Three tales of accountability… or lack thereof. I start with a “heartwarming” tale of a supposed Excel error - $92 million error - that becomes an opportunity to strengthen the corporate team… yay! (That’s not exactly what happened, FWIW.) The second one is from Liz Farmer and involves a Virginia town with finances in a mess. And the third… is really big. But shouldn’t surprise anybody.

Episode Links

Liz Farmer’s substack

I was not realizing this story is free to all:

Here is a quote from this free story:

A commonality with all the fiscal distress laws I’ve reviewed is that decisions are to be made for the sake of the health, safety and well-being of residents. When a locality is chronically unable to manage its finances, it endangers vital public services and puts residents at risk.

But state takeovers can go horribly wrong. In Michigan, studies have shown that the wide-ranging authority of the emergency manager law and the resulting lack of accountability of the manager in place in 2014 contributed directly to Flint’s devastating water crisis.

This is a worst-case scenario, but it shouldn’t be dismissed as an extreme. The fear that an outsider will strong-arm duly elected local officials and subvert the will of the people is a legitimate one. The key here is accountability. Virginia’s law requires an emergency manager to submit regular reports to state and local entities, which is one mechanism for accountability.

Sadly, the more common scenario is that residents suffer harm due to local officials’ inability (or unwillingness) to make the tough decisions that a fiscal crisis requires. Emergency response times tick upward, garbage litters the streets because trash pickup is unreliable, libraries and community centers operate on shortened hours—you get the point. I haven’t done a deep dive into Hopewell’s long-term financial trends, but I did stumble upon one datapoint that suggests residents here have increasingly been paying for the city’s fiscal woes.

I highly recommend Liz Farmer’s work.

The Norwegian Sovereign Wealth Fund Story

Financial Times: The Norwegian Sovereign Wealth fund’s $92 million error [paywall]

ResearchGate: Anthropological gaze, stories, and reflections on NBIM culture

Last year (spring 2022) we had an off-site. One of our workshops was on “Mistakes and how to deal with them”. We wrote post-it notes, classifying them into different categories from harmless to no-goes. One of my post-it notes, I remember it vividly, read: Miscalculation of the Ministry of Finance benchmark. I placed it in the category unforgivable. When I wrote that note, I honestly couldn’t even dare to think about the consequences . . . And less than a year later, I did exactly that. My worst nightmare. It was a manual mistake. My mistake. I used the wrong date, December 1st instead of November 1st which is clearly stated in our mandate. The mistake was not revealed until months later, by the Ministry of Finance. They reported back that the numbers did not add up. I did all the numbers once more, and the cause of the mistake was identified. I immediately reported to Patrick [Global Head] and Dag [Chief]. I openly express that this was my mistake, and mine alone. I felt miserable and was ready to take the consequences — whatever they might be.

Federal Debt and Entitlement Issue

Charles Blahous in Discourse Magazine: Americans Should Be Less Complacent About Social Security

STUMP Related Posts

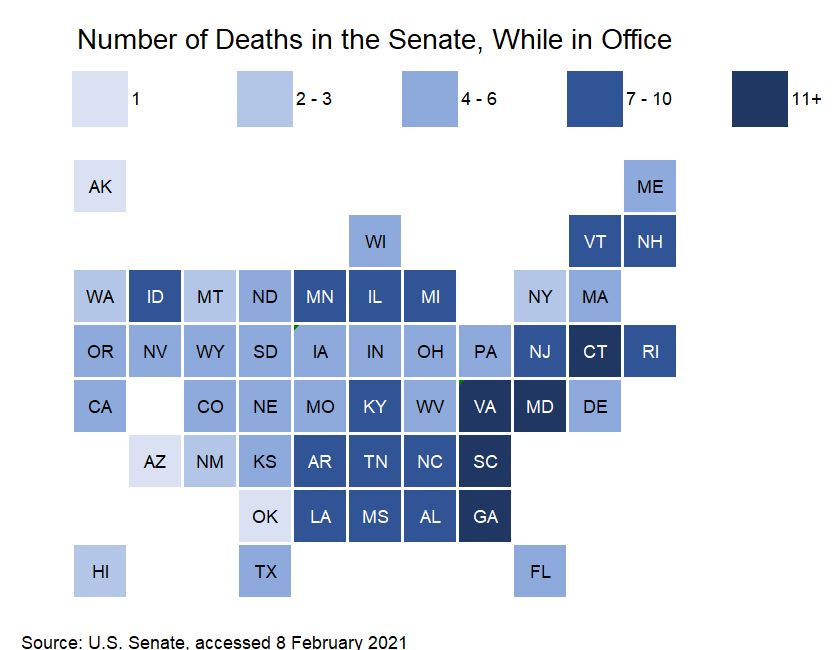

Political mortality: on old people in the Senate and death probabilities

Let me break into my series on external causes of death into a political aspect of mortality. A year ago, I pointed out that the Senate was an old folks’ home in more ways than one. The Senate is based on the Roman Senate, which is based on the Latin term for old people —

Senate Mortality 2023: Top Ten Old Senators

I saw this on the Althouse blog: "Senator Dianne Feinstein... announced on Tuesday that she would not run for re-election in 2024 but would finish out her term in Congress..." "... Ms. Feinstein, 89, has had acute short-term memory issues for years that sometimes raise concern among those who interact with her. She has never acknowledged the problems.... …

Mortality with Meep: On The Congressional Body of Old Folks and Deaths in Office

I just got this news alert: Sen. Richard Shelby Will Not Run for Reelection in 2022 Senator Richard Shelby (R., Ala.) announced on Monday that he will not run for reelection in 2022. Shelby is the third Republican senator to say he will not seek reelection at the end of his current term, along with Rob Portman of Ohio and Pat Toomey of Pennsylvania.

Share this post