Public Finance Spotlight: Truth in Accounting

Providing annual reports on the Financial State of the States and fighting for good governmental accounting standards

Continuing my series spotlighting my favorite sources on public finance data and policy, today I’m looking at Truth in Accounting.

I just did a quick search on “Truth in Accounting” and this blog (which has been around since 2014 on STUMP.marypat.org), and they have appeared in 63 posts since 2015 (not including this post).

A note: Bill Bergman had been the director of research at TIA for much of the period I was linking to the site, and is now elsewhere. I will be using some material from his TIA days in this post. But worry not, Bill — you’re getting your own standalone post next month… hold your horses!

Annual State of the States/Cities Reports

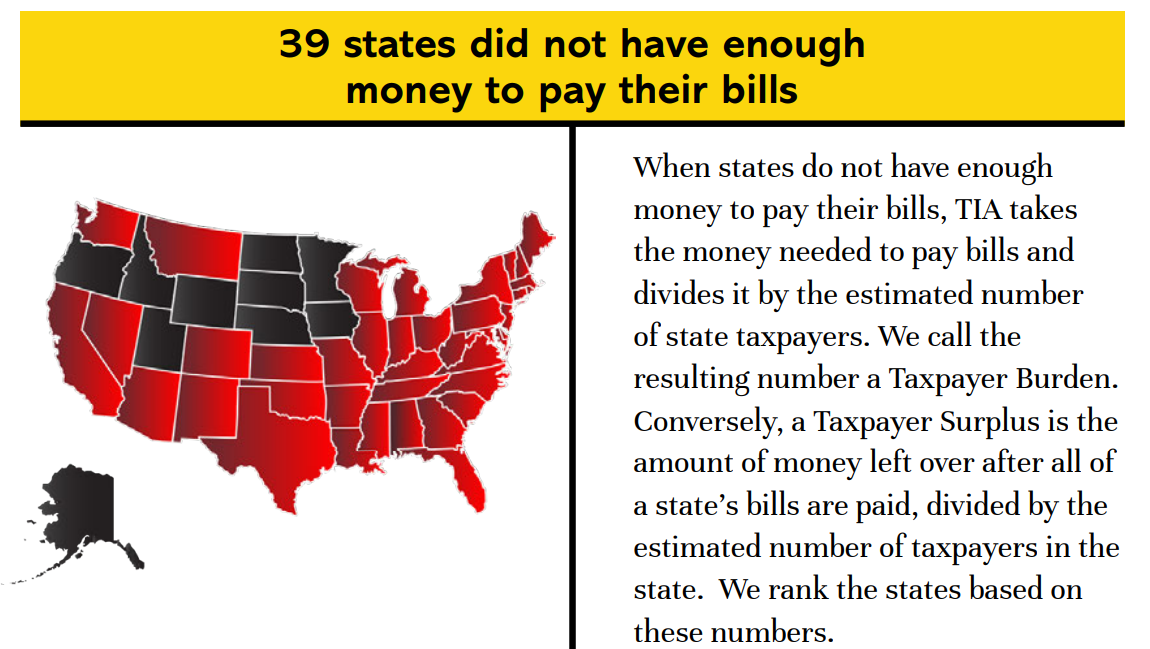

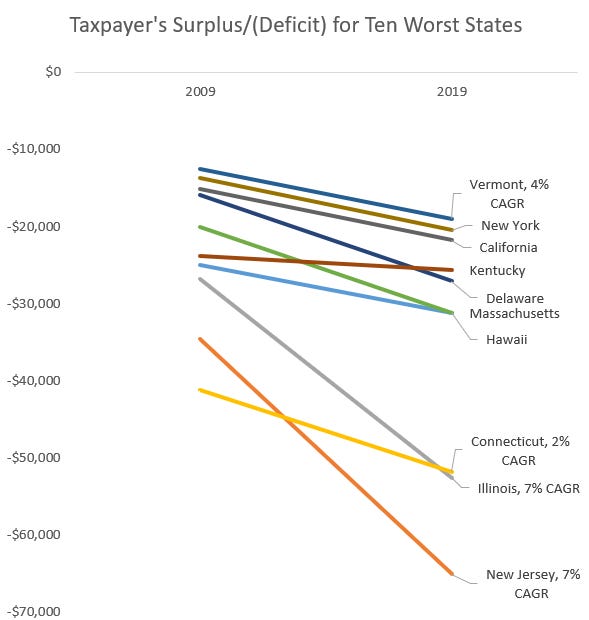

Annually, TIA publishes their Financial State of the States reports, and they also have their Data-Z database that also serves up their state and local indebtedness metrics.

Over the years, they’ve also added a Financial State of the Cities and Financial State of the Union.

Here are some clips from their most recent Annual State of the States, which is the report they’ve been doing the longest:

Let’s compare the 2022 result against the 2021 result:

So you can see that 2022 looks improved, but one of the things you have to think about: the super-duper bailout in March 2021 and the dilatory nature of governmental financial reporting as mentioned above.

TIA bases its report solely on the government’s own financial reporting. I checked one of the states by hand once, just to make sure the numbers matched the ACFR, and it does.

What about the nature of the debt of the states?

Now, you may be looking at that and having a quizzical look on your face: how can there be $1.2 trillion in debt, and $699 billion be pension debt and $665 billion be OPEBs (other post-employment benefits) debt?

$699 billion + $665 billion = $1334 billion = $1.3 trillion.

And states also have outstanding bonds!

Well, some states are in the black (as seen above), and have assets that counteract that. So that’s some of the issue.

A continuing source of data

One of the things I like to do is take the data from the regular reports of TIA and revisualize the information.

An example: Classic STUMP: Visualizing the Financial State of the States

After the March 2021 bailout, I looked at how TIA graded the states and did a tile grid map:

This post was in September 2021, and I noted:

Now, you may be thinking, wasn’t there some kind of federal bailout of states? It didn’t happen while Trump was president, but it sure passed in the Biden/Pelosi/Schumer era. It wouldn’t be in the financial year 2020 reports, but we can consider what may happen to the surplus or deficits in next year’s report, when the states get around to reporting their take.

Which you can see in the 2022 maps above.

I didn’t do a 2022 post on the annual TIA report, as I considered the bailout distorted the long-term dynamics.

However, I will be wanting to see what is going on with the 2023 report. It is useful to have this sort of annual report covering multiple years, so one can build up a record of trajectories and likely future paths.

As noted above, they’ve been doing the state-level reports the longest, but they’ve added other governmental levels recently. I have done a few posts based on their city-level reports, particularly focusing on Chicago and New York City, for obvious reasons.

Advocate for good accounting standards in government

As it says on the tin, the primary thrust of Truth in Accounting is to advocate for good accounting standards for the government.

We’ve been through this multiple times — for private organizations, such as publicly-traded companies and non-profits, there are multiple outside parties that have been able to impose accounting standards (particularly, the federal government) that make sense and protect the interests of key parties.

However, when it comes to governmental entities, there remains much to be desired.

First, the issue of timeliness:

Sheila Weinberg: But California did just issue their 6/30 financial statement. Oh, but that was their 6/30 financial statement for June 30 of 2021. Can you imagine a corporation issuing their financial report 631 after their fiscal year ends? I don’t think they could get away with it.

No, they couldn’t.

I just keyed it up to that particular point, but this was in the middle of Sheila Weinberg, Founder & CEO of TIA, making the point that many (or most) states and local governments voting on the next year’s budget before they even know how well the prior one worked out.

There are huge lags that make for extremely poor money management and planning.

But it’s worse than that — many go by cash accounting in their financial reports which is extremely inappropriate when it comes to long-term situations as with pensions and retiree health benefits.

Accrual vs Cash Accounting

Truth in Accounting has long advocated for accrual accounting in financial reporting for such items as pension benefits.

In a nutshell, most states and localities do not account for the increase in pension (and similar) obligations over a time period and have it flow through their income statement. That’s accrual accounting.

What they do is note the amount they deigned to contribute to the pension funds or amounts actually disbursed to post-retirement benefits that were pay-as-you-go, such as retiree health care.

Truth in Accounting has had a campaign to reform Government Accounting Standards, which they call FACT-based accounting.

Here is their description:

Many states have requirements to balance their budget every year, but because of the way they prepare financial reports, budgets that appear balanced are anything but. All too often, governments’ official financial statements don’t reflect reality because they follow “cash based” accounting principles. What does that mean?

With cash-based accounting, financial reports show expenses only when money is paid, not when debt or future expenses are incurred. By only reporting cash spending, and not accumulated debt, the financial reports paint a much rosier – but far from accurate – picture of government finances.

This delusional and nontransparent approach to government accounting has had dire real-world consequences for cities, states, and their citizens. When it comes time to pay the previously-hidden debt, elected officials face a sudden need to hike taxes or slash services—or both. People suffer.

As a result of their campaign, I submitted remarks and posted about it here. Alas, the video is no longer at the link there, but an explanation of my arguments, and a bunch of context are provided in my linked post. Here is a January 2019 post in which I talk about the letter I wrote to GASB.

I did it solely due to Truth in Accounting — they brought the issue to my attention, as well as for the call for responses. I also let other people know about the situation.

Fighting the good fight

Truth in Accounting provides me with data in these annual reports, which builds up a body of material I can use in posts. This data is also available through their Data-Z site.

But one of their biggest values has been making the case for being a strong advocate for good, transparent, and timely government financial reporting.

I know this is incredibly geeky to many people, but it is very important. One of the biggest red flags surrounding Puerto Rico’s essential fundamental fiscal unsoundness, for instance, was its years without audited financials.

TIA does get attacked because its motives are called into question. Two posts, in particular, I looked at two particular attacks:

And yes, I mention Bill Bergman in that one, so I will mention him again — he was often the person from TIA poking me about various subjects to get me to look at something more closely. (And yes, Bill, I will point that out next month, too.)

Then I would get annoyed and write a 1000-word post filled with GIFs, graphs, and links to a decade of receipts of what had happened before.

It’s good to have proof.

If accurate accounting is making ugly things come to light, complaining about the accounting is not going to be productive. I could pull out examples from corporate shenanigans.

But I’ll just leave you with this gif.

And check out Truth in Accounting!

Great spotlight. You can always count on TIA to give us the real assessment of a gov's (and therefore a taxpayer's) debt burden.