The Federal Reserve hikes interest rates, the stock market takes a dive, the new British PM announces new policy, the pound takes a dive, and people notice that maybe the bills are starting to come due. JUST KIDDING! The politicians are still partying with current money, future money, and nonexistent money. Huzzah!

Related Links

Effective Federal Funds Rate, 2000-now:

FOMC Actions, going back to 2003:

Open market operations (OMOs)--the purchase and sale of securities in the open market by a central bank--are a key tool used by the Federal Reserve in the implementation of monetary policy. The short-term objective for open market operations is specified by the Federal Open Market Committee (FOMC). Before the global financial crisis, the Federal Reserve used OMOs to adjust the supply of reserve balances so as to keep the federal funds rate--the interest rate at which depository institutions lend reserve balances to other depository institutions overnight--around the target established by the FOMC.

The Federal Reserve's approach to the implementation of monetary policy has evolved considerably since the financial crisis, and particularly so since late 2008 when the FOMC established a near-zero target range for the federal funds rate. From the end of 2008 through October 2014, the Federal Reserve greatly expanded its holding of longer-term securities through open market purchases with the goal of putting downward pressure on longer-term interest rates and thus supporting economic activity and job creation by making financial conditions more accommodative.

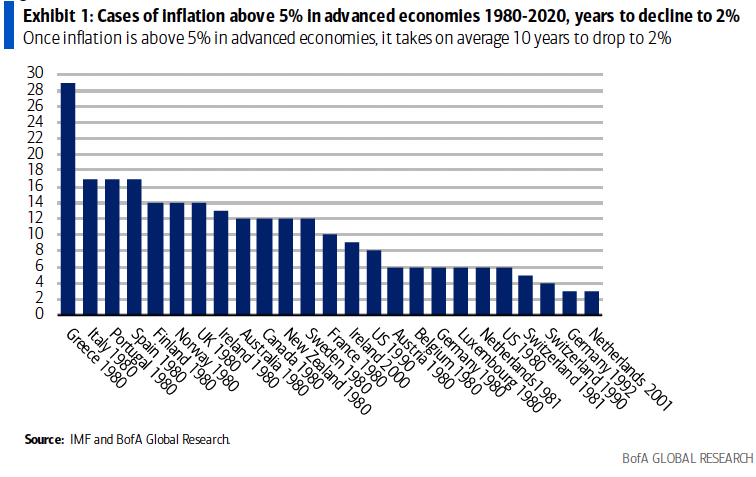

From the IMF and Bank of America Research:

Federal Reserve, Last updated 27 Aug 2020: Why does the Federal Reserve aim for inflation of 2 percent over the longer run?

For many years, inflation in the United States has run below the Federal Reserve’s 2 percent goal. It is understandable that higher prices for essential items, such as food, gasoline, and shelter, add to the burdens faced by many families, especially those struggling with lost jobs and incomes. At the same time, inflation that is too low can weaken the economy. When inflation runs well below its desired level, households and businesses will come to expect this over time, pushing expectations for inflation in the future below the Federal Reserve’s longer-run inflation goal. This can pull actual inflation even lower, resulting in a cycle of ever-lower inflation and inflation expectations.

If inflation expectations fall, interest rates would decline too. In turn, there would be less room to cut interest rates to boost employment during an economic downturn. Evidence from around the world suggests that once this problem sets in, it can be very difficult to overcome. To address this challenge, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation modestly above 2 percent for some time. By seeking inflation that averages 2 percent over time, the FOMC will help to ensure longer-run inflation expectations remain well anchored at 2 percent.

Brookings, June 2018: Alternatives to the Fed’s 2 percent inflation target

Today, the 2 percent inflation target is under scrutiny, in part because of fears that framework will hamper the Fed’s ability to fight future recessions. In the early 2000s, economists at the Fed and elsewhere estimated that the inflation-adjusted (or real) neutral interest rate—the short-term interest rate expected to prevail when the economy is at full employment and prices are stable—was around 3 percent. With 2 percent inflation and a 3 percent real neutral rate, then, nominal rates would hover around 5 percent when all was calm. In a recession, the Fed would have plenty of room to cut interest rates by 4 or 5 percentage points as it often does in a recession.

The latest projections of the long-run neutral real rate are much lower—perhaps 1 percent or even less. Most Fed officials project that the nominal short-term interest rate, the one the Fed influences most directly, will be between 2.8 percent to 3.0 percent in the long run, well below the 1960-2007 average of 6 percent. Because getting interest rates much below zero is impossible, the Fed won’t be able to cut rates by 4 or 5 percentage points when the next recession arrives, and that could prolong the pain of any downturn.

Megan McArdle, 23 Sept 2022: Governments need to realize that the era of economic freebies is over

When inflation was quiescent and real interest rates were hovering near zero, politicians could pursue their policy goals or, heck, just pander for votes, by injecting some borrowed money. And, boy, did they! But when inflation is high, the central bank will set about undoing these actions by tightening monetary policy, and markets will make you pay with higher bond yields. Boost the economy with borrowed money, and you will see the gains clawed back by higher interest rates. The resulting economic contraction and inflation will erase the political gains along with the economic ones.

….

The past 15 years have convinced a lot of people that they didn't have to face unpleasant truths, that hard realities could always be magicked away with more government money. But the real economic constraints were always there underneath, waiting to reassert themselves. Now they have, and if governments don't deal with those realities, reality will deal harshly with them.