Let’s look at the current proposal (but not too long, our faces might melt).

Reason: Biden Is Trying To Pass a Wealth Tax—Again. It Could Be Unconstitutional.

Now, like a sequel to a movie that wasn't any good the first time around, a variation of the Biden-Wyden wealth tax is back for another try in the president's latest budget. This time around, the White House is trying to sell it using slick language. The New York Times reports that a White House document described the tax, aimed at those with assets of more than $100 million, as "a prepayment of tax obligations these households will owe when they later realize their gains."

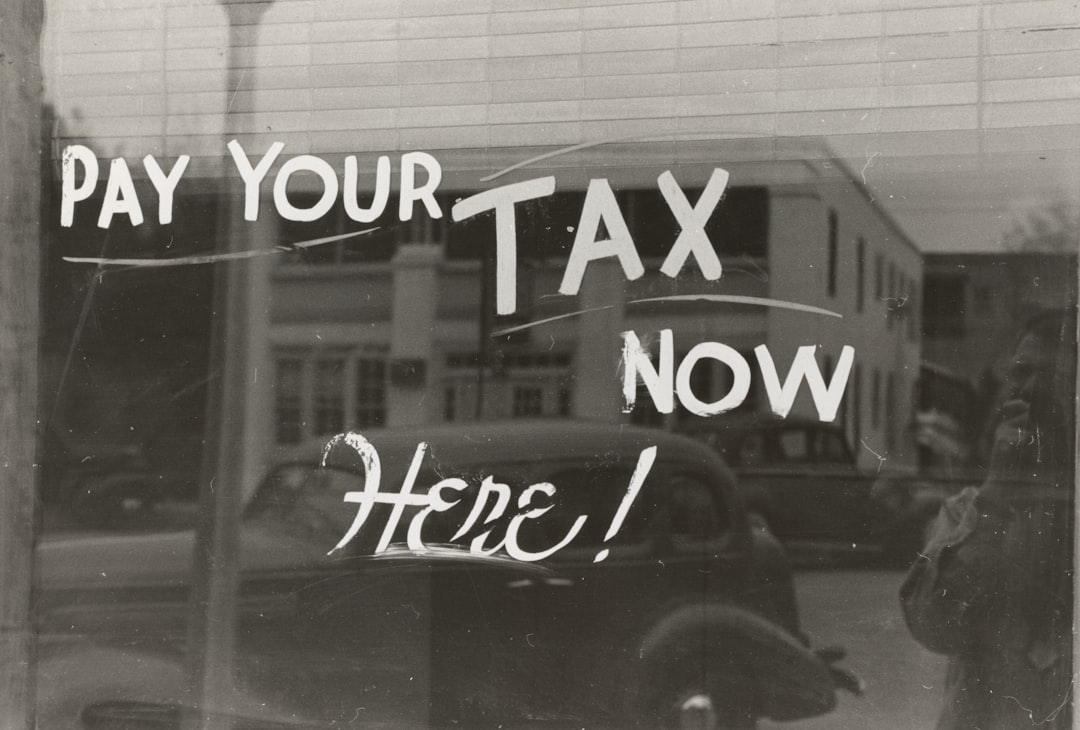

Here’s a thought — how about having people pay their taxes

WHEN THEY OWE THEM.

You know what? Let’s get rid of tax withholding.

Back to the piece:

Many of the same problems that applied to the original Biden-Wyden wealth tax apply to this new iteration of it. It could well be unconstitutional. Its retroactive application violates a principle of the rule of law. The small number of people targeted by it raises concerns about consent of the governed and about taxation without representation. There are practical issues having to do with the valuation of assets whose value may fluctuate wildly over time. We should be figuring out ways to ease the burden of taxation and shrink the size of government, not moving in the opposite direction. The money would be better used by the rich people who own it than by the lobbyist-influenced politicians in Washington.

I don’t want to steal their thunder, so go over there to read the rest of the piece.

As I mention in the audio podcast above, Elizabeth Warren has floated this idea before (I guess they’re slapping the Biden/Wyden names on it to make some old guys happy…though Warren is the same age as Wyden).

When Warren was running for the Dem nomination for President in 2019, she floated her version of a wealth tax:

Sen. Elizabeth Warren (D-Mass.) will propose a new annual “wealth tax” on Americans with more than $50 million in assets, according to an economist advising her on the plan, as Democratic leaders vie for increasingly aggressive solutions to the nation’s soaring wealth inequality.

Again, this is much, much below a supposed billionaire tax.

I am not going to quote myself, but simply re-write what I wrote at the time. A lot of wealthy people, in reality, have difficult-to-value assets. You don’t actually know their asset value until they cash out, and some of them never do cash out while they’re alive.

Why should they? What does Elon Musk, for example, have to prove?

What are they trying to actually accomplish with this tax bill… if it could actually get passed?

Something to think about.

As I mention in the podcast, they can’t even get rid of the SALT cap, which is a bigger deal to more people.

So, maybe it’s just a distra-

oooooh nice squirrel

Uh, what was I saying?

Anyway, next week will likely be about deaaaaaath.

Well, I hope not about taxes.

Share this post