Taxing Tuesday: Bad Ideas French Coalition

They may find out that voting a pony for yourself doesn't work really well

You know, it’s supposed to be summer and lazy times, but for some reason, everybody has been scheduling important electoral events lately. The first U.S. presidential debate, the UK parliamentary election, and then the one-two rounds of French parliamentary elections.

I’m not going to get into the razor-thin coalition put in place by tactical voting.

I just want to talk about their stupid fiscal/tax ideas.

Let’s get into it!

Stupid French Fiscal Policy, Take N

Leading British Conversation: France’s new left-wing coalition reveals plans to introduce a 90 per cent tax on the rich amid shock election result

France’s new left-wing coalition has announced plans to include a 90 per cent tax on the wealthy after winning the most seats in Sunday’s snap election.

The New Popular Front (NPF), a coalition of different left-wing groups, sent shockwaves through French politics over the weekend after winning more seats than both Ensemble, the party of Emmanuel Macron, and Marine Le Pen’s far-right National Rally.

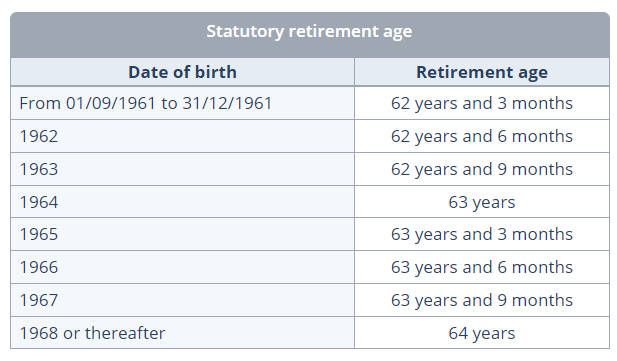

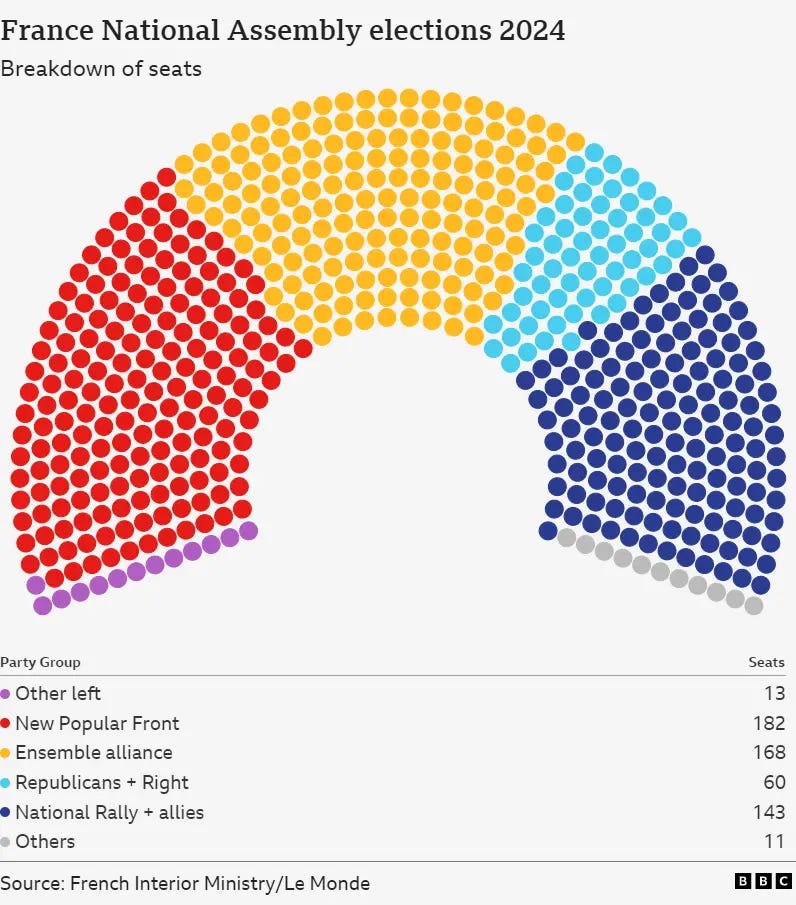

However, despite winning the most seats at 182, the NPF did not win a majority and is set for a power struggle with Macron in the coming days.

The NPF’s leaders met on Monday to agree upon who they should put forward to lead their proposed new government.

“We are preparing to govern, to apply the programme which is ours,” said Manuel Bompard, co-ordinator of the France Unbowed party.

….

This programme looks set to include 90 per cent tax rate on annual income of over €400,000 as well as the slashing of retirement age from 64 to 60.

The NPF is also committing to at least €150 billion in spending over the next three years and calling for a 14 per cent rise in the minimum raise.

Yeah, that should be real fun.

I am going to focus on those two items:

decrease the retirement age from 64 to 60

90% tax rate on incomes above €400,000

Because they’ve both been around before, failed as policies, and now are being brought back by the leftist parties. Macron is not going to go for these.

French Retirement Age Redux

Here are my prior posts on the French retirement age: (in chronological order)

January 2023: Retirement Age - Protests in France, But Choices Must be Made

Feb 2023: French Retirement Ages, Social Security Benefit Cuts to Come, and What is Sustainable

Apr 2023: The French Continue to Protest Over Retirement Age Changes

Here is the short version of what was going on above: [but you can click through to get the details]

France had an absurd full retirement age (under conditions) of 62 up until recently

France actually is one of the longest-lived groups in Europe

France is also one of the highest-taxed countries in Europe and deep in debt

Macron basically had to force through a bill to raise the retirement age to 64 in 2023 through parliamentary tricks

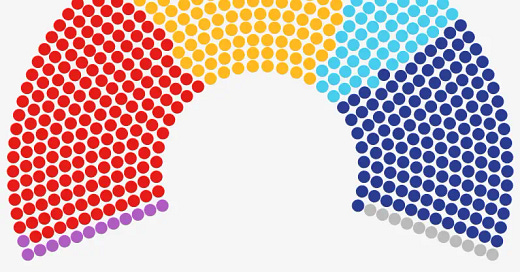

In 2023 (and before), there had been a lot of protests in France specifically against raising the retirement age to 64. Here’s how the retirement age currently goes:

This leftist party which now claims to be in control (though it does not have a majority and who knows if it will be able to hold a coalition together) wants to push the retirement age back down to 60.

Back down? Oh yes.

In 1983, Francois Mitterand set the retirement age down to 60 (being a good socialist and all), from the prior age of 65. It stayed at 60 for a good long while, until it was pushed up to the unconsciable level of 62… in 2010.

Before the French protests over retirement age in 2023, there were the protests of 2010: France's Perpetual Revolution

The French have a long tradition of taking to the streets as an irrational answer to economic reforms. In 1848, when a democratically elected government tried to contain monetary inflation, the nascent Socialist Party raised barricades in Paris. Alexis de Tocqueville, then a member of the parliament, wrote in his "Memoires" that the French knew a lot about politics and understood nothing about economics. The current disruption of French cities by strikes and riots illustrates the continuity of this political culture.

The pretext for the current "social movement," as we call it in French, is a perfectly rational initiative by President Nicolas Sarkozy to raise the legal age of retirement to 62 from 60. It had been lowered to 60 from 65 in 1983 by the socialist François Mitterrand. Going up to 62 is thus a modest return to sanity: 62 happens to be the average in the European Union.

The author of the op-ed had an optimistic end:

To conclude that France never changes, however, would be slightly mistaken. In spite of a Napoleonic right and a Marxist left, the French economy has become much more market-oriented than it was 20 or 30 years ago. The best and the brightest now want to become entrepreneurs, not top bureaucrats. Such an evolution was not desired by political leaders but instead has been forced on French society through the liberating influence of globalization and the European Union. This confrontation between Mr. Sarkozy and the unions doesn't mean much compared to those historical trends.

Ooooh, Guy Sorman, I have some bad news.

(jumping from 2010 to 2024)

There are 577 seats total. To control parliament requires 289 seats… which no one party has.

NPF are the leftists with the stupid retirement age and high-income-tax ideas. (And price controls and high minimum wage.)

Ensemble is Macron’s group. Centrists, I suppose.

National Rally is the ultra-right-wing party of Le Pen.

So perhaps the NPF should be pulling back on their grand stupid ideas.

France’s Prior Wealth Tax

Just quickly, because this has always come up on STUMP in light of attempts to bring in a wealth tax in the U.S.

Also, a wealth tax is not the same as a very high marginal tax rate on income past a certain level.

2019: Taxing Tuesday: Let's Soak the Rich...Hey, Where Are They Going?

Before I begin with the tax stuff, I feel like preening for a moment: one of my most useful skills is that I can learn from other people’s mistakes. I can watch someone do something ill-advised, see the result, and then say “Hey, I don’t need to try that out! That’s going to end in disaster!”

To be sure, I’ve made my own mistakes because I haven’t seen everybody else’s mistakes. But I’ve watched things happen directly, and I’ve read news and history books and been able to draw some conclusions.

2019: Taxing Tuesday: Spitting in the Wind in Illinois, I Hate the NY Legislature, Stupid Tax Ideas, and More

More than a dozen European countries used to have wealth taxes, but nearly all of these countries repealed them, including Austria, Denmark, Finland, France, Germany, Iceland, Ireland, Italy, the Netherlands, Luxembourg, and Sweden. Wealth taxes survive only in Norway, Spain, and Switzerland.

Before repeal, European wealth taxes — with a variety of rates and bases — tended to raise only about 0.2 percent of gross domestic product in revenue, based on Organization for Economic Cooperation and Development data. That is only 1/40th as much as the U.S. federal income tax raises.

….

In the 1970s, the British Labour government pushed for a national wealth tax and failed. The minister in charge, Denis Healey, said in his memoirs, “We had committed ourselves to a Wealth Tax; but in five years I found it impossible to draft one which would yield enough revenue to be worth the administrative cost and political hassle.”

That was not by me, but by Chris Edwards at National Review.

The U.S. used to have marginal income tax rates topping 90%, for what it was worth.

In the “golden era” of the 1950s/early 1960s.

Let’s see what resulted from all these large rate differences!

It’s not a zero correlation, but I wouldn’t build a model based on this data.

This is all to say… multiple countries are having a competition over the most messed-up election results and scramble for power.

France, you’re in the running!

The French will "kill the goose that laid the golden egg" as far as producing wealth and actual tax revenue. Plus France's debt levels are very high, not a good sign for the future.