Why Would the Republicans Be Tempted to Bail Out Public Pensions?

Answering the unasked question from the new guy

Okay, he’s not an intern, but the guy who wrote the following piece is a Thomas L. Rhodes fellow at National Review, which is described as:

The Thomas L. Rhodes Journalism Fellowship was created to honor “Dusty” Rhodes, an engaging and well-respected conservative leader who served as the president of National Review and the chairman of The Lynde and Harry Bradley Foundation’s board of directors. The Rhodes Fellowship is made available to a new or recent college graduate, up to age 25 (when initially applying) who shows interest and capability in writing on, broadly speaking, current affairs, but with a focus on finance, business, taxation, fiscal policy, economics, and the workings of the free market, all of which were subjects of particular interest to Mr. Rhodes.

Let me get into the piece, and then talk about some of the things not in the piece.

No Bailouts for Public Pensions

Republicans Need to Promise Now: No State Pension Bailouts

One of the reasons defined-benefit pensions went away is that the federal government passed the Employee Retirement Income Security Act (ERISA), a law heavily regulating them, in 1974. But that law exempted government pensions. So while the private sector had to adjust to reality by shifting just about everyone to defined-contribution retirement plans, government was allowed to persist with defined-benefit pensions.

…Oh man. I will do my next podcast episode on ERISA (I was planning on doing that anyway). ERISA is 50 years old (like me!), and whether it was passed or not, DB pensions would have been on their way out due to reality.

But a big issue has been that ERISA, creating the PBGC, a backstop for failed private plans, whether single employer or union plans. Plans not covered: state and local government pensions and church plans.

Governments also sometimes fail to make annual required contributions to their pension funds. Even if they did, they’d probably still come up short because many state pension funds use unrealistic assumptions of financial returns to calculate how large the annual required contributions should be. Most states assume discount rates of 7 percent or higher, a very difficult return to achieve with investments safe enough to be in a pension fund.

Sometimes fail?

Some of them have never made “required” contributions by plan. They didn’t “fail” so much as deliberately chose not to make full contributions.

However, well-spotted that those plans that always made full contributions can find their funded status decreasing even so due to assumptions that don’t match reality.

Update: Why Have "Full Contributors" Lost So Much Ground In Twenty Years in Public Pensions?

Back in 2017, I asked a question: Public Pensions: Why Do 100% Required Contribution Payers Have Decreasing Fundedness? Well, it’s 6 years later, and the situation is no better. The data, as per usual, come from the Public Plans Database. So as not to be too restrictive (otherwise, I would have had only 38 plans to plot), I chose plans that averaged contr…

Focus on Asset-Side Shenanigans

I notice that the author, like many others, focuses on the asset-side shenanigans.

Mind you, there are plenty of asset-side shenanigans, but the problem is that it is how expensive these life-long promises are that drives many of the shenanigans, and, of course, the inherent political aspect of a big pile of money controlled by political interests.

I do want to highlight four reforms he mentions:

Oklahoma began enrolling all new state-government hires in defined-contribution retirement plans starting in 2015. The old defined-benefit system will pay the people who were already in it without taking on any new liabilities from new employees. Oklahoma has more than enough assets to cover its debt and improved its pension-funding ratio by 52 percent between 2012 and 2021.

Wisconsin made major public-pension reforms as part of the Act 10 fight in 2011, requiring public employees to contribute to their own retirements where previously they did not contribute at all. The state now has overfunded pension benefits by more than $2 billion.

In 2014, Tennessee introduced hybrid retirement plans that include a defined-benefit component and a 401(k). That has allowed the state to stabilize its pension payments while still giving the same, or better, benefits to retirees. The hybrid plans saved Tennessee about half a billion dollars between 2014 and 2022, and Tennessee also has overfunded pension benefits.

Michigan passed laws in 2017 and 2022 that make state grants to local-government pension funds conditional on reforming the funds. These laws include strict state oversight of funds that receive grants and require them to use more realistic discount rates and make full annual required contributions. In part because of these reforms, Michigan’s credit rating was upgraded by S&P from AA- to AA in 2018.

There are subtleties to all of these, and the metric on the Oklahoma pensions are just weird. Looking at the two largest Oklahoma pensions:

Oklahoma Teachers (2012: 54.8% funded, 2023: 75.1% funded)

Oklahoma PERS: (2012: 80.2% funded, 2023: 98.5% funded)

So, yes, the funded ratios improved, but which improved more… and would I really want to give more kudos to the plan that started out deeply underfunded, even if it improved more via a percentage improved metric (as opposed to percentage points increased)?

That said, huzzah for Oklahoma!

Highlight the worst!

This is where he is on point:

But some states continue to fail, year after year. Illinois’s pension problem is so severe that pension payments will consume 20 percent of its general funds this fiscal year, yet it is still contributing $4.5 billion less than it should. Illinois has unfunded pension benefits totaling $146 billion. New Jersey’s public-pension system is several times more generous than a typical 401(k), and despite the state’s making its scheduled pension payments the last few years, it is still nowhere close to solvency.

But it’s also a bit off:

It’s not a perfect red-state/blue-state issue. Kentucky has a poorly funded pension system, and New York has a well-funded one. But it will shake out to a red vs. blue issue in Washington, D.C., if states come begging for bailouts. That’s because Illinois will likely be the first to crash, but it’s also because the primary beneficiaries of any such bailout would be public-sector unions.

One of the things that is missing: why would Republicans be tempted to bail out public pensions?

They will be, and it’s not obvious from what he wrote as to why.

Prior Pension Bailout: Multiemployer Pensions

This is what he wrote about the most recent pension bailout:

Yet we have seen how Democrats approach pension shortfalls for unionized workers in the American Rescue Plan Act: They sent failing multiemployer pension funds for private-sector union workers almost $90 billion, with no strings attached. The bailouts included no requirements to reform the funds. And Joe Biden stood with AFL-CIO president Liz Shuler and Teamsters president Sean O’Brien to brag about this naked transfer of taxpayer money to irresponsible union pension funds.

So here’s the thing. We knew that the MEP pensions were going to get bailed out by 2025.

The reason why: Central States Teamsters specifically was a key, catastrophically failing pension plan that was going to wipe out the PBGC MEP program by 2025.

The question was what conditions were going to be attached…. (and various Republican legislators put forth bailouts with strings attached)

….and the answer was: no conditions. Because Central States got some good timing. They got their bailout by piggybacking on a pandemic that had no connection to their failing situation.

I was unhappy at the time.

MoneyPalooza Monstrosity: It Passed! More on the Multiemployer Pension Bailout

Well, they did it. They finally did it. You maniacs!! I will be looking at the multiemployer pension bailout more in this post, and the state/local government bailout in a later post. The state of the bailout: FULL AND MORE….. NYT: Rescue Package Includes $86 Billion Bailout for Failing Pensions

Public Pensions Also Involve Groups Important to Republicans

I’ll make it obvious: while the author (Dominic Pino) points out many public employee unions support the Democratic party, other public employees are better-known as Republican supporters.

Like, oh, police and firefighters? Maybe even prison employees?

There may be other groups as well.

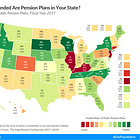

I have pointed out that teachers’ pensions are the most strained, as they are the biggest state and local public employee group, but police and firefighter pensions tend to be even less-funded than teacher pensions.

The reason is that police and firefighter pensions tend to have lower retirement ages in reality, and especially higher disabled retirement rates.

For those who want to play bailout hardball, they are going to threaten all of the public pensions….

…except for the ones for the politicians, of course. Those will be safe.

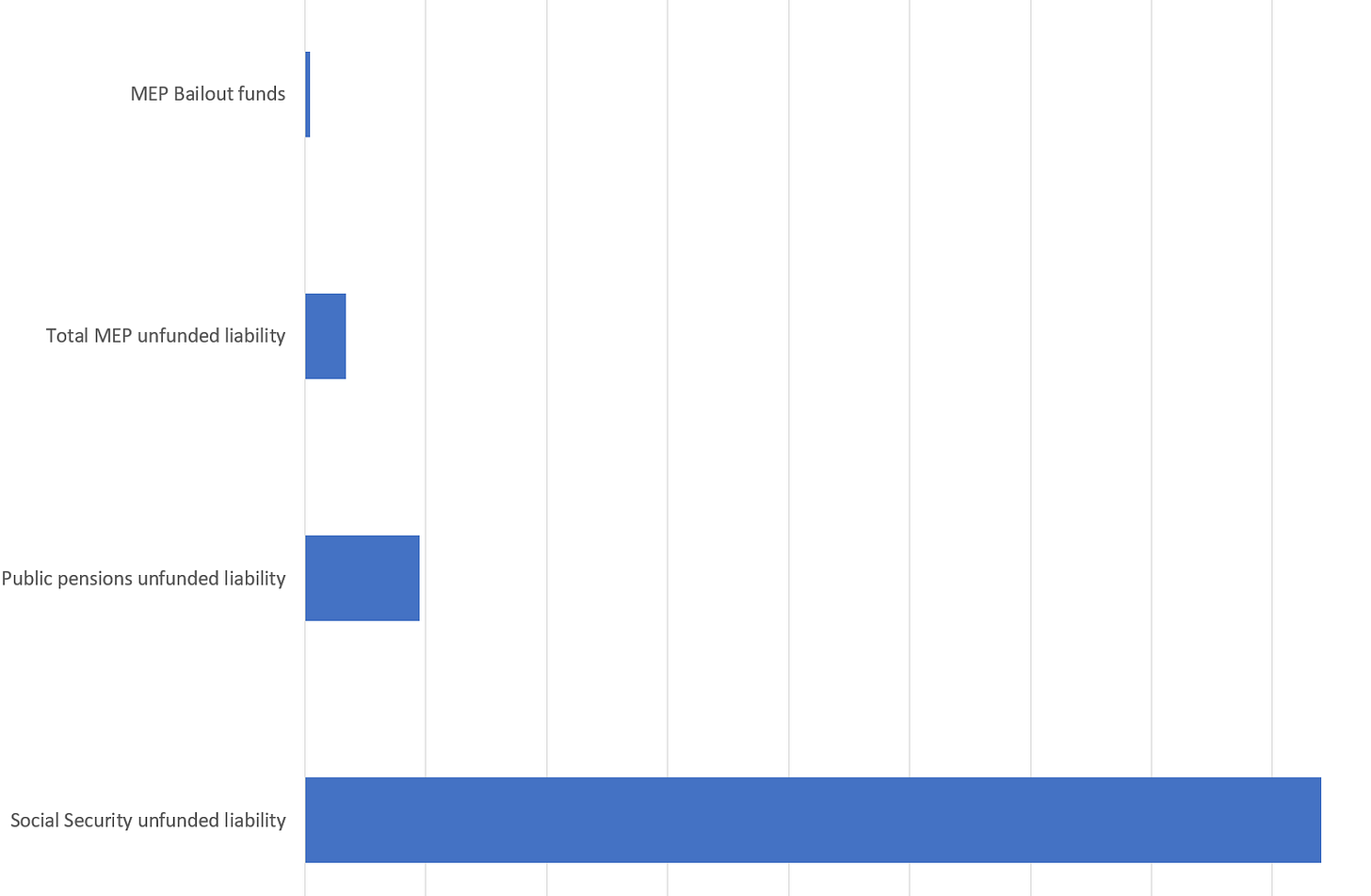

The “safety” from fully bailing out all the public pensions it requires trillions of dollars.

I made this comparison back when they passed the MEP bailout bill:

Notice I didn’t put the numbers on the scale. I could update this. Eventually.

Hey, maybe they could bail out the public pensions.

It would be easier than dealing with Social Security.

Related Posts

May 2020:

April 2020:

April 2023:

Feb 2023: