Related Links

Recent post on Providence, Rhode Island POBs:

Older STUMP posts on POBs:

2018: Illinois Idiocy: Digesting the Presentation of the Mega Pension Obligation Bond Idea

https://stump.marypat.org/article/906/illinois-idiocy-let-s-run-some-scenarios-on-a-gargantuan-pob

That was an idea of issuing a $100+ billion POB to cover the ginormous unfunded pension liabilities of Illinois. They didn’t do it.

2015: Why are Pension Obligation Bonds OF THE DEVIL? A Lesson from the Dollar Auction

The dollar auction is a truly evil game. I used to forbid people from playing it at Mathcamp. That’s not a joke.

I had a really ugly graph on that post, and yes, I’ve gotten better with the graphs over the years. The ugliness of that graph was a partial inspiration to seek solutions. (Other ugly graphs as well).

You can barely see it, but there was a POB between 2003 and 2005. It barely made a dent in the unfunded pension liability.

And what then? In the ten years since 2005, Illinois underfunded the TRS pension fund by at least a billion dollars a year.

With regards to contributions, there was a choice on the part of the “government”.

With regards to all the other reasons for shortfalls — investment experience, experience in salary changes and longevity — the government had less direct control. But they definitely had a choice with regards to how much of the budget to apply to the pensions.

And every damn year, the Illinois government made a conscious decision to shortchange the pension. That was not an accident.

POBs are most often used by governments that were shortchanging the pensions, or goosing the benefits in insane and seemingly sane ways, to paper over said shortchanging. This farce lasts only so long.

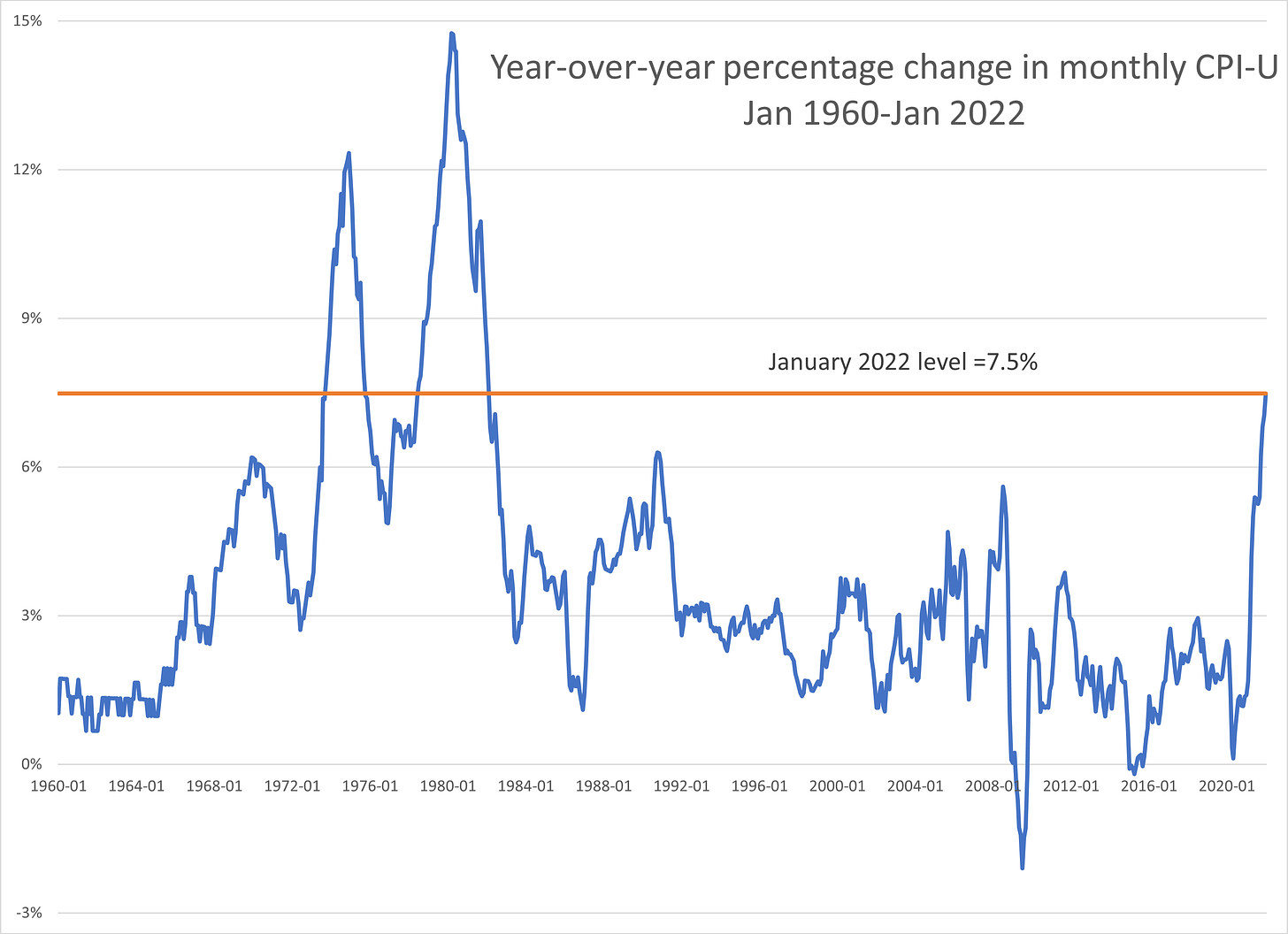

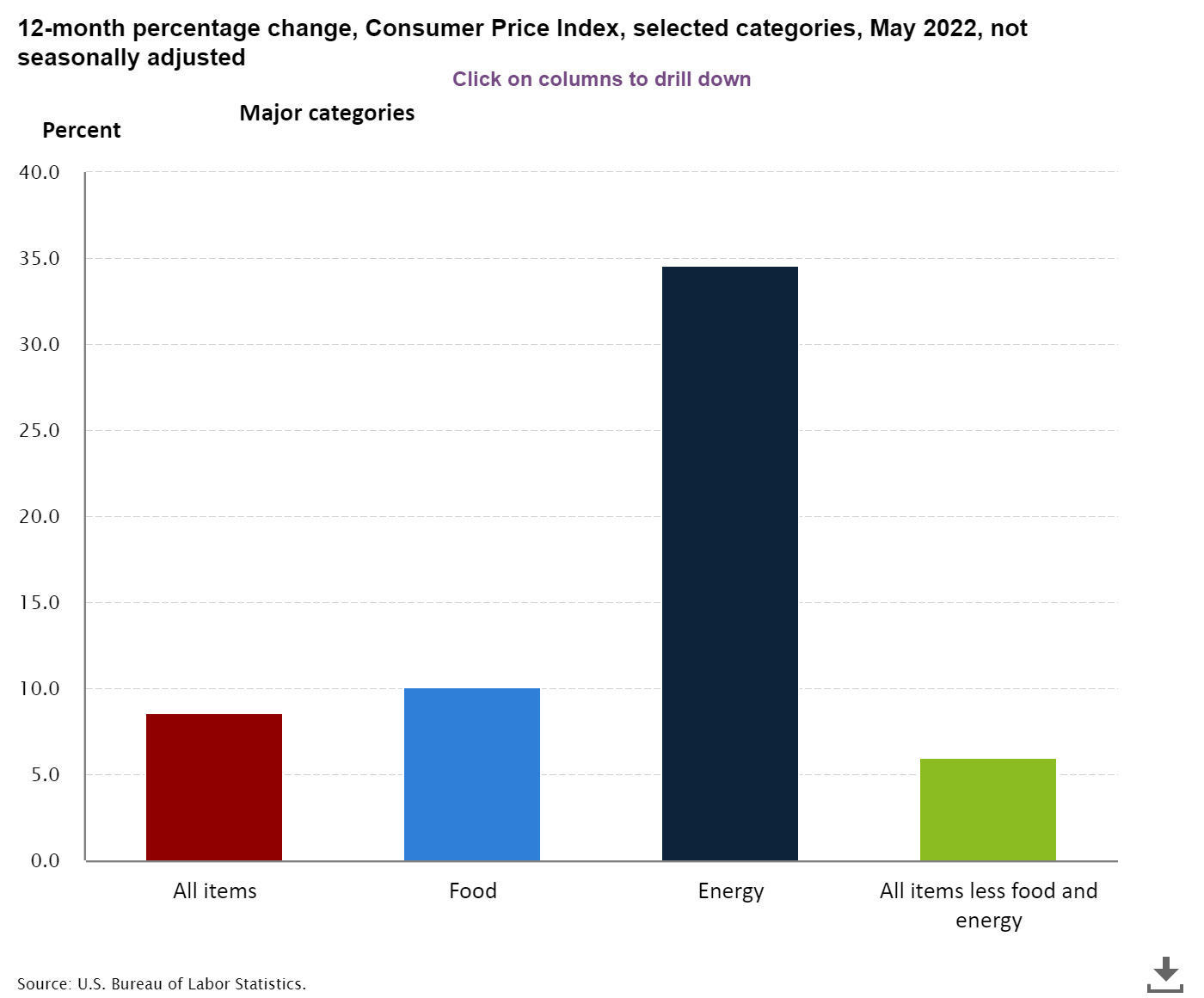

February 2022: Positioning for a Potential Interest Rate Hike: Public Finance and More

Ah, the good ole days of temporary inflation of January 2022. Remember that?

I also have a list of some of my POB lowlights over the years.

So yes. I very much hate pension obligation bonds. Mainly because of all the lying surrounding them.

Share this post