Related Links:

Press Release from the Pioneer Institute in June:

Study Finds Pension Obligation Bonds Could Worsen T Retirement Fund’s Financial Woes

A new study published by Pioneer Institute finds that issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

With POBs, government entities deposit revenues from bond sales into their pension funds and use the money to make investments they hope will deliver returns that outpace borrowing costs.

“Virtually every study of POBs finds that timing and duration of the bond issues are critical,” said E.J. McMahon, author of “Rolling the Retirement Dice.” “Bonds floated at the end of a bull market are the most likely to lose money, and that makes this idea a wrong turn at the worst possible time.”

To reiterate, the report is at this link: Rolling the Retirement Dice

Let me grab a few key graphs and tables from the report:

There is a lot going on in that graph, so focus simply on the red line: the funded ratio. Its scale is to the right, going from about 120% in 2001, down to under 60% in 2020.

This is the alternative valuation I mentioned. The 7.25% valuation in the top row is the official valuation. That made for the 57.9% funded ratio as of the end of 2020. The 6.25% valuation is also in the actuarial report, as they provide valuation at +/- 1 percentage point difference from the official valuation rate.

The 4.37% valuation is based on investment-grade corporate bond rates. The 3% valuation was based on 30-year Treasury rates as of late May 2022.

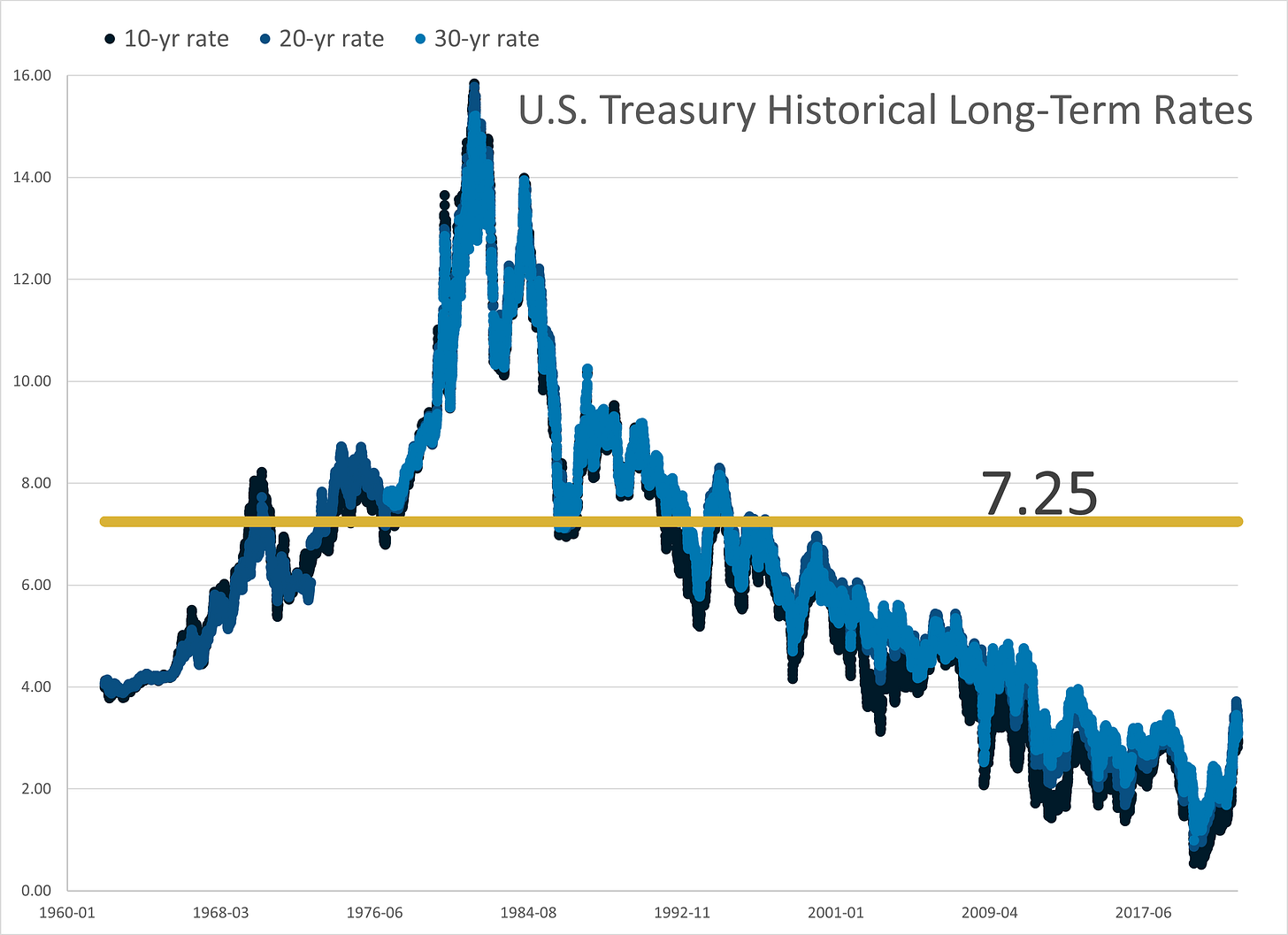

So, I have decided to do a graph - of the 10-year, 20-year, and 30-year rates for the history I have them. Just so you can see how the 7.25% compares, historically.

I put in the line for the 7.25%, the current valuation rate for the MBTA, so that you can see the time period for which long-term Treasury rates were above that level. Just so you can compare.

Actuarial Standard of Practice 4 — current

Actuarial Standard of Practice 4 — revision that will be going into effect February 2023

3.11 LOW-DEFAULT-RISK OBLIGATION MEASURE

When performing a funding valuation, the actuary should calculate and disclose a low-default-risk obligation measure of the benefits earned (or costs accrued if appropriate under the actuarial cost method used for this purpose) as of the measurement date. The actuary need not calculate and disclose this obligation measure more than once per year.

When calculating this measure, the actuary should use an immediate gain actuarial cost method.

When calculating this measure, the actuary should select a discount rate or discount rates derived from low-default-risk fixed income securities whose cash flows are reasonably consistent with the pattern of benefits expected to be paid in the future. Examples of discount rates that may meet these requirements include, but are not limited to, the following:

US Treasury yields;

rates implicit in settlement of pension obligations including payment of lump sums and purchases of annuities from insurance companies;

yields on corporate or tax-exempt general obligation municipal bonds that receive one of the two highest ratings given by a recognized ratings agency;

non-stabilized ERISA funding rates for single employer plans; and

multiemployer current liability rates.

When plan provisions create pension obligations that are difficult to appropriately measure using traditional valuation procedures, such as benefits affected by actual investment returns, movements in a market index, or other similar factors, the actuary should consider using alternative valuation procedures such as those described under section 3.5.3 to calculate the low-default-risk obligation measure of those benefits earned or costs accrued as of the measurement date.

For purposes of this obligation measure, the actuary should consider reflecting the impact, if any, of investing plan assets in low-default-risk fixed income securities on the pattern of benefits expected to be paid in the future, such as in a variable annuity plan.

When calculating this measure, the actuary should not reflect benefit payment default risk or the financial health of the plan sponsor.

Other than the discount rate or discount rates, the actuary may use the same assumptions used in the funding valuation for this measure. Alternatively, the actuary may select other assumptions that are consistent with the discount rate or discount rates and reasonable for the purpose of the measurement, in accordance with ASOP Nos. 27 and 35.

The actuary should provide commentary to help the intended user understand the significance of the low-default-risk obligation measure with respect to the funded status of the plan, plan contributions, and the security of participant benefits. The actuary should use professional judgment to determine the appropriate commentary for the intended user.

I will likely have more to say about the new ASOP 4 as we get closer to its effective date.

Share this post