefits you were expecting.

With significant inflation, most calculations of what is needed for constant purchasing power in the future become about as stable as the nuclear reactor in the #4 unit at Chernobyl, Ukraine. Yesterday, I saw an episode of Perry Mason (1959) where a management executive at an exclusive clothing designer company was asked what he salary was, she replied: "$150 per week, i.e., $7,800 per year. I wonder what such a person would have had for a pension from that income to last 15-20 years of retirement? What happens when the tax base shrinks?