I love the classics. Bobby Bonilla Day has it all: deferred annuities, too-high discount rates for a present value, Bernie Madoff, trying to avoid a “tax”, credit risk… let’s look in on my favorite sports deal while it’s still paying out, this July 1.

Episode Links

Coverage of Bobby Bonilla Day

Fox Sports: What is Bobby Bonilla Day? Explaining the New York Mets' ongoing contract saga

Major League Baseball might be intertwined with July 4, but another early-July holiday holds special significance for a significant portion of baseball fans.

That day is July 1, also known as "Bobby Bonilla Day." It's the day when the New York Mets pay their annual deferred fee to former player Bobby Bonilla — who last played an MLB game in October 2001.

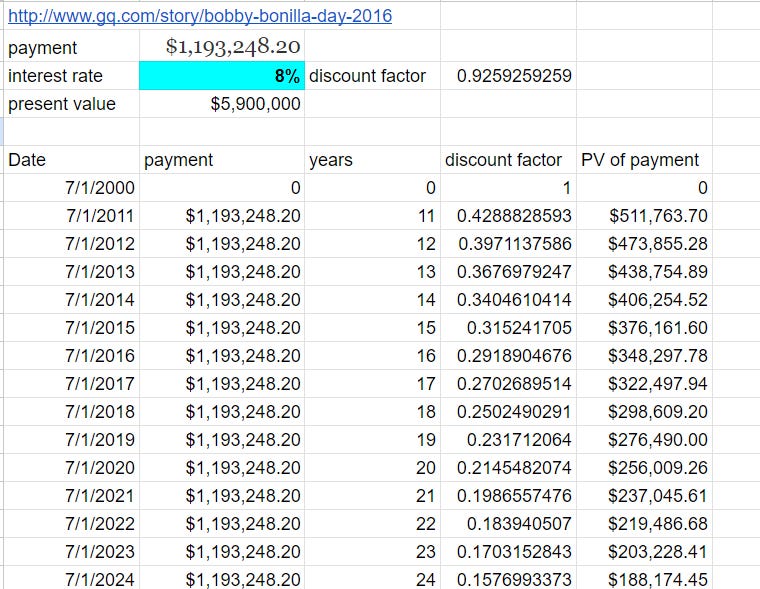

Bonilla was owed $5.9 million when the Mets cut the aging player in 1999 and bought out the rest of his contract. Instead of paying him the sum up front, however, then-Mets owner Fred Wilpon cut a deal with Bonilla's camp. The Mets would pay Bonilla in installments, with annual interest, every year from 2011-2035. Those installments will eventually total nearly $30 million, much more than what Bonilla was owed, according to ESPN.

But there were several upsides for the Mets to pursue this strategy as well — at least, that's the way it looked at the time. The Mets used the $5.9 million to create an annuity with a securities investor they were heavily in business with at the time that would pay them back in annual dividends. By doing so, they also freed up that money from their payroll for MLB bylaws purposes, meaning that they could use it to sign other players without adding to the total roster payroll that the league could potentially levy taxes against.

The investor with whom they created the account was known for paying back those dividends with high interest, so the Mets themselves thought they would reap the profits of millions of dollars over the course of the deal even when subtracting all the money they would pay Bonilla.

Just one problem — that investor's name was Bernie Madoff, and in 2009, Madoff was convicted of running the largest Ponzi scheme fraud in recorded history and sentenced to 150 years in prison. In other words, the profits that the Mets were counting on in their Bonilla strategy likely never came. The fallout of Madoff's crimes financially devastated the Mets, whose dealings with the corrupt money manager went far beyond their Bonilla agreement. The Mets struggled financially for the rest of Wilpon's tenure as owner until the team was sold to current owner Steve Cohen in late 2020.

(2022) ESPN: What is Bobby Bonilla Day? Explaining why the former Met gets paid $1.19M every July 1

How rare is this arrangement?

Bonilla last played for the Mets in 1999 and last played in the majors for the Cardinals in 2001, but he will be paid through 2035 (when he'll be 72).

Here are some other notable deferred-money contracts, courtesy of ESPN Stats & Information's Ryan Milowicki:

• Bobby Bonilla (again): A second deferred-contract plan with the Mets and Orioles pays him $500,000 a year for 25 years. Those payments began in 2004.

• Bret Saberhagen: Will receive $250,000 a year from the Mets for 25 years (payments also began in 2004; this was the inspiration for Bonilla's deal).

• Max Scherzer: Will receive $105 million total from the Nationals that will be paid out through 2028.

• Manny Ramírez: Will collect $24.2 million total from the Red Sox through 2026.

• Ken Griffey Jr.: Will receive $3.59 million from the Reds every year through 2024 as the deferral from his nine-year, $116 million deal signed in 2000.

• Todd Helton: Will get $1.3 million from the Rockies every year through 2023 as the result of $13 million deferred when he signed a two-year extension in 2010.

Wikipedia: https://en.wikipedia.org/wiki/Bobby_Bonilla

Bonilla signed with the New York Mets during the 1991-92 offseason, becoming the highest-paid player in the league at the time, earning more than $6 million per year. However he struggled to live up to expectations with the Mets (which made the contract the subject of much criticism)[5] and throughout the rest of his career. He played with the Baltimore Orioles from 1995-1996, reaching the American League Championship Series with the team in 1996. He earned two additional All-Star appearances and helped the Florida Marlins win the 1997 World Series.[4] After being traded to the Los Angeles Dodgers part way through the 1998 season, he signed for a second time with the New York Mets in 1999. When the Mets wanted to release him at the end of the year, he negotiated a settlement whereby the Mets would pay him $1.19 million every year from 2011 through 2035 on July 1, a date that has become known in Mets fandom as "Bobby Bonilla Day". He is also paid $500,000 by the Orioles every year from 2004 to 2028 due to them also having a deferred contract with him.[6] After two more lackluster seasons, one each with the Atlanta Braves and St. Louis Cardinals, he retired at the end of the 2001 season. Through his 16 years in professional baseball, Bonilla accumulated a .279 batting average, with a .358 on-base percentage and a .472 slugging percentage.

Mets and Bernie Madoff

Curbed, April 2021: One More Thing Bernie Madoff Helped Ruin: The Mets

When you see Bobby Bonilla’s name trending on Twitter on a day like this, as a Mets fan, do you laugh, or do you cry?

I always laugh because it’s, like, my professional requirement at this point. But you know, it starts with a cry, right? There are certain phrases in the Mets vernacular that when you see them trending your heart just sinks and you’re like, Oh, what now? So, you know, if that’s a long way of asking, did I find out that Bernie Madoff had died because of Bobby Bonilla trending — Yes, I did.

ESPN, April 2021: Bernie Madoff, whose Ponzi scheme affected New York Mets, dies at 82

NEW YORK -- Bernie Madoff, whose Ponzi scheme led to the former New York Mets owners being embroiled in a $1 billion lawsuit, has died in prison at age 82.

Madoff burned thousands of investors, outfoxed regulators and received a 150-year prison term. He died of natural causes at the Federal Medical Center in Butner, North Carolina.

Among his victims were director Steven Spielberg, actor Kevin Bacon and Nobel Peace Prize winner and Holocaust survivor Elie Wiesel. But he had ties to sports figures as well. Hall of Fame pitcher Sandy Koufax was a client. And former Mets owners Fred Wilpon, Jeff Wilpon and Saul Katz were major investors. Their involvement changed the trajectory of the franchise.

Wilpon and Katz had over 500 accounts with Madoff and were sued for $1 billion by the trustee for the victims who claimed they knew, or should have known, about the fraudulent returns from Madoff's scheme, according to The New York Times.

Mets and Bond Ratings

Feb 2010, Reuters: New York Mets stadium debt falls deeper into junk

June 2020, Forbes: New York Mets’ Citi Field Debt Is Downgraded To Below Investment Grade

It may have just gotten a little tougher for Fred Wilpon to hang on to the New York Mets.

This afternoon, credit rating agency S&P Global Ratings announced it was lowering its ratings to BB+, from BBB, on the New York City Industrial Development Agency’s series 2006 $547.4 million payment-in-lieu-of-taxes (PILOT) bonds, $58.4 million installment purchase bonds, $7.1 million lease revenue bonds, and series 2009 $82.28 million PILOT bonds issued for Queens Ballpark Co. LLC (Citi Field), the baseball team’s ballpark. S&P said it was also assigning a recovery rating of 1, reflecting an expectation for very high (90-100%; rounded estimate: 95%) recovery in the event of a default.

The team made a PILOT bond payment of $44 million in 2019. The BB+ rating is the first step toward being rated below investment grade. Specifically, an insurer rated BBB has good financial security characteristics but is more likely to be affected by adverse business conditions than are higher-rated insurers while an insurer rated BB or lower is regarded as having vulnerable characteristics that may outweigh its strengths.

The Mets—owned by Sterling Equities, which is controlled by Jeff Wilpon, his son Jeff, and Saul Katz—have been on the block for a while. A deal with Steve Cohen broke down in February. Most recently, former MLB All-Star Alex Rodriguez and Jennifer Lopez were trying to raise money to buy the team, which Forbes valued at $2.4 billion in early April. In early May, I wrote that the couple had ended their attempt to buy the team because they couldn’t get sufficient funds. But it was reported five days ago that Rodriguez and Lopez are taking another shot.

Oct 2023, Fitch Ratings: Fitch Affirms Queens Ballpark Company LLC (Citi Field, NY Mets) at 'BBB'; Outlook Stable

Fitch Ratings - New York - 04 Oct 2023: Fitch Ratings has affirmed the 'BBB' rating for the New York City Industrial Development Agency's (NYCIDA) PILOT $551.5 million revenue bonds, series 2021; $6.0 million lease revenue bonds, series 2006; and $49.2 million instalment purchase revenue bonds, series 2006, all issued on behalf of Queens Ballpark Company, LLC (QBC). The Rating Outlook is Stable.

RATING RATIONALE

The rating reflects Major League Baseball's (MLB) solid league economics and the historical franchise strength of the New York Mets which play at the Citi Field stadium in Queens, New York City. The QBC retained rights revenue stream provides strong coverage of operating costs and stadium PILOT and lease obligations, although ticket and suite revenues have shown historical variations in attendance levels based on team performance. Rating case coverage of all debt averages 3.7x from 2023-2045, while net revenue coverage of PILOT payments averages 3.3x over the same period.

Older STUMP Posts/Links

Dec 2023: Let's Make a Deal! Ohtani Restructures His Pay

Google spreadsheet with the present value calculation

2023: Happy Bobby Bonilla('s Agent) Day 2023!

2022: Happy Bobby Bonilla Day for 2022!

2021: Happy Bobby Bonilla Day! In Praise of Valuable Annuities

2020: Classic STUMP: Happy Bobby Bonilla Day! And Independence Day! Make Mine a Valuable Annuity!

2018: Mornings with Meep: Happy Bobby Bonilla (and Bruce Sutter) Day!

Happy Bobby Bonilla Day 2024!