Howdy all — things are really rough this week, with Stu having a liter of fluid drained from around his right lung (more: pleural effusions, pulmonary embolism, and these are still being handled).

Evidently, this sort of issue is not uncommon for long-time cancer patients. I had to drive into Manhattan multiple times, involving dodging construction, blocked streets, and of course, people on electric bikes dodging between vehicles. FUN.

I already beat up on Chicago to relax, so let me do a few quick hits on Minnesota.

Prior Minnesota posts:

13 Aug 2024: Podcast: Tim Walz and Public Pensions: What's the Risk?

9 Apr 2024: Podcast: Public Pension Problems -- Proposed Solutions, But Will They Fix Anything? - Minnesota Teachers is one of the pensions

28 Mar 2024: Around the Pension-o-Sphere, 27 Mar 2024: Illinois, Minnesota, and Teamsters Payback?!

Edward Siedle’s Posts on Minnesota Teachers Pensions

Edward Siedle has been involved in both Ohio STRS and Minnesota Teachers pension plan participants’ call for forensic investigations of their plans, primarily with regards to their investments and the costs/fees involved. He would be the one conducting said investigations, of course. He has done such investigations for other pension funds in the past.

I last linked material involving an op-ed piece he had for the NY Post on the investment performance of the Minnesota Teachers Retirement Association, which is the system administering the pension plan for the Minnesota public school teachers.

Let’s look at what he’s written since then:

12 Aug 2024: Walz As Chairman Of Minnesota Pension System Agreed To Be Kept In The Dark

19 Aug 2024: Minnesota Center for Fiscal Excellence Predicts State Pension Investigation Finds "Bupkis." State Officials Panic.

22 Aug 2024: Minnesota Pension Miracle Under Tim Walz's Watch

29 Aug 2024: In 30 Seconds ChatGPT Casts Doubt On Minnesota Pension 30 Year Performance "Miracle"

5 Sep 2024: Minnesota Attorney General Keith Ellison Doesn't Want To Hear About State Pension Abuses

The one post I find interesting is the one from the 29th, and I have my reasons (which I will not expound because cf: open of the post):

zzzz

The $140 billion State of Minnesota pension fund claims to have beaten the market regularly over the past 30 years— by the exact same percentage, 0.2.

That’s remarkable, exceptional…. even unbelievable.

….

Nevertheless, in Ohio, the Minnesota state pension performance claims recently caught the attention of the Editor of the Toledo Blade:

“A long term look at Minnesota’s pension math is just as perplexing. The teachers retirement fund purports to beat a composite index they created by 0.2 percent measured over 1, 5, 10, 20, and 30 years. The odds of that level of consistency over each measure of time are infinitesimal (emphasis added).”

….

So, last night we asked ChatGPT to weigh in on the issue:

What is the likelihood that an investment fund could beat the market by exactly the same number: .02% on a 1, 5, 10, 20 and 30 year basis?

30 Seconds later ChatGPT said the likelihood was extremely low and offered the following analysis:

The likelihood that an investment fund could beat the market by exactly the same margin (0.02%) over different time periods (1, 5, 10, 20, and 30 years) is extremely low (emphasis added). Here’s why:

Market Variability: Markets are inherently volatile, and the performance of an investment fund relative to the market can vary greatly over time due to changes in economic conditions, interest rates, market sentiment, and other factors. Consistently outperforming the market by the same margin over different time periods would require an extraordinary level of stability and predictability, which is rare.

Statistical Unlikelihood: The probability of achieving the exact same difference in performance over multiple time frames is very low due to the statistical nature of investment returns. Small differences in returns are often influenced by a variety of factors that can change over time, making it unlikely to see the same exact margin of outperformance over different periods.

Performance Measurement: Fund performance is typically measured with varying degrees of precision depending on the time frame. Short-term performance (like 1 year) can be heavily influenced by short-term market fluctuations, while long-term performance (like 30 years) is more reflective of the fund’s underlying investment strategy and market conditions over an extended period. The exact margin of outperformance can be influenced by many factors that may not remain constant.

Luck vs. Skill: Achieving exactly the same outperformance margin across various time periods could be indicative of either extraordinary skill or an element of luck. In practice, even skilled fund managers find it challenging to maintain consistent outperformance over different time horizons due to the dynamic nature of markets.

In summary, while it’s theoretically possible for a fund to beat the market by the same margin over different periods, the likelihood of this occurring is extremely low due to the inherent variability in market performance and the numerous factors affecting investment returns.

We then asked ChatGPT:

Are the benchmarks public pensions use to gauge their investment performance biased?

To which, ChatGPT responded:

Public pension benchmarks can sometimes exhibit biases, and understanding these biases is crucial for evaluating the performance of public pension funds accurately. Here are several ways in which benchmarks might be biased:

Selection Bias:

Index Composition: Public pension benchmarks often use indices that may not fully represent the fund's actual investment universe. For example, if a benchmark is based on a broad market index, it might not account for specific asset classes or sectors that the pension fund holds, potentially skewing performance comparisons.

Survivorship Bias: If a benchmark includes only funds or securities that have survived over a long period, it might exclude those that have underperformed or failed. This can result in an overly optimistic view of performance.

Performance Bias:

Target Setting: Benchmarks might be set based on historical performance or specific targets that don’t necessarily reflect the current investment environment or the fund’s strategic asset allocation. This can make it challenging to compare the fund's performance accurately.

Custom Benchmarks: Some pension funds use custom benchmarks designed to match their specific investment strategy or risk profile. These benchmarks can be crafted in ways that make performance look better than it might be when compared to more standardized benchmarks.

Time Period Bias:

Short-Term vs. Long-Term: Benchmarks might be evaluated over different time periods than the fund’s performance periods. Short-term benchmarks may not capture long-term performance trends, and vice versa, potentially skewing the perceived success of the fund.

Asset Allocation Bias:

Strategic Allocation: A benchmark might not reflect the actual strategic asset allocation of a pension fund. If a fund has a unique allocation strategy that deviates significantly from the benchmark, the comparison might not be fair or meaningful.

Sector and Style Bias:

Sector Weighting: Benchmarks might be heavily weighted in certain sectors or asset classes, which can create biases if the pension fund has a different sector allocation. For instance, a benchmark heavily weighted towards technology might not accurately reflect the performance of a pension fund with a more diversified or conservative allocation.

Risk Profile Bias:

Risk Tolerance: Benchmarks might not align with the risk profile of the pension fund. If a benchmark is more volatile or less volatile than the fund’s investments, it can create misleading comparisons regarding performance.

Mitigating Biases: To address these biases, it’s essential to:

Choose Appropriate Benchmarks: Use benchmarks that closely match the pension fund’s asset allocation, risk profile, and investment objectives.

Regularly Review Benchmarks: Periodically review and adjust benchmarks to ensure they remain relevant and reflective of the fund’s strategy.

Use Multiple Benchmarks: Consider comparing performance against multiple benchmarks to get a more comprehensive view of how the fund is performing relative to various market segments.

Understanding and accounting for these biases helps in making more informed evaluations of a pension fund’s performance.

End ChatGPT

I have other thoughts of how the 20-basis-points per year “edge” could have been “achieved”, and yes, it’s unlikely to have been true.

Two-Part Profile of the CIO of Minnesota SBI

Pensions & Investments:

Part 1, 4 Sept 2024: Minnesota state board CIO Jill Schurtz is all about balance — in private markets as well as perspectives

Part 2, 5 Sept 2024: How a second-grade exchange shaped Minnesota state board CIO Jill Schurtz's outlook on opportunity

Here are the items I’m interested in excerpting, and they’re all from part 1:

zzz

Earlier this month, the Minnesota state board reported a net investment gain of 12.3% for the $93.7 billion in combined defined benefit assets that it oversees for the fiscal year ended June 30. The gain topped its composite benchmark by almost 50 basis points.

Before joining the state board in 2022, Schurtz led the then-$1.2 billion St. Paul Teachers' Retirement Fund Association for nearly nine years as executive director and CIO.

….

Q: Is there a dollar amount tagged to the climate roadmap?

Q: We're starting out with what we think is a pragmatic number. We're targeting $1 billion over the next five years. Part of the reason we've selected that number, and again, trying to be pragmatic and think about this in the same way we do all allocations, we think the majority of these opportunity sets will live in the private markets portfolio. So when we think about that portfolio is roughly $22 billion, we think that targeting kind of a pacing of roughly $200 million a year is consistent with our overall pacing on private markets and keeps us within our risk tolerances.

….

Q: Let's flip to private markets, which are currently about 25% of the portfolio, and private credit, in particular, is about 9%. What role are you looking for private markets to play in the portfolio?

A: I've inherited a really seasoned, successful private markets program, with a lot of gratitude and respect to my two predecessors: Mansco Perry and Howard Bicker.

We’re looking at this as a different source of alpha for the portfolio. We’re looking to balance — just broad strokes when we think about asset allocation — public equities, fixed income and our private markets. We know that when we invest in private markets, obviously we're accepting illiquidity. So liquidity, we value greatly in a public pension plan. We have a covenant to meet benefit payments. Given how highly we value liquidity, we know that we need to have an allocation that’s accretive to the overall portfolio over long periods of time. When you look over that three, five, 10, 20 (years), since inception, this portfolio has added meaningfully on an absolute basis and relative to public markets.

We know that every single year that's not going to be the case. But if you're a long-term investor, you have to look at private markets through that lens. It's not a quarter by quarter, it's not a year-by-year investment.

Q: We have written quite a bit about investors' enthusiasm for private credit. Some now are talking about bubbles. Do you subscribe to that?

A: I think there can be a bubble in any particular asset class, any time. And yes, there have been remarkable inflows in this environment, and it's worth taking note. Having said that, we are still open for the right manager with the right strategy to invest in private credit, again in our private markets portfolio. First, the real question is that balance. Can we get that same exposure in a liquid public markets manager? The key inquiry for us is how are we balancing liquid vs. illiquid and where can we catch the premium. We have not mandated that we're going to do X percent direct lending or X percent in private credit. We're taking that decision on a manager-by-manager basis, our level of conviction in that manager — do we have a long-running relationship and do we think in this moment in time, that strategy makes sense.

That’s what popped out at me.

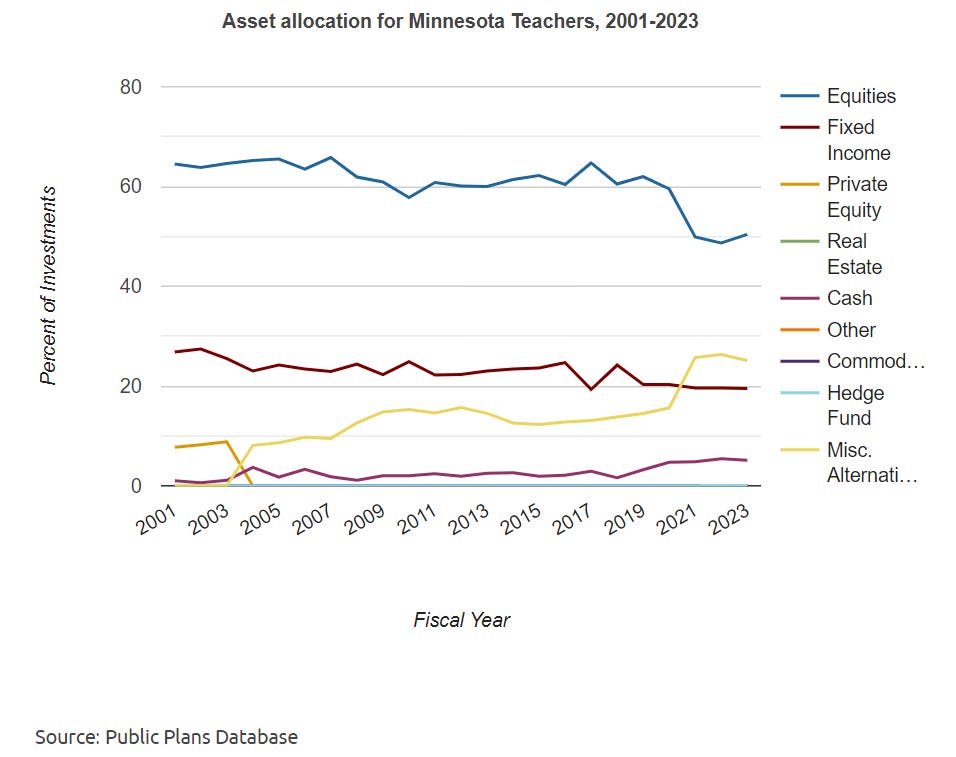

A reminder of the history of allocations for Minnesota Teachers (which is the same as the other SBI-invested-for-funds):

The private equity/credit is lumped into “alternatives” here.

That’s just how they do it in Minnesota, I suppose.

Payments to Private Companies and Donations from Employees

From Open the Books:

Between 2019 and 2022, Gov. Walz accepted at least $890,000 in campaign donations from individuals working for at least 434 different Minnesota vendors, auditors at OpenTheBooks found. Those same companies collected nearly $15 billion in payments from the state between 2019 and 2023.

….

Unfortunately, the state checkbook produced for OpenTheBooks.com through an open records request does not distinguish which payments were contracts versus grants, legal settlements or other spending. In fact, the rationales for all its payments are left out of the records. [emphasis added]

While it’s not the type politicians routinely bemoan, it seems like Minnesota has its own sort of dark money.

The Minnesota governor’s office and the Harris-Walz campaign did not return requests for comment on this article.

Walz finished his re-election campaign [for governor] with over $627,000 cash on hand as of Dec. 31, 2023. State candidates are barred from using leftover campaign funds on federal elections, but it would be legal for Walz to refund the contributions and ask donors to send the money back to the Harris-Walz campaign.

Here are some of the companies whose employees and executives gave campaign cash to Gov. Walz and separately received state payments.

Looking at some of these rinky-dink amounts, like Target or General Mills, I can imagine it can be just going shopping for cereal or staples for the office in some of these cases.

For the health services companies, I think you can imagine what the money was for. That employees working for these companies donated for a re-election campaign probably doesn’t mean much.

Still, it’s interesting to see.