Happy Bobby Bonilla Day! In Praise of Valuable Annuities

Financial guarantees are often worth more than you think

As an actuary, Bobby Bonilla Day is my favorite day of the year.

The short version of the story is that Bobby Bonilla’s agent negotiated a very valuable deferred annuity arrangement for his client over 20 years ago, and Bonilla is still benefitting from this deal.

Bonilla got a guaranteed 8% nominal return covering 35 years. That’s pretty sweet.

Bobby Bonilla Day in 2021

I’ve been writing about Bobby Bonilla day for 5 years now….

2016: Happy Bobby Bonilla Day! and more Americana

2018: Mornings with Meep: Happy Bobby Bonilla (and Bruce Sutter) Day!

2020: Classic STUMP: Happy Bobby Bonilla Day! And Independence Day! – Make Mine a Valuable Annuity!

You can go back to those pieces for earlier coverage, but this is something the sports and finance folks love writing about each year, and they’ll be writing about it until 2035.

So let’s look at 2021 coverage!

ESPN: Bobby Bonilla Day explained – Why the Mets still pay him $1.19M today and every July 1

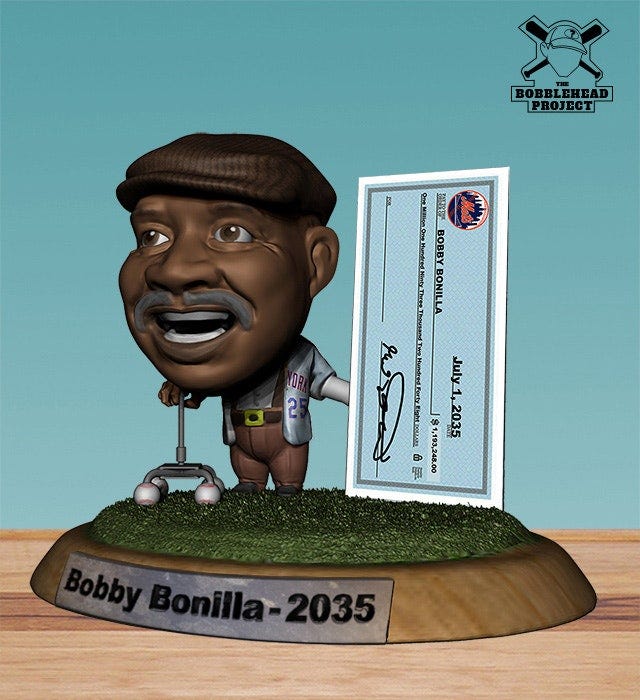

The calendar has turned to July 1, and that means one thing: It’s time for Mets fans everywhere to wish each other a Happy Bobby Bonilla Day! Why? On Thursday, 58-year-old Bobby Bonilla will collect a check for $1,193,248.20 from the New York Mets, as he has and will every July 1 from 2011 through 2035.

Because of baseball’s salary structure, Bonilla’s annual payday is often more than some of the game’s current young stars will make in a given year — and this season that even includes the salary of a leading American League MVP candidate and some potential 2021 All-Stars.

But the Mets are not alone in the practice of handing out deferred payments to star players long after they last suited up for the team, with former MVPs and Cy Young winners among the notable names still collecting annual paychecks from their previous employers.

The ESPN piece compares Bonilla’s payout to current starting salaries, which is not the appropriate comparison. I’ll talk about an appropriate comparison in a bit.

Bobby Bonilla made an announcement for the Mets:

Meh, it’s not a guaranteed 8% return, but it’s not nothing.

NY Post: Airbnb pitches $250 Citi Field sleepover to honor Bobby Bonilla Day

This Airbnb stay hits it out of the park.

Fans will have the opportunity to book a one-night stay at the New York Mets‘ Citi Field Stadium for $250 — and it comes with VIP suite-views to two games, the opportunity to throw an opening pitch, Mets swag and unlimited snacks.

The lucky Mets’ fan, who can bring three friends to their Queens, N.Y. sleepover, will throw the ceremonial first pitch for the July 28 night game. Booking opens on July 8, first come — first serve, according to the Airbnb listing.

However, the promotion is actually in honor of “Bobby Bonilla Day,” a viral “holiday” that trends every year on July 1. Bonilla, 58, is the retired Mets player who opted to receive $1.19 million every July 1 until 2035 as part of a deal that let the Mets out of a $5.9 million payment to the beloved player in 1999.

We’ve still got 14 more years to go until the final check:

A video I made a couple years ago on this great day:

Guaranteed 8% return over 35 years is valuable

As I mentioned above, I don’t think it’s appropriate to compare Bonilla’s payouts against current paychecks. It has nothing to do with anything.

What the payments have to do with is that in 2000, Bobby Bonilla was supposed to be paid $5.9 million for that year. The Mets didn’t want to do that, for a variety of reasons.

The Mets made a deal with Bonilla that was equivalent to a guaranteed 8% return over 35 years, and that deal started in 2000. I calculated it based on the payments, and yes, the math works out. There is a Bernie Madoff angle to this deal, and you can read about that here.

So what is the appropriate comparison?

Well, I don’t have any 35-year interest rates, but I do have 30-year interest rates. Those are “guaranteed” (about as guaranteed as you’re going to get), and that might be an appropriate comparison.

On June 30, 2000, the 30-year Constant Maturity Treasury rate was 5.90%.

The appropriate date on which to make the comparison of this annuity deal was July 1, 2000. The present value at 8% was $5.9 million. But if the valuation rate appropriate to value the deal was 5.90%, the present value was $8.7 million.

Using a proper valuation rate, Bobby Bonilla’s agent negotiated almost 50% higher than what the original contract was worth.

The payment they should be comparing against is $811,016, which is the payment Bobby Bonilla would have gotten if the annuity had been valued at 5.90% instead of 8%. That would have been a payment 32% lower than what he’s actually getting.

Calculations for comparisons are here.

This was a bad deal for the Mets, and a fabulous deal for Bobby Bonilla.

So congrats once again to Bobby Bonilla and his agent, and I hope people learn the value of financial guarantees. They’re often worth more than you think.