In this episode, I talk about the potential taxability of student loan forgiveness (for state income tax), but more about the long-term public finance problem. Those seeing a small bailout now will be expected to pay for a larger problem in just a decade.

Related Links:

Tax Foundation: List of States That Might Tax Student Loan Debt Cancellation Dwindles, originally posted August 25, 2022, updated August 30, 2022

Arkansas. One of a handful of states which does not conform to the Internal Revenue Code in any significant way, Arkansas’s tax code is silent on the treatment of student loan debt forgiveness, and the ordinary rule—that a discharge of indebtedness constitutes taxable income—should prevail absent state action.

Massachusetts. For most purposes, Massachusetts uses an individual income tax conformity date of January 1, 2005. As such, the state does not conform to the new federal provision.

Minnesota. Minnesota’s conformity date is December 31, 2018, which is well prior to ARPA, and the state currently lacks any other provision to exclude student loan debt cancellation from income.

Mississippi. Another state which largely goes its own way in defining its tax base, Mississippi retains the ordinary treatment of discharged debt and is in line to tax student loan debt forgiveness.

North Carolina. Although North Carolina conforms to a post-ARPA version of the Internal Revenue Code, its conformity statute contains an add-back which taxes student loan debt forgiveness despite the federal change.

Wisconsin. With a conformity date of December 31, 2020, Wisconsin is currently in line to tax student loan debt forgiveness.

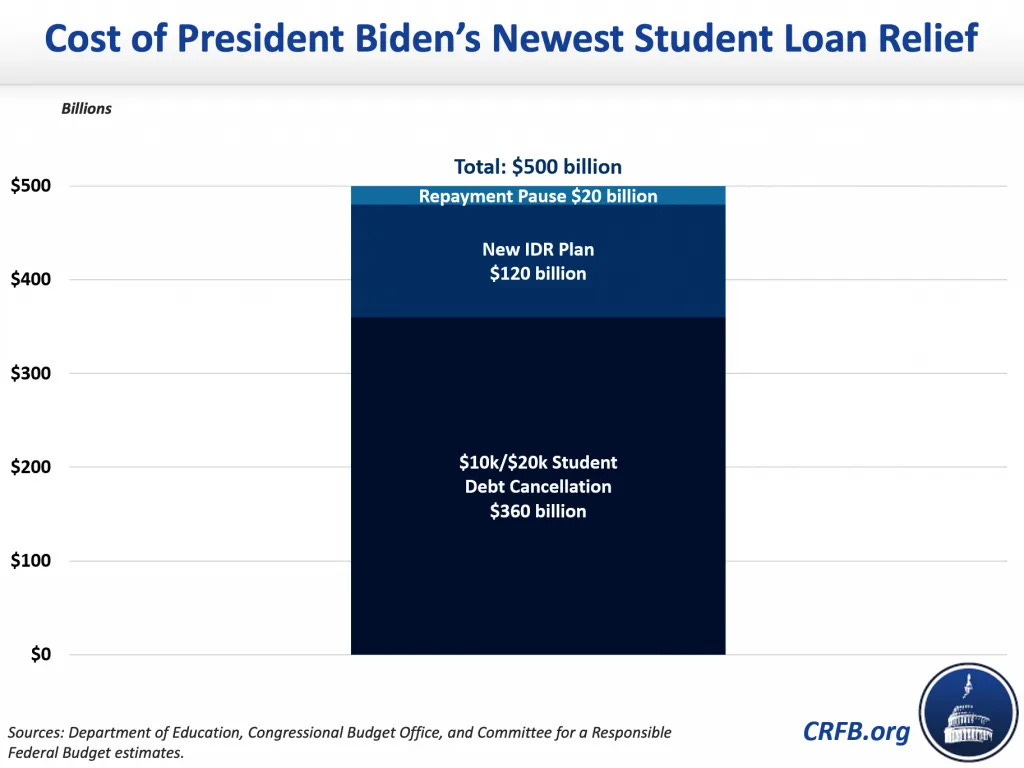

Estimates of student loan forgiveness

Wharton model: THE BIDEN STUDENT LOAN FORGIVENESS PLAN: BUDGETARY COSTS AND DISTRIBUTIONAL IMPACT

President Biden’s new student loan forgiveness plan includes three major components. We estimate that debt cancellation alone will cost up to $519 billion, with about 75% of the benefit accruing to households making $88,000 or less. Loan forbearance will cost another $16 billion. The new income-driven repayment (IDR) program would cost another $70 billion, increasing the total plan cost to $605 billion under strict “static” assumptions. However, depending on future IDR program details to be released and potential behavioral (i.e., “non-static”) changes, total plan costs could exceed $1 trillion.

Committee for a Responsible Federal Budget: New Student Debt Changes Will Cost Half a Trillion Dollars

President Biden today announced a set of changes to student loans – including cancellation of up to $20,000 for some borrowers – that will cost between $440 billion and $600 billion over the next ten years, with a central estimate of roughly $500 billion. Combined with today’s announcement, the federal government’s actions on student loans since the start of the COVID-19 pandemic have cost roughly $800 billion. Of that amount, roughly $750 billion is due to executive action and regulatory changes made by the Biden Administration.

Reuters: Analysis: Biden's student loan forgiveness may erase savings of climate, drugs law

President Joe Biden's controversial plan to forgive up to $20,000 in student loans for tens of millions of Americans could erase the projected $300 billion deficit reduction that his hard-fought climate, drugs and tax legislation would generate over 10 years - by as much as two times.

The extent of the additional federal debt incurred by the one-time gift to college graduates and ex-students depends on which estimates are used, economists say.

Non-government budget analysts project the program's total 10-year cost at $500 billion to $600 billion, including extending a repayment pause on all federal student loans through Dec. 31 and reducing future payments based on income.

Related Posts

March 2021:

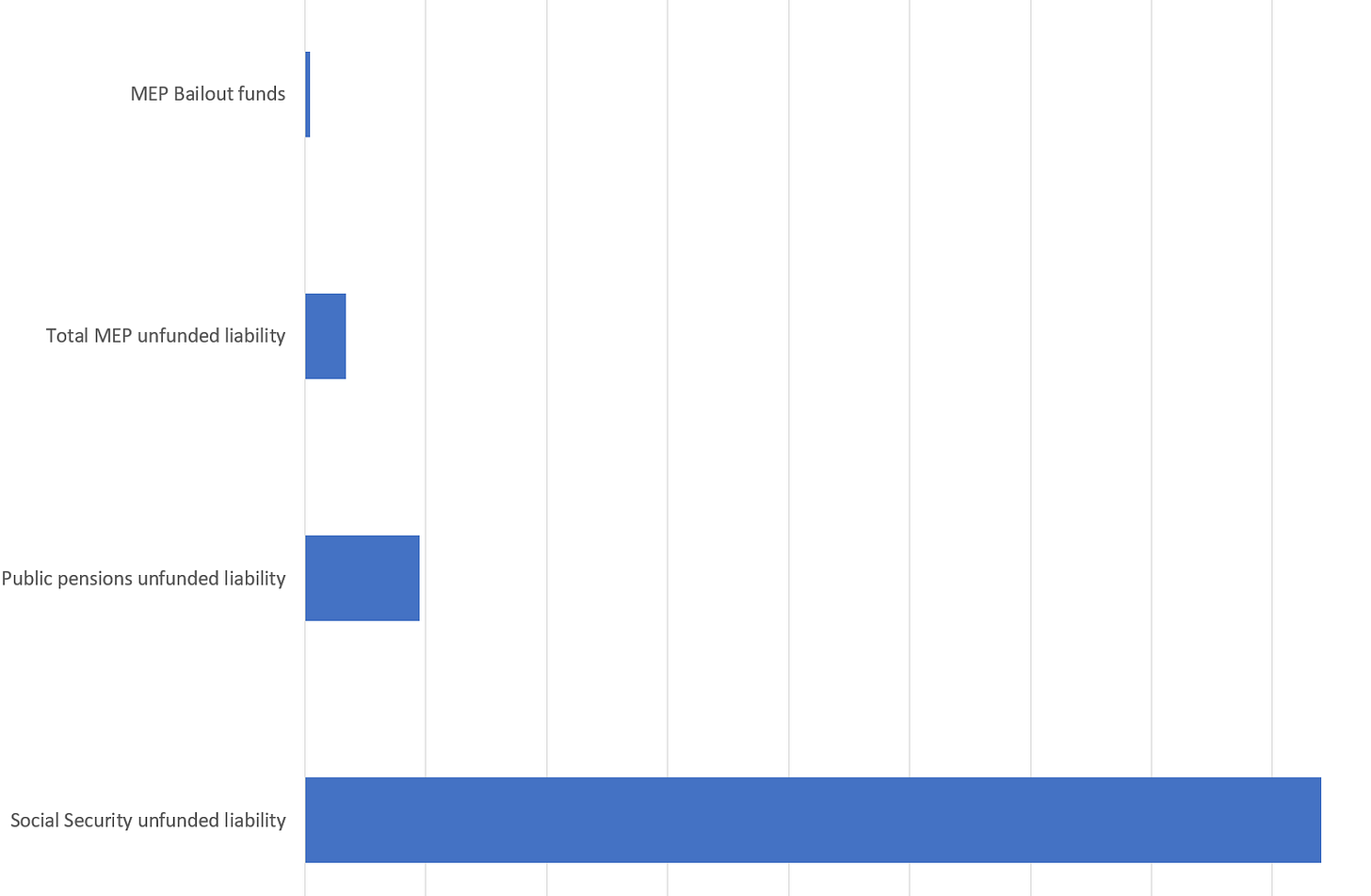

Let me make a comparison of four numbers:

the MEP bailout size in the current bill ($86 billion)

total MEP underfundedness ($673 billion)

a theoretical public pension bailout ($1.9 trillion)

a Social Security “bailout” amount ($16.8 trillion)

Here ya go:

June 2022:

Share this post