Last Friday in France, the Constitutional Council gave Macron the go-ahead on his fait accompli (and that’s it for the French in this post, other than the French terms that have snuck in the normal Norman way into our language) of switching the official retirement age in France up from 62 years old to 64 years old. Things are moving ahead.

The Hill: France’s Macron signs controversial bill raising retirement age

France’s retirement age will increase from 62 to 64 despite broad and violent protests against the measure, which was pushed by French President Emmanuel Macron.

Macron signed the controversial bill into law Saturday after France’s high court approved the increase on Friday. The government plans to implement the bill by September.

….

Polls have consistently shown that a majority of French people do not support the measure, which Macron says is necessary given the aging population of France.

….

Opponents of the bill, including multiple unions, have already committed to massive protests for Labor Day, May 1.

You do that.

As I have noted before, the French are long-lived, and already highly taxed:

And their fertility levels, while high compared with the rest of Europe, are no great shakes:

No matter how the short-term politics shake out, the long-term demographic reality is going to have the effect that no, you’re not going to have a cushy state-sponsored retirement at age 62.

Let’s check in with other countries.

Social Security Full Retirement Age in USA

There are a variety of Hokey Pokey politics with Social Security going on right now, as with this opinion poll from the end of March:

The Hill: Almost 8 in 10 would oppose raising full Social Security retirement age: poll

Nearly 8 in 10 Americans said in a new poll that they would oppose the federal government raising the full retirement age for Social Security from 67 to 70.

In a new Quinnipiac University poll published Thursday 78 percent of respondents said they would oppose the move, while 17 percent of those surveyed said they would support it.

I actually clicked through to the poll to see how the question was actually worded.

45. Would you support or oppose raising the full retirement age for Social Security from 67 to 70?

Now, this question isn’t misleading. Most people do know you don’t have to wait until age 67 to start taking Social Security benefits. So they’ll understand full retirement age isn’t about being eligible to take benefits.

(But many may not have known that 67 years old is the current full retirement age.)

But most people don’t know all the consequences of changing the full retirement age. And I still bet many people might think that eligibility is somehow involved.

Evidently, if people said they opposed raising the full retirement they were asked an additional question:

When asked whether they would support raising the full retirement age for Social Security from 67 to 70 if it meant that benefits would last longer, 62 percent of respondents said they would still oppose the measure, while 30 percent of those surveyed said otherwise.

So that’s a bit of a change in results. Not enormous, but still a change.

However, when you say “retirement age” to most people, they don’t think “It affects how much I get”, they think “When am I allowed to retire?”

And that is several different ages for different things, even for federal law issues:

Age 59 1/2 years for being allowed to withdraw from tax-deferred accounts without tax penalties for retirement income

Age 62 for Social Security old age benefit eligibility

Age 65 for Medicare medical benefit eligibility

Then there are ages where you are forced to do certain things, such as required minimum distributions from tax-deferred accounts (and that age has been pushed up. It used to be 70 1/2 years old.)

The “full retirement age” for Social Security old age benefits has multiple effects, none of which is one’s eligibility for the benefits themselves. It affects the benefits you receive in terms of what age you start taking benefits and the difference between that age and the full retirement age.

If you started taking benefits before your full retirement age, and you continue working… yeah, your benefits will be reduced. It’s all based on the full retirement age.

Yes, it’s complicated. It’s not intended to be easily understood.

But by changing one number, it does adjust benefits downward to make the program sustain for longer.

However, the politics don’t work well because of two things:

You change “full retirement age” and people hear “I have to wait longer to retire” (they should, to be sure, but that’s not exactly what this means anyway)

While longevity is increasing in the U.S. generally, it is the people getting the highest benefit levels living longest… and yes, people do know that. So simply saying “People are living longer”, well, we know that some people are living longer than others.

So touching “full retirement age” in isolation is bad politics.

Things can be done, though.

The Effects of Expectations

No, I’m not going to talk life expectancy in this post.

One of the effects of setting an “expected” retirement age is that people expect to retire around that age. To be sure, reality will retire you at some point, whether you like it or not. But check this out:

Of course, some of this is a result of men not living much past age 65 in early years, so yes, labor force participation rates for age 65+ is going to be pretty high when most of that population is in the age 65 - 70 bucket. Not many age 80+ men back in 1850.

The Social Security Administration was formed during the FDR Administration in the Great Depression, and the first monthly old age benefits were paid out in 1940:

Payment of monthly Social Security benefits began in January 1940, and were authorized not only for aged retired workers but for their aged wives or widows, children under age 18, and surviving aged parents.

Maybe that explains the dip in labor force participation rates in 1940.

To be sure, many people retire as soon as they are “allowed” to, but also there’s a matter of what’s “expected” in society.

As noted above, in the U.S., there are multiple ages of relevance to retirement, but one of the biggest ones is the “full retirement age” for Social Security. Many people still take benefits before then, but it does give people the idea that there’s an expectation of older and older retirement ages.

European Retirement Ages and Lengths

Euronews: Pension reform in France: Which countries have the lowest and highest retirement ages in Europe?

In France, the current early retirement age stands at 62 years of age for both men and women. In fact, 62 is the early retirement age in almost half of the countries, including Sweden, Portugal, Norway, Italy, Greece, and Austria.

Actual retirement ages are more varied compared to early retirement ages and closely reflect the mandatory retirement age. For men, it ranges from 52 years in Turkey to 67 years in Norway and Iceland.

For women, it is 49 years in Turkey, whereas Norway and Iceland have the highest retirement ages of 67 years.

…..

The gap between women and men in expected years of retirement varies from 2.0 years in Ireland to 7.5 years in Cyprus.

By 2020, European women typically can expect to live 4.3 years more than men after they exit the labour market.

While the EU average is 4.6 years, in France, the gender gap stands in favour of women by a total of 3.6 years.

Interestingly, life expectancy in retirement for both highly varies across Europe. For men, it ranges from 14 years in Latvia to 24 years in Luxembourg.

For women, it varies from 18.9 years in Latvia to 28.4 years in Greece. Women are expected to have 26 years or more to spend while retired in Belgium, France, Greece, Italy, Luxembourg and Spain.

I’m not putting in all the countries.

These expected times in retirement are a combination of the official retirement ages and the average age at which people actually retire (if you read the piece, for all I’ve been going on about the retirement age of 62 years in France, few people actually retire at that age).

Obviously, there is a sex gap in longevity, and some of the gaps are because women often retire at younger ages than men do.

Think France Has An Issue? Check Out China

WSJ: China Is Facing a Moment of Truth About Its Low Retirement Age

China has one of the lowest retirement ages among major economies. Under a policy unchanged since the 1950s, it allows women to retire as early as at age 50 and men at 60. Now, local governments are running out of money just as a wave of retirees hits. That is leaving Beijing with little choice but to ask people to work longer—a move economists say is long overdue but one still likely to meet with resistance.

I know the Chinese aren’t short-lived.

China has seemed to be on the verge of changing the retirement age for years, but has let several deadlines pass without coming up with a plan. However, economists and demographers say Beijing may finally take action this year, as the economy is starting to recover and as Xi Jinping has secured a third term as China’s leader—which makes a politically unpopular move less perilous for the Communist Party.

Many countries face similar struggles. French President Emmanuel Macron’s push to raise France’s retirement age elicited weeklong protests. Like China, the U.S. is facing demographic headwinds with the cost of its Social Security system starting to exceed its income in 2021.

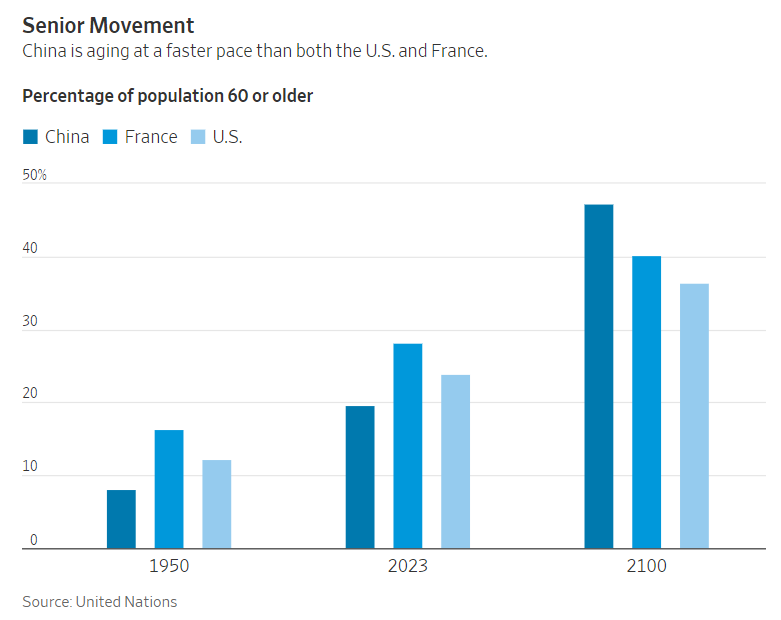

But China is aging at much lower income levels and at a much faster pace than France and the U.S. One result of its one-child policy, in place for decades before being scrapped in 2016, is a dwindling number of women of childbearing age and a generation of only children who are less eager to marry and start a family.

Not having so many babies? Really? That’s having an effect?

During the pandemic, Vivi Shi, now 46, closed her construction business in Wuhan and started living off a pool of state pension payments, private savings and investments. “All of a sudden nobody was working, and it felt OK to not be working your tail off,” she said.

So, she’s younger than me, and maybe she’ll be able to make it work (and yes, I noticed she was from Wuhan).

But it reminded me of a few of my fellow Gen Xers who had struck it big fairly young, with their first start-up or employee stock options, and thought “Hey! I can retire super early!”

And then realized they had to make these assets persist through decades… especially as inflation didn’t stay low…..

[and then got back into the game]

Retirement Age: Policy Choices Have Consequences

“Retirement age” is a term that does a lot of heavy lifting in public policy.

It can mean the earliest age of eligibility to take tax-advantaged distributions from savings.

It can mean when one is forced out of certain jobs.

It can be a parameter in a benefits formula, which has other effects, such as adjustments if you delay taking benefits beyond that age, or taxation of benefits, or other such situations.

It can mean a societal expectation, and it might have gendered aspects, which will have effects on what people will do.

But in many cases, there is a political angle, where people don’t want to deal with the trade-offs between people living longer then having to pay for the benefits being promised without changing the various retirement ages.

If those retirement ages aren’t changed in policy while the real longevity trajectories change — well, there will be problems.