UPDATED 5/22/2024: More Ohio STRS Commentary: Alternative Assets in Pensions, Anonymous Memos, and Teachers Pensions in General

Developing, as they say...

Yesterday was the second day of the Ohio STRS board meeting, and let me remind you of the story thus far: [skip to the next section if you know the history]

Ohio teacher retirees have had no cost-of-living adjustments since 2017, which make active and retired teachers unhappy

A group of active and retired teachers have been pursuing an “activist” strategy in electing members on the Ohio STRS board (which oversees the pension fund), and have elected in a majority of teacher board members who agree with this.

Wade Steen had been appointed as one of the “investment expert” board members by Ohio governor DeWine, but had been yanked by DeWine … after a year’s worth of court wrangling, the court said DeWine couldn’t do that, and Steen was back on the board. He’s part of the “activist” faction.

An anonymous memo was sent accusing Steen and one of the teacher board members, Fichtenbaum, of having a conflict of interest involving an investment firm that had proposed a strategy that supposedly would reduce investment costs and improve results.

The state’s attorney general filed a lawsuit to have Steen and Fichtenbaum yanked from the board… right before the board’s meeting this week.

The Ohio STRS board meeting occurred on Wednesday and Thursday of this week. The first order of business was to remove the prior chair, replacing with Fichtenbaum as chair.

Here are the posts/podcast on these items:

6 May 2024: Public Pension Governance Drama in Ohio

10 May 2024: Ohio Pension Drama Continues: Investigation Called on "Hostile Takeover"

16 May 2024: Ohio State Teachers Pension Drama Continues! Board Turmoil!

Commentary from Ted Siedle

Ted Siedle has long been involved in investigating asset-side issues of public pensions. He had called for an investigation into Ohio STRS, and had issued his own report, based on what information he could get at.

However, of course, as with many public pensions chasing yield (so that they can try to avoid having to increase contributions and therefore taxes), there is a substantial amount of alternative assets in the portfolio.

Here have been Siedle’s remarks on the recent events:

11 May 2024: DeWine Declares War On Ohio Teachers Pension Transparency Reform

16 May 2024: Ohio Teachers Lead The Fight To Restore Integrity To State Pensions

17 May 2024: Did Ohio Teachers State Pension Really Just Say That?

Let me pull out a few quotes from the second item, because that’s the one that has embedded in it his report on Ohio STRS, called “The High Cost of Secrecy”, dated June 2021.

This is what he writes:

At this moment, STRS Ohio participants are leading a national crusade to eliminate Wall Street secrecy schemes at all public pensions across the nation. (For example, Ohio teachers are currently working with Minnesota teachers to reform that state’s $28 billion teacher plan.)

Although disappointing, it is no surprise that Ohio elected officials who depend upon Wall Street for campaign donations to fund their political ambitions have hastily—within days—united to thwart a valid pension board election and oppose overwhelmingly popular teacher transparency reforms. Prompted by bogus claims of a “hostile takeover” of the pension by Governor DeWine, Ohio politicians have predictably rallied to support Wall Street billionaires who have been looting the nation’s public pensions for nearly two decades.

Let’s review what has happened in Ohio in the last few years.

After years of growing distrust, teachers sought out and paid for—with their own funds—a forensic investigation of their pension conducted by the leading pension forensic expert in the world [that’s Siedle], a former SEC lawyer who has investigated over $1 trillion in retirement plans. Frustrated by lack of answers, they legitimately sought a “second opinion” as to whether the billions set aside for their retirement were being prudently managed.

Who can argue with teachers scrutinizing the fund they depend upon for their retirement security?

The damning findings of that investigation were broadly disseminated to pension stakeholders, including provided to all state officials in Ohio—politicians who implicated in the wrongdoing identified and who did nothing in response to the 127-page expert report. The report was also provided to federal officials at the SEC and FBI.

The Report rightly identified widespread fiduciary breaches, apparent violations of law and mismanagement. For example, the $90 billion pension had not been audited—as required under Ohio law—for the past 16 years. The Ohio Retirement Study Council—as to which Attorney General Yost served as Legal Counsel since 2019—had utterly failed to do its job, leaving the teacher pension and tens of billions in two other Ohio pensions at risk. No Ohio politician disputed this finding—a fiduciary audit was hastily undertaken, entirely in response to the teacher’s forensic investigation. The ORSC actually blamed the 16-year delay on Covid-19 and no state officials, including the Attorney General, was held accountable for this collosal failure.

His report, “The High Cost of Secrecy”, is dated June 2021.

And you can tell Siedle is a lawyer, because there is not a single graph in that report. Or even a table with numbers in it.

But that lack of audited financials… WHOA NELLY. That’s bad.

UPDATE [5/22/2024]: the bolded bit was referring to a special kind of audit, not the regular kind of audit of the financials — I will post on this more later. The special audit, which was conducted later, can be seen here at the Ohio Retirement Study Council Site: 2022 Fiduciary Performance Audit of the State Teachers Retirement System of Ohio

Siedle is quoted in this piece:

WVXU: DeWine has 'grave concern' about Ohio teachers' pension fund board, but STRS critic isn't surprised

Forensic investigator Ted Siedle looked into STRS in 2021 after being hired by the retired teachers. His subsequent report blasted STRS for a lack of transparency, high fees and poor performance. STRS fired back, saying the report contained “numerous misstatements and allegations not supported by evidence".

Siedle said he's not working with Steen, Fichtenbaum or other members of the STRS board, but said state officials clearly don’t want the board to make changes with the fund.

“This is not a hostile takeover by a reform-minded board. It's a reform-minded board trying to restore integrity and fight back a hostile takeover that happened years ago," Siedle said.

….

Siedle said if STRS had been prudently managed, there would have been $90 billion available over the past 30 years to pay the COLA. That's a claim STRS has denied. And in March, the fund's actuary Cheiron said an on-going 3% COLA would add about $21 billion in liabilities.

But Siedle and other "reformers" have pushed for changes to STRS including re-examining private equity and alternative investments, which they say are secretive, risky and have exorbitant fees.

"Warren Buffett has told public pensions for decades now that they should index their money in fully transparent, low-cost index funds," Siedle said. "There's absolutely no need for richly compensated staff. There's no need for paying any staff bonuses and the money would be managed better. And the pension would be twice the size it is were it prudently invested in low cost, fully transparent index funds. And if there's anyone on the staff of STRS who thinks they're smarter than Warren Buffett, I would submit they're not."

STRS has said state law requires it to diversify its investments to minimize the risk of large losses, so it can't invest solely in an index. And it's said its alternative investments have outperformed the rest of the fund's holdings in recent years.

I am with Siedle in being aghast at this supposed last statement. Both he, I, and others in the investment sphere know we don’t just mean an S&P 500 index fund when we say “invest in index funds”, but there are multiple indices out there with funds for each index.

I use various index funds in my own investing, with different index funds for different sectors. I will show a snapshot from one of my 401(k)s (without the accumulations):

Not all of these are index funds, obviously (and I do need to review my allocations — I see some of these were at 0, and I need to check what’s going on). But some are international, some are small cap, some mid cap, some broad market, I’ve got real estate and fixed income.

I’m not even using all the index funds being offered.

There are lots of choices available for index funds.

Comparisons of Ohio STRS against other pensions: Size

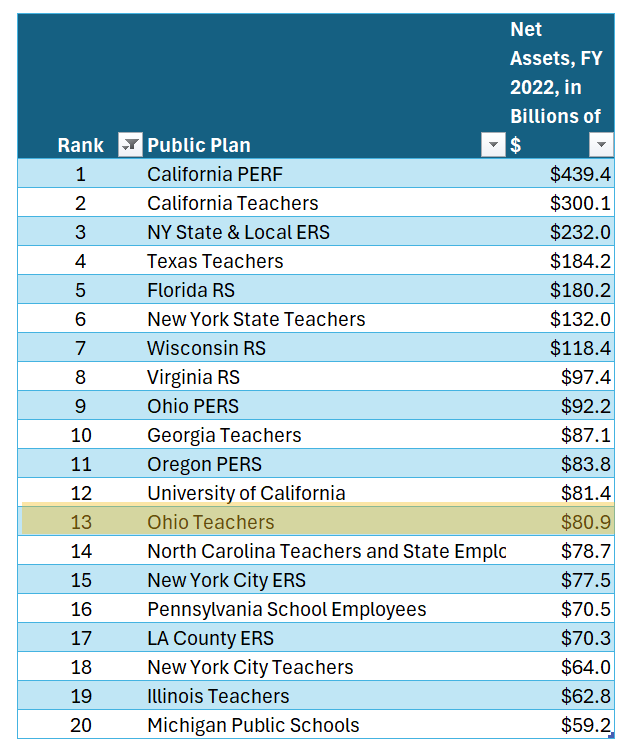

Using data from the Public Plans Database, let’s see what the largest public pension funds are (fiscal year 2022):

These numbers are going to be different from the $90 billion that is repeated, because the PPD is updated only through FY2022.

However, the point is that of the 217 U.S. public pension funds the database has FY2022 data for, Ohio STRS comes in at #13.

That the fund hadn’t been audited for over 15 years is a serious gap in governance. Puerto Rico had a similar issue (okay, PR had a worse issue.)

But the alternative asset issue is not unique to Ohio, and the governance issue there can be serious.

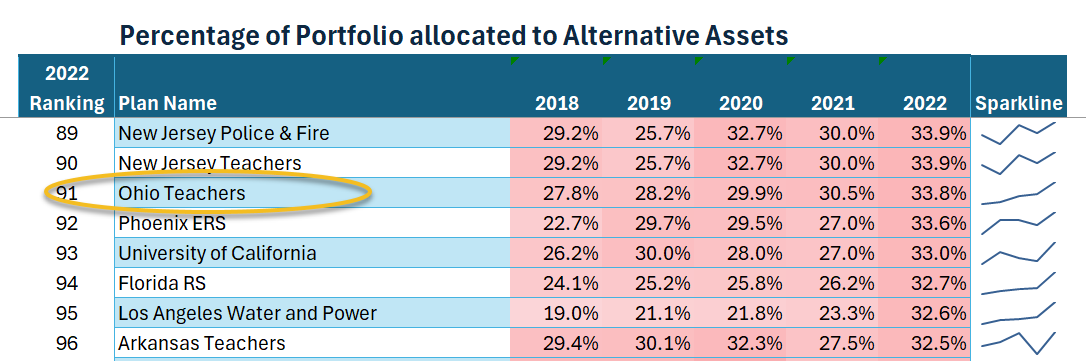

Comparisons of Ohio STRS against other pensions: Allocations to Alternatives

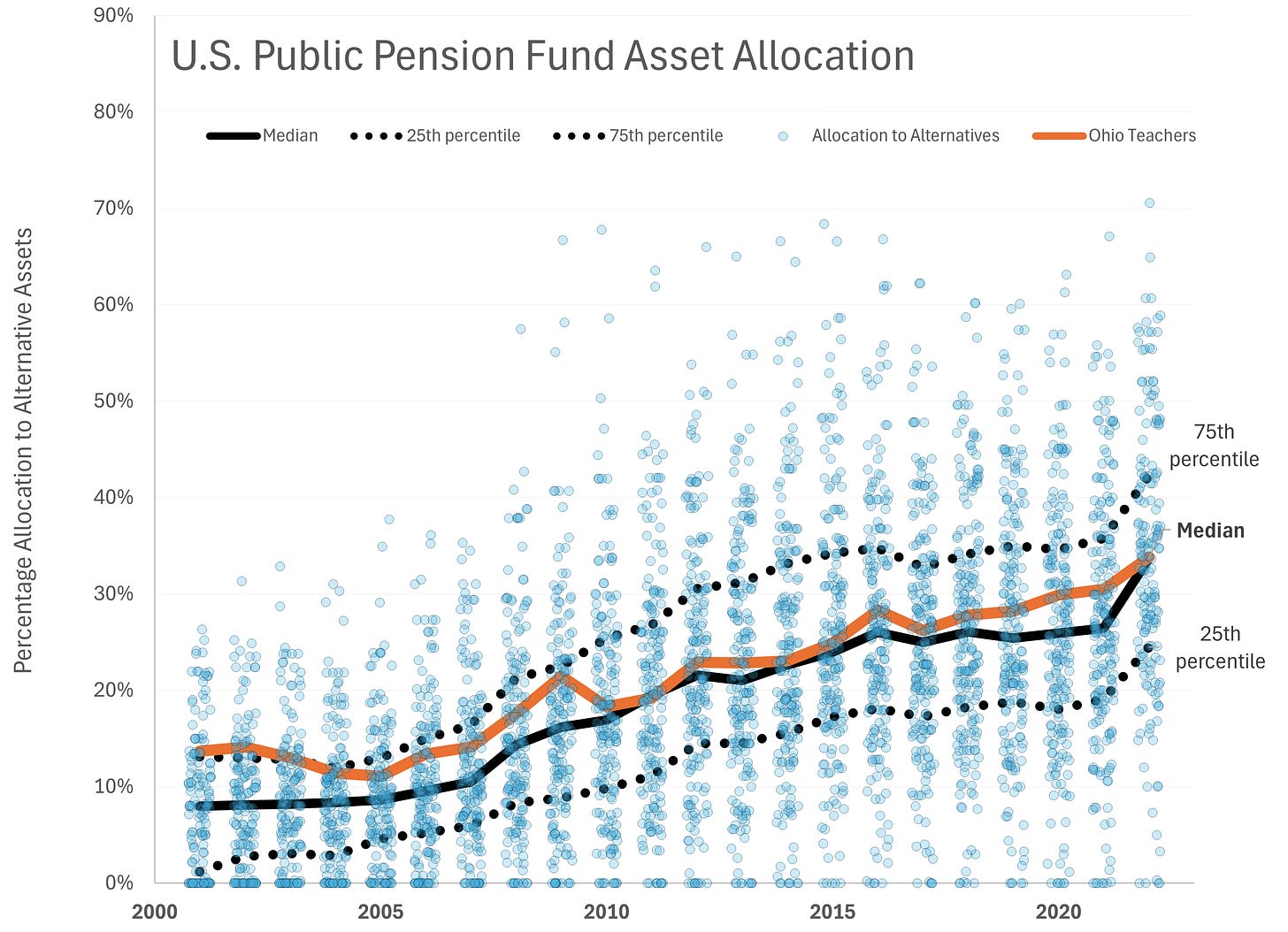

In my earlier post on alternative assets, I showed that Ohio STRS is exactly at the median allocation:

Let me redo the graph of allocations so you can see that:

That orange line is Ohio STRS (or Ohio Teachers) allocation to alternative assets.

They pretty much allocated at the median level — they weren’t at the extreme ends.

However.

The question becomes: how appropriate is it for public pensions to go into some of these deals, given the limitations on possible oversight?

History: STUMP on Alts in Public Pensions

Ten years ago, I wrote a series of posts on alternative assets in public pensions:

August 2014: Public Pensions and Alternative Assets: Dallas Shows How It Can End — Dallas Police & Fire Pensions had horrid concentration risk in alts, which they pursued due to very high guarantees in their pension benefits they were trying to support

September 2014: Public Pensions Watch: Don’t Go Chasing Waterfalls….or Alternative Asset Classes, pt 1 of many — I noted the reason many public pensions pursued alts was that they were trying to maintain high discount rates to make pension liabilities look cheaper than I think they actually are

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 2 of many, New Jersey - David Sirota & John Bury feature here

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 3 of many, South Carolina — note the name Curtis Loftis

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 4 of many, San Diego - this is San Diego County, which had a highly leveraged strategy, and this one actually got unwound later. Thank goodness.

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 5 of many, Some Boosterism - so I allowed some positive talk in this post. I have nothing against alts per se. However, I am skeptical that public pension fund boards are able to provide appropriate oversight when there is a great deal of alts.

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 6 of many, Rhode Island - Siedle shows up here

Sept 2014: Public Pensions Watch: Alternative Asset Classes, pt 7 of many, North Carolina - Siedle is here, too

September 2014: Public Pensions Watch: Alternative Assets, pt 8 of many -- New Jersey followup

Sept 2014: Public Pensions Watch: California pension fund pulling out of hedge funds

Sept 2014: Public Pensions Watch: Reactions to Calpers Pulling Out of Hedge Funds

Sept 2014: Public Pensions Watch: More Reactions to Calpers Pulling Out of Hedge Funds

Yes, Ted Siedle features a lot in the above posts.

But That’s Not All! More Alts!

Let me select a few more:

May 2023: Choices Have Consequences: Public Pension Investments in Alternative Assets

May 2021: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? 2021 Edition

2018: Alternative Assets and Pension Performance: A Dive into Data

2017: Which Public Pension Funds Have the Highest Holdings of Alternative Assets? Has It Paid Off?

2017: Public Pension Assets: Our Funds were in Alternatives, and All We Got Were These Lousy High Fees

2015: Reddit-Public Pension Connection: Alternative Assets and Risk

2021: PSERS Update: What if it's just sloppy processes?

2020: A Fisking of Yet Another Public Pension "Explainer" and a Closer Look at Texas ERS

That’s not all of my posts on alternative assets in public pensions, but it’s some of them.

Again, while Siedle has this causal chain: Wall Street folks want their fees —> they lobby/give campaign donations to state/local politicians —> increased alternative assets in public pensions

This is my causal chain: public pension benefit promises are expensive —> alternative assets promise higher returns than “vanilla” assets —> increased allocations to riskier assets to avoid asking for higher contributions/taxes

Both of us question the appropriateness of alternative assets at such high levels in public pensions, whatever the causal chain. I’m with him there.