French Retirement Ages, Social Security Benefit Cuts to Come, and What is Sustainable

il y a plus d'une façon de tuer les vieux....

Let us check in with France as it seems they’re on round 4 or 5 (for this season) of protesting raising the retirement age from 62 to the unconscionable decrepit age of 64 years.

WSJ: French Workers Hold Fresh Strikes Against Macron’s Pension Overhaul

Thousands of people went on strike and took to the streets Thursday to protest French President Emmanuel Macron’s plan to raise the country’s retirement age, turning up the pressure on his government as parliamentary debates over the measures intensify.

For the fifth time in four weeks, teachers, train drivers, nurses, oil-refinery staff and other workers marched in demonstrations from Paris to Marseille. The protests are aimed at pressuring the Macron government to reverse a plan to raise the retirement age to 64 years old from 62 by 2030.

The protests have shaken support for Mr. Macron’s plan in the National Assembly, France’s lower house of parliament. A handful of lawmakers from Mr. Macron’s party, Renaissance, and its centrist allies have threatened to vote against the pension bill. Conservative party Les Républicains remains divided over the proposed measures, with some members tacking to the left of Mr. Macron and demanding more exceptions to the retirement-age increase.

The French are Revolting!

Let’s get some background. I found some Wikipedia pages for the “seasons” of pension reform strikes/protests that are all related:

There were also strikes in 1995, but that wasn’t strictly about general pension reform (though one group was grumpy about a proposal about losing the right to retire at age 55).

One of the main issues is that noted French politician François Mitterrand had dropped the full retirement age down to 60 years back in 1983, which was an absurdly low level even then. Before Mitterand’s move, the retirement age had been 65 years, which was pretty standard across OECD nations (more below).

Over time, they managed to move the full retirement age back up to 65, but there was an early retirement age of 62 — similar to the earliest age one can claim Social Security old-age benefits.

That said, longevity for the French has been extending, just as it has in the U.S. and other developed nations.

Comparing longevity in retirement

But the main problem, of course, is that France has an absurdly low age at which one can take a fairly substantial retirement benefit, and while the U.S. has bumped up its full retirement age for my generation (Gen X) and younger folks to 67 years old, the French are still providing substantial pensions for many at age 62 and having a full retirement age at 65.

I found a paper comparing OECD systems from 2011, so the data are a little dated. Some of the countries profiled have changed their “pensionable ages” since 2011, especially given the Global Financial Crisis of 2008-2010.

However, here is a selection of some of the OECD countries, plus the OECD average, with the male life expectancy from pensionable age (as this tends to be lower than the female life expectancy).

France really is the highest in the entire OECD group. You can see the point at which the pensionable age was dropped to 60 and then slightly adjusted to 62.

But while France has a severe problem, note the OECD average and all but the UK line, are generally increasing. (Though, in reality, due to bad mortality trends in the USA since 2011, and I’m not talking about the pandemic…. that’s for another time….)

Basically, France has the most acute issue in terms of how long these retirement cash flows are expected to last.

But pretty much all the OECD countries have an issue…. like the U.S. and Social Security.

Social Security is also a problem, but not an acute problem yet

This is being hyped up right now by Biden with respect to his budget battles (or, rather, debt limit battles) with House Republicans.

Reason: Social Security and Medicare Cuts Are Coming, Whether Politicians Do It or Not

President Joe Biden tweeted last week that he will be a "nightmare" for Republicans who dream of cutting Social Security and Medicare. With this statement, Biden showed that he's either shockingly ignorant about these two programs and any Republican reform efforts—or lack thereof—or just another politician who washes his hands of what happens when he's out of office and the programs hit upcoming obstacles.

I have an idea which one it is. However, before revealing my guess, it's worth revisiting the issue more fully. Each time I write about Social Security and Medicare, newspapers receive letters to the editors revealing how little the general public understands about entitlement spending and where it's headed. This misunderstanding is particularly acute and ominous when it comes to Social Security.

….

Consider Social Security. The program is funded by a payroll tax of 12.4 percent. The revenues collected don't belong to the workers except in the sense that paying taxes makes us eligible to receive Social Security when we retire. But these revenues don't go into accounts with our names on them. Instead, they are used to fund payments made to current retirees. It's a pay-as-you-go system, not an investment account. In the former, adjustments are sometimes necessary.

….

Consider again Social Security. Right now, benefits paid out come from the payroll tax as well as money borrowed by the Treasury. Why does the Treasury do that? Because Social Security has a trust fund with about $2.6 trillion in IOUs that it can redeem when the payroll tax isn't covering all the benefits. That's been the case since 2010.

….

Biden—who's spend a half-century in the Beltway and knows how this works—unwittingly used the right word to describe his intention to block to Medicare and Social Security reform. By not acting, benefits will be cut without any possibility of sheltering those seniors who are poor. The nightmare looms for them.

So, I will say that Rugy (the author) overstates the case.

First, it’s not clear to me that Biden knows anything intellectually at this point other than Medicare/Social Security is a useful political bludgeon.

Second, the Trust Fund is not projected to officially run out for several more years. The automatic cuts won’t kick in for about a decade (unless Congress does something totally nuts). I doubt Biden will be around to do anything about it then, just as I considered the Dianne Feinstein announcement that she would complete her term to be a bit presumptuous.

In all these cases, people talk about benefit cuts, but there is more than one way to cut benefits, you know.

Macron is talking about benefit cuts in France by raising retirement ages, and various proposals are out there to reduce Social Security benefits for those who have lots of assets (aka means-testing). These guys are saying to abolish Social Security entirely, and I’m semi-on-board — I think what is sustainable is welfare for seniors.

Years ago, I had talked with an actuary who used to work at the Social Security Administration who pointed out the whole point of the program, initially was to prevent senior poverty. Well, let’s go back to that sole goal.

But there’s more than one way to cut benefits….

More than one way to shorten the amount of benefits

Here’s an “innovative” idea via the New York Times:

Yeaaaaah.

But if you’ve heard about Canada’s MAID program, you might understand why you may be hearing more and more about these type of solutions….

These… uh… [okay, I need a thesaurus, because this is going to walk a very fine line on taste]…. ultimate ways to close out a series of cash flows, and shorten that life expectancy past pensionable age.

Okay, what I’m saying is that dead people are very inexpensive, especially when they’re no longer the source of taxes, but rather pulling out precious taxes in the form of Social Security, Medicare, and Medicaid.

Back in 2014, I responded to Zeke Emanuel’s infamous “I hope to die at age 75” piece with this: Diversion: Who Was Doctor Death Really Targeting With Death at Age 75 Goal?

First, Dr. Emanuel is one of the Emanuel Brothers – his two other famous brothers being Ari and Rahm. Ari Emanuel, Hollywood Super Agent, had a character based on him in the HBO series Entourage. Rahm Emanuel is a Democratic politician who had worked in both the Clinton and Obama administrations, and is currently mayor of Chicago.

….

maybe he was trying to be nice to his brother.

After all, public pensions are a huge problem for Chicago. Maybe Rahm is tempted to do a Daley and stick in office — Richard J. Daley was mayor of Chicago for 21 years and son Richard M. Daley was mayor for 22 years (had to stick it out to beat dad, didn’t ya).

If so, then Chicago pensions are a problem Rahm has absolutely got to deal with in a long-term way. If public pension retirees died at age 75, as opposed to ten years later (which is closer to the “real” life expectancy of retirees, as opposed to life expectancy from birth – but more on that in a later piece), a lot of the public pension problem would be solved.

Similarly, if old people could be convinced that life simply isn’t worth living past age 75, as opposed to living past age 85 as most of them do… well, that Social Security cash flow problem isn’t so much of a problem anymore, is it?

I saw the theme again in December 2020: COVID News Round-up: Suicides, Increasing Deaths, Duty to Die, and Dolly Parton

But back to the story sent to me, from 1984: Lamm: we all have a ‘duty to die’

Yeah, this is something that not only sticks in my craw, but cannot be dislodged via any surgical instruments one can bring to bear.

….

Ex-Governor Lamm is not a Boomer, having been born in 1935, but he wasn’t that old in 1984. Going to the Wikipedia article on Lamm:

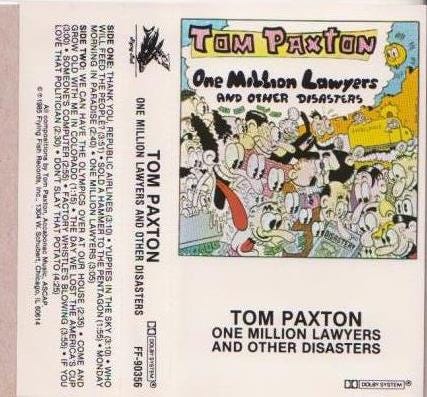

In 1984, his outspoken statements in support of physician-assisted suicide generated controversy, specifically over his use of the phrase “we have a duty to die.” Lamm later explained that he “was essentially raising a general statement about the human condition, not beating up on the elderly,” and that the exact phrasing in the speech was “We’ve got a duty to die and get out of the way with all of our machines and artificial hearts and everything else like that and let the other society, our kids, build a reasonable life.“His dire predictions for the future of social security and health care (“duty to die”) earned him the nickname “Governor Gloom”. His views were satirized by noted folk singer Tom Paxton in January 1985.

The Baby Boomers should be expecting to hear more and more of this talk, as the Social Security Trust Fund runs out.

Once upon a time, the Boomers were the biggest voter group, and pandered to, but they’ve been dying off so much as they age, the Gen Xers, we Baby Busters, actually outnumber the Boomers in the millions right now:

Yes, the Millennials outnumber we Gen-Xers, but that’s just fine.

I’m just pointing out that the bars drop off rather steeply as you climb the age groups, and as the money crunches, and people have been taught material comfort being their highest value…. (which probably was not a good idea, doncha think)… some people may bring up a duty to die again.

To be sure, there will be other standard choices — means-testing on benefits, benefits cuts, tax increases, retirement age increases, plus the hidden taxes and hidden cuts to make reductions more palatable.

But don’t assume that it will only be the “nice” choices on offer.