Public Finance Round-Up 2024 June 5: NY, Chicago, and Audit Delays!

Let's take a taste of the public finance world!

Let’s peek in on some of the news bubbling around… and some of the “olds” for that matter…

The New York City Congestion Charge Hokey-Pokey

NYTimes: Hochul Pushes for Congestion Pricing Delay in Last-Minute Reversal

Gov. Kathy Hochul is quietly maneuvering to delay a plan to toll drivers entering Manhattan’s central business district, just weeks before it is slated to go into effect, according to two people familiar with the discussions.

The first-in-the-nation congestion pricing plan, which has been decades in the making, is slated to start June 30. Drivers using E-ZPass will pay as much as $15 to enter Manhattan south of 60th Street.

But even as Ms. Hochul believes that congestion pricing is good environmental policy, she has concerns that the timing was less than ideal, according to a person familiar with her thinking. The governor feared that it might deter commuters from returning to the central business district, which has yet to fully recover from the pandemic.

Ms. Hochul’s gambit, if successful, could also help her fellow Democrats in the House who might otherwise face angry voters in an election year. But it would be a devastating blow to advocates and organizers who have worked for more than a decade to bring this change to New York City.

This idea has been bumping around for a long time, and the “environmental policy” is a standard ploy, but the main issues I’ve always heard are:

make traffic more manageable

get more revenue for the MTA

That was it.

It would encourage people to not drive into the city, but to use the trains or other mass transit — as it is, it’s very unpleasant driving into the city. I think people are idiots if they do.

But here is a piece from TimeOut NY that had this map and prices:

This is hitting in 2024 — a big election year… yeah, I can see why this would be unpopular. But the MTA needs the dough.

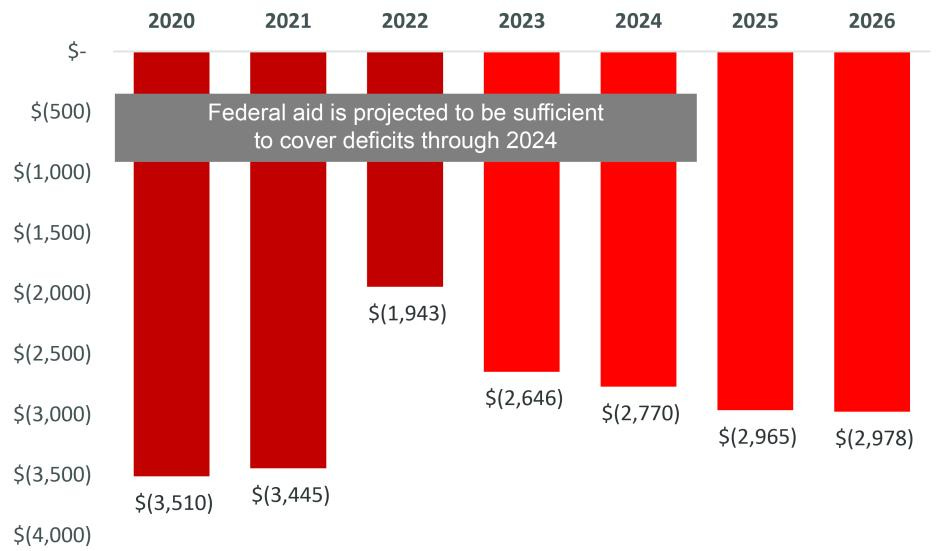

Since it’s not really labeled, those deficits are obviously not a few thousand dollars each year. They’re not even a few million dollars each year.

It’s reaching $3 billion per year.

Press Release from my Representative, Mike Lawler: Congressman Mike Lawler Blasts Hochul's Blatant Election-Year Congestion Pricing Stunt

Related:

Chicago is reaching the death spiral

City Journal: How Debt Ate Chicago

Chicago has dominated America’s heartland since the late nineteenth century. As the City of the Big Shoulders, it has been a place whose self-reliance and drive allowed it to compete with coastal metros boasting more obvious advantages. Chicago’s landscape and weather may leave something to be desired, but the city’s combination of cosmopolitanism and localism, embodied in its diverse neighborhoods, has helped give it a distinctive American personality. Yet bad services, corrupt politics, and elevated crime have made life in Chicago increasingly unpleasant, all worsened by the city’s parlous finances.

An ever-mounting debt burden is the greatest threat to the city’s survival. As that problem worsens, more residents will question whether they want to stay in a windswept city paying down someone else’s pension—or decamp for places that don’t place such a millstone around their citizens’ necks.

This is a longer version of the op-ed the author, Judge Glock, wrote for the Wall Street Journal: Chicago Will Need a Miracle to Escape Its Debt Burden

Like many large cities, Chicago got lucky during the pandemic. President Biden’s American Rescue Plan dispensed funds using a formula that gave preference to older, and generally more Democratic, cities. Chicago was a major beneficiary, receiving about $2 billion in federal aid. The support allowed the city to run a surplus in 2022 of more than $300 million. For the first time, Chicago put in the required contribution for all four of its major pension funds. This led Moody’s to remove Chicago’s junk-bond status.

But Chicago retains by far the worst debt rating of any of the largest American cities, and it has done nothing to reform its bad habits. In 2022 the city saw a delay in property-tax receipts, and, despite the flush times, money proved so tight that the pension funds couldn’t pay current retirees. In September 2023, Mayor Johnson’s office projected a $538 million budget hole for the next year, almost three times what the previous mayor had expected, and a potential $1 billion deficit for 2025.

Chicago has been bailed out by miracles before, but its current problems are structural and seem to have no clear solution. That doesn’t mean the city will necessarily suffer Detroit’s fate and find itself in bankruptcy. The dangers of insolvency are real, but just as with the exploding federal debt, too much focus has been put on the possibility of a single disaster and too little on the more obvious cost: deepening decline. Chicago could keep paying off its bondholders and retirees by bleeding public services, hiking taxes, and driving out still more residents, but it would become a shell of its former self.

What’s silly is that it doesn’t require a miracle for Chicago to escape its debt burden.

It simply requires municipal bankruptcy, which, in Illinois, requires the Illinois state legislature to allow Chicago to declare bankruptcy.

Now, one may say that it requires the equivalent of a political miracle to allow that to happen, and that may be true.

Then there’s my other idea: ALIENS!

Related:

Audit delays: A bad sign

Liz Farmer:

This is a non-paid article (I checked!), and Liz Farmer reports:

The University of Illinois Chicago and Merritt Research Services produce an annual report on audit times and I looked at their latest data in combination with data from previous years’ reports. That analysis showed that median audit times since 2009 have increased by 14% to 168 days. That’s three weeks longer than it was before the Great Recession.

The report is here: Credit Rating and Geography: Examining the Timeliness of Municipal Bond Audits

Here is a graph from the report:

You can see that the audit time for counties spiked in fiscal year 2020 (gee, wonder why), but the main thing to notice is that states’ median audit times from 2011 - 2019 actually decreased, and then shifted upwards in the pandemic period.

From Liz Farmer:

[T]he chart above shows the impact from a perfect storm of:

increasing retirements,

increasingly complicated accounting requirements, and

additional financial reporting related to federal pandemic grant funds.

These developments have also resulted in fewer businesses that want to take on government clients, which adds to the overall issue.

In my next newsletter, I’ll dive even deeper for my paid subscribers into the data behind these trends and the consequences. If you want to be on that list, click below!

Hie thee thither to subscribe!

The slippage on audits is not great, because outsiders like me have to wait for these audits before the financials will be released. That lengths the feedback loop on decision-making, meaning budget-making can be even more divorced from reality than usual.